In this Pepperstone review we give our ratings based on their nearest peers. We tell you what we think of them after testing them with real money and highlight the key costs, facts and figures of their accounts.

Pepeprstone Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Expert Review

Pepperstone Review

Name: Pepperstone

Description: Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with international offices and around 400,000 active clients. They offer spread betting and CFDs on 1,200 major market instruments, which means they focus on the most heavily traded assets, mainly forex and indices trading. Of those 900 are shares on the major stocks on international exchanges.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Why we like them

Pepperstone is a good choice for traders that want to automate their trading strategies through MT4. As far as MT4 brokers they are one of the biggest and best and offers so good EA packages.

Pros

- Tight pricing

- Wide range of MT4 markets

- Pre-built MT4 indicator packages

Cons

- Limited market access

- Only third-party platforms

-

Pricing

(5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1Ratings Explained

- Pricing: Razor tight pricing (on their Razor account).

- Market Access: Mainly FX, but lots more stocks are being added.

- Platform & Apps: Hopefully we will see an own brand platform but their MT4 and cTrader packages are tp notch.

- Customer Service: Local offices around the world and personal account managers for large active traders

- Research & Analysis: Lots of education and technical and algo indicator documentation.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts (apart from the Tennis) and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign. They are a global brokerage so you can at the moment trade crypto, but only if you are a professional client in the UK or are in a jurisdiction that hasn’t banned crypto derivatives.

Management

If you want to know more about the man currently running Pepperstone you can read my interview with Tamas Szabo, who has been Group CEO of Pepperstone since 2017, joining from IG where he started in 1996. So plenty of experience at the helm, Tamas, has been in the business for 25 years.

One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts or anything like that and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign.

As I said Pepperstone offers CFD trading for international clients and spread betting for UK customers. Spread betting of course unique to the UK as trades are structured as bets so if you make money trading you don’t have to pay capital gains tax on your profits.

Trading Platforms

Pepperstone doesn’t actually have its own proprietary trading platform instead they offer TradingView, MT4/5 and cTrader. MetaTrader is gradually pushing brokers and clients to MT5 because it’s faster and a bit more user friendly, however, there is a lot of resistance from traders, especially those that use EA’s or Electronic Advisors, as most have been written for MT4 and can’t be converted for MT5 without being re-written.

Automated Trading

If you haven’t used one an EA, an Electronic Advisor enables you to trade automatically based on certain market criteria, usually based on technical analysis. So if the market does x, you buy, if the market does y you sell. The idea is that you set up a trading strategy and set it on autopilot to trade on your behalf. It’s not necessarily high-frequency trading that was featured in Flash Boys or Flash Crash, but it’s similar. If you want to know more about high-frequency trading those are two books well worth reading, Michael lewis has an excellent way of explaining complex derivatives and I particularly enjoyed Flash Crash because the chap it’s about was a client at the brokerage where I used to work and some people I know were mentioned in it, which is always quite amusing.

A few things to note though about EAs, unless you have a VPS or VPN they won’t work if you turn your trading screen isn’t on and you can’t use them on the web version or mobile. However, Pepperstone will set you up with a free VPS connection if you want one and do a certain amount of business.

MT5 versus MT4

MT5 is one of the most popular trading platforms on the planet and is used by millions of traders and hundreds of brokers. The key benefits are that it’s pretty simple to use and universally recognised, so if you used MT4 or 5 with one broker, switching accounts is fairly easy. Initially, it does have a clunky institutional feel to it, but once you get the hang of it it’s fairly simple to use.

Pepperstone’s MT5 does have its advantages over other brokers though. Mainly the packages they offer, the spreads and the execution, but also the regulation. Pepperstone are regulated by the FCA, so if you are a UK client a certain amount of your funds are protected by the FSCS if Pepperstone was to go bust. You are not protected if you are using MT4 or 5 through an offshore broker, and to be honest, if you are based in the UK you should always be trading with an FCA regulated broker, or the FCA regulated entity of a broker. It is tempting to go offshore to get better margin rates since ESMA capped them but you can get them as a professional client and if you can’t qualify as a professional client you probably shouldn’t be trading with excessive leverage anyway.

