To buy shares in Uber (NYSE:UBER), you need a US stock trading or share dealing account that will let you buy US-listed stocks. Follow these three steps if you want to buy shares in Uber from the UK:

- Decide if you want to buy Uber shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Uber shares (NYSE:UBER)?

Buying one NYSE:UBER share costs $96.47. However, as well as the $96.47 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

It’s also important to remember that share prices can move quickly, for example, the current NYSE:UBER share price is $96.47 which is a change of 0.07 or 0.04% from the last closing price of 96.47 with 5,224,921 shares traded giving NYSE:UBER a market capitalisation of $201,609,514,538. The most recent daily high has been 96.84 and daily low 95.63. The NYSE:UBER share price 52 week high has been 97.72 and the 52 week low 54.84. Based on the most recent NYSE:UBER share price opening of 96.47, the current NYSE:UBER EPS (earnings per share) are 5.73 and the PE (price earnings ratio) is 16.81.

Pricing data automatically updates every 15 minutes

Is Uber a good investment in the long term (NYSE:UBER)?

If there is a company that represents the ‘gig economy’, it would be Uber (NYSE:UBER). It pioneered the ridesharing industry and spearheaded the movement in ‘micro-entrepreneurs’. The company was listed on Nasdaq with great fanfare back in 2019, and achieved an IPO valuation of $82 billion. Not bad for a 10-year old company!

While Uber’s growth has been phenomenal, accusations have always dogged the company, from the treatment of its ‘independent’ contractors to harassment and data breaches. So bad were some of these accusations that Uber even got rid of the company founder in 2017. In the past few years, the company has devoted time and management attention to straighten things up.

Is Uber a good investment now? Yes and no, as there are always pros and cons when analysising a company like Uber.

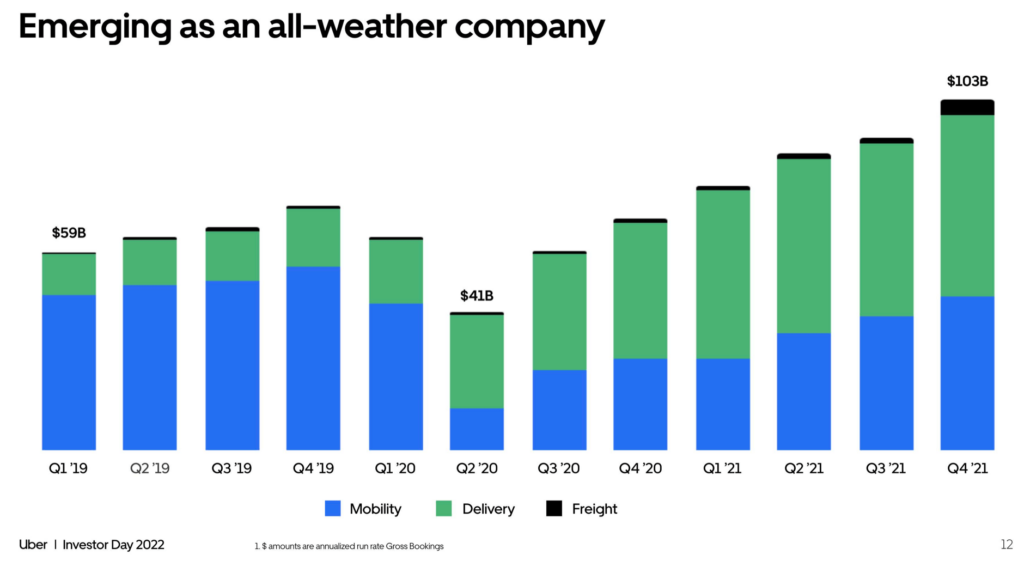

On the plus side, you can argue Uber is now a mature platform that is generating billions of revenue annually. It is expanding rapidly into sectors that are promising, eg Uber Eats has revenues of $8 billion. From 8 cities in 2011, Uber now has a presence in 10,000 in 2021. Its has developed a brand that is well-known across the world. Uber may even turn into a ‘super app’ where you could book any travel mode (planes, car, e-cycles etc). The company weathered the pandemic well, as the chart below shows.

Source: Uber

But pessimists may argue that Uber’s best days are over. It is not profitable too. The company is becoming more regulated and is maturing into one of those boring corporations. This is no longer a growth stock that will rise 10x like before. You will be lucky to get 2-3x. And, there will be ‘new Uber’ to come in the future. So despite its size, the case for buying Uber is weaker than before.

In summary, Uber is an ex-hyper growth company that is now operating at a more predictable and steadier level. There could be a case for buying the stock long term, just that one has to wait for better opportunities to do so.

When is the best time to buy Uber shares (NYSE:UBER)?

The best time to buy Uber is when it stops sliding and forms a base formation. At what level, you ask? That’s the key – nobody knows.

Uber has nearly broken the $32 resistance three times this summer and failed each time. This shows relatively strong selling pressure, which may lead to a break of the support at $25. I would avoid buying much when prices do that, as selling momentum could be reinforced on a break of support and a test of its all-time lows near $13-15. Wait for the current downslide to end before commencing some buying of the stock.

Is the Uber share price overvalued or undervalued at the moment?

Most investors are waiting to see how deep the looming US recession will be. The US Fed is still hiking rates and this may exert considerably pressure on asset values, particularly on volatile assets like stocks.

