Pepperstone is viewed positively on Good Money Guide, but with clear distinctions between customer sentiment and expert evaluation. Customers on the site give Pepperstone a strong rating of 4.6/5, praising tight spreads, fast withdrawals, good service, helpful webinars and education, and responsive support, with very few complaints. Experts describe Pepperstone as a great broker for active, low-cost and automated trading, especially on MT4/MT5/cTrader, noting tight pricing and broad market access. The broker also wins repeated Good Money Guide accolades such as Best MT4 Broker 2025, underscoring its platform strength.

Pepperstone Customer Reviews

Tell us what you think of this provider.

x

x

Great value for money. Great…

Great value for money. Great customer service

Simple, contains what you need…

Simple, contains what you need to trade and no gimmick features

5/5

great UI/UX, very intuitive user…

great UI/UX, very intuitive user flows – i can quickly get most of my key actions done. Minimal friction

3/5

Pros:

Not used

Cons:

Don’t use

5/5

Pros:

Technology and research information. Overall fees, deposits and withdrawals

Cons:

Nothing

4/5

Pros:

Its MT4 which is my favourite platform

Cons:

Nothing

5/5

Pros:

Everything is awesome. I love to trade with pepperstone. IÔÇÖm so that pepperstone is giving us chance to trade. Thabk you!

Cons:

All the things

3/5

Pros:

No comment at this moment

Cons:

No idea

5/5

Pros:

I would say the 1:400 leverage on currencies

Cons:

no ideas on this one

5/5

4/5

Pros:

genuine and good support

5/5

3/5

Pros:

Dealing

Cons:

Tighter spreads

3/5

Pros:

Great customer service and low fees

3/5

4/5

Pros:

cfds & spreadbet

Cons:

increase range of SB assets

3/5

Pros:

?

Cons:

don’t use enough to comment

2/5

Pros:

none

Cons:

change there platforms

Pepperstone Expert Reviews

Pepperstone is a great broker for automated trading and active traders

Provider: Pepperstone

Verdict: Pepperstone is a great all round broker for active traders looking for low costs. Especially for those that want to automate their trading as they are one of the biggest and best MT4 brokers with a very good set of EA packages. Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with international offices and around 400,000 active clients. They offer spread betting and CFDs on 1,200 major market instruments, which means they focus on the most heavily traded assets, mainly forex and indices trading. Of those 900 are shares on the major stocks on international exchanges.

72% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone a good broker?

Pepperstone is a great trading platform for traders who want low costs, wide market access and wide range of trading platforms, including one of the best MT4/MT5 packages available to retail traders worldwide.

Pricing: Razor tight pricing (on their Razor account).

Market Access: Mainly FX, but lots more stocks are being added.

Platform & Apps: Pepperstone’s MT4 and cTrader packages are top-notch.

Customer Service: Local offices around the world and personal account managers for large active traders

Research & Analysis: Lots of education and technical and algo indicator documentation.

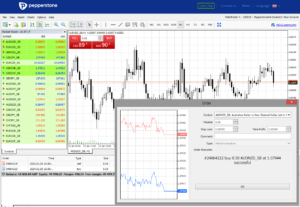

Yes, I’ve used both trading platforms that Pepperstone offer, MT4/5 and cTrader, which include TradingView charting. cTrader is a more traditional trading platform with a basic layout, simple order execution and sentiment indicators. Whereas MT4 is one of the most popular and complex trading platforms available used by millions of traders and thousands of brokers.

However, what makes Pepperstone’s MT4 offering stand out is the brokerage behind it. Pepperstone offers it’s MT4 clients experienced account executives based in London and other local offices around the world. Plus, Pepperstone have put together a package of expert indicators and trader tools that are available to download for free that can be plugged into MT4.

To win business Pepperstone competes on price and compared to other trading platforms it is one of the cheaper options. For example, the Razor account can offer forex trading with zero pips, with the commission charged post-trade. Or traders can opt for the standard account, which adds a 1 pip markup, but is built into the spread.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts (apart from the Tennis and now sponsoring Aston Martin) and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign. They are a global brokerage so you can at the moment trade crypto, but only if you are a professional client in the UK or are in a jurisdiction that hasn’t banned crypto derivatives.

