eToro Customer Reviews

Tell us what you think of this provider.

4/5

easy to use

easy to use

I find it quite expensive…

I find it quite expensive and not very user friendly so dont use it too much

used occasionally and it does…

used occasionally and it does the job

OK

OK

N/a

N/a

No thoughts do not use…

No thoughts do not use them a great deal

interesting

interesting

crap, only used it for…

crap, only used it for crypto and it was poor

Good. used for buying bitcoin

Good. used for buying bitcoin

eToro Expert Review

eToro Has Become One Of The Biggest & Most Innovative Brokers Around The World

Provider: eToro

Verdict: eToro is a social trading platform that lets their users share new and existing CFD positions and their investment portfolios. eToro was founded in 2007 in Tel Aviv, Isreal and has grown to offer investing and trading on 3,000 global assets (including real cryptocurrencies) to 30 millions users worldwide.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro a good broker?

Yes, eToro does have its flaws for experienced investors, but if you are just getting started eToro is a great introduction to financial markets. eToro is actually a very innovative trading platform offering copy trading, social networking and unleveraged CFDs.

eToro is one of the most innovative trading platforms with a huge range of popular investors to follow and good access to global stocks and cryptocurrency.

- Pricing: Even though eToro is commission free there are high FX conversion fees between 1.5% and 3%. Overnight financing is also expensive for CFD positions compared to competitors.

- Market Access: For the majority of investors you can trade the most popular markets, but lacks access to small-cap stocks and exotic derivatives.

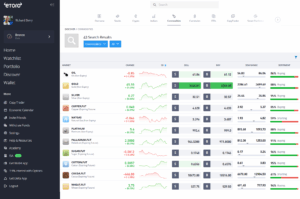

- Platform & Apps: Very good, nearly gets top marks for intuitiveness, but misses out because of no sophisticated order types

- Customer Service: No phone number available to non-premium clients, but generally quick responses to chat and email queries.

- Research & Analysis: A mixed bag here – some good social investing fees on the platform and digestible guides, but no direct actionable research.

Is eToro better for trading or investing?

Ever since I sat in The Angle pub, next to the Silicon Roundabout opposite where I was a stockbroker (at Walker Cripps Weddle Beck) 15 years ago discussing the merits of eToro as a forex broker, I’ve been fascinated with their journey. I’ve interviewed the founder, the UK MD and watched (despite the industry’s loathing) as they have shrugged off the masquerade of day trading, into becoming a global investment platform sensation. In this review, I’ve tested them year after year and pontificated on what sort of customer should be using them.

In the past, I’ve been very rude about eToro, I didn’t like the way they’d gamified trading and along with Plus 500, they almost made it too easy for inexperienced traders to play the markets.

But are times changing?

Social & Copy Trading

A while ago, we published an interview with the founder of eToro Yoni Assai, about whether or not copy trading could be a challenger to traditional fund management. Copy trading is not new, it’s been around for years, whereby investors will copy the positions of an amateur trader in the hope of making money.

I first came across the concept about 15 years ago, when traders would follow futures traders on Strategy Runner. This of course was for professional regulated advisors to make it easier to have a wider client base and helped with execution allocations. The Strategy Runner technology was later bought by MF Global before its demise. Then came MT4, again, focussing on high-risk markets, like forex and index trading.

But one thing these platforms lacked was a community.

Trading Communities

This is odd because the trading and investing community is one of the most focal out there. There are some hilarious bad pontificators and some very good ones across the entire investment landscape. Seeking Alpha, has some excellent lay contributors looking at stock fundamentals. LSE.co.uk (“London South East” and absolutely no relation to the London Stock Exchange) still have a vibrant community of share chat for UK small-cap stocks. Reddit, has it’s meme’s for pump and dump schemes, and even Saxo Markets, the professional trading platform, tried to introduce a social network for traders called tradingfloor.com where you could link your trading account and see and copy other traders. Covestor tried the concept for stocks in the US, but couldn’t make it work.

One very interesting aspect of eToro’s social trading offering is that they now have a huge amount of data from a broad range of successful investors and traders. They have packed this all together into something they call the GainersQTR smart portfolio which aggregates the investments of the best popular investors on the platform.

But eToro keeps on going from strength to strength. So what is the appeal and why do they have over 20 million users and growing?

