Interactive Brokers is rated extremely highly on Good Money Guide, especially for experienced investors and active traders seeking global market access. Experts highlight IBKR’s institutional-grade platform, very low trading costs, and unrivalled range of products including shares, options, futures, ETFs and FX across dozens of exchanges worldwide. It is positioned as one of the most powerful brokers available, though the platform can feel complex for beginners. Customer reviews on Good Money Guide are generally positive, with users praising pricing and market access, while occasional criticism focuses on the learning curve and customer service responsiveness. Overall, IBKR is seen as a top-tier choice for serious traders.

Interactive Brokers Customer Reviews

Tell us what you think of this provider.

Simply the best

Vast product choice, low fees, complete guidelines and formation, great reports

Best investing platform

I have been using the platform for 3 years now.

It offers a wide choice of investment options with an app that is very complete and easy to use.

Shining in the woods.

Quite transparent, saving money of investors, giving lot of options to choose from.

Best brokers for global investors and traders

I have been using this platform from UAE for more than 5 years and completely happy with that platform, technical support and withdrawal convenience.

Great, simple, easy

Great platform!

Best in Class

Simply 5* , great Trading and Investing Platform. Keep going…

The best

Great comprehensive platform with low fees and excellent service

For both begginers and pros

The platform has just made my life so much easier. I feel like I have been trading and investing for decades.

reliable, fast and well-priced service

Provides what I wan’t, executes as I wan’t it and provides even more. I’m fine with it since several years

Excellent, Accurate and Fast

Very efficient, fast and accurate platform

Ibkr pioneer and the best

It’s the best no doubt

My best experience

Streamlined and efficient

Best platform

I have been working in private banking for many years, and I can confidently say that this is the best investing platform I have come across. The combination of competitive fees and outstanding service truly sets it apart. In fact, the overall experience is superior to what some private banks are currently offering.

Very good User Interface

The Mobile & Desktop Apps are extremely user friendly. The data on each stock/listing is extensive and further filters/cuts can be added to have the desired view. The statements provide a detailed overview of activity and MTM report.

Excellent trading platform

During my more than 7 years of experience trading US stocks and ETFs with different 8 brokers I have yet to come across a broker that would top Interactive Brokers. I hope they keep up the good work.

The best broker ever

I have been a client of Interactive Brokers for more than 7 years now. I am a raving fan of their services. As a long-term investor I am more than satisfied with all the aspects of their work.

Great

Great

Best trading platform

The platform that I have been using since 2021

Best in Class

great prices, great selection on global markets and access – app could be more user friendly

Excellent platform

Using IB for more than 10 years and during this time I find it an excellent platform for the non-expert trading user

Interactive Brokers Expert Review

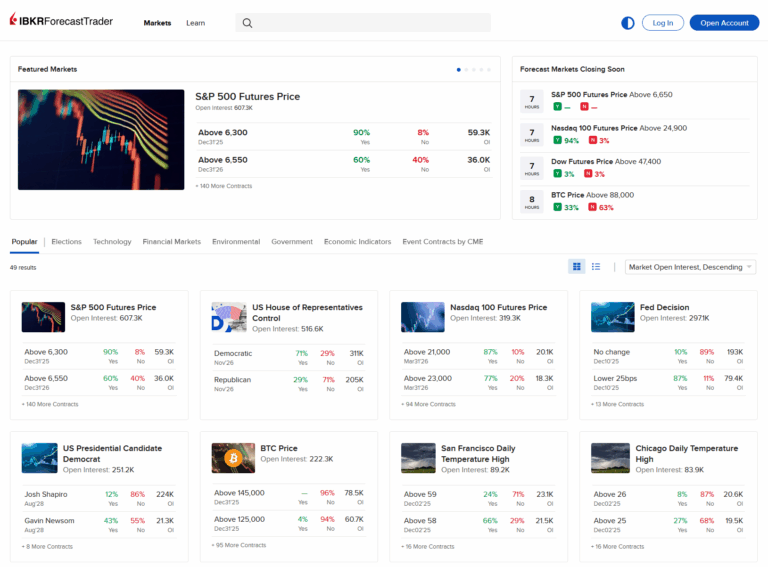

Interactive Brokers has a platform for everyone with very low costs

Provider: Interactive Brokers

Verdict: Interactive Brokers is an exceptional trading platform that offers institutional-grade trading capabilities to private clients around the world. IBKR has some of the lowest trading and investing fees and the widest market range in the industry. Interactive Brokers is a major US online automated electronic broker company. The financial broker is listed on the Nasdaq Exchange with ticker IBKR. The firm operates in 150 electronic exchanges in 34 countries, and offers trading in 28 currencies. Interactive Brokers has more than 3.19 million institutional and retail customers.