One of the main things that make Pepperstones MetaTrader offering stand out is market range, you get loads of forex pairs, the major indices and they are also increasing the number of shares they offer. They have the major FTSE 100 stocks and a few hundred US, European and Australian stocks, but that is growing. But, it is still nowhere near as many markets as someone like IG or Saxo offers. Also, Pepperstone is still only a trading platform so you can’t hold any of your long-term investments with them.

Trading Tools

Pepperstone also has a unique package of MT5 downloads which they call Smart Trader Tools, which include plugins like Trade Terminal where you can set your preferences for assets. So for example if you always trade cable in 1 lot, and have a stop 10 pips away and a limit 20 pips that will be your default OCO when you trade.

You also get things like a Pivot Points plugin where you can trade off previous highs and lows. Some other main features of MT4 are one-click trading, and the ability to trade off the charts. You can also move your entry and exit points automatically. If you trade four markets you can have four set up on screen and have your defaults for each one.

cTrader

One of the major drawbacks about MT5 though is that it doesn’t show your margin when you trade, which to be honest isn’t great if you are a beginner because you have no idea what your exposure is or how much risk capital is going to be used up. It will tell you your overall margin position, but it won’t show you your individual margin rates. Which is daft. However, Pepperstone’s other platform cTrader does do this. To be honest, I actually prefer cTrader, I think it’s more user-friendly, it breaks down your margin. The disadvantage of course is that you can’t run net and hedged positions. You can’t trade with EAs but I don’t really like them anyway, I think the chances of clients making money with an off-the-rack automated trading strategy is pretty slim. It may work for a bit to nick a trade here and there but if you leave it running over a massive market correction you can get wiped out. You also can’t trade as many shares on cTrader as you can on MT5, which is a shame.

I think it has a cleaner layout, with everything pre-installed and you can trade in a web browsers rather than having to download the software. If you are building your own EA then MT5 is for you but if you are just eyeballing the market and taking a view I prefer cTrader as you get news, calendars, plus Autotrachtists is on there as well and is linked to the pair you are looking at.

Education & Analysis

One other thing to note as well is that when it comes to learning to trade or understanding the markets it is incredibly difficult. Pepperstone has partnered with The Corillian Academy, to provide some educational content. Corillian was set up by some fairly sophisticated traders with decent backgrounds. Richard Adcock for example has been on the board of the society of technical analysts for 30 years.

Customer Service

Although probably the main benefit of Pepperstone over the majority of MT4 brokers is customer service. It’s a big risk trading the financial markets and there are often big sums of money involved. So being able to phone someone up who can execute trades for you and give you a full demo of the platform is almost more important, in my mind anyway, than pricing and market access. If you’re in the UK, you get to talk to your dealers in London, through direct dial.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepeprstone Awards

Pepperstone always do very well in our awards for their MT4 offering. They have won best MT4 broker in 2023, 2022, 2021 and 2020.

75.3% of retail investor accounts lose money when trading CFDs with this provider

