The current Barratt Developments (LON:BDEV) share price is 500p (as of 23/09/2024 16:39) which is a change of 0.3 or 0.06% from the last closing price of 500 with 2,000,484 shares traded giving Barratt Developments a market capitalisation of £7,254,505,000. The most recent daily high has been 504.21 and daily low 495.8. The Barratt Developments share price 52 week high has been 582.6 and the 52 week low 384.15. Based on the most recent Barratt Developments share price opening of 500, the current Barratt Developments EPS (earnings per share) are 0.12 and the PE (price earnings ratio) is 43.26.

How to buy shares in Barratt Developments (LON:BDEV)

To buy shares in Barratt Developments (LON:BDEV), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Barratt Developments:

- Decide if you want to buy Barratt Developments shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

Buying one LON:BDEV share costs 500p. However, as well as the 500p cost of buying the shares you will also have to pay stamp duty, commission when you buy and sell shares and custody fees for holding your shares on your account. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Barratt Developments Share Price Chart

Barratt Developments (LON:BDEV) Share Price Analysis 2/12/22

Are Barratt Developments’ shares (LON:BDEV) a good investment and should you buy when they are down 40% over a year?

Barratt Developments’ share price (LON:BDEV) is down around 40% over the last year, but why? The housing market is one of the key pillars of the UK economy. A buoyant property sector supports a wide array of industries, including construction, internal decorations and property services. Moreover, property owners are sitting on thick equity cushions and have siphoned billions of equity to support consumption and retirement.

Price history

Historically, bricks and mortar and housebuilders like Barratt Developments have been a gold mine.

But are they still a good buy? Nationwide, the UK’s biggest building society, has published its long-running property index today. It bodes ill for the property market.

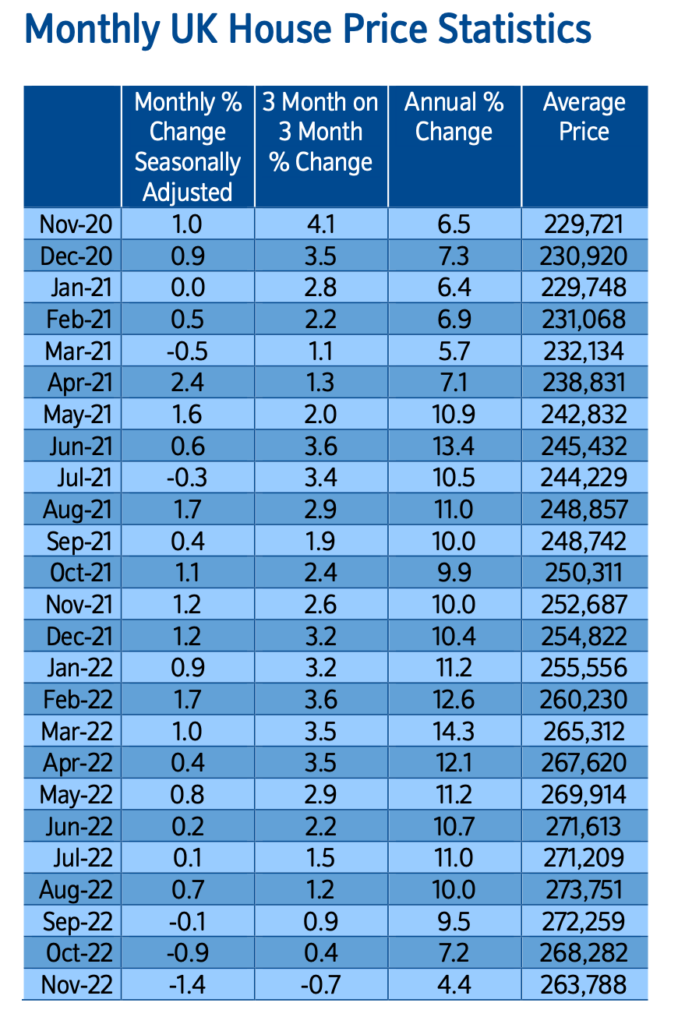

“Prices fall 1.4% month-on-month,” the headline screams, and this is the “biggest fall since June 2020 – following 0.9% drop in October (see table below).” The report notes that the housing market has ‘ lost a significant degree of momentum’.

Source: Nationwide

Against this backdrop, are Barratt’s shares worth buying into now? There are pros and cons of buying developers’ stocks at this moment. Let’s talk about the downside first. Is the monetary tightening over? I suspect not. Inflation remains high and many central banks have explicitly said they are not done tightening. Policy rates may not go up as quickly as before – but they are still going up.

Secondly, is the property market out of the doldrums? Again, the answer is no. As Nationwide pointed out above, UK property prices are regressing downwards – not rallying higher. Mortgage approvals are falling as the cost of higher mortgage rates bites. Unsurprisingly, there are plenty of macro risks weighing on property stocks.