Is Interactive Brokers any good?

Yes, Interactive Brokers is simply unmatched in terms of market access, account types and execution options for retail traders. It always has been and remains one of the cheapest trading and investing platforms globally.

Yes, Interactive Brokers is simply unmatched in terms of market access, account types and execution options for retail traders. It always has been and remains one of the cheapest trading and investing platforms globally.

The proof they say is in the pidding and IBKR, has increased it’s market share in the UK dramatically over the past few years. In 2024 alone, they increased the number of accounts by 142%. An amount I suspect will continue to rise, of all the brokers we cover, they provide the most updates, most platforms and are always looking to offer new markets, that investors actually want.

2025 Awards: Best Professional/DMA Broker 2025

Pricing: Top marks as IBKR don’t charge a custody (account) fee and commission are the cheapest around

Market Access: Top marks again for the widest selection of markets available

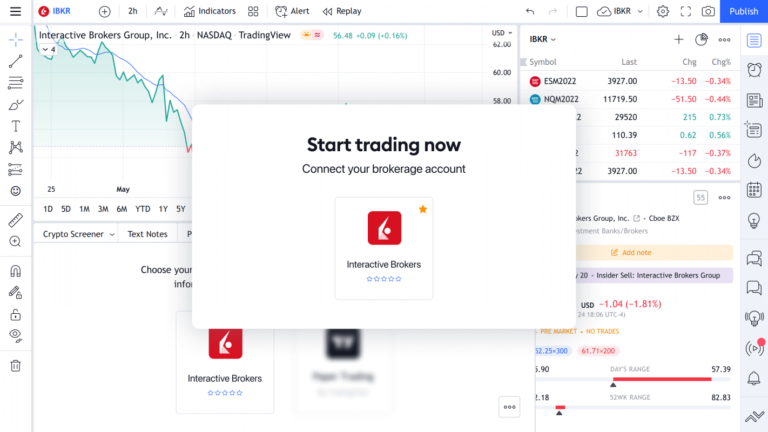

App & Platform: Hard to beat – excellent range of institutional grade execution tools and simple apps for beginners

Customer Service: IBKR let themselves down a bit here. If you are a big customer you get an account manager, otherwise online support is slow

Research & Analysis: Some of the best education, screeners and market data for free on their website and integrated into IBKR platforms.

I’ve used Interactive Brokers for about 20 years now. I’ve interviewed their founder (Thomas Peterffy), their UK MD (Gerry Perez), they’ve been a competitor (when I was a broker myself), a customer and a partner over the years. I’ve traded live with real money when thoroughly testing their platforms.

This included an in-depth conversations with their Head Of Product (Steven Sanders) to get inside insights on the best parts of the platform and services that some clients may not know about. In this review, I lay out my verdict on Interactive Brokers as an industry expert so you can decide if they are the right investing and trading platform for you.

There is one thing that Interactive Brokers gives you above all other brokers, and that is control. You can invest and trade in pretty much anything you want, in pretty much any account type, pretty much how you want.

If you are not familiar with Interactive Brokers (IBKR) they are American, but global, as most American things are, with the notable exception of their news, which always seems to be local. But I digress, IBKR was one of the first brokers to offer electronic trading to the masses. They were founded in 1978 and if you want to know more about the man who founded them and is still running the show, read my interview with Thomas Peterffy, the founder and chairman.

Highlights: The key things to focus on if you are considering opening an account with Interactive Brokers is that:

They are cheap: No other investment or trading platform can match their discount commissions, FX rates and zero account charges

Huge market range: IBKR offer by far the best access to global stock exchanges around the world

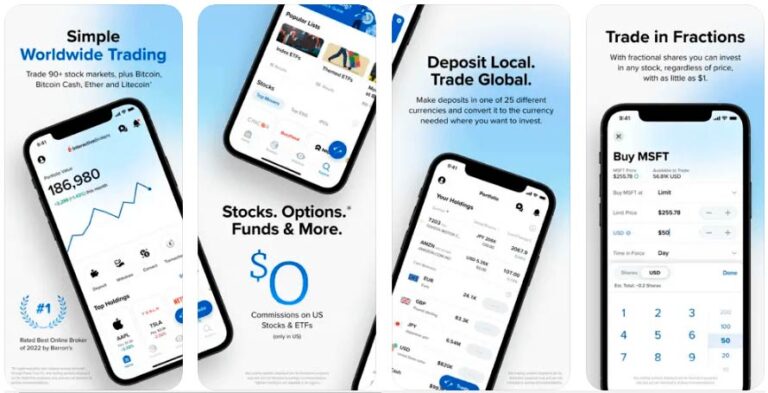

They innovate and create :You can invest in so many different ways through IBKR, from their beginner IBKR LITE apps, to their institutional-grade desktop workstation trading platform. They have some of the most advanced and easy-to-use features available to private investors.