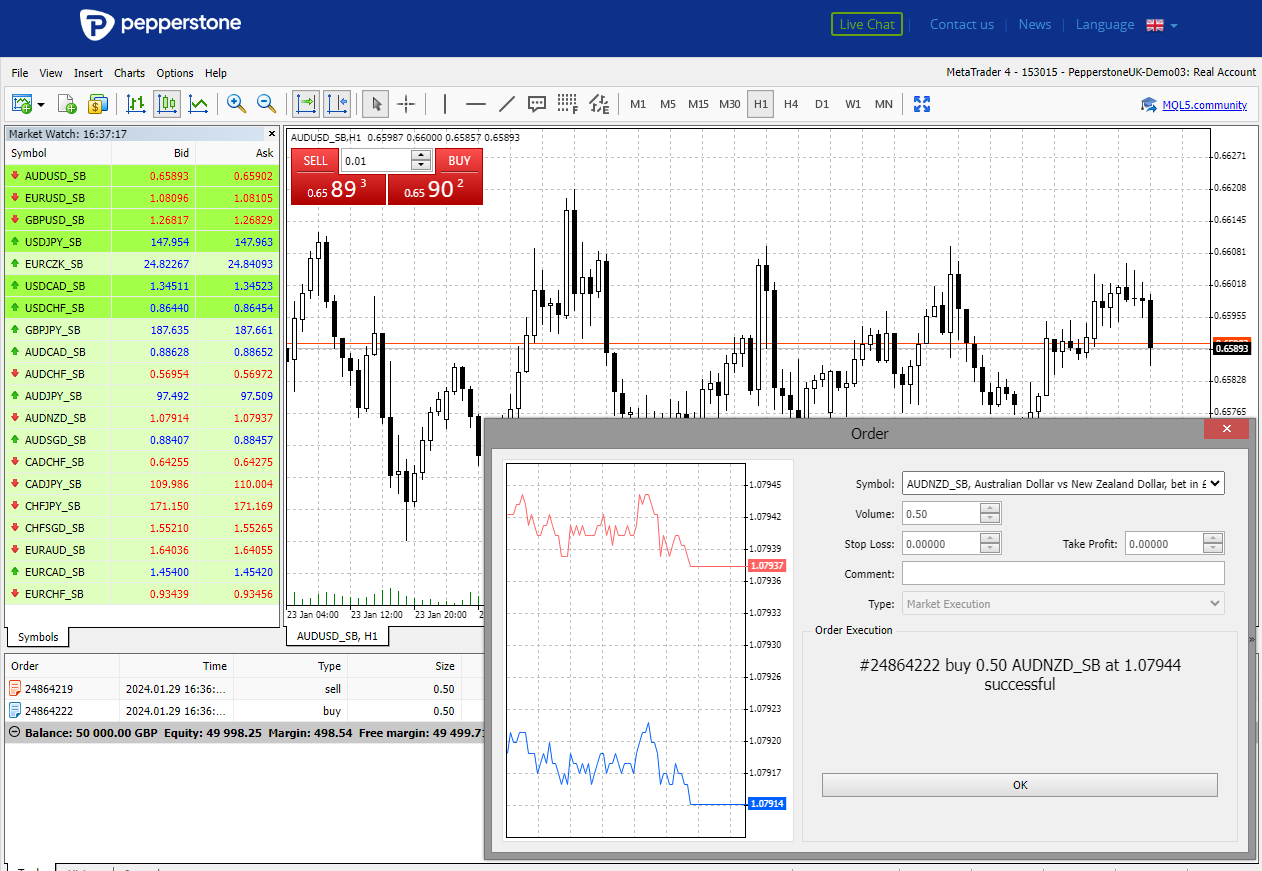

Pepperstone Video Review

Watch as we demonstrate trading live on a real account through Pepperstone’s two trading platforms, MT4 & cTrader.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Facts & Figures

Pepperstone Total Markets | 1200 |

| ➡️Forex Pairs | 100 |

| ➡️Commodities | 28 |

| ➡️Indices | 28 |

| ➡️UK Stocks | 192 |

| ➡️US Stocks | 890 |

| ➡️ETFs | 107 |

Pepperstone Key Info | |

| 👉Number Active Clients | 400,000 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | 0 |

| 📅Founded | 2010 |

| ℹ️ Public Company | ❌ |

Pepperstone Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ✔️ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

Pepperstone Average Fees | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 0.9 |

| ➡️DJIA | 2 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.4 |

| ➡️EURUSD | 0.1 |

| ➡️GBPUSD | 0.40 |

| ➡️USDJPY | 0.40 |

| ➡️Gold | 1.6 |

| ➡️Crude Oil | 2.5 |

| ➡️UK Stocks | 0.1% |

| ➡️US Stocks | $0.02 per share |

75.3% of retail investor accounts lose money when trading CFDs with this provider

Can you spread bet on Pepperstone?

Yes, Pepperstone is one of the few brokers that lets you spread bet through TradingView, MT4/MT5 and cTrader.

Pepperstone introduced spread betting in early 2021 with a focus on tight pricing for major instruments and automated trading on through trading platforms.

Overall, Pepperstone is a good choice for clients that want to spread bet on MetaQuotes as it’s MT4 & MT5 package is one of the best around. Plus Pepperstone are one of only two brokers that offers spread betting through TradingView.

- Spread betting markets available: 1,200

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

Pepperstone operates a tiered approach to spread betting accounts. Newer clients typically joined Pepperstone’s standard accounts; more experienced traders can elect to join the firm’s Razor account. The latter is used mainly for scalping and algorithmic trading. As seen below, Razor accounts have lower spreads than standard accounts in the FX markets but they also incur some commissions.