Management: If you want to know more about the man currently running Pepperstone you can read my interview with Tamas Szabo, who has been Group CEO of Pepperstone since 2017, joining from IG where he started in 1996. So plenty of experience at the helm, Tamas, has been in the business for 25 years.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts or anything like that and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign.

As I said Pepperstone offers CFD trading for international clients and spread betting for UK customers. Spread betting of course unique to the UK as trades are structured as bets so if you make money trading you don’t have to pay capital gains tax on your profits.

Trading Platforms: Pepperstone doesn’t actually have its own proprietary trading platform instead they offer TradingView, MT4/5 and cTrader. MetaTrader is gradually pushing brokers and clients to MT5 because it’s faster and a bit more user friendly, however, there is a lot of resistance from traders, especially those that use EA’s or Electronic Advisors, as most have been written for MT4 and can’t be converted for MT5 without being re-written.

Automated Trading: If you haven’t used one an EA, an Electronic Advisor enables you to trade automatically based on certain market criteria, usually based on technical analysis. So if the market does x, you buy, if the market does y you sell. The idea is that you set up a trading strategy and set it on autopilot to trade on your behalf. It’s not necessarily high-frequency trading that was featured in Flash Boys or Flash Crash, but it’s similar.

If you want to know more about high-frequency trading those are two books well worth reading, Michael lewis has an excellent way of explaining complex derivatives and I particularly enjoyed Flash Crash because the chap it’s about was a client at the brokerage where I used to work and some people I know were mentioned in it, which is always quite amusing.

A few things to note though about EAs, unless you have a VPS or VPN they won’t work if you turn your trading screen isn’t on and you can’t use them on the web version or mobile. However, Pepperstone will set you up with a free VPS connection if you want one and do a certain amount of business.

MT5 versus MT4: MT5 is one of the most popular trading platforms on the planet and is used by millions of traders and hundreds of brokers. The key benefits are that it’s pretty simple to use and universally recognised, so if you used MT4 or 5 with one broker, switching accounts is fairly easy. Initially, it does have a clunky institutional feel to it, but once you get the hang of it it’s fairly simple to use.

Pepperstone’s MT5 does have its advantages over other brokers though. Mainly the packages they offer, the spreads and the execution, but also the regulation. Pepperstone are regulated by the FCA, so if you are a UK client a certain amount of your funds are protected by the FSCS if Pepperstone was to go bust. You are not protected if you are using MT4 or 5 through an offshore broker, and to be honest, if you are based in the UK you should always be trading with an FCA regulated broker, or the FCA regulated entity of a broker. It is tempting to go offshore to get better margin rates since ESMA capped them but you can get them as a professional client and if you can’t qualify as a professional client you probably shouldn’t be trading with excessive leverage anyway.

One of the main things that make Pepperstones MetaTrader offering stand out is market range, you get loads of forex pairs, the major indices and they are also increasing the number of shares they offer. They have the major FTSE 100 stocks and a few hundred US, European and Australian stocks, but that is growing. But, it is still nowhere near as many markets as someone like IG or Saxo offers. Also, Pepperstone is still only a trading platform so you can’t hold any of your long-term investments with them.

Trading Tools: Pepperstone also has a unique package of MT5 downloads which they call Smart Trader Tools, which include plugins like Trade Terminal where you can set your preferences for assets. So for example if you always trade cable in 1 lot, and have a stop 10 pips away and a limit 20 pips that will be your default OCO when you trade.

You also get things like a Pivot Points plugin where you can trade off previous highs and lows. Some other main features of MT4 are one-click trading, and the ability to trade off the charts. You can also move your entry and exit points automatically. If you trade four markets you can have four set up on screen and have your defaults for each one.

cTrader: One of the major drawbacks about MT5 though is that it doesn’t show your margin when you trade, which to be honest isn’t great if you are a beginner because you have no idea what your exposure is or how much risk capital is going to be used up. It will tell you your overall margin position, but it won’t show you your individual margin rates. Which is daft. However, Pepperstone’s other platform cTrader does do this. To be honest, I actually prefer cTrader, I think it’s more user-friendly, it breaks down your margin. The disadvantage of course is that you can’t run net and hedged positions.