Interactive Brokers Account Types: IBKR offer by far the most types of accounts globally including regular investing account, active trader accounts, direct market access, futures, options and fractional stock trading

You can also earn money on your cash, you can buy bonds (high and low yielding), buy warrants, partake in placings, vote on company corporate actions. You can convert currency at 0.2%, which is cheaper than most specialist currency brokers or money transfer apps.

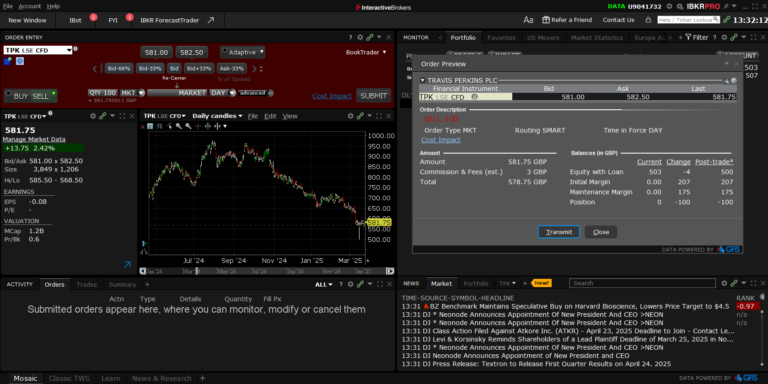

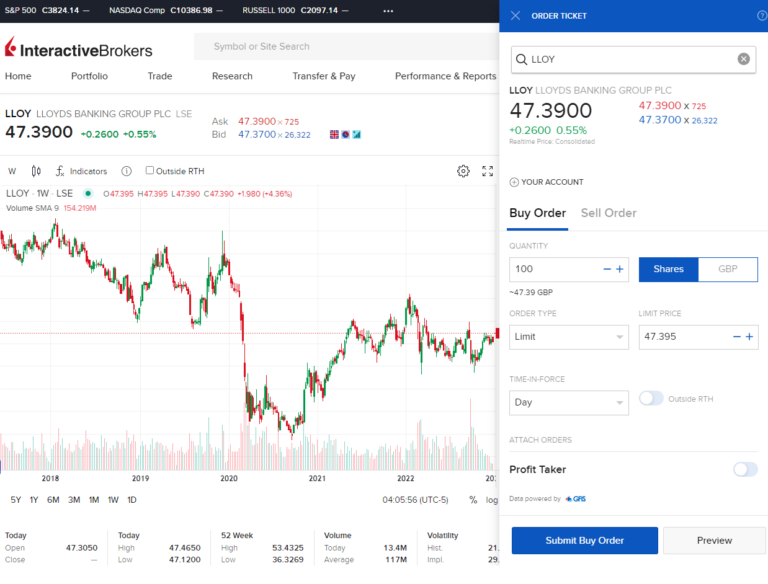

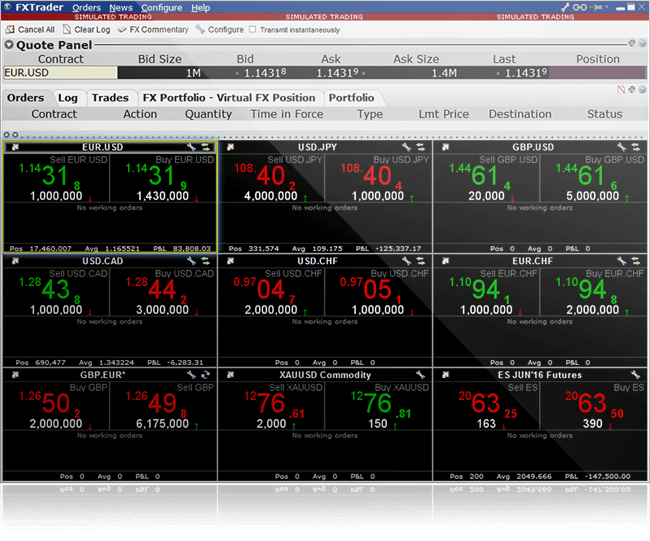

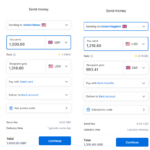

Foreign Exchange: Which actually segues me nicely to prove my control point. With most brokers you have to choose an account base currency (if you are in the UK that is probably going to be GBP) and when you trade, no matter what currency an asset is traded in your P&L will be converted to that base currency. But with Interactive Brokers you can run your account in multiple currencies.

