To invest in an IPO (initial public offering), you need to apply for shares though and have a stock broker to hold the shares in. This can be done through an aggregator platform like PrimaryBid or directly through a stockbroker like Hargreaves Lansdown, Interactive Investor or AJ Bell. This guide explains how to invest in IPOs, the process, the risks and also some of the best accounts to get access to new issues and placing.

We have also ranked, compared and reviewed some of the best accounts for investing in IPOs, new issues and placings in the UK that are regulated by the FCA.

Interactive Investor – Best overall for new issues, IPOs and placings

- Fixed fee investing

- DIY & managed accounts

- IPO, new issue & placing access

- GMG rating: (4.6)

- Customer rating: 4.2/5 (792 reviews)

Interactive Investors offers its customer access to new issues and IPOs from companies listing on the stock exchange for the first time. You can apply for shares in these businesses through II, but you will need to open a trading account to do so. II advertises the available new issues on the dedicated IPO section of its website there and there are links to offer documents and details of the issue. II does not charge a commission for new issue applications.

Hargreaves Lansdown – excellent access and allocation to IPOs, new issues and placings

- Good customer service

- Cheap for shares

- Good IPO access

- GMG rating: (4.6)

- Customer rating: 3.7/5 (1,304 reviews)

Capital at risk

Hargreaves Lansdown offers the chance to get involved with IPOs alongside other investments. You can access the latest share offers through their website. If you have heard of one which they have not covered for any reason, you can also let them know about it.

IG – offers grey market pricing on IPOs

- Large range of markets

- Go long and short

- Low-cost trading

- GMG rating: (4.3)

- Customer rating: 3.9/5 (523 reviews)

Capital at risk

IG allows its share dealing clients to subscribe to IPOs and placings through PrimaryBid. To do this you will need to have an IG share dealing account and an account at PrimaryBid then it’s just a case of linking the two. Once that’s done you can apply for placings and new issues through PrimaryBid and any allocations you receive will be transferred to your IG Share dealing account. See our review of PrimaryBid.

IG makes no additional charges for subscribing to IPOs and placings through PrimaryBid, which levies no charges either.

However, IG will also often make a so-called “grey” market price in major IPOs. The grey price is a price in the shares of a company that is listing before it floats allowing traders to take an early view on the stock ahead of the IPO. If you believe the IPO will exceed the likely issue price then you would go long in the grey market or should you believe that the price of that stock will fall below the suggested IPO price, then you would go short in the grey market.

AJ Bell – apply directly for IPOs and new issues

- Low-cost investing

- Lots of account options

- Good research & analysis

- GMG rating: (4.2)

- Customer rating: 4.2/5 (844 reviews)

Capital at risk

Through AJ Bell it is possible to invest in some Initial Public Offerings (IPOs). You can find information on upcoming IPOs on the company’s IPO page.

To participate in an IPO, you must have an account with AJ Bell. You can apply for shares within any of your AJ Bell accounts.

There are no dealing charges or stamp duty payable for making an IPO application. However, normal dealing charges will apply if you choose to sell your IPO shares once they are issued.

PrimaryBid – best for access to all IPOs, new issues & placings

- Allocate to your broker from PrimaryBid

- Access most IPOs, new issues and placing

- Specialist IPO access

- GMG rating: (4.2)

- Customer rating: 3.6/5 (100 reviews)

Capital at risk

Using PrimaryBid you can apply for shares in companies that are floating on the stock exchange for the first time. These deals are known as flotations or IPOs and are part of the primary markets through which companies access capital, as opposed to the secondary markets, where shares are traded independently of any fundraising.

To apply for shares in a new issue you first need to open a PrimaryBid account and to do that, you will first need to download their app from either the Apple or Android app store, or register using their website.

Note though that for some issues you will also need to be an existing customer or account holder of the company that’s floating, added to which you will need to have a trading account with a stockbroker into which PrimaryBid can transfer any shares you are allocated.

PrimaryBid is not the first platform to try and democratise new issues. ALL IPO which was acquired by ADVFN in 2009, ran a similar service, however that shut down in 2018 creating a gap in the market for PrimaryBid to try and fill.

Further reading:

What is an IPO?

IPO, short for Initial Public Offering, is the process of selling part of a company to the public.

The IPO process is usually conducted by regulated financial institutions like investment banks and stockbrokers. A lead manager of the IPO is known as a book runner. They will first study the company (‘due diligence’), write up an offer document for investors, called a ‘prospectus’, and then roadshow the business to institutional clients and sound out their appetite for the company.

