To start investing the first thing you need an investment account, but there is a lot more to investing than that. In this guide to investing, we’ll cover everything you need to know including, what investing is and why you might want to do it. The pros (and cons) and the eight stages of investing explained, plus answers to some commonly asked questions.

How To Invest – The #1 Beginner guide

Investing is the key to building wealth. Today, literally anyone can invest their money, as technology has made it very easy to do so. If you’re wondering where to even start when it comes to learning how to invest – you’re in the right place.

What Is Investing?

Before we learn how to invest, let’s make sure we’re clear what it is – and isn’t. Investing is a way of growing your money over the long term. Not to be confused with ‘saving’, it involves putting money into financial assets – such as shares or bonds – in the hope of obtaining higher returns than those offered by savings accounts.

Investing has many benefits. For example, it can help you:

- Achieve your financial goals – By investing your money, you can grow your wealth significantly over time.

- Take advantage of the power of compounding – Compounding is the process of generating earnings on an asset’s previous reinvested earnings. Over time, it leads to exponential growth of an investor’s capital.

- Protect your money from inflation – If you keep your money in a savings account, it may lose value over time due to inflation. By investing your money, and obtaining a higher rate of return on it, you can potentially protect it from inflation.

- Diversify your income streams – By investing your money, you can diversify your income streams and increase your chances of achieving financial security.

➡️The terms ‘investing’ and ‘trading’ are often used interchangeably. However, there are key differences between the two financial strategies. Generally speaking, the goal of investing is to build wealth over the medium to long term with buy-and-hold strategies. By contrast, the goal of trading is typically to generate profits in the short term by using more active financial strategies.

Our Expert Says

The Pros And Cons Of Investing

Investing has advantages and disadvantages and it’s important to be aware of both.

The main advantages are:

- It’s possible to generate high rates of return on your money

- You can compound your returns over time

- You can protect your money from inflation

- It can help you achieve your financial goals

The main disadvantages are:

- Returns are never guaranteed

- It’s possible to lose money

- It can take time to build wealth

- You may have to lock your money away for a while (depending on the type of account you use)

If you look at this example from Wealthify, you can see over time even making a small initial investment, with regular monthly investments, can be very profitable, as opposed to keeping your money in the bank.

Remember: these are predictions based on past performance and the markets can go up and down – your capital at risk when you invest.

Now we know what investing is, along with its pros and cons – here are the eight steps to get you started:

1) Determine Your Goals And Risk Tolerance

Before you start investing, it’s important to determine your financial goals. The best investments for you will depend on your goals. At this stage of the process, it’s also important to establish your risk tolerance. This will impact the type of investments you choose.

When determining your goals and risk tolerance, it’s a good idea to think about your liquidity requirements. Investing money that you are likely to need in the short term could backfire as you may be forced to sell your investments at the wrong time.

2) Choose A DIY Or A Managed Approach

There are two main ways you can invest:

DIY

With this approach, you are in charge of selecting your investments. The advantage of DIY investing is that you have more flexibility with your investments and fees may be lower. On the downside, it is more hassle, and more time is needed for research.

Managed

With this approach, you outsource the selection of investments to a third party. The advantages of the managed approach are that it is generally less hassle and can free up time. On the downside, you have less flexibility and fees may be higher.

3) Choose What Types Of Assets You Want To Invest In

There are many different types of assets you can invest in. Here are the most popular:

Stocks

Stocks, or ‘shares’, are investments that represent ownership in a company. Examples of stocks include Apple, Tesla, and Tesco. Stocks are higher-risk assets, however, over the long term, they have historically generated strong returns for investors. For example, since the inception of the S&P 500 index in 1926, it has returned over 10% per year on average.

Investment Funds

Investment funds are collective investments. With funds, your money is pooled together with the money of other investors and spread over a range of different stocks or assets by a professional portfolio manager. The main advantage of investing in funds is that they offer diversification. Another advantage is that, compared to investing in individual stocks, they require less research.

ETFs

An ETF (exchange-traded fund) is a type of investment fund that aims to track the performance of a specific stock market index, industry sector, or asset. ETFs are similar to regular investment funds; however, a key difference is that they are traded on the stock market. This means that they can be purchased and sold just like regular stocks.

Investment Trusts

Investment trusts are a type of investment fund. There are two major differences between investment trusts and regular funds though. One is that investment trusts are closed ended (meaning that they have a fixed amount of capital to invest) while investment funds are open ended. The other is that investment trusts trade on the stock market whereas investment funds don’t.