So, if you put in GBP and trade the S&P for example, your P&L will be in USD. If you buy USD stock you get the option to attach a currency conversion to the transaction so you can convert exactly the right amount to cover the purchase, or you can choose to run a deficit in USD.

It’s not such an issue for small traders, as currency exposure, whilst important to be aware of, isn’t the most pressing matter. But if you are running a net flat long/short global macro portfolio, then keeping on top of your currency exposure could be the difference between making money or not.

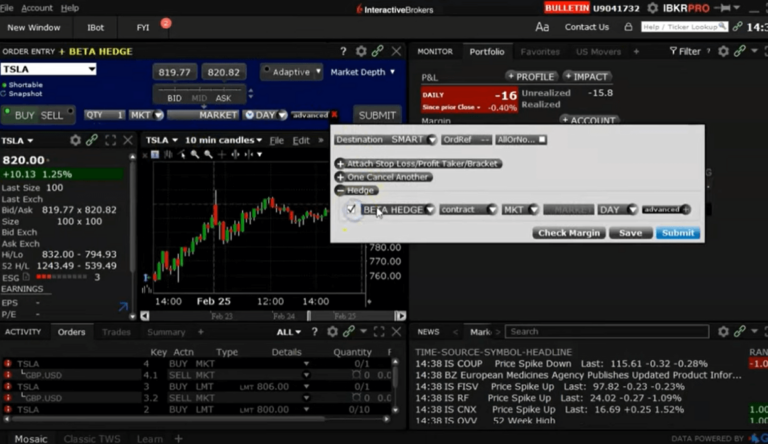

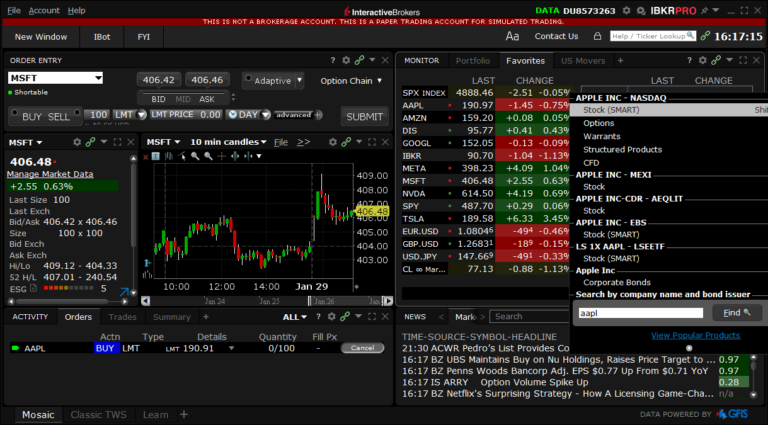

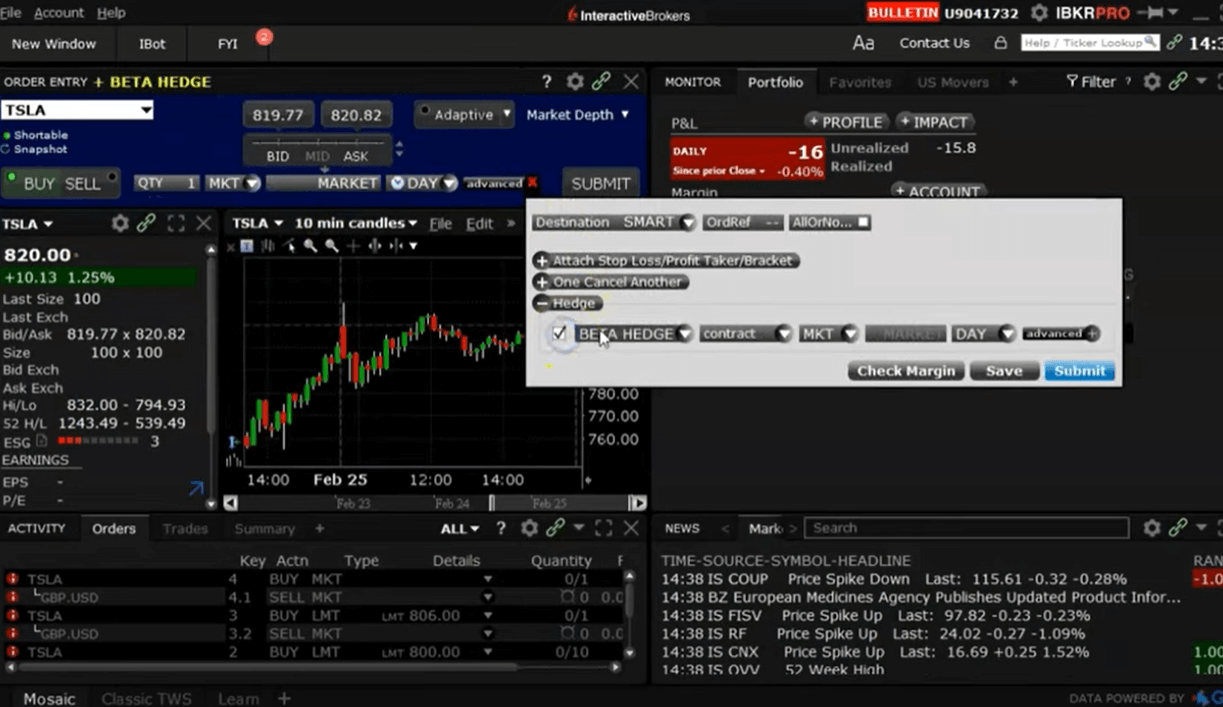

Desktop Trader: Through ScaleTrader, (one of the founder’s favourite features) IBKR also gives you some very advanced order functionality, the sort you usually only get with professional trading systems like Fidessa (for stocks) or TT (for futures).

If you’re building a big position and don’t want the market to know you’ve got a big order to work, IBKR’s order ticket will let you gradually feed that into the market (but only charge you for the single order).

You can automatically drop bids and offers into the market based on time and price to take advantage of volatile markets. You can also set it to scalp for quick profits in choppy markets.

Pairs Trading: You can trade one stock against another automatically by spread, percentage or price.

Why is that important? Because it can help you build a market-neutral portfolio and when we asked the boss of IBKR the habits he saw in his most profitable customers, (referring back to our interview with him for the third time) he said the ones that traded one stock against another, often did well.

Interactive Brokers Universal Account: You can of course do these things with other brokers, but what you can’t do is do them all in one place.

For this review, I spent a while talking to Steven Sanders, IBKR’s head of Marketing & Product Development, and he said in the twenty years, he’s worked for Interactive Brokers the thing he’s most proud of (other than it being founder lead and therefore very little red tape when you want to get things done) is the implementation of the Universal Account, where everything is done from one account.

What’s amazing to me is that nobody else really offers it. Ten years ago when I was a derivatives broker at Man Financial, we offered everything that IBKR did, but all on separate platforms. We have a couple of big accounts, £20m upwards, that we were always trying to lure back from IBKR with our personalised voice brokerage where you could phone us up we’d take care of your complicated orders for you.

But times change, there is still demand for bespoke voice brokerage, but not as far as Interactive Brokers are concerned. They do offer it from specialists desks if needed, but most trading and investing is done online.