Investing for growth

The first thing eToro is keen to point out, when I spoke to the newly appointed UK MD, Dan Moczulski, is that eToro is not a trading platform anymore, they want to be an investing platform. I’ve known Dan for years, he knows the markets and the technology inside out and is well respected within the industry. So I spent an hour with Dan on Zoom, whilst he explained what eToro was all about and where they want to go.

When you execute a trade, unlike other trading platforms where max leverage is automatically given, the default leverage setting on stocks is zero, you can opt for more if you want. However, even though eToro buys the stock in the underlying market, you don’t get voting rights, can’t transfer the stock out, but you do receive your entire dividend entitlement (after it’s been taxed at source). For index and forex trading, though it reverts to form and leverage is set at 20x for indices like the FTSE and 30x for Forex pairs like EURUSD.

Day trading

eToro is not very good for day trading. For a few reaons, the main one being they don’t want to be. My mate Dan, the UK eToro MD told me that they want to be an investing platform rather than a trading platform. He was actually quite put out that we’d included eToro in the trading section, rather than the investing category.

But, whilst I still think there are better options for longer-term investors (although their copy trading track record is doing very well), I don’t think eToro is any good for day trading. There isn’t enough order functionality like, algos, DMA, OCOs, or even limit entry orders. Prices, even though they mimic the bid/offer cannot be tightened up with DMA access. Yes, there is an opportunity to take intra-day positions on indices and forex pairs, but it just doesn’t “feel” like a day trading platform to me.

Brokers like IG, CMC Markets, and City Index are much better for short-term trading. You can compare what we think are the best day trading platforms here, and see how eToro fits in.

Diversfication

But they say, that what they are actually trying to promote is diversification in portfolios by giving new investors the tools to explore the markets. One way they try and do this is through fractional shares and the way people buy stocks. They say they want to give people the opporuntiy to buy lots of little amounts of lots of different stocks (encouraging diversification), If you have £1,000 to invest, you can buy £100 of 10 shares instead of having to figure out how many shares of company A, B & C equates to £100, if at all.

Recurring orders

eToro have just introduced these and it’s been a long time coming. Being able to set up regular buy orders is a really power tool for beginner investors as it forces you to create good investing habits. One of the best ways to invest is little and often when you can afford it. So you can set up regular orders just after you get paid, which means that you are always allocating money to the market. You also benefit from reduced FX conversion fees (0.75%), which means itis actually cheaper for you to invest automatically than to do it yourself.

USD account balances

One thing though, that has always irked me about eToro and one of the reasons I’ve classified it as a trading platform rather than investing account is that all trades are settled in USD. In my mind, they fall at the first hurdle as an investment platform, because, how can you have an investing account where you don’t actually own stocks, you can’t invest in an ISA, there are no SIPPs and you are hit with dreaded foreign exchange fees on every trade you make. All those things are key to an investment account.

But, Dan was quite keen to explain why this was the case. It’s a one size fits all solution. If they want to offer free trading, they have to keep things as simple as possible and using USD as a default currency solves two issues.

One, USD is a global currency and most of the trades on the platforms would be settled in USD anyway, even in the UK.

Does zero commission equal zero costs?

The second issue is how they make money when they have zero commission. eToro makes money on foreign exchange (roughly 0.5% per trade) and they make money from withdrawal fees. There are also some stocks that are not zero commission and CFDs are exempt where eToro makes money on the bid/offer spread. Zero commission may be a loss leader of sorts in the UK, as whilst they earn 0.5% in conversion fees, they lose

As an eToro trader you used to be able to offset that FX charge, because if you ought UK shares, you were not charged stamp duty. But eToro has recently announced that they will no longer be absorbing the stamp duty tax. eToro said they absorbed this as part of their simplicity and low-cost model. But unfortunately, that is no longer the case.

Essentially, you get what you pay for and if you want all this for free you have to compromise on something, which is everything being dealt in USD.

38 Million Users

Perhaps, eToro’s most valuable asset is its client base. 38 million users, all with differing opinions and sentiment. Afterall, that’s what makes market. Opinion, it drives buy and it drives sellers. When more people buy the market goes up, and viceversa.

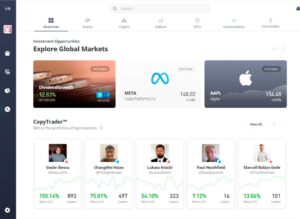

eToro has built a community of almost 20 million accounts, traders or investors. And when you open up the platform it definitely has more of a social media platform instead of a trading platform.

There are two types of community.

The first is the opinion-based, where the feed is populated with the latest views from eToro clients.