Bonds

Bonds are fixed-income investments that represent loans made by investors to borrowers. They typically pay a fixed rate of interest to investors for a certain period of time. Bonds are generally lower risk than shares. Therefore, they can help investors create more balanced portfolios.

4) Understand Investment Risks (And How To Manage Them)

Each type of investment has its own unique risks. It’s crucial to understand the risks before you invest. Generally speaking, the higher the potential rewards on offer from the investment, the higher the level of risk.

Risk can never be eliminated entirely when investing. However, it can be reduced significantly with simple risk management strategies. Two straightforward risk management strategies include:

- Diversifying your portfolio – Diversification is the process of spreading your money out over many different assets so that you are not over-exposed to any single asset. A well-diversified portfolio will be diversified at two levels – between asset classes and within asset classes.

- Adopting a long-term investment horizon – In the short term, the stock market can be volatile. However, in the long run, the market tends to rise. So, the longer you invest for, the less chance you have of losing money.

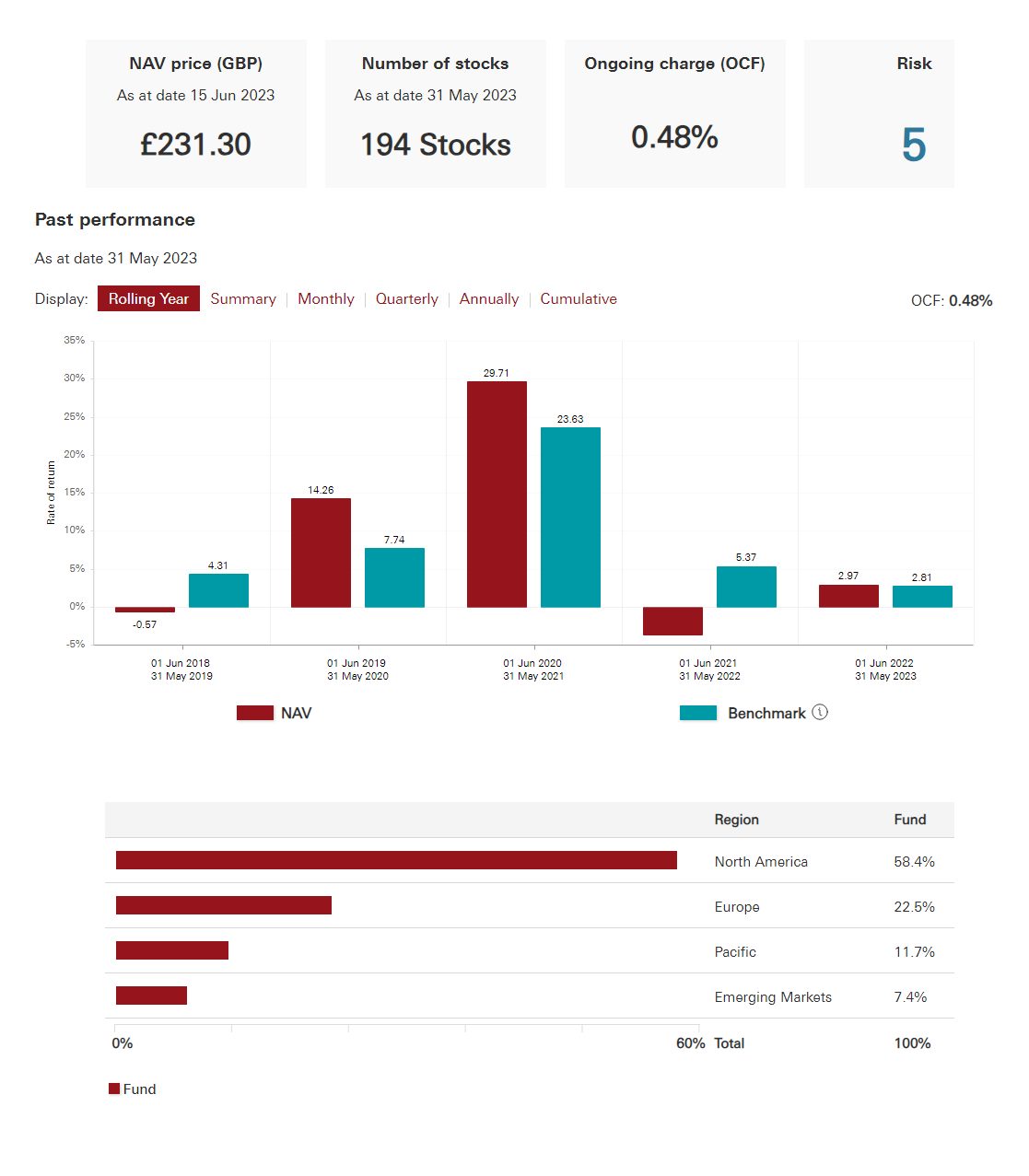

A very good way to do this is by buying a fund that invests in the global markets. By investing in a global fund, you are buying into stock markets and companies worldwide in one go. The Vanguard Global Equity Fund, which you can buy through Hargreaves Lansdown, for example, will give you exposure to a broad range of 194 stocks in US, UK, Europe, Pacific and Asia.

5) Develop An Investment Strategy

There are many different ways of investing. Some of the most popular strategies include:

- Growth investing – Investing in companies that are expected to grow at a fast rate in the future

- Value investing – Investing in companies that appear to be trading at a discount to their ‘intrinsic’, or true value

- Quality investing – Investing in high-quality businesses that are highly profitable and have financial strength

- Dividend (income) investing – Investing in companies that pay regular dividends to their investors

- Small-cap investing – Investing in smaller, faster-growing companies

- ESG investing – Investing in companies that meet environmental, social, and governance (ESG) criteria

6) Take Advice From The Right People

It’s not hard to find people handing out financial advice today. On YouTube and TikTok, for example, there are thousands of ‘finfluencers’ offering advice on where to invest.

Be careful here. Many of these influencers have no professional financial qualifications. And they are unlikely to have an understanding of your financial goals and risk profile.

If you are looking for investment advice, the best approach is to speak to an Independent Financial Adviser (IFA) or expert wealth manager. They will take time to discuss your goals and risk tolerance and then develop an investment strategy specifically for you.

It’s worth noting that there are some reputable providers of stock tips, such as Seeking Alpha and The Motley Fool. However, it’s important to do your own research in order to ensure that the recommended investments are in line with your goals and tolerance for risk.