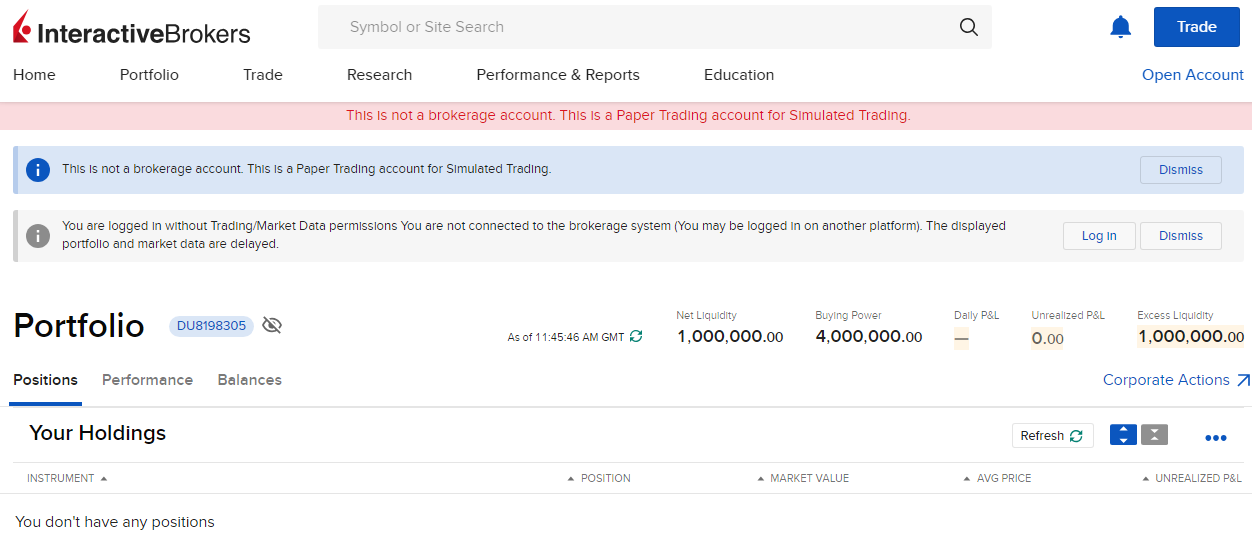

Demo Account: Interactive Brokers does have a demo account, but they call it a free trial instead. This is odd, because you don’t actually have to pay to have an account with IBKR. In fact, Interactive Brokers is one of the only trading platforms that does not have a custody fee for investing in a GIA, SIPP and ISA.

If you want to know more about that, you can listen to my podcast with Gerry Perez, the UK MD, who explains, how they offer such amazing market access for such little cost.

You get a cool $1m to paper trade with on the Interactive Brokers demo account or ‘Paper Trading version’ as they call it. You get access to the easy-to-use investors portal and the more complex IBKR TWS provides delayed market data, simulated trading and access to all of our unique tools and offerings, including the IBKR Risk Navigator, the Volatility and Probability Labs, Portfolio Builder, Research and News.

But, to be honest, I didn’t find the demo account very good. Lots of information was missing and I couldn’t place a trade. I’m not sure why, and actually, that’s going to be a bit of an issue for Interactive Brokers because demo accounts are a great way to get client’s interest. In a world where so many brokerages a vying for the same business, even small hiccups like that can cause a massive drop off rate in opening an account.

Usually, IBKR’s technology is first-rate, but the demo account isn’t up to scratch. I didn’t use the paper trading account, just the live trading platform with real market orders.

Customer Service At Interactive Brokers: It’s not all great, it takes a while to get through on the phone to customer service, and it has a slightly outsourced feel about it (if you know what I mean).

The desktop trading platform, despite its exceptional functionality, is also a bit ‘Windows 95’. But if you don’t need all the bells and whistles, the web based platform, or app has a more modern feel to them.

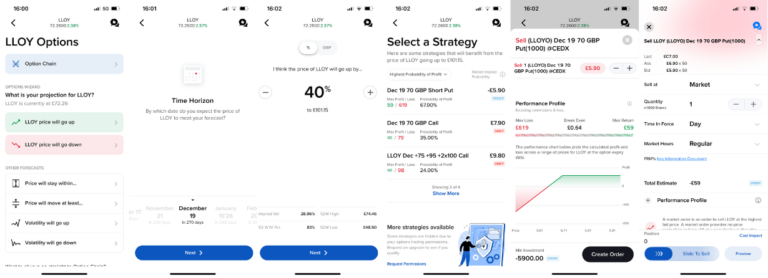

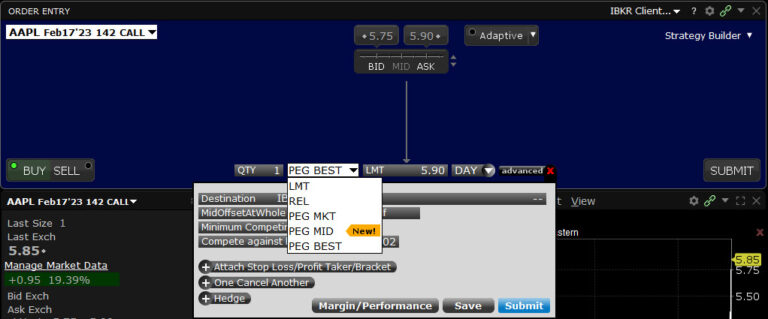

Options Strategy Builder: Options trading is gaining in popularity in the UK, mainly because of the press attention they derived from meme stocks (where US traders punt via options). But they are still a very complicated product. So what Interactive Brokers has down is create a Strategy Builder product, that essentially reverse the process of putting on options strategy trades.