The second is copy trading. You can copy anyone you want (as long as their account settings permit it). Or you can copy what eToro call “Popular Investors”, these are investors who have applied to join eToro’s copytrader platform and aim to earn money from it.

Popular investors

Popular investors can earn up to 1.5% of AUC (assets under copy), or however much money other investors on the platform have chosen to allocate to copy their portfolios. However, eToro is keen to point out that once you have $15,000 copying your trades, you are vetted (not endorsed) by eToro and have to stick within risk parameters. Otherwise it would become a scammers paradise.

The thing about investing is that it’s actually quite easy, any fund manager will tell you that the key is to do your research, buy some good stocks, and then do nothing for a very long time. So as long as you do your research and pick some good investors to follow, who are following the same principle then you “should be ok”. BUT, fund managers have oversight, they have compliance officers and risk committees, so they can’t just change their mind about how and what they invest in. Of course, with some notable exceptions, cough, cough Woodford.

When you look at a potential trader to copy, you can see their trading history, their risk parameters and also what they are invested in. Which if nothing else is a good place to start building a portfolio, because you can see where the best performing investors are putting their money. Which is actually a good strategy in the fund management world as well. Morningstar for instance shows the top ten holdings a fund holds. Take a look at Blue Whale for example, you can see what they are invested in and either copy them by buying the fund, or just buy the top ten stocks they hold in your own investment account. If you want to know how fund managers actually invest we have a couple of good interviews with Stephen Yui from Blue Whale and Jamie Ross from Henderson.

If you don’t know which unregulated amateur traders to follow, you have the option to buy a portfolio of aggregated “Popular Investors” diversifying your risk further, or can opt for a smart portfolio that has been put together by a professional investment firm.

Or if you want exposure to sectors there are Thematic funds, like, for instance, if you want to invest in the Metaverse, which is a hot topic right now. eToro have a selection of what they call Smart Portfolios, where they have selected stocks relevant to sectors, a bit like buying ETFs. So if you want to invest in the Metaverse, but don’t know where to start the MetaverseLife Smart Portfolio contains a basket of stocks and crypto that has exposure to the Metaverse.

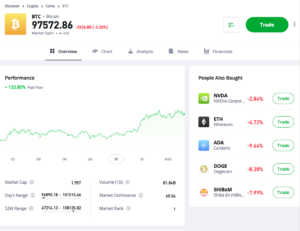

Cryptocurrency

This brings me quite nicely onto Cryptocurrencies. In the UK Crypto derivatives are banned by the FCA for retail traders. If you want to invest in cryptocurrency in the UK you either have to be classified as a professional trader, or by them on a crypto-exchange or platform like eToro on a fully paid-up basis.

One thing eToro has always been really good at is being first to market with new assets, they offer quite a wide variety of cryptos compared to other regulated fintechs, but also vet which cryptos they add by demand, liquidity, the tech behind them and also overall due diligence. Cryptocurrencies are too big to ignore and accounted for roughly 73% of eToro’s commission during the second half of 2021. So you can’t trade crypto derivatives, but you can invest in them with eToro, you can buy them, sell them and transfer them out to an external wallet with eToro money.

Customer Service

If you are one of the masses, customer service can be a bit of a pain, there is no telephone helpline and the support enquiries that we have made have generally taken a day or so to be responded to.

But with 20 million customers, a great proportion, who are no doubt beginners that is no surprise. If you have enough money on account ($25k upwards), you do get access to a dedicated desk of dealers in Europe and Canary Wharf.

So, who is eToro for?

So if you are a small trader, eToro does offer a very innovative way to access the financial markets. It’s quite jolly on the social media feed on the platform, and it is what it is. This is what people want, obviously, as they have 20 million customers. The largest incumbents still have only hundreds of thousands in the UK and in the US a few million.

The key difference between investing in trading, is that investing is a long-term thing, trading is speculation for short-term profits.

However, even though eToro may be positioning itself as an investment platform rather than a trading platform, I’d still consider the investments on offer to be high risk, for your fun money.

I genuinely enjoyed playing with the platform and testing what was on offer. It’s game-changing, but I still think they have a long way to go before you’d allocate more than a small percentage of your overall investment portfolio with them. Your longer-term investments are in my view better off with a boring investment platform like Hargreaves Lansdown or Interactive Investors. But, it will be interesting to see how eToro matures over the years, along with their customer base.

Is eToro a good trading platform?