Currently, Uber is worth about $56 billion. No dividend yield and no profits either. In other words, Uber is a typical growth stock. As such, the valuation metrics for Uber can be wide.

With a quarterly revenue of $8 billion (last announced on November 1), the company is still showing reasonably strength on top-line numbers. Losses, however, came in at about $1.2 billion. The question for Uber is whether it needs to tap shareholders or the stock market for funds in the next few quarters to sustain these losses. For now, the company is operating within its means.

In the context of higher interest rates, which typically compress the valuation on growth stocks, Uber ‘s share price may be ‘overvalued’. I would not be surprised to see a cheaper valuation in the months ahead.

Why has Uber’s share price dropped recently?

Like most other tech stocks, Uber has been under selling pressure over the past few months. The stock is currently capped below the resistance level at $35. Some reasons for Uber’s weak price performances included:

- a weakening consumer sentiment – due to the rise in mortgage costs and consumer prices.

- a rise in fuel costs – which is compressing corporate margins

- a fall in technology sectors – of which Uber is a major component

Chartwise, Uber share price is steadying at around $25-30.

What is Uber’s share price prediction?

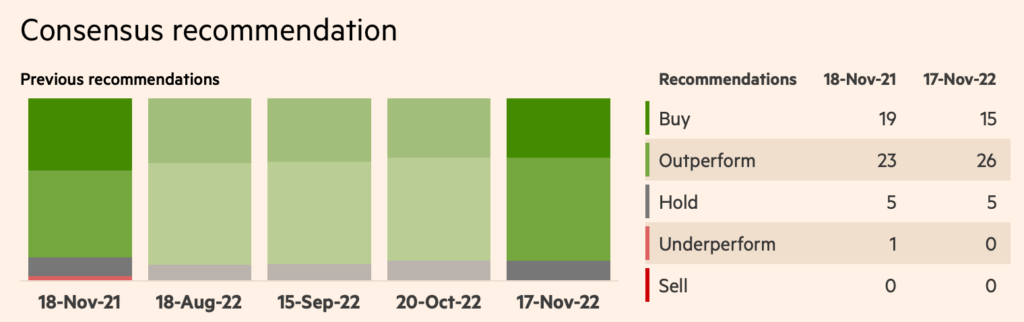

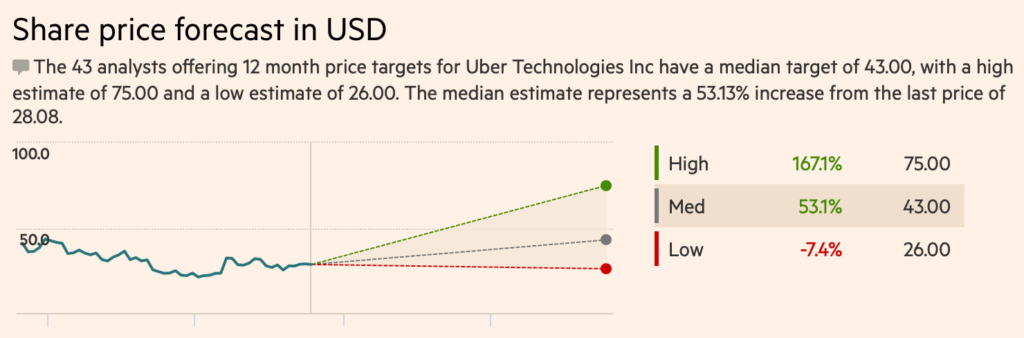

Wall Street’s optimism on Uber is high. Just look at the distribution of Uber’s stock recommendations – nearly all are outright ‘Buy’ or market ‘Outperform’. Only 5 say ‘Hold’. No sell or market underperform. Most analysts have price expectations above the current price level.

This is interesting and begs the question: Why is Wall Street so bullish on a stock that has 1-year performance of -34%? Do they know something that the market doesn’t? Or are analysts just ignoring Uber’s current decline? I can’t tell.

With such a strong fanbase in Wall Street, Uber may continue to outperform major Nasdaq indices.

Source: Financial Times

You can use our table to compare the best brokers for trading Uber shares. All brokers in this list are authorised and regulated by the FCA. CFDs & spread betting carry a high level of risk and losses can exceed your deposits.

If you want to buy shares in Uber from the UK, you need an FCA-regulated stock broker that provides access to US stocks. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling US stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

Uber share price FAQ (NYSE:UBER):

The answers to our frequently asked questions by people interested in buying Uber shares about Uber’s share price are automatically updated every 15 minutes.

What is the live Uber share price?

The current Uber share price is $96.47

How much has Uber’s share price moved today?

Uber’s share price has moved $0.07 or 0.04% today.

How much was Uber’s share price yesterday?

Yesterday, Uber’s share price closed at $96.47

How many Uber shares are traded each day?

There were 5,224,921 shares traded in Uber yesterday.

What is Uber’s market capitalisation (market cap)?

Uber has market cap of $201,609,514,538

What has been Uber’s share price most recent daily high?

Uber’s most recent daily high has been $96.84

What has been Uber’s share price most recent daily low?

Uber’s most recent daily low has been $95.63

How high has the Uber share price been in the last year?

The Uber share price 52 week high has been $97.72

How low has the Uber share price been in the last year?

The Uber share price 52 week high has been $54.84

What is Uber’s earnings per share?

Uber’s current earnings per share (EPS) is 5.73

What is Uber’s price-earnings ratio (PE)?

Uber’s current price earnings ratio (PE) is 16.81

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com