The UK base rate is set to drop in 2020. Make sure you own some of UK high-paying dividend stocks for income.

More Good Money Guides

Why Bank of England will soon cut the base rate in 2020

Hopes of a post-election spending boost were dashed today (Jan 17). UK retail figures, released by the ONS, showed a spending contraction over the crucial December month. The annual growth in retail sales volumes dropped to 0.9% suggests that consumers are tightening their purse strings. This dismal set of figures came after the UK Nov GDP data detailing a contraction in the UK economy.

In light of these figures, investors are now expecting the UK central bank to cut its base rate soon. The economy is stuttering and some stimulus – monetary or fiscal – are now required to keep the country motoring ahead.

64% is the market probability of a rate cut by the Bank of England later this month. Whether or not this will happen I do not know. But it is clear that the UK economy is hitting some rough patches and a rate cut will happen, sooner or later. The new governor will be keen to show he knows how to tackle a slowing economy.

As rates fall closer and closer to zero, this means that income from savings will be suppressed further. In turn, the income stream from stocks becomes even more important for many yield-hungry investors.

Share dividend payout near-record amount in 2020

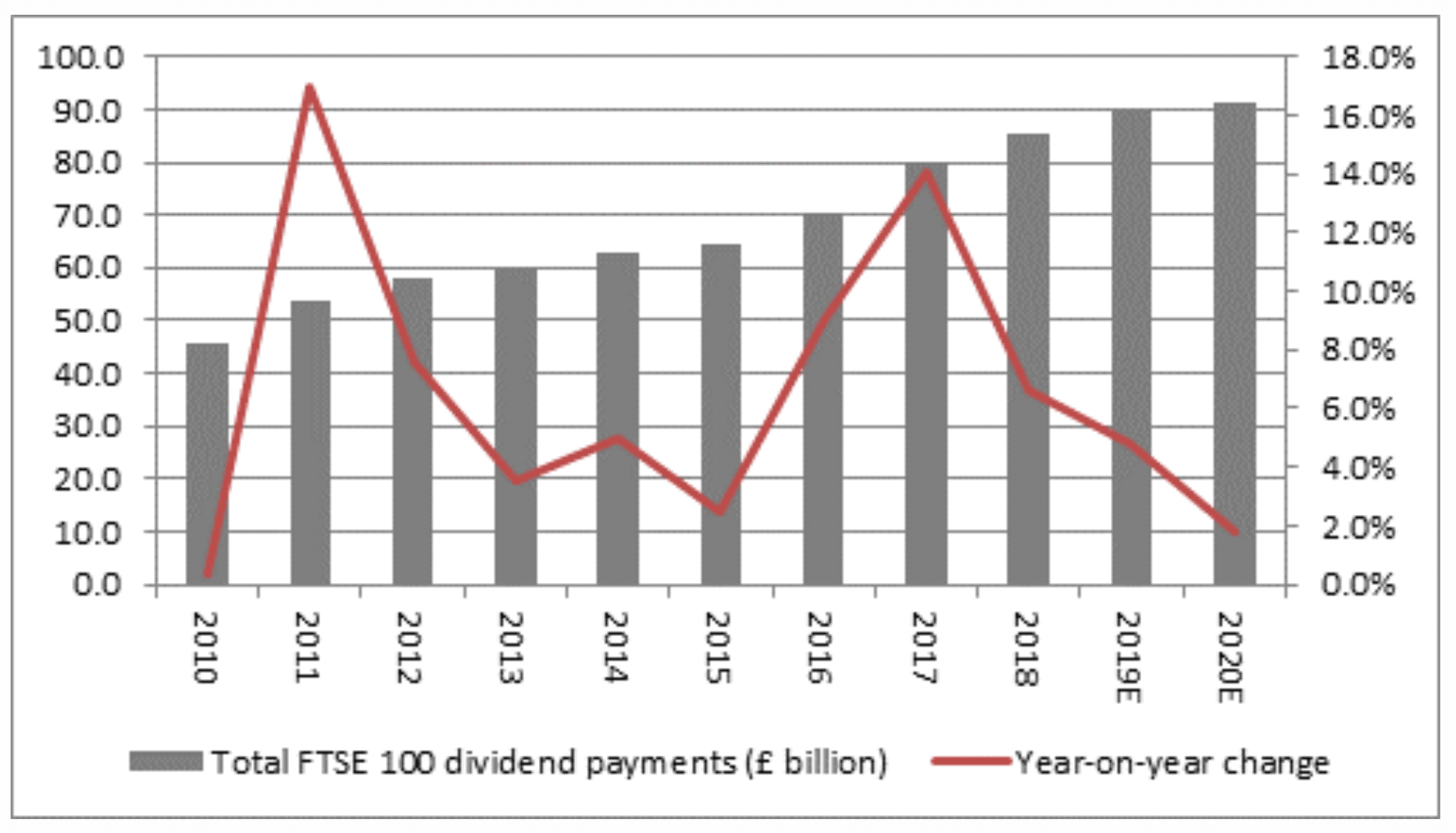

According to a recent AJ Bell estimate, some £91 billion will be distributed to shareholders in 2020. This is a record amount (see below).

Source: AJ Bell

Yes, dividend growth is slowing. But at £91 billion, this amount is twice the payout back in 2010. This shows UK corporate owners are pulling in plenty of cash. With this huge pot of cash estimated to return to shareholders this year, the investment lesson is clear. You must invest your hard-earned cash in some of UK stocks to grab part of the payout. And one should do it fast because stock prices are rising on hopes of a rate cut.

Which stocks, you wonder, should we be looking to buy for income?

Which sectors to buy for dividends in 2020?

Hunting for dividend is different to growth investing. This is because the high corporate growth is typically found among smaller, newer companies. Solid dividend payers, however, normally comes from larger firms in established industries.

Below are four sectors that are throwing off a surprisingly number of good yielders in the UK:

- Tobacco Stocks

- Financials

- Housebuilders

- Miners

I used sectors as a broad guide because stocks in the same sector tend to perform similarly.