If you have a significant amount of money to invest (over £250,000) you should talk to a wealth manager for advice. If you are starting to invest with small amounts robo-advisors (or digital wealth managers) are a good place to start, as they provide online advice and pre-built portfolios to buy into.

7) Understand The Different Types Of Investment Accounts

Before you start investing, it’s a good idea to determine the best type of account to invest in. In the UK, you have a number of options when it comes to investment accounts:

| Type Of Account | Tax Efficient? | Annual Allowance |

| General Investment Account (GIA) A standard investment account with no tax benefits | ❌ | N/A |

| Stocks and Shares ISA A tax-efficient investment account. All investment gains and income are tax-free. | ✅ | £20,000 |

Investment accounts that are open to those aged between 18 and 40. Contributions come with a 25% bonus from the government (up to age 50). However, there is an annual allowance of £4,000 and money cannot be accessed until you turn 60 or buy your first property. Within a LISA, all investment gains and income are tax-free. | ✅ | £4,000 |

Self-Invested Personal Pension (SIPP) A government-approved pension account. Within a SIPP, all investment gains and income are tax-free. Additionally, contributions come with tax relief. On the downside, money within a SIPP cannot be accessed until age 55 (57 from 2028). | ✅ | £60,000 |

8) Compare Investment Account Providers

Before you open an investment account, it’s worth doing some research into the various account providers in order to find the best account for your needs.

When choosing an investment account provider, there are a number of factors to consider including:

- The investment options available

- The investment tools and research available

- The trustworthiness and reliability of the platform

- The customer service and support on offer

- The provider’s fees and charges

By comparing the options available from the various providers, you can find the right account for you, whether that’s a no-frills, low-cost account, or a comprehensive, full-service account.

Once you have chosen a provider, you can open and fund an account, and start investing. You may also want to consider looking at what investment apps are on the market.

➡️ Tip: Use our account finder to help you find the right account for you.

➡️ Bonus Article: 5 Simple Ways To Improve Your Investment Performance

Get Started As Soon As Possible

It may seem daunting to take the plunge and start investing, but there is an old mantra:

“It’s not timing the market, it’s time in the market”

This means that it’s impossible to guess when the best time to start investing is because the stock market does not go up in a straight line. However, it does always generally go up in the long-term.

Take a look at the below chart of the UK and US stock markets’ performance over time from Investors Intelligence. There are dips and rises, but they generally always go up. If you try and pick the tops and bottoms of the market, you will miss out on longer-term growth.