You tell Strategy Builder what you think the market is going to do. For example, either, go up, stay still, not move for a while, or volatility will increase and it will create an options strategy around that. Instead of you having to know what strategy to put in place or working out the individual options legs.

IMPACT Ethical Investing: In tune with moving with the times, Interactive Brokers has also released the IMPACT app to help people investing in ESG and impact sectors, so they can put their money to good.

You can see the IMPACT dashboard on desktop, but it also operates as a standalone app that connects directly to your IBKR account and scores your portfolio based on how ethical the stocks you hold in it are. Ratings come from FactSet and Refinitiv, and there is this excellent feature that allows you to swap into more ethical stocks.

If one of your holdings is flagged as not that ethical, the app will suggest another one and at the click of a button, it will sell your shares and calculate how many new shares of a more ethical but similar company to buy and do it all for you. If you’re in the US, you can also make charitable donations directly on the app.

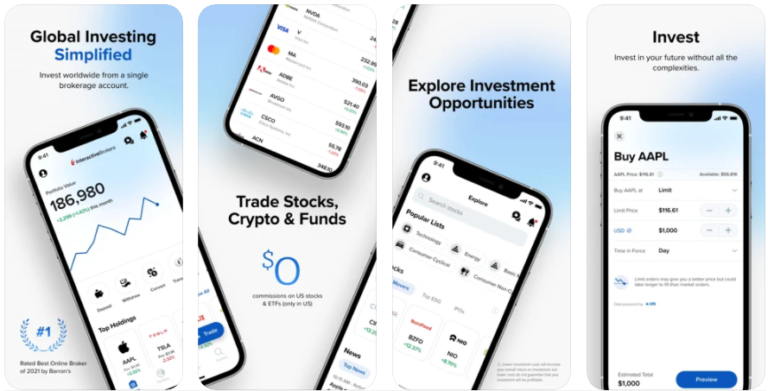

Interactive Brokers For Beginners: There is no doubt that Interactive Brokers is a proper trading platform, for those who know what they are doing and cater mainly to the more sophisticated investor. But they are making an effort to open their services up to the newer breed of investor and trader.

It’s standard now among many fintechs, but IBKR were actually the first to offer no commission trading. They also offer fractional shares through IBKR LITE and IBKR Pro accounts and have removed the monthly minimum account charge.

The hope of course is that by onboarding investors when they just start, they can look after their investments for the next 40 years, just as they have been doing for their existing clients for the last 40.

Interactive Brokers runs a Student Trading Lab where students from 600 schools and universities take part in a $1m paper trading account for the purposes of getting a better understanding of the markets. No broker these days can tell you what to buy or sell, but IBKR GlobalAnalyst helps you hunt out undervalued opportunities, across the world, not just in the US.

IBKR offer a Trading Academy, podcasts, webinars and blogs for beginners and experienced traders so that new customers survive the markets to become long-term clients.

Plus, they are cheap.

24-Hour ETFs At Interactive Brokers:Interactive Brokers has a list of 24 selected ETFs available to trade around the clock from Sunday evening, east coast time, through to the close on Friday, by adding these funds to its US overnight trading facility.

Clients who are permissioned to deal in US stocks, are able to trade these ETFs 23.50 hours a day, five days per week, allowing them to react to news stories, macroeconomic and geo-political events as they happen, rather than waiting for US markets to open.

The trading hours and ETFs are available to both retail and institutional clients alike and are traded via the firm’s IBEOS system. Trades can be submitted using multiple order types.

The range of ETFs is pretty broad and includes firm favourites such as SPY, QQQ, DIA and IWM, which track the S&P 500, Nasdaq 100, Dow 30 and Russell 2000 indices respectively. You can also short those indices by trading the SH, PSQ, DOG, and RWM inverse ETFs.

Pros

- Very low dealing fees

- Wide market range

- Direct market access

- Complex order types

Cons

- Customer services can be slow

- No financial spread betting

-

Pricing

(5)

-

Market Access

(5)

-

Apps & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.859.7% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Video Review

In this video review of Interactive Brokers we trade live on a real account and highlight some of the key platform features.