Yes, eToro is a trading platform where you can trade CFDs (Contracts for Difference). It is also an investing platform where you can buy shares and ETFs as an investment.

What are financial instruments on eToro?

Financial instruments refer to the markets or stocks you can trade. With eToro you can trade around 3,00 stocks, 75 cryptocurrencies, 27 commodities 39 currencies, 19 indices and 264 ETFs. Data correct Oct 22

What is copy trading on eToro?

Copy trading means that you automatically copy the trades of other investors on eToro. It is a type of passive investment strategy, but is risky because you are putting your investing decisions in the hands-on an unregulated amateur trader.

How much does it cost to open an eToro trading account?

It is free to open a trading account with eToro but if you want to start trading, you need to deposit funds. In the UK the minimum deposit starts from $50 USD and varies across the countries.

Does eToro have a mobile app?

Yes, a huge amount of trading and investing is done through eToro’s mobile apps. The app is available in both the Apple and Android app stores. You can compare eToro’s app to some of the best trading apps here.

Does eToro offer CFD trading?

Yes, you can trade CFDs with eToro, but you must understand how CFDs work because they are leveraged trading products which means that you can lose money quickly when trading CFDs.

Is eToro the best CFD broker?

No, only around 5% of eToro’s trading volumes in 2021 were from CFD trading, the rest was from cryptocurrency and investing. Whilst eToro does offer CFD trading their offering is very light compared to brokers like Saxo Markets and Interactive Brokers which both offer direct market access (DMA) CFDs.

Can you upgrade to a professional client with eToro?

Yes, you can upgrade to professional client status with eToro. You will get less protection from the FCA, but you will get better margin rates if you want to increase your trading leverage. However, the majority of customers on eToro are private clients in the UK are classified as retail clients. It means they are non-professional traders and investors and as such get more protection from the FCA and reduced leverage rates. You can compare the difference between retail and professional traders here.

Is there a risk of losing money with eToro?

Yes. As with all investing and trading accounts, you can lose money. There is a high risk of losing money when trading with eToro as only around 20% of retail traders make money when trading CFDs. The risk of losing money is less when investing, as you are not trading on margin. But as with all investing if you pick poorly performing investments or copy traders who perform badly, you will lose money.

If you cannot afford to risk losing money and you are thinking of trading on eToro you should not do it. eToro is a trading and investing platform and it is a well-known fact that around 80% of traders lose money on CFDs. Even with investing, your money is at risk, and if you invest in stocks and markets that go down you will get less back than you put into your eToro account. However, eToro does have a growing copy trading platform where you can see the portfolios of profitable traders and investors.

Are eToro fees high?

eToro fees are not high for trading as they offer commission-free trading. However, if you are trading CFDs with eToro, the overnight CFD financing charges are much higher than other brokers. FX fees are also relaively high when buying US stocks and converting GBP to USD.

Is your money safe with eToro?

In the UK eToro is regulated by the FCA so if they go bust your money (up to £85k) is protected by the FSCS. However, your money is not safe from you making bad investment decisions or picking a bad trader to copy trade.

Does it cost money to withdraw funds from eToro?

Yes. eToro charges $5 when you withdraw money. This is one way that eToro makes money.

Do I have to pay tax on profits made with eToro?

Yes. If you make money with eToro you have to pay tax on the profits. The only way to avoid paying tax on trading profits is to trade financial spread bets in the UK. If you want to know more about spread betting, I explain why it is tax-free investing here.

Does eToro have a monthly fee

Yes. eToro will charge you $10 a month if you do not use your account after 12 months. This is called an inactivity fee and will not take you below a zero account balance.

Does eToro offer SIPPs and ISAs?

No. eToro does not offer tax-efficient stocks and shares ISA accounts of SIPPs for you to invest for your retirement. However, eToro does have a partnership with MoneyFarm where you can have a stocks and shares ISA account.

How does eToro make money?

eToro makes money on the difference between the bid and offer spread when you buy and sell shares, indices, commodities, forex pairs and cryptocurrency. eToro also makes money in fees for depositing and withdrawing money and on FX conversions.