If you want to know more about timing the market, we have the following guides you may find helpful:

- Should you invest when the market is at all-time highs?

- Should you invest by drip feeding or in a lump sum?

Understanding Market Cycles

Why do market move in cycles? “People,” explained Warren Buffett recently, “get smarter but they don’t get wiser. They don’t get more emotionally stable. All the conditions for extreme overvaluation or undervaluation absolutely exist, the way they did 50 years ago.” In other words,

- Bull/bear markets do not last forever. They interchange.

- Each market cycle is unique. Calling the top/bottom it is very tricky.

- Each cycle is (usually) led by different assets.

- Risk is low at the bottom of the cycle and high at the top.

Easy enough. A lot of these are just plain common sense. The hardest part is putting these knowledge to work. Out of the market too early, regrets will swell on rallies. Overstayed the party, profits will vanish. Few get it right consistently. But that does not mean you should not try.

Enhance Your Portfolio Through Market Cycles

Know where we are now (roughly). The first step is to pinpoint the current market cycle.

- How long has the current market trend started? Is it long by historical standards?

- What about the economy? Is it doing badly or well or muddling through?

- What is the central bank trying to do? Accommodative or restrictive?

All you need is a rough guide to the Big Picture.

Look for warning signs. This is where your market knowledge comes in. I give three examples below:

- Yield curve – One of the most reliable economic signals is the position of the yield curve – particularly, the inversion of the yield curve. Anytime you see an inversion of the yield curve, be prepared for a slowdown in the future.

- Property bubble – Most economic cycles are accompanied by excesses in property because of the lag in supply. If you see a property bubble based on bad lending practices, be prepared for a credit crisis some time down the road.

- Valuation of assets – If an asset is valued very highly (by historical standards), you know that the market psychology is very bullish. This is dangerous because of the cavalier attitude towards risk and leverage.

Protect your portfolio. Concentrate on survival over a market cycle.

- As the bull market runs, trail stock positions with stoploss orders – mental or actual.

- Have rules for exiting the market, either partially or fully.

- Do not be afraid to hold cash. Why? because you need cash to buy assets when they are ‘cheap’. You make your fortunes in a bear market by paying for assets far beneath their value.

Fine tune your system. Devise clear rules for buy/selling.

- Use new/52-week/26-week price highs as a buying guide.

- To sell, use stop-loss, indicators or simple 52-week lows.

- Make a Yearly Asset Allocation rule, eg, reduce/increase allocation based on the length/size of a market trend. Moving a few percentages into defensive positioning could increase the odds of outperformance over the long term.

The key here is not the rules – different people have different rules. It is your ability to follow them. I can not stress this enough. The best investors are rational, disciplined, and unemotional. If you find yourself easily swayed by the mob psychology – stay away from the screens.

Curious about how to get even better at investing? Have a look at our 5 tips to improve your investment performance.

How To Invest – FAQs

It’s possible to start investing with a small amount of money. Today, many platforms allow you to get started with less than £100. Free platforms like CMC Invest or low cost platforms like AJ Bell are good for small account sizes.

There are two main types of risks you need to consider when investing. The first is investment risk. This is the risk that your investment could fall in value. This risk is impossible to eliminate entirely, but it can be reduced by diversifying your portfolio and investing for the long term.

The other risk is platform risk. This is the risk that the platform you are using goes bankrupt and ceases to trade. You can reduce this risk by choosing a reputable investment account provider that is regulated by the Financial Conduct Authority (FCA), covered by the Financial Services Compensation Scheme (FSCS), and uses a separate custodian for customers’ assets.

Some of the most popular investments today include:

- Stocks – The stocks of well-known companies such as Apple, Amazon, and Tesla are typically very popular with investors.

- Investment funds and trusts – In the UK, funds and trusts such as Fundsmith Equity and Scottish Mortgage Investment Trust are popular with investors.

- ETFs – ETFs are always popular with investors as they are low-cost investments that offer instant diversification.

The main costs when investing are:

- Trading fees and commissions

- Annual platform fees

- Ongoing fees for investment funds, investment trusts, and ETFs

You can use our guide to investment accounts to compare the costs of different platforms.

The best place to start investing is often with a diversified global investment fund, investment trust, or ETF. By starting with this kind of investment, you will give yourself broad exposure to the stock market. Once you have built up this investment, you can look to branch out into other investments such as individual stocks or actively-managed funds.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognized as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.