You can’t trade with EAs but I don’t really like them anyway, I think the chances of clients making money with an off-the-rack automated trading strategy is pretty slim. It may work for a bit to nick a trade here and there but if you leave it running over a massive market correction you can get wiped out. You also can’t trade as many shares on cTrader as you can on MT5, which is a shame.

I think it has a cleaner layout, with everything pre-installed and you can trade in a web browsers rather than having to download the software. If you are building your own EA then MT5 is for you but if you are just eyeballing the market and taking a view I prefer cTrader as you get news, calendars, plus Autotrachtists is on there as well and is linked to the pair you are looking at.

Education & Analysis: One other thing to note as well is that when it comes to learning to trade or understanding the markets it is incredibly difficult. Pepperstone has partnered with The Corillian Academy, to provide some educational content. Corillian was set up by some fairly sophisticated traders with decent backgrounds. Richard Adcock for example has been on the board of the society of technical analysts for 30 years.

Customer Service: Although probably the main benefit of Pepperstone over the majority of MT4 brokers is customer service. It’s a big risk trading the financial markets and there are often big sums of money involved. So being able to phone someone up who can execute trades for you and give you a full demo of the platform is almost more important, in my mind anyway, than pricing and market access. If you’re in the UK, you get to talk to your dealers in London, through direct dial.

Pros

- Tight pricing

- Wide range of MT4 markets

- Pre-built MT4 indicator packages

Cons

- Limited market access

- Only third-party platforms

-

Pricing

(5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.172% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Facts & Figures

Pepperstone Total Markets | 1200 |

| ➡️Forex Pairs | 100 |

| ➡️Commodities | 28 |

| ➡️Indices | 28 |

| ➡️UK Stocks | 192 |

| ➡️US Stocks | 890 |

| ➡️ETFs | 107 |

Pepperstone Key Info | |

| 👉Number Active Clients | 400,000 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | 0 |

| 📅Founded | 2010 |

| ℹ️ Public Company | ❌ |

Pepperstone Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ✔️ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

Pepperstone Average Fees | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 0.9 |

| ➡️DJIA | 2 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.4 |

| ➡️EURUSD | 0.1 |

| ➡️GBPUSD | 0.40 |

| ➡️USDJPY | 0.40 |

| ➡️Gold | 1.6 |

| ➡️Crude Oil | 2.5 |

| ➡️UK Stocks | 0.1% |

| ➡️US Stocks | $0.02 per share |

72% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone News

Is CFD trading on Pepperstone legal in the UAE?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset

Pepperstone MT4 Expert Review: Best MT4 Broker 2025

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Is Pepperstone good for forex trading?

Yes, Pepperstone is a good forex broker, as this is one of their core products and they really focus on trying to compete on tight pricing, especially on MT4/MT5. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a

Pepperstone Spead Betting Expert Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Is Pepperstone legal in the UAE for forex trading?

Expert opinion: Pepperstone full review Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors

Pepperstone isn’t available to US clients so here are 3 alternatives

Pepperstone is a popular forex and CFD broker. Founded in Melbourne, Australia in 2010, it’s available to traders in many countries today. Does Pepperstone accept US clients? Unfortunately not. Here’s why. Why Pepperstone doesn’t accept US clients Pepperstone is a multi-regulated broker. Today, it’s regulated by the Australian Securities and Investments Commission (ASIC) in Australia,

Is Pepperstone’s Demo Account Any Good For MT4, MT5 In The UK?

Pepperstone does have a demo account for MT4 and MT5 for UK and international traders to try before they open a live account. But, there are a few things to be aware of. I tested the Pepperstone MT4 demo account and compared it to the live account, as it doesn’t really give a good overview

Is Pepperstone or IC Markets better for commodity trading?

Based on our metrics Pepperstone is better for commodities trading as they are regulated by the FCA (Financial Conduct Authority). Commodities markets available: 28 Minimum deposit: £1 Account types: CFDs, spread betting Pricing: Gold 0.5 , Oil 2.5 With Pepperstone, you can trade commodity CFDs or spread bet on Gold, Silver, Crude, Natural gas with razor sharp pricing, low

Does Pepperstone use MT4?

Yes, MT4 is one of Pepperstone’s primary trading platforms. However, they are building their own trading in-house and also offer cTrader and MT5. MT4 markets available: 1,200 Minimum deposit: £1 MT4 account types: CFDs, spread betting Equity overnight financing: 2.5% +/- SONIA Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9 With Pepperstone’s MT4 account you get 85 pre-installed indicators and 28

Does Pepperstone offer financial spread betting in the UK?

Yes, Forex broker Pepperstone launched spread betting in the UK in early 2020. It was fairly sensible move as it brings Pepperstone’s online trading inline with other major brokers like IG, CMC Markets and City Index who also offer spread betting alongside CFDs. The key difference between spread betting and CFDs is that as financial

Does Pepperstone offer stock market and synthetic indices?

Yes, you can trade synthetic indices like the VIX with Pepperstone or some of the most popular stock market indices like the S&P 500. Indices available: 28 Minimum deposit: £1 Account types: CFDs, spread betting Index pricing: FTSE 1, DAX 1, Dow 2, NASDAQ 1, S&P 0.4 Pepperstone sources razor-sharp pricing, from multiple Tier 1 banks and liquidity providers, with competitive fixed

Does Pepperstone have a good trading app?

Pepperstone does not have it’s own app but instead relies on branded versions of the MT4/MT5 and cTrader trading platforms it’s clients use. Pepperstone has four trading apps, MT4/MT5, cTrader and TradingView which provide access to CFDs and spread bets on the major markets for active traders with tight spreads. Pepperstone has a good version

Pepperstone and Aston Martin F1 Team strike top sponsorship deal

Trading platform Pepperstone has struck a deal with the Aston Martin F1 Team to become the latter’s official global forex and trading partner. Under the new partnership, Pepperstone branding will debut on the AMR25 Formula 1 racing car when it is launched ahead of the 2025 F1 season. Pepperstone CEO Tamas Szabo said: “We are

Pepperstone MMA partnership with UFC strikes for Asian market

Online trading provider Pepperstone has signed a deal to become the official partner of leading Mixed Martial Arts (MMA) organisation UFC in Asia. The strategic tie-up will see UFC in Asia give the trading provider brand a boost through UFC in Asia’s marketing channels. Pepperstone group CEO Tamas Szabo said: “We are thrilled to join

Pepperstone wins Best MetaQuotes Broker at the Good Money Guide Awards 2024

Pepperstone won Best MetaTrader Broker because, alongside offering MT4, they also provide MT5 with a well-designed package of indicators to enhance trading strategies. Pepperstone always do very well in our awards for their MT4 offering. They have won best MT4 broker in 2023, 2022, 2021 and 2020. Richard BerryRichard is the founder of the Good

How to get quicker withdrawals from Pepperstone

One of the most common complaints that traders have is that it can take a long time to withdraw your funds from a broker. In this guide we take a look at how long it takes to withdraw money from a Pepperstone account and what you can do to speed up the process. How long

Does Pepperstone allow scalping?

Yes, Pepperstone does allow scalping, in fact, it has an account that is specifically designed to appeal to higher frequency, short-term traders, such as scalpers. Pepperstone’s Razor account has narrow spreads, which in some cases can fall to zero. The idea here is that narrow spreads make scalping and short-term trading strategies economically viable. After

Can you spread bet on MT4 with on Pepperstone?

Yes, Pepperstone is one of the few brokers that lets you spread bet through TradingView, MT4/MT5 and cTrader. Pepperstone introduced spread betting in early 2021 with a focus on tight pricing for major instruments and automated trading on through trading platforms. Overall, Pepperstone is a good choice for clients that want to spread bet on

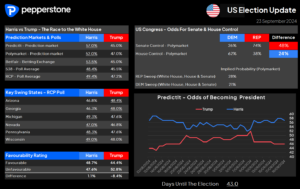

Pepperstone launches a dedicated US election analysis service

Pepperstone, one of Australia’s largest forex trading platforms, with offices across the globe, is launching dedicated coverage of the forthcoming US elections. Pepperstone will provide clients with a dedicated analysis of the election and key events leading up to it. The next of these is the Vice Presidential debate scheduled for Tuesday, October 1st. When

Pepperstone launches 24 hour US equity CFD trading

Pepperstone has introduced 24-hour CFD trading on US equities and it will make the new service available to clients via the MT5, cTrader, and TradingView platforms. There are no additional trading charges and no minimum ticket charge, with commissions from just $0.02 per share. The new service will allow clients to trade popular US stocks,

Pepperstone Talks: Tennis & Trading

One thing Pepperstone does really well is trying to educate their clients so they don’t lose money. Afterall, a profitable trader is a profitable client for a broker which is why as well as a load of online resources Pepperstone also puts on live in person events for active clients. The last one I went

Pepperstone launches proprietary trading platform in Australia

Pepperstone, the Australian forex broker has launched it’s own trading platform for the Australian market. Historically traders have only been able to use MT4, MT5 and cTrader. Both are great platform, but this means that Pepperstone can be more connected to its customers and adapt the platform to their specific needs. Richard BerryRichard is the

Pepperstone launches spread betting direct from TradingView

Pepperstone has announced that its UK spread betting customers will now be able to trade directly from their TradingView terminals. Pepperstone, which recently won the TradingView Broker of the Year award, has introduced connectivity that allows its customers to link their Spread Betting account to their TradingView account and Spread Bet directly from their TradingView

Pepperstone reduces Dax trading costs by 25%

Forex trading platform, Pepperstone the Melbourne headquartered FX and margin trading broker has announced a substantial reduction in the spread it charges on one of the worlds most actively traded equity indices. The CFD broker which has operations in the UK, Europe the Middle East and Africa will cut its Dax spread by 25.0% reducing

UK stock trading on MT5 now available through Pepperstone

Australian-based spread betting broker Pepperstone has announced the addition of a range of leading UK equities to its Spread Betting operations. Pepperstone is best known as a margin FX broker and as one of the biggest users of MT4 in the world. So it’s no surprise that the bets in UK shares will be available

Pepperstone Launches Australian Share CFD Trading

Pepperstone, one of the biggest online trading brokers in Australia have introduced equity CFDs on 50 leading Australian shares to UK clients. The new contracts will be available over the multi basset friendly MT5 trading platform. The newly launched Australian equity offering will compliment Pepperstone’s existing US equity CFDs. The group offers margin trading on

Pepperstone expands forex & CFD trading in Dubai with DFSA Licence

In June 2020 Melbourne based CFD & forex broker Pepperstone announced this week that it had secured a DFSA (Dubai Financial Services Authority) license as part of the groups Middle East expansion. Pepperstone (read Pepperstone reviews) will operate out of Dubai through a new entity Pepperstone Financial Services (DFIC) Limited which will be headed by

Tamas Szabo, Pepperstone CEO on what clients really want from their forex broker

As a relatively new forex broker founded in Australia in 2010 Pepperstone has been gradually expanding it’s global footprint as well as offering more tradable instruments and moving on from the core Forex pairs in the UK and Europe. In a world where it’s seemingly never been easier to set up a forex broker, brokerages

Chris Weston from Pepperstone introduces professional accounts for Australian traders in the wake of ASIC proposed margin restrictions

Pepperstone has begun promoting its professional account as ASIC gains product intervention powers. Australian FX and CFD brokers are still digesting the proposed ASIC margin restrictions made a month ago by the Australian securities regulator ASIC. Those proposals would restrict the levels of leverage available to retail margin traders in Australia. The suggestions, which were

Pepperstone adds more US Share CFDs to it’s MT4 & MT5 lineup

CFD and Forex broker Pepperstone has expanded its univers of traded assets to include US Stock CFDs. It’s a smart move seeing as Forex brokers are taking an absolute battering by regulators at the moment. Plus, brokers should be looking to attract more traders for index trading and CFD stock trading to diversey their income

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.