Pros

- Really simple to use

- Social and copy-trading

- Set your own leverage

- Pre-built sector portfolios

Cons

- Can only trade and invest in USD

- No SIPPs or ISA

- No direct market access

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.661% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Facts & Figures

eToro Total Markets | 2,976 |

| ➡️Forex Pairs | 41 |

| ➡️Commodities | 32 |

| ➡️Indices | 13 |

| ➡️UK Stocks | 313 |

| ➡️US Stocks | 1104 |

| ➡️ETFs | 263 |

eToro Key Info | |

| 👉Number Active Clients | Over 1.5m |

| 💰Minimum Deposit | $50 |

| ❔Inactivity Fee | $10 per month |

| 📅Founded | 2006 |

| ℹ️ Public Company | ❌ |

eToro Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ✔️ |

eToro Average Fees | |

| ➡️FTSE 100 | 1.5 |

| ➡️DAX 30 | 2 |

| ➡️DJIA | 6 |

| ➡️NASDAQ | 2.4 |

| ➡️S&P 500 | 0.75 |

| ➡️EURUSD | 1 |

| ➡️GBPUSD | 2 |

| ➡️USDJPY | 1 |

| ➡️Gold | 4.5 |

| ➡️Crude Oil | 5 |

| ➡️UK Stocks | 0.09% |

| ➡️US Stocks | 0.09% |

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

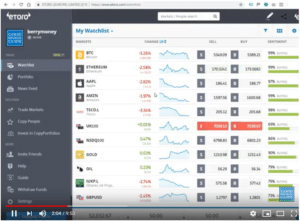

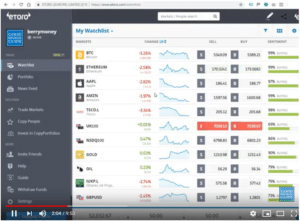

eToro Video Review

In our video review we test the platform with real money and show some of the good and bad features on the eToro trading platform.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro News, Reviews & Interviews

Is eToro good for ETF investing in the UK?

Is it legal to trade CFDs on eToro?

Does eToro offer a demo account?

Is eToro any good for commodities trading?

Can you do forex trading on eToro?

Is the eToro safe to use in the UK?

Is eToro’s GIA good for long term investing in 2025?

Is eToro good for beginner investors?

How to Buy Shares in the eToro from the UK

eToro UAE Expert Review: Access ADX Stocks & Global Markets

eToro Cryptocurrency Expert Review: Best Cryptocurrency Broker 2025

Andrew McCormick head of eToro US on what sets eToro apart for American investors

eToro’s ISA gives you 2% cashback in partnership with Moneyfarm

How does eToro earn its money without charging commission?

eToro continues US expansion with New York launch

eToro wins best cryptocurrency platform at the 2024 Good Money Guide Awards

Jeppe Kirk Bonde hits 30,000 users & $90m copying his trades on eToro

How does withdrawing money eToro compare to other brokers?

Investing in pound sterling comes to eToro

eToro boosts it’s Aussie offering and acquires Australian investing app Spaceship

Can you lose money on eToro?

Can you make money with eToro?

Does eToro have CFD trading?

Indices investing on eToro is one of it’s major benefits

eToro Versus Plus500: Which is the better trading platform?

Who are eToro’s biggest competitors?

Is eToro good for crypto?

Is eToro good for dividend investing?

Can you short stocks on eToro (and how do you do it)?

eToro reduces it’s withdrawal fees

eToro adds GBP trading accounts to its platform

eToro’s smart portfolio capital-guaranteed investment adds Tactical-Edge

eToro introduces AGM voting across all of the equities it offers

Investing In Bitcoin With Simon Peters, eToro’s Crypto Expert

Is eToro any good for trading Natural Gas?

eToro extended it’s extended-hours trading to 45 US stock CFDs

eToro starts charging stamp duty

eToro retail investor beat shows love for crypto, the US and self-confidence

eToro charts it’s way to the top of Twitter

eToro upgrades it’s charting with TradingView

eToro Video Walkthough 2023 – What we like and dislike about them

eToro introduces the ability to stop copying a portfolio but keep the existing positions

eToro keeps its US options open and buys Gatsby

Dan Moczulski, eToro UK MD on the new “global” way to invest

eToro increases it’s currency conversion fee to push users towards eToro Money

eToro lowers the stakes for traders with smaller minimum deposit

eToro Platform Video Review – Is the social trading platform any good?

High Returns? eToro launch the CannabisCare CopyPortfolio

eToro’s Bitcoin sponsorship of seven premier football teams is an interesting move towards physical crypto

eToro launches innovative CopyFunds investment

eToro nominated for Good Web Guide “Website of the Year”

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more here: https://www.etoro.com/customer-service/terms-conditions/trading-restriction/

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com