They will underwrite the IPO to sell the shares successfully. In return, bankers earn fees for this effort. Some IPOs are so huge that the IPO fee can be tens of millions.

If you are more interested in buying into more established public companies here is how to buy shares in any company.

Advantages of investing in initial public offerings

- Discounted offering – . The biggest advantage is that you get to buy shares at a discount to their current value. When IPOs launch, shares are typically offered at a discount to attract buyers. So if you are able to pick up shares as part of the initial offering, you are likely to take advantage of a potential discount. For example, Facebook (NASDAQ:META) was listed in May 2012 at $38, when its pace of growth was high. Tesla (NASDAQ:TSLA) first sold shares to the public in 2010, when it was still small and growing. Investors who bought into the listing would have made a bundle over the past few years.

- Potential for positive volatility – depending on the success of an IPO, there is typically lots of volatility within the first few days of its launch on the stock market. If there is huge demand for the shares, there is the potential for positive volatility where prices could rise as much as 40% within the first few days. For example, Royal Mail (LON:IDS) shares rose 38% on its first day with prices almost doubling in value within a few weeks

- You can short IPOs – when trading as opposed to investing, you don’t have to just buy an IPO and hope that prices will rise. You can also short-sell them, meaning you can take advantage of falling prices, giving you greater flexibility. So if you think an IPO will underperform, you can short sell its prices with a CFD broker.

Risks of investing and trading an Initial Public Offering

- Expect volatility – as mentioned above, most IPOs suffer from volatility in the first hours and days of its launch. This can make trading them extremely hard to predict, especially when done so using leverage. On the one extreme you have the Royal Mail example. On the other you have Facebook, which launched at $38, rose to a high of $45 within hours only to fall back to $38 by market close on its first day. Within a few months, shares were trading as low as $20.

- Form can be temporary – how an IPO trades on its initial days as a publicly traded company is no guarantee of how it can trade in the subsequent months or years. So for some investors it may be wise to wait until the volatility has calmed before getting involved in trading an IPO

- Beware first earning season – when private companies goes public, it means they are now required to update shareholders on their earnings every quarter, as opposed to once a year. This can add even more volatility to the stock as initial investors react to whether the firm is living up to the claims made in its prospectus.

- You can lose money – Not all IPOs are guaranteed to make money for investors. New issues are by nature speculative because the business is new. Valuations are driven by sentiment, which can be volatile. Worst-than-expected results can also lead to a persistent downtrend of its stock price. Share prices of an IPO can – and often do – trade below that of the issued price. Investors who bought into the IPO will suffer losses. One example is Aston Martin (LON:AML). The luxury car company sold its shares to the public at £19 in October 2018. After a while, the stock slumped and last year traded below 50p.

Five factors to consider when investing in an IPO

Should you wish to participate in newly-listed companies, here are five key questions you should ask before plunging in:

1) What’s the story?

Every new company has a good story to tell. What’s the vision? Is the sector a completely new one? Two decades ago, dot-com firms were all the rage. Now, payment, AI, cloud, automation, robotics, and software are some of the hottest sectors. These fads often change, but more often than not, an exciting story will be easier to sell to investors.

2) Is the firm profitable and growing?

While most investors would prefer a profitable company, the real factor driving the success of a company is often growth.

Young companies in a new sector grow rapidly. They will need to spend heavily to acquire new customers or build the latest state-of-the-art factories. Thus, investors will overlook its present loss-making activities and support the IPO for future growth. Many tech companies were losing money when they were an IPO, including Amazon.

