The impact of interest rate hikes on the property market is far-reaching and significant, especially after the social upheaval caused by a global pandemic. This guide looks at property cycles and how readers can take advantage of the looming cyclical downturn in real estate and short the property markets.

The property market is cyclical

Few assets are more sensitive to interest rates than property. The reason is simple: properties are expensive. Did you know the highest-priced property in the UK reaches a quarter of a billion pound? Few investors acquire a real estate portfolio without borrowing money from lenders.

Borrowing, however, incurs costs. This cost is commonly known as interest rate. The higher the rate, the more expensive the borrowing becomes. The property you can buy at 0% borrowing rate is substantially reduced when rate is at 10%.

Moreover, interest rate does not stay the same over time. There are times when the borrowing costs rise and times when they fall. As interest rate rise and fall, this causes property prices to fluctuate along with it. A cycle is created.

Ask any experienced property dealers about a property cycle, he or she will tell you that the property market is sometimes cold, sometimes warm. In some years, the market sizzles to an intolerable temperature (like 2021 just after the pandemic).

This cyclical nature is observed in many other property markets too, such as US, Japan, Sweden, or Singapore. In other words, the property cycle is global feature, not just in the UK.

How does a property cycle work?

The setup of a property cycle is simple. It’s made up of seven basic phases.

- Inception. A housing booms always start from this key factor: Supply-demand imbalance. Property yields are high. Speculative capital low. Demand strong; supply low. Prices go up slowly but steadily.

- Price growth. Growth is sustained for some years. Developers increasingly confident about the future. Housing developments increase. Housing credit expands.

- Setback and recovery. Corrections occur as house prices overheat temporarily. Perhaps a short recession causes price rallies to stall.

- Accelerated Growth. Once the economy recovers, capital returns to the property market. Those who bought in phase 3 during a recession made a fortune, enticing others to join the game. Affordability falls, but the wider public joins the game (often via second/third/fourth homes). Access to credit becomes much easier (think Subprime).

- Boom and bubble. Developers leveraged up – and build as many as possible. Average home owner leverages up. Bank credit reaches its zenith. Speculative capital – often from outside the country – bid aggressively for properties. Affordability and yields are extremely low. It’s all about capital growth and ‘flipping’.

- Price collapse. Factors that induce a property collapse include:

- (a) Credit restriction,

- (b) Higher borrowing costs,

- (c) Drastic fall in real demand,

- (d) Cooling measures. As a result, capital flee the sector. Prices slump. Housing inventory spikes. Bankruptcies soar as leveraged players suffer massive equity drawdown. There will be ‘White Elephants’ around. Negative equity abounds.

- Recovery. After the supply-demand imbalance moves back into equilibrium, the market is ready for the next boom-bust cycle. This recovery may take some years, depending on (a) How big the speculative boom was, (b) How much supply in the market. For example, the Japanese property bust lasted more than 20 years (1990-2010); whereas UK’s housing bust in 1990 lasted just five years.

Armed with this setup, how should we approach the property market?

2023: Will higher rates dampen property prices?

We are now in a ‘new world’. The 2020 covid pandemic had caused a massive social dislocation; the war in Ukraine upended the global geopolitical order. The economic conditions in 2023 are no longer the same as they were back in 2019.

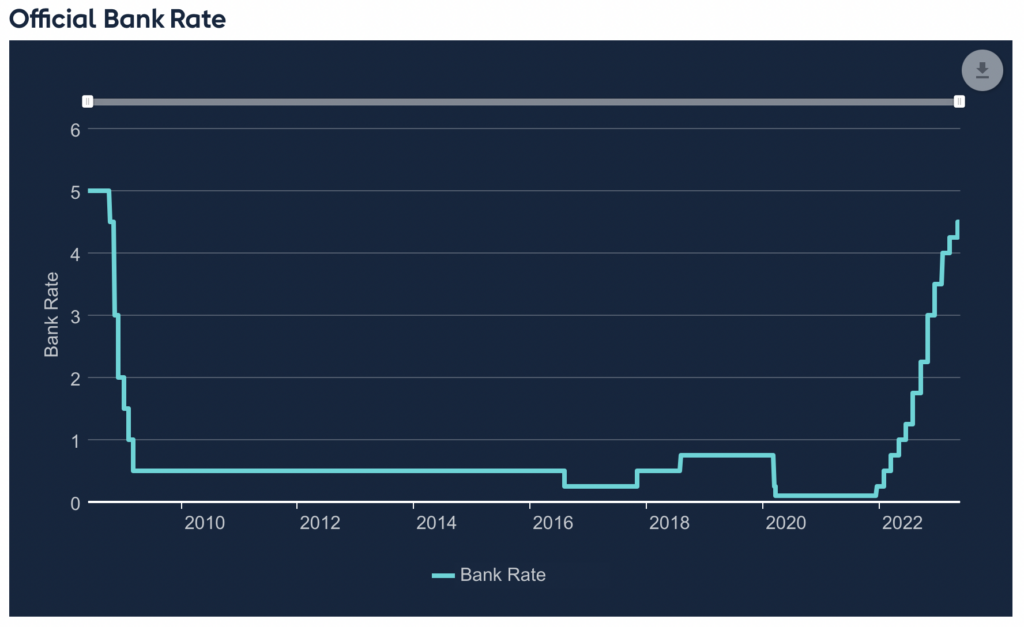

After a string of rate hikes – 12 to be precise – UK’s policy rate now stands at a staggering 4.5%. This is the highest level in more than a decade (see below).

What caused the central bank to raise rates at such a frightening pace? Inflation. UK’s inflation rate rocketed from near 0 in 2020 to double digits this year. (April 2023 CPI inflation remains at a worrisome 7.8%.) Supply constriction, surging commodity prices like energy and food, and ample credit – all played a part in the inflation saga.

This is a sea change from the economic conditions prevalent during 2010-2020. Gone are days when inflation hovers around 2-4%. The era of ‘easy money’ is probably over.

Does this impact negative property prices? You bet. Charlie Munger, Berkshire Hathaway’s vice chair, warned recently (April 2023) that “a lot of real estate isn’t so good any more.” He further remarked that. “We have a lot of troubled office buildings, a lot of troubled shopping centres, a lot of troubled other properties. There’s a lot of agony out there.”

This means that there could money to be made on the downside. In fact, 2022 saw a lot of adjustment in property prices and may continue as long as interest rates keep rising.