59.7% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers Facts & Figures

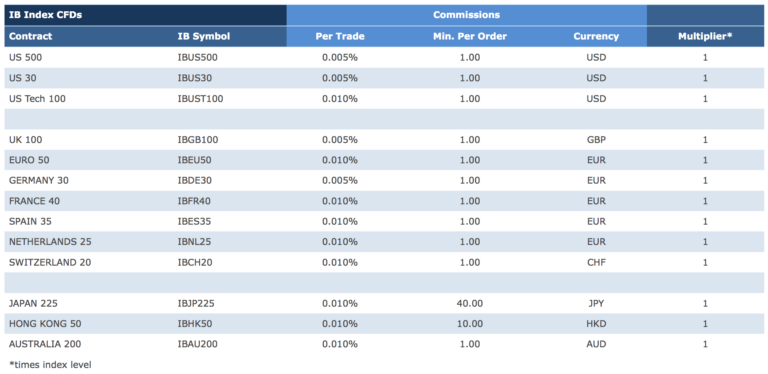

IBKR CFD Markets | Over 5230 |

| 👉 Forex Pairs | 100 |

| 👉 Commodities | 20 |

| 👉 Indices | 13 |

| 👉 UK Stocks | 500 |

| 👉 US Stocks | 3500 |

| 👉 ETFs | 1100 |

IBKR Key Info | |

| 👉 Number Active Clients | 1750000 |

| 💰 Minimum Deposit | $0 |

| ❔ Inactivity Fee | $0 |

| 📅 Founded | 1977 |

| ⬜ Public Company | ✔️ |

| 🏢 HQ | Greenwich, Connecticut |

IBKR Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ❌ |

| ➡️ DMA (Direct Market Access) | ✔️ |

| ➡️ Futures Trading | ✔️ |

| ➡️ Options Trading | ✔️ |

| ➡️ Investing Account | ✔️ |

IBKR Average Costs | |

| ➡️ FTSE 100 | 0.005% |

| ➡️ DAX 30 | 0.005% |

| ➡️ DJIA | 0.005% |

| ➡️ NASDAQ | 0.005% |

| ➡️ S&P 500 | 0.005% |

| ➡️ EURUSD | 0.0008% |

| ➡️ GBPUSD | 0.0008% |

| ➡️ USDJPY | 0.0008% |

| ➡️ Gold | 0.0007% |

| ➡️ Crude Oil | 0.0007% |

| ➡️ UK Stocks | 0.02% |

| ➡️US Stocks | 0.003% |

59.7% of retail investor accounts lose money when trading CFDs with this provider

Interactive Brokers News

Interactive Brokers FAQ

Yes, very. We rate Interactive Brokers as safe as they are one of the largest investment platforms in the world and excel in almost every category compared to peers in our matrix. For UK customers funds are protected by the FSCS, and you can keep an eye on the company’s health by following its share price on the NASDAQ (IBKR:NASDAQ).

Yes, as well as providing brokerage services for banks, professionals and hedge funds beginners can also access similar pricing and market access through the Web Portal and IBKR mobile apps.

Yes, UK investors and traders can use IBKR. The UK entity is regulated by the FCA and has an office on Fenchurch Street in the City of London. Interactive Brokers offers, CFDs, futures and options and physical investing through a GIA, ISA or SIPP account in the UK.

There is no minimum deposit to open an account with Interactive Brokers. You can open an account without depositing funds, they once you are familiar with the platforms and investment features, you can deposit funds at a later date. It is also free to deposit funds via Wire transfer, or you can deposit via your Wise account.

No, Interactive Brokers does not offer financial spread betting. However, you are able to trade the spread between different futures contracts through futures spreads. You can see a list of brokers that offer financial spread betting here.

The current Interactive Brokers (NASDAQ:IBKR) share price is $66.92 which is a change of -1.47 or -2.15% from the last closing price of 68.39 with 3,988,186 shares traded giving NASDAQ:IBKR a market capitalisation of $113,508,094,814. The most recent daily high has been 67.29 and daily low 65.89. The NASDAQ:IBKR share price 52 week high has been 79.18 and the 52 week low 32.82. Based on the most recent NASDAQ:IBKR share price opening of 66.92, the current NASDAQ:IBKR EPS (earnings per share) are 2.22 and the PE (price earnings ratio) is 30.19.

IBKR share price pricing data last updated: 16:00 12-Mar-2026

Yes, Interactive Brokers has some of the best interest rates on uninvested cash. You can compare the best cash on uninvested cash rates from investment platforms here.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.