The good thing is that housebuilders are entering the downswing in a stronger position than before. In the last fiscal year, Barratt reported pre-tax profits of a billion pounds. They are spending millions buying back their own shares. And the property market is sliding, not crashing. There is no banking crisis (yet) which may lead to a property crisis.

Overall, we could be in the early part of a down cycle. Until the macro environment improves, Barratt shares could stay stagnant for a while longer. If you’re focussing on the very long term (5 years or longer), then Barratt could be a candidate to buy.

Cyclical share price moves

As we pointed out in Taylor Wimpey’s stock analysis, property is cyclical.

This means that Barratt’s share price move in cycles too. There is no escape – or ‘decoupling’ – from the underlying property market. When the property market is strong, Barratt profits from it.

But remember, Barratt is also a stock. As we all know, stock prices do not reflect the business efficiently at all times. There are periods when share prices can go berserk. Think of GameStop or AMC last year. A speculative frenzy pushed share prices significantly above the value of the underlying business.

Sometimes, a stock can meander sideways for years, like Barratt during 2015-2022 (see below).

Occasionally, the stock market becomes manic depressive and you can buy part of a business for a fraction of its worth. That’s the time to buy Barratt’s shares. Are we there yet? I suspect not. But a further drop may open up such opportunities.

Bearish sentiment

Barratt’s share price is a reflection of the market sentiment, expectations of the property market, and macro trends. At any given time, there are many factors that could impact Barratt’s shares.

Currently, the market is more preoccupied with what the central banks will or will not do. The background sentiment is bearish – and the market typically finishes a stock if it misses profit margins by a few percentage points.

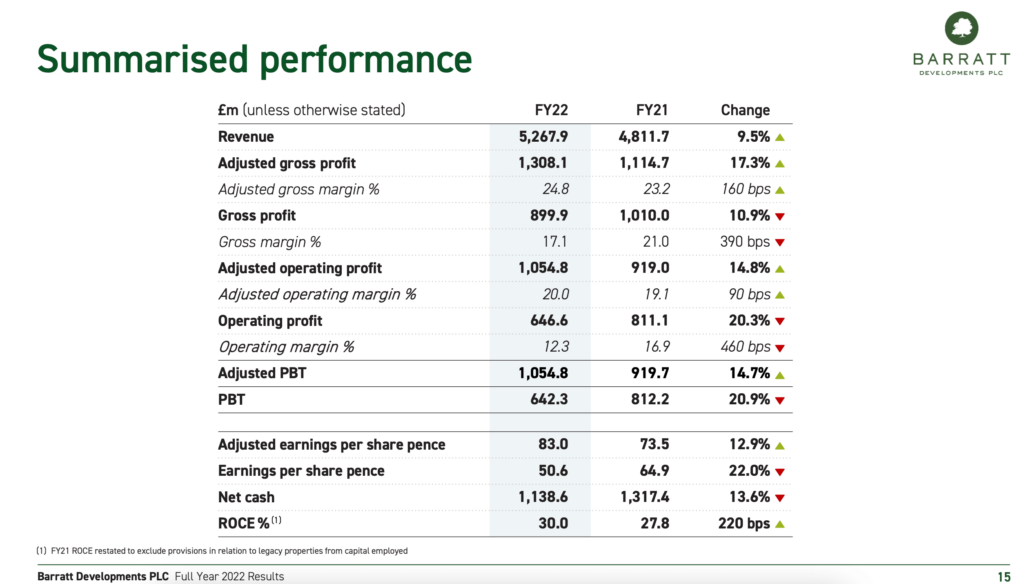

Fundamentally, Barratt seems to be in a strong position (compared to 2007). A quick glance at its headline results below shows a profitable company with some cash to survive a downswing. At price-earnings of 8 and yield in excess of 9%, the stock appears ‘cheap’. But what is cheap can become cheaper.

Source: Barratt plc

Slumps

UK’s macro outlook has deteriorated significantly since summer, on three factors:

- Monetary tightening – by major central banks in the US and EU has tightened liquidity significantly. This led to higher borrowing costs across the entire economy

- Bungled ‘Mini Budget’ – by the last Chancellor which further raised the mortgage rates significantly for many property owners.

- Affordability of new homes dropped – after mortgage rates spiked up.

Taken together, these factors have taken a lot of wind out of Barratt’s share price. Prices slumped from 500p in the summer to 320p in the autumn. Oversold, a technical rebound is currently underway.

Predictions & forecasts

The City is becoming more cautious about Barratt’s share price. Over the past year, a smaller number of analysts have put up ‘Buy/Outperform’ recommendations on the stock (17 vs 13).

That’s not surprising given how poorly the developer has performed since late 2021 (-43% over 12 months).

Against a period of heightened macro uncertainty, I would be surprised to see more ‘Hold’ recommendations in the future.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com