Pepperstone does not charge an inactivity fee, which is excellent for low-latency traders. The firm has no regular maintenance fee like some investment accounts. There is no minimum deposit either.

In the UK, Pepperstone offers protection on negative balance for retail clients only. This means that should the market swing violently against you and wipe out your risk capital, your account will not go below zero. Professional accounts, however, will be required to post additional equity and can go into negative equity.

For funding, Pepperstone accepts Visa, MasterCard, Paypal or bank transfers.

Most withdrawals are free, although international Telegraphic Transfer (TT) may incur fees by the banks which will be passed on to clients.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Does Pepperstone offer stock market and synthetic indices?

Yes, you can trade synthetic indices like the VIX with Pepperstone or some of the most popular stock market indices like the S&P 500.

- Indices available: 28

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Index pricing: FTSE 1, DAX 1, Dow 2, NASDAQ 1, S&P 0.4

Pepperstone sources razor-sharp pricing, from multiple Tier 1 banks and liquidity providers, with competitive fixed spreads as low as 1 point on UK100, 0.9 on GER40, with no commissions. 99.99% fill rate*, fast execution and no dealing desk intervention.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Does Pepperstone use MT4?

Yes, MT4 is one of Pepperstone’s primary trading platforms. However, they are building their own trading in-house and also offer cTrader and MT5.

- MT4 markets available: 1,200

- Minimum deposit: £1

- MT4 account types: CFDs, spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

With Pepperstone’s MT4 account you get 85 pre-installed indicators and 28 additional Smart Trader Tools where you can build and run your EAs using MetaQuotes Language 4 (MQL4) and identify statistically significant market movements with Autochartist.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone or IC Markets better for commodity trading?

Based on our metrics Pepperstone is better for commodities trading as they are regulated by the FCA (Financial Conduct Authority).

- Commodities markets available: 28

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Pricing: Gold 0.5 , Oil 2.5

With Pepperstone you can trade commodity CFDs or spread bet on Gold, Silver, Crude, Natural gas with razor sharp pricing, low spreads and fast execution without worrying about physical delivery, ownership and rollovers.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone’s Demo Account Any Good For MT4, MT5 In The UK?

Pepperstone does have a demo account for MT4 and MT5 for UK and international traders to try before they open a live account. But, there are a few things to be aware of. I tested the Pepperstone MT4 demo account and compared it to the live account, as it doesn’t really give a good overview of the true scope of Pepperstone’s MetaQuotes offering.

Pepperstone’s demo account isn’t that great compared to their live trading platform. Yes, you can trial the standard, Razor or spread betting demo, you can also choose how much you want to trade with from £200 to £50,000. But, you only get access to a handful of forex pairs (no commodities, stocks or indices) and you can’t set your own leverage, something you can do with other MT4 demo accounts. It’s a real shame, because the live MT4/5 account from Pepperstone is excellent, it has won “best MT4 broker” in our awards many times, but the demo really lets them down. You also don’t get access to any of the indicators, or research that you do with the main account.

Pepperstone’s demo account gives you a balance of up to £50k to test MT4 for 60 days with access to 20 major forex pairs.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone a good trading platform?

Pepperstone doesn’t have it’s own trading platform in the UK yet as Pepperstone mainly uses cTrader and MT5/MT5 but is building their own trading platform. This is mainly due to the unreliability of third-party platforms, specifically MT4 app being withdrawn from the App store.

Pepperstone has launched a proprietary trading platform in Australia. Historically traders have only been able to use MT4, MT5 and cTrader. Both are great platform, but this means that Pepperstone can be more connected to its customers and adapt the platform to their specific needs.

We can expect to see Pepperstone proprietory platform rolled out globally shortly.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Does Pepperstone have a good trading app?

Pepperstone does not have it’s own app but instead relies on branded versions of the MT4/MT5 and cTrader trading platforms it’s clients use.

Pepperstone has four trading apps, MT4/MT5, cTrader and TradingView which provide access to CFDs and spread bets on the major markets for active traders with tight spreads.

Pepperstone has a good version of the MT4 app for tight spreads on forex and is one of only two brokers to offer spread betting via TradingView in the UK.

Pepperstone’s version of the MT4 trading app, will connect you to your MT4 account with Pepeprstone but when I tested it the algo and automatic trading functions of the desktop version are not available through the app.

