Interactive Brokers, the US-based multi-asset brokerage that has operations across Europe and Asia, has launched a new securities lending dashboard that will allow investors to access stock loan and short selling data.

Stock lending analytics

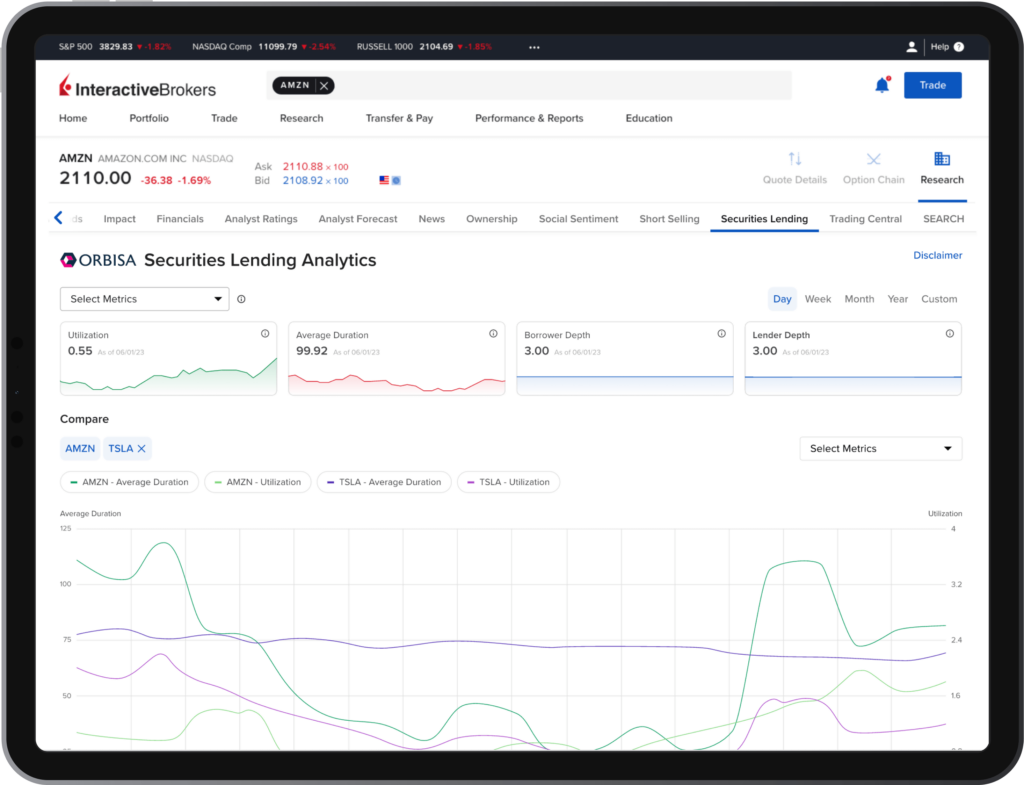

The securities lending dashboard provides sophisticated individual investors and institutional clients with an overview of the securities lending market.

Clients will be able to view real-time data points such as the number of shares out on loan in a given stock, the amount available for stock borrowing and the utilisation of that capacity.

As well as other indicators that will allow them to assess borrowing demand in a security.

This can give an indication in to how much a stock is being shorted, by those who think the share price will go down.

What is securities lending?

Securities lending or stock loans are an essential part of the securities providing additional and supporting short sales without which stock markets wouldn’t function as efficiently.

Institutional investors who are often long-term investors in stocks and shares will often lend out those stocks to shorter-term traders for a fee, as a way to earn an additional income.

Stock loan and borrow is the mechanism that allows traders to sell short through derivative contracts such as CFD trading.

In order to settle the short sale trade, in the underlying security, a broker will borrow stock in the stock loan market and deliver that borrowed stock for settlement.

When the CFD short position is closed, the borrowed stock is repurchased and returned to the lender.

Traders can use securities lending data to assess the viability of trade, perhaps to identify short-selling opportunities, or to highlight stocks which may be vulnerable to a short squeeze.

Under which stock prices can move rapidly higher.

Orbisa partnership

Interactive Brokers have developed the securities lending dashboard in conjunction with industry specialists Orbisa who are experts in the collation, analysis and interpretation of stock lending data and indicators.

The dashboard will offer two tiers of data some of which is complimentary, and some of which can only be accessed through a premium subscription.

The new dashboard can be accessed via Interactive Brokers mobile client portal and the trader workstation or TWS platform.

Milan Galik, Chief Executive Officer of Interactive Brokers said of the launch:

“Interactive Brokers continues to be at the forefront of transparency in the securities lending market”

He added that:

“The new Securities Lending Dashboard is a straightforward tool for advanced traders and hedge fund clients seeking to analyze potential short-selling investment opportunities. Our clients can now access a more comprehensive data set to evaluate their short trade ideas and use our Securities Loan Borrow system to identify shortable securities.”

As we have noted recently brokers are finally listening to what their clients want in the way of tools and services.

And they are adding increased utility to their platforms and making their offerings stickier, by providing these value-added and data-driven products, as they increasingly come to recognise the value and importance of client retention and building longer-term relationships.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.