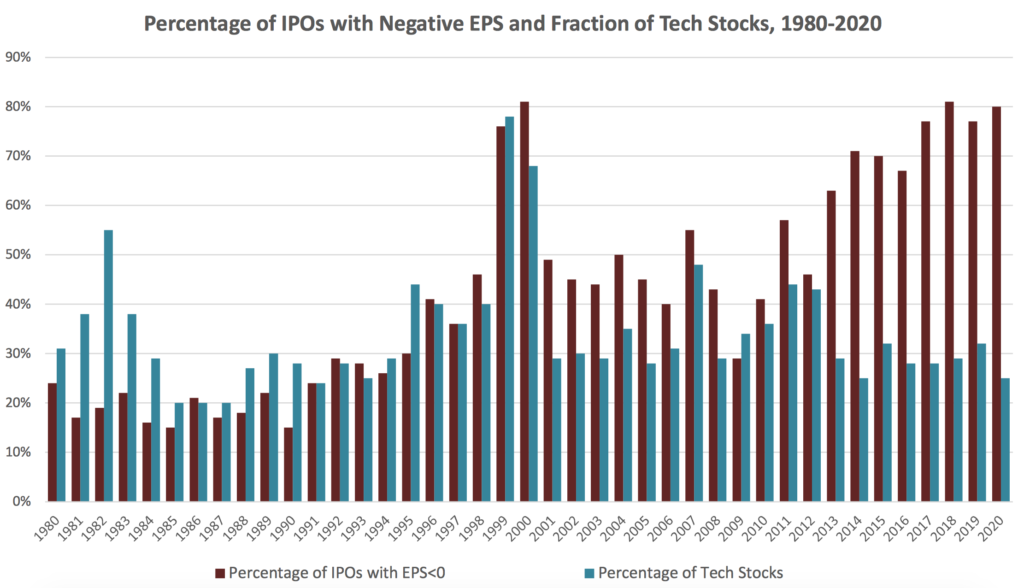

In recent years, most US companies seeking an IPO were loss-making. Some studies showed that up to 80% of IPOs in America have negative earnings (see below).

Source: Prof Jay Ritter (link)

3) How did the previous IPOs perform?

This is an important question because it is about investor psychology. Investors are more likely to buy more if prior IPOs, especially in the same sector, were hugely successful.

Investors who made money trading the IPO will most likely reinvest the profits in the next one.

4) What is the valuation?

IPOs follow the stock market cycle. Demand is no doubt stronger during the bull phase. Valuations are higher, liquidity more plentiful.

Investors and traders can make lots of money ‘flipping’ IPOs during a mania, such as the dot-com boom in the nineties. Many companies take advantage of the positive mood and IPO at a high valuation – without making an effort to build a real underlying business.

Once the speculative mania ends, many IPOs went bankrupt. The new businesses weren’t sustainable.

As an investor, you will need to determine which cycle we are in now and whether the IPO is sensibly priced. If it is too high, it means expectations are overly bullish. Future growth is already priced in the share price. Even the company does well in the future, this may to lead low price growth.

5) Are any big cornerstone investors buying into the IPO?

A large successful investor buying into an IPO signals that the investors believe in the company for the long term. This is a positive and bullish signal.

Last year, Warren Buffet bought his first IPO since 1956, in a company called SnowFlake (SNOW). Now, hearing that, would you be more or less confident of the offering?

IPO investing FAQs:

Stock placings are another way in which companies that are not currently listed can gain access to stock markets and the investors in them.

Placings are often used by companies who do not necessarily need to raise money, or if they do, they wish to have only a select number of new institutional shareholders.

Placings are typically organised by the company’s brokers/bankers, who approach institutional investors and invite them to participate in the placing, setting out the terms of the proposed issue and the nature of the business that they will be investing in. In this type of issue, there is usually little or no opportunity for retail investors to participate.

That said, the placing is proving popular among listed smaller companies looking to raise additional capital.

Often, the company will issue new shares at a discount to the current share price.

Depending on the size of the issue and the demand for the shares, these placings may take place through just one or two brokers, though in larger issues, there may be a bigger underwriting group.

In theory, there should be an opportunity for retail investors to participate in these secondary placings, though they are often conducted on a first-come-first-served basis. So, whether you hear about them before they’re completed may depend on your broker and their connections.

Retail investors can invest in IPOs, but, they are certainly not for everyone There are no guarantees that the listing price of new issues, however they are brought to market, will be higher than the issuing price.

If the share price of the new issue in the secondary market falls below the issued price, then you will have a running loss on your investment. You then have a decision to make as to whether you should sell the shares and take that loss, or hold on in the hopes that the price will recover above the issue price in future.

New issues are by nature speculative; investors are putting money into businesses that may have little or no track record, valuations for which are often driven by sentiment and can prove to be fragile, if, for example, the recently floated company experiences a downturn in its markets, loses a large order or suffers some other form of disappointment.

New issues are a form of IPO but more often than not these days, the term IPO refers to the floatation of a large ongoing concern such as a tech unicorn or state-owned business etc.

When smaller companies come to list or float on the stock exchange, they are referred to as being a new issue. This is particularly true of the UK, the phrase IPO being an Americanism.

The term new issue can also be used to describe an issuance of shares or debt/bonds from an existing and listed business; for example, a company whose ordinary shares are listed on the stock exchange may make a new issue of convertible bonds to raise additional working capital for a project or expansion.