The cTrader Pepperstone App though is feature-rich including, market sentiment, market depth economic calendars, and technical analysis from Autochartist which displays regularly updated trading signals.

There is no stand-alone trading signal feed, but once you are looking at a market, Autochartist will display the most recent signal from 15 minute, 30 minute, 1 hour and 4 hour time frames and automatically display a buy or sell one-click order button based on if it is a long or short signal.

The app also breaks down your trading statistics based on previous trades per asset. So for example, if you are trading a US stock on the app, it will tell you how well you have done in the past with your overall net profit, what commission you have paid, your best and worst trades and how long you generally hold a position in that stock for.

Market access is narrow and pricing is tight.

75.3% of retail investor accounts lose money when trading CFDs with this provider

24 hour US equity CFD trading

In June 2024 Pepperstone introduced 24-hour CFD trading on US equities and it will make the new service available to clients via the MT5, cTrader, and TradingView platforms.

There are no additional trading charges and no minimum ticket charge, with commissions from just $0.02 per share.

The new service will allow clients to trade popular US stocks, such as Apple and Nvidia, around the clock, allowing them to take advantage of any overnight news or events that could affect equity prices.

Equity CFDs or Contracts for Difference are cash-settled, non-deliverable contracts that provide clients with an economic interest in the rise and fall of a stock’s share price without conferring ownership of the underlying stocks.

CFDs are leveraged by the CFD broker, providing the client with a much larger exposure to the underlying instrument, than they could afford in the cash market, with the same account balance.

In effect, the broker lends the client the additional funds to control that larger position and levies a funding charge on the client’s account, if the CFD is held overnight.

Though trades closed within a business day do not attract funding charges.

Out-of-hours trading has become increasingly popular and some of the biggest moves in the prices of US equities come pre and post-market these days. For example, US Technology stocks often report earnings after the market close.

Yet, there can be limited liquidity out of hours, and traders need to factor this into their strategies, but overall the ability to enter or exit a US equity CFD trade, 24 hours a day is a bonus.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Is Pepperstone good for forex trading?

Yes, Pepperstone is a good forex broker, as this is one of their core products and they really focus on trying to compete on tight pricing, especially on MT4/MT5.

Pepperstone has four forex trading platforms, MT4/MT5, cTrader and TradingView and is generally one of the cheapest brokers for forex trading. Forex trading is cheap with Pepperstone because they focus on FX as a core market rather than offering lots of stocks and less popular assets.

Yes, Pepperstone are able to offer some of the tightest forex spreads and commissions for major FX pairs. You can also trade minor and exotic FX crosses as a spread bet or trade CFD. Although no currency futures or options. Liquidity, pricing, and execution time on Pepperstone’s platform are good, given its access to multiple Tier 1 banks.

Pepperstone’s USP, when compared to other forex brokers, is their MT4 offering for traders who want to automate their forex trading strategies. Pepperstone has done partnerships with FX Blue which measures currency strength and also has a free (for clients) package of MT4 indicators which can be used to set up and simulate, then go live with trading algorithms based on technical indicators and price action.

Forex Trading Platform

For forex traders, who want manual execution, the cTrader forex trading platform offers good functionality where you can trade directly from the charts, as well as drag and drop stops and limits.

You can also trade forex via TradingView and if you are in the UK, Pepperstone is one of the view firms that lets you trade on TradingView as spread bets.

Pepperstone Talks: Tennis & Trading

One other thing Pepperstone does really well is trying to educate their clients so they don’t lose money. Afterall, a profitable trader is a profitable client for a broker which is why as well as a load of online resources Pepperstone also put on live in person events for active clients.

The last one I went to was at 1 Moorgate Place and focussed on the opportunities, risks and rising volatility when navigating the markets. There were some good sessions from Ali Crooks, Charlie Burton, Mark Holstead, and Adam Harris, hosted by their resident analyst, Michael Brown.

But actually, I was there to see what Greg Rusedski, who apparently likes to trade, too.

Pepperstone has a long history of sponsoring tennis, and I’ve been with them for a few Queens matches.

Amazingly, Greg seemed to know his stuff. No selfie, though.

But if you are an active trader with Peppersotne, you may just get invited along, and if you are, it’s well worth going to a Pepperstone Talk.

75.3% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.