Tobacco Stock Dividend Plays – BATS and IMB

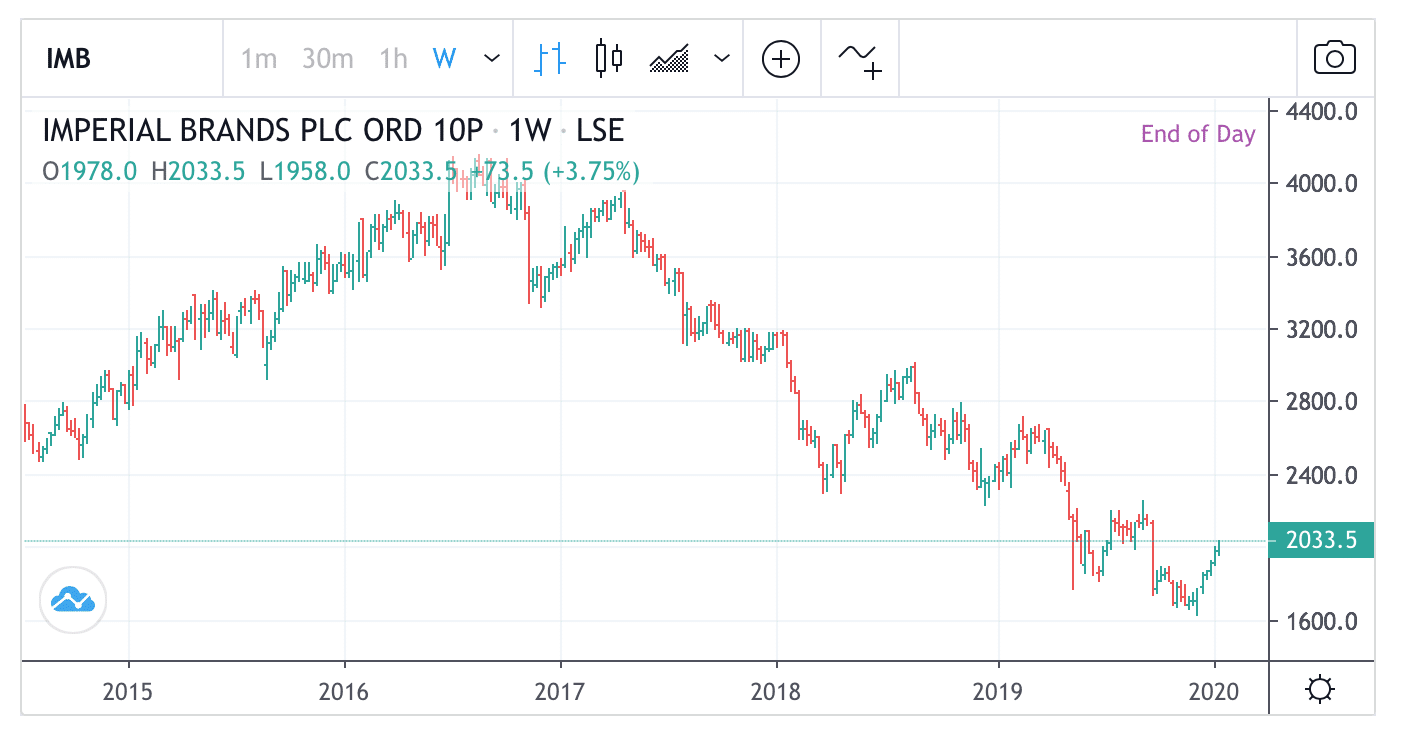

The key stocks in the sector are British American Tobacco (BATS) and Imperial Brand (IMB). The latter is trading at near 10% yield.

The fact that IMB have rallied 25% since November last year is no coincidence. Investors are anticipating a re-rating of the stock – and the sector generally. The sector’s multi-year bear market may be over for now.

Financial Stocks Paying High Dividends

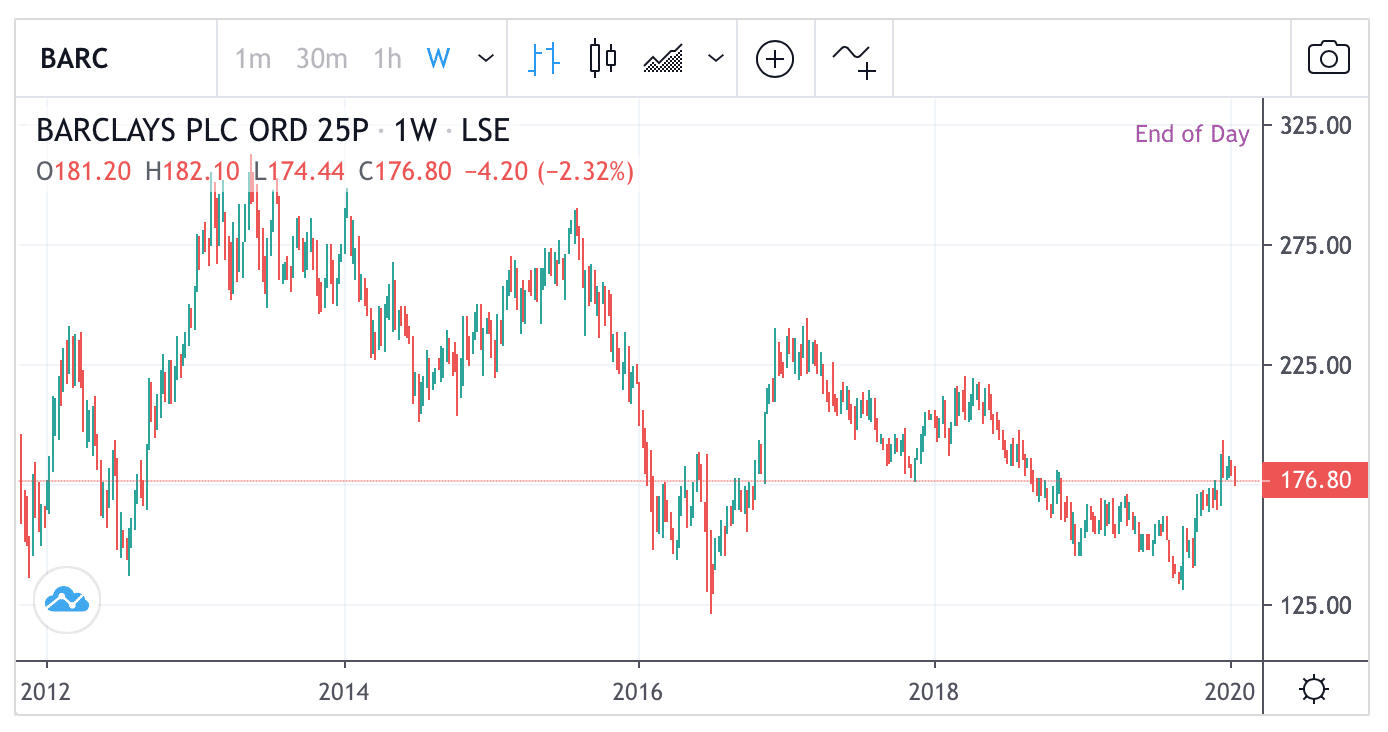

There are some interesting picks in the financial sectors. First, the banks. Some UK-based banks, like Barclays (BARC, 3.9%) and Lloyds (LLOY, 5.4%), provide relatively good yield. Another choice is the £4.5 billion Investec (INVP) yielding at at 5.4%.

Technically Barclays just rebounded off its multi-year lows near 140p, a recovery that accelerated after Boris Johnson’s election. But I have to say Barclays’s chart is not very exciting against the pattern of falling highs and further Brexit negotiations. Still, there is some scope for a recovery into the 200p region.

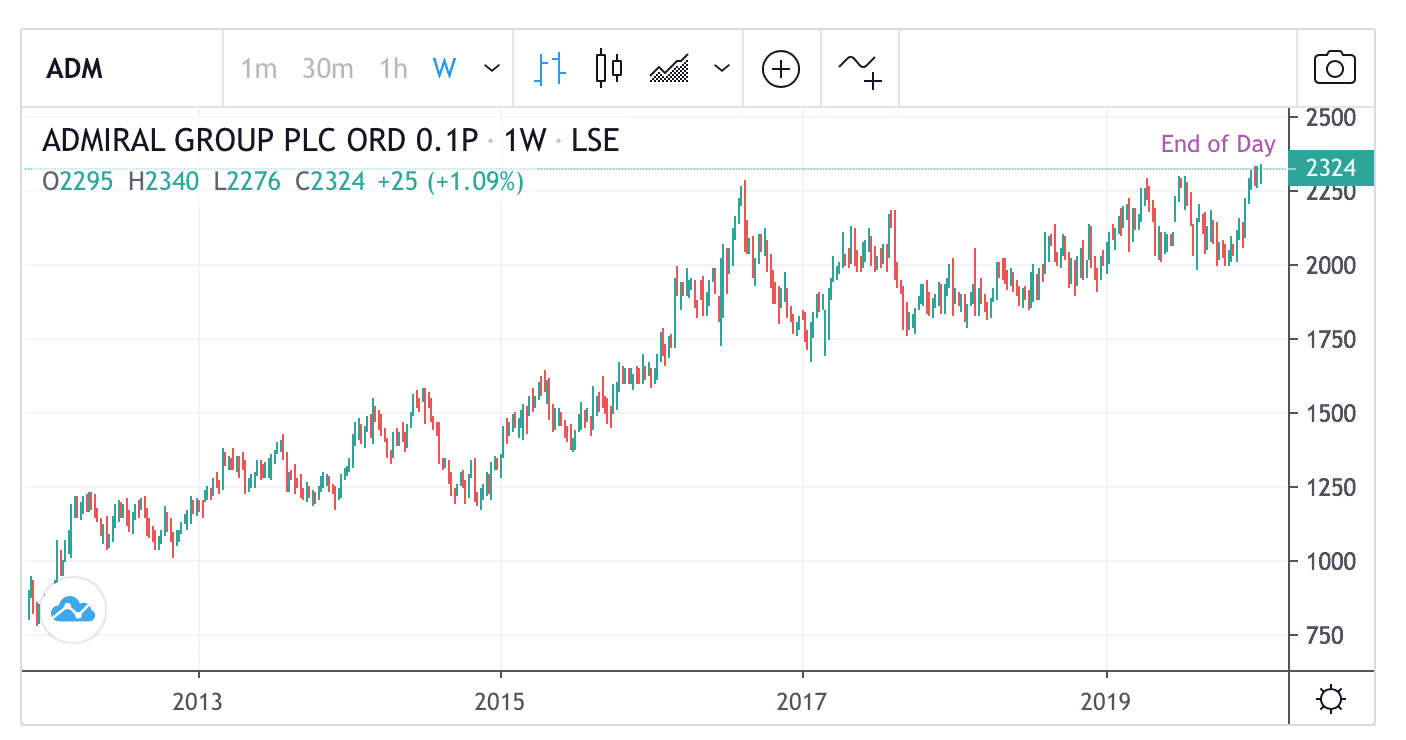

In the insurance sector, some juicy interesting headline yields are noted, particularly Aviva (AV., yield 7.8%), Direct Line Insurance (DLG, yield 6.4%) or Admiral (ADM, 3.9%).

While Hasting, a competitor to DLG and ADM, recently reported a profit warning, it seems the market is still holding faith in the car insurance sector. Admiral is trading near its long-term highs. More remarkable is ADM’s trend steadiness. A good yield and a steady uptrend are a great combination.

Housebuilders Dividend Plays

The UK property market has remained remarkably steady in the post-Brexit years. So much so that Persimmon reported a £1 billion in the last financial year – the largest ever by a housebuilder. With a headline yield of 8.7%, no wonder investors are bidding up the stock. PSN’s share prices are on the verge of breaking its 2018 highs (see below).

Meanwhile, Barratt Developments (yield 3.6%) – (read our Barratt Developments (LON:BDEV) share price analysis), Taylor Wimpey (TW/, yield 3.2%) and Bellway (BWY, 3.8%) are all breaking out of their long-term ranges into new all-time highs. Momentum is on their side. Expect further near-term gains.

Miners & Resource Stock Dividend Plays

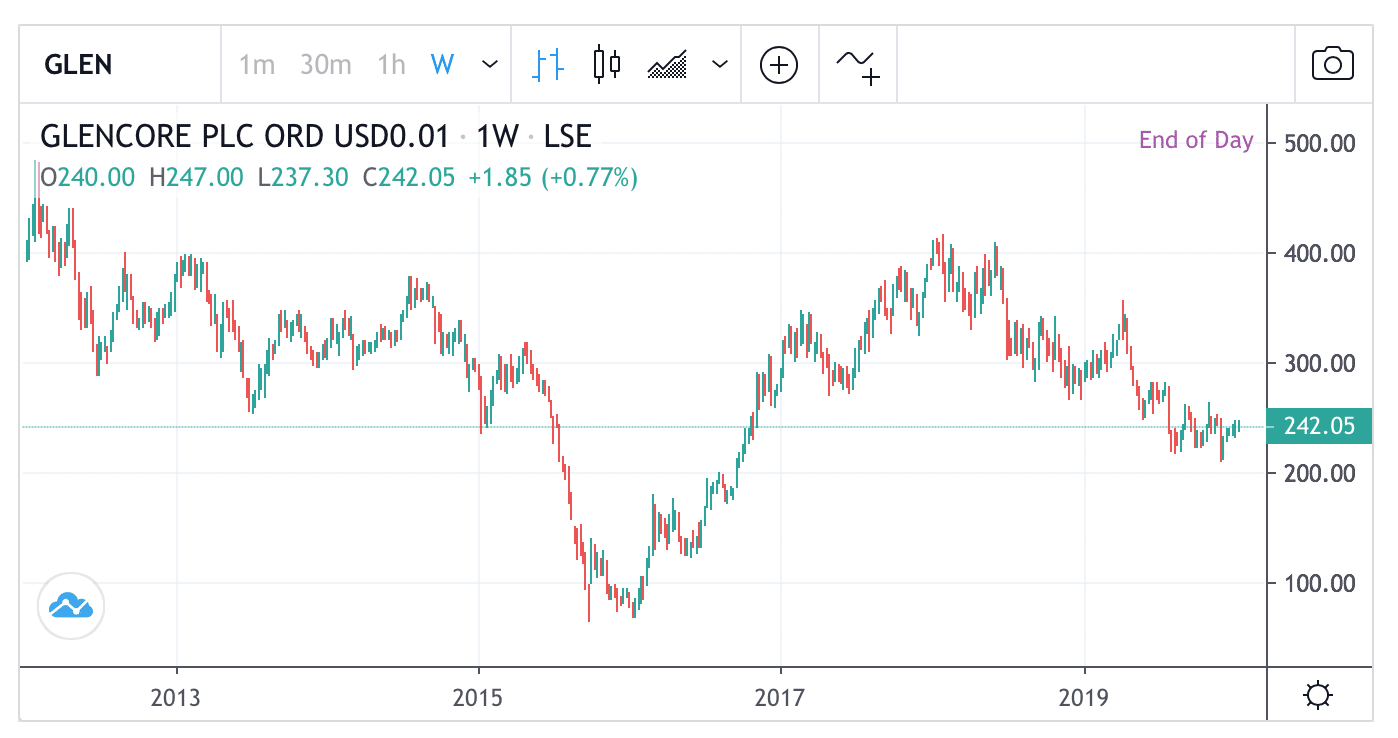

Among the big miners, one of the higher yielder is Glencore (GLEN). The stock is currently yielding 6.5%.

GLEN is one of the largest commodity traders in the world. But the stock was held back by legal wrangling and debt. As a result, its share price is struggling under a two-year bear market.

Still, if the firm can maintain its current payout, it might be some investment risk worth taking, especially as sideways support is emerging at 200p (see below).

For a ‘safer’ miner, Rio Tinto (RIO) is a viable choice. Its yield is a chunky 7.2%.

Time to take a look at iShares UK Dividend ETF (IUKD)?

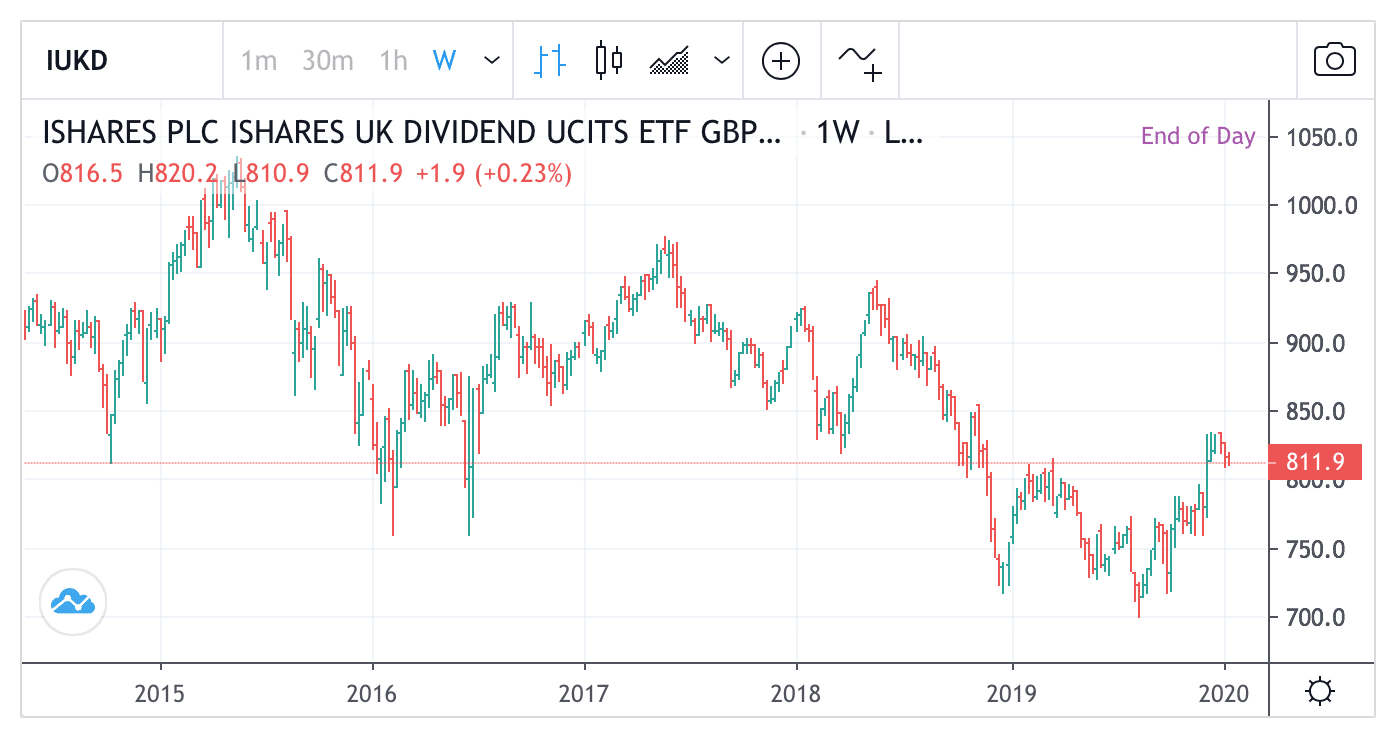

Lastly, you may wish to take a look at iShares UK Dividend ETF (UKD), which holds a portfolio of stocks based on their quoted yields.

The £845 million ETF contains 50 holdings. According to its factsheet, at the top of the ETF’s holding list is Persimmon (PSN), followed by Hammerson (HMSO) and Aberdeen Life (SLA). So if a stock is a high yielder, chances are it will be included in the fund. The fund’s distributing yield is 5.73%.

Notes

1. All dividend yields quoted in the article are approximate.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.