Source: Bank of England

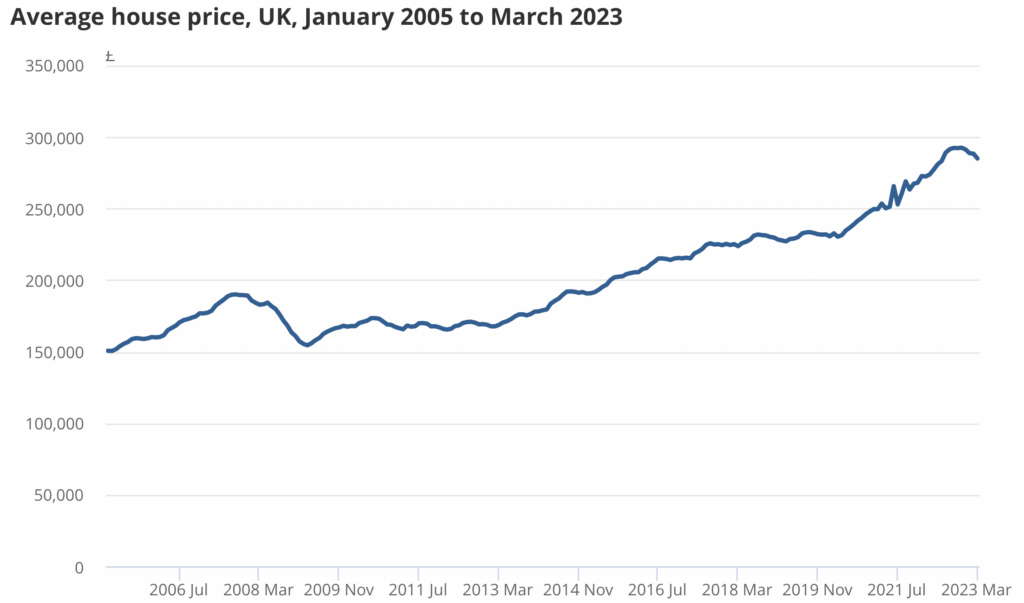

If we take a quick look at the UK house prices, things are certainly no longer as rosy as they were back in 2022. Prices appear to have peaked. The multi-year bull market has stalled near the £300,000 (average house price) level. Any further rate hikes later this year may easily tip the market over.

So, how should you navigate through a potential property market downturn? Are there ways to profit from it?

Source: ONS UK

UK & International Property ETFs

- iShares UK Property UCITS ETF (IPRP)

- HSBC FTSE EPRA Developed UCITS ETF (HPRD)

- iShares European Property Yield UCITS ETF (IPRP)

- VanEck Vectors Australian Property ETF

- iShares UK Property UCITS ETF

- Vanguard Australian Property Securities Index ETF

- iShares Asia Property Yield UCITS ETF

- iShares European Property Yield UCITS ETF – IPRP (NL)

- iShares Trust – iShares International Developed Property ETF

- iShares Developed Markets Property Yield UCITS ETF – IDWP

- iShares US Property Yield UCITS ETF – IUSP

- iShares European Property Yield UCITS ETF – IPRP (LSE)

Ways to take advantage of a falling property market

There are a few ways to profit from a falling property market.

- Spreadbet on property stocks – bet on prices falling

- Buy property companies on the cheap

Let’s talk about the first – spreadbetting on UK property instruments.

One of the best things about spread betting is that you can bet on pretty much anything. There are a few property sectors that you can sell in the London Stock Exchange:

- Housebuilders – like Persimmon (PSN), Berkeley (BKG), Barratt Development (BDEV) or Taylor Wimpey (TW.)

- Commercial REITS – like Land Securities (LAND), British Land (BLND) or Segro (SGRO)

- Property Exchange Traded Funds (ETF) – such as the iShares UK Property UCITS ETF (IUKP)

If you place a negative bet (‘shorting’) on an instrument, you win when its share price drop.

Three elements to pay attention when you are shorting any of these instruments: One, the leverage of the bet. Two, the potential risk and reward of the trade; and three, the characteristic of instrument.

Take Persimmon. The £3.9 billion developer saw its share price crashed from 2,800p to 1,200p last year (-57%). Any seller of the stock would have racked up big gains. The stock has ample liquidity and its price move is wide. A break of the psychological 1,200p support may lead to a further decline into the round number level at 1,000p.

However, some property ETFs may have a wider spread due to poorer liquidity and their share prices don’t move much. If you wanted to use it as part of your spread betting strategy to hedge against the value of your property portfolio, make sure you look into the overnight running costs thoroughly. The financing charges may be high and the width of the spread may take a while to recoup in a stagnant market.

On the second part, when buying ‘cheap’ property stock, you have to remember three points:

- What is “cheap” now can become cheaper later – especially as interest rates keep rising or when a recession arrives

- What does the property company own? Is the company owning attractive property assets or assets that are significantly underwater and there is no way to recoup these losses? Where are property locations?

- How indebted is the property company? Unfortunately when bad times arrive, some leveraged property company will fold as its finances cratered (think: Silicon Valley Bank) As such you want to buy only the strongest property that will survive

Conclusion

This guide takes a quick look at the property market cycle and how you can profit from it. There are no hard and fast rule, just general guidelines.

No doubt that the year-long interest rate hikes are having a significant impact on the real estate market. Prices are being adjusted and there will further adjustments in the coming months.

Make sure you stand ready to take advantage of these adjustments and prepare to navigate through a turbulent period.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.