But whether the new issue is from a business listing for the first time or an issue of new paper from a company that’s already listed, the process is very similar to that of the IPO, but on a smaller scale. The issue will typically be underwritten; permission to list the new securities is sought from the exchange and offer documents are prepared. The underwriters and their associates will gauge demand and applications for the new shares or bonds are invited from investors and the new issue is listed on the exchange.

Investment returns will depend on many variables, such as the issues you apply for and participated in, your approach to trading the issues, that is whether you sell the new issue on the first day of trading regardless, or whether you tuck them away for a few weeks, months or even longer.

As the FT pointed in May 2019 (written in the wake of the disappointing IPO of ride-sharing app Uber NYSE:UBER ), the price of Facebook (NASDAQ:META) moved very little in its early trading after it IPO’d back in 2012, but its share price has risen multiple times in value over the last seven years.

A long-term study of US IPOs, using data from 1980 through to 2016, conducted by Professor Jay Ritter of the University of Florida, found that the average return from among more than 8,500 US IPOs was +17.90%, based on their first day of trading, and some +21.90% over a three-year holding period.

Those returns, of course, are based on the idea that an investor participated in each one of the new issues and using averages can, of course, mask a wide range of underlying individual outcomes.

The London Stock Exchange keeps a list of upcoming new issues here.

The number one reason is to raise new equity to expand the business. The other reason is to raise money and repay some of the debt raised earlier. Early investors in the company may also wish to sell their shares to the public to exit the investment.

In an IPO prospectus, it will list all the important information related to the IPO, such as:

- Valuation of the company

- Number of new shares to be issued

- Exchange to be listed

- Indicative price range

- Offer period

- Timing of the IPO, among others

A global tech company usually considers a US listing first because investors there are more receptive to these type of companies. A mining company, on the other hand, may look to the UK.

In recent years, stock exchanges have competed aggressively with each other to attract the largest IPOs. To date, the largest IPO in history is Saudi Aramco floatation in 2019 at $29.4 billion, followed by Alibaba (BABA) listing in 2014 at US$25 billion.

Stockbrokers can provide access to IPOs or you can invest through PrimaryBid and normally have some allocation for retail investors. If you’re interested in IPOs, ask your stockbroker to add you to their list of contacts. Hargreaves Lansdown has this IPO alert where you can sign up.

Depending on the popularity of the IPO, you may not get all the shares you wanted to buy. During a roaring tech bull market, for instance, most tech IPOs were hoovered up by institutional investors.

Another point worth noting is that not all IPOs are available to retail investors.

No, it is quite common for private investors to get less than they applied for if an IPO is oversubscribed.

Once the key points of the IPO have been nailed down, investors will weigh how much shares to buy and what its allocation is.

In popular IPOs, investors tend to apply for more stock than they actually want in expectation of their allocation being scaled back in the final issue; the more demand there is for the new shares then the higher the IPO price is likely to be.

Firstly, you will need to have a stockbroker that allows its clients to participate in the new issue’s markets in the widest sense.

If your broker does offer new issues and you meet the criteria, you will also need to have liquidity at hand. When you apply for new issues, you typically apply for a fixed number of shares at a set price (the issue price) and you will need to have the funds available, on-demand, to pay for those newly issued shares.

It’s worth bearing in mind that new issues crop up regularly and that if all your money is tied up in one issue, you run the risk of missing out on others. That may be ok if you are cherry-picking, but Stags, as those who trade in new issues are known, often try to participate in as many new issues as possible to try and spread their risk and diversify their returns.

This depends on the individual issue, though there will normally be a minimum holding period.

The purpose of the new issue is usually to raise fresh cash and create new shareholders for a company. The underwriters and other advisors to a new issue don’t like to see the new money they have raised, and the new shareholders they have created immediately heading for the exit.

There may also be some practical issues that can delay the ability to sell a new issue. For example, you may need to be in possession of the newly issued shares before you can sell them. It’s best to check what these restrictions are before you invest in a new issue, on a case by case basis.

For larger IPOs, CFD and spread betting brokers will often make prices in the IPO, which means that there is potential to put on a hedge if you can’t immediately sell your new shares.

A stock market floatation is when shares are first admitted to be publically traded rather than privately held.

The phrase floatation comes from the term “free float” of shares, which refers to the amount of shares that are available for the public to buy and sell.

A good example of a company with a low float is VinFast the EV car maker from Vietnam. We reported in our analysis that one of the reasons the VinFast share price crashed after they IPOd was because when they floated the company shares there were very few shares available for the public to trade.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the IPO investment accounts via a non-affiliate link, you can view the product pages directly here: