AJ Bell Customer Reviews

Tell us what you think of this provider.

User friendly experience

Decent service and few headaches

The best thing about AJ Bell is that generally their platform just works and they don’t make any mistakes that cause me difficulties. For a fairly low-cost, execution-only service this is what I need from my investment provider.

Very reliable platform

I keep my SIPP here & am impressed with the service, their comms & sensible prices.

I have been a customer for +/- 10 years

Easy to navigate and deal, reasonable prices

I’ve had a SIPP with AJ Bell for several years and have been very pleased with the service. The site is easy to navigate, stocks simple to trade and the costs are reasonable.

Simple and easy to use

Very happy with the service. Clean layout and relatively low commission costs.

The best I’ve used

I’ve used a few different options and started with the free trading apps. However, I’ve found AJ Bell to be great since making the switch.

My choice and no regrets

Very pleased with their service. Good help line with any issues. Lots of guidance and I trust them.

Good

Good all round communication, services,website

Decent Value but Lacking Stability & Accountability

AJ Bell offers decent value for money compared to some competitors, but my experience has been mixed. Over the years, I’ve encountered several issues with platform stability, which can be particularly frustrating during crucial trading periods. Additionally, I’ve often felt like just another number rather than a valued customer when raising concerns. While I’ll continue using the service for now, the increasingly competitive platform market makes it worth exploring alternatives. The website and app are functional and reasonably user-friendly, but overall, there’s room for improvement.

AJ Bell Expert Review

AJ Bell Review: A low cost full service investing platform

Provider: AJ Bell

Verdict: AJ Bell is an award-winning, low-cost online investing platform for UK DIY investors. Founded in 1995, AJ Bell has grown to become one of the UK’s leading investment platforms. Today, it has more than 440,000 customers and assets under administration (AUA) of over £150 billion.

Is AJ Bell good for investing?

AJ Bell is an excellent full-service stock broker that offers a wide range of services for investors, including share dealing, fund investing, cash-saving services, and mobile dealing. It also offers a range of accounts including Stocks and Shares ISAs, Lifetime ISAs, Self-Invested Personal Pensions (SIPPs), dealing accounts, and investment accounts for children.

Pros

- Wide range of investments

- Low account costs

- Discounts for frequent investors

Cons

- High charge when you deal over the phone

- High FX charges below £10k

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.8Capital at risk

AJ Bell Facts & Figures

| ⬜ Public Company | ✔️ |

| 👉 Number Active Clients | 350,000 |

| 💰 Minimum Deposit | £1 |

| 💸 Client Funds | £65 billion |

| 📅 Founded | 1995 |

| Account Types | |

| ➡️ General Investment Account | ✔️ |

| ➡️ SIPP | ✔️ |

| ➡️ Stocks & Shares ISA | ✔️ |

| ➡️ Junior ISA | ✔️ |

| ➡️ Lifetime ISA | ✔️ |

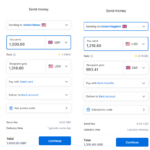

| Dealing Costs | |

| ➡️ UK Shares | £9.95 |

| ➡️ US Stocks | £9.95 |

| ➡️ ETFs | £9.95 |

| ➡️ Bonds | £9.95 |

| ➡️ Funds | £1.50 |

Capital at risk

AJ Bell News

AJ Bell’s Lifetime ISA (LISA) Boosts Your Investments By 25%

AJ Bell’s lifetime ISA is an excellent way to save for your first home (or your retirement). When you invest in a lifetime ISA with AJ Bell you are investing in the stock market where you can potentially make more money than in a cash-interest lifetime ISA. However, it’s important to remember that when investing,

AJ Bell Cash Savings Hub rates reduced to 4.55%

In this guide review AJ Bell’s Cash Savings Hub and compare it to rival offerings by Hargreaves Lansdown, Raisin and Flagstone. Robin AmosRobin has more than six years of experience as a financial journalist, most of which were spent at Citywire, and covers the latest developments in the investing, trading and currency transfer space. Outside

Is AJ Bell good for ETF investing?

Yes, AJ Bell is an excellent choice for investing in ETFs as they have some of the lowest fees of all the traditional investment platforms like Hargreaves Lansdown and Interactive Investor. Expert opinion: AJ Bell reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the

Is AJ Bell good for index funds?

Yes, AJ Bell has an excellent index fund offering where you can invest in funds that track the performance of specific indices, stock markets and sectors. In AJ Bell’s index fund screener, they have over 300 passive index funds, which you can rank by Morningstar rating, ongoing fund charge and YTD returns. Compared to Vanguard

Does AJ Bell Offer Ethical Investing?

AJ Bell offers a range of options for the ethical investor. Through the AJ Bell platform, investors can access ethical funds such as the Liontrust UK Ethical fund as well as ethical ETFs such as the iShares MSCI World SRI ETF. AJ Bell has also created its own ethical fund, the AJ Bell Responsible Growth

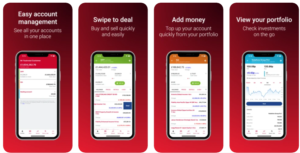

AJ Bell’s Investing Apps are Best for Low-Cost App Fund Portfolios

AJ Bell does have an investing app, which is a good way of checking on your investments when out and about. But, I have to say, it’s a bit clunky compared to full-service brokers like Interactive Brokers or even new apps like CMC Invest. It’s not as good as the main website, as you dontt

How much does it cost to invest internationally with AJ Bell?

AJ Bell’s dealing service lets you buy international shares online quickly and easily in a SIPP, stocks and shares ISA, lifetime ISA or Dealing account, but it is quite expensive. The platform offers dealing in 24 international markets including the US, Canada, Japan, France, Germany, Italy, and Spain. Not all shares in these markets are

Can you invest in OEICs with AJ Bell?

Yes, there are around 30 OEIC (open-ended investment company) funds available to invest in via the fund screener on AJ Bell’s investment platform. Expert opinion: AJ Bell reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With

Is AJ Bell Stocks & Shares ISA any good?

AJ Bell’s investment ISA is one of the cheapest around, especially for large accounts. A stocks and shares ISA is a tax-efficient investment account in which you can invest up to £20,000 per year. When you invest in a socks and shares ISA, you pay no tax on any capital gains or income from your

Is AJ Bell’s SIPP any good?

AJ Bell ’s SIPP is a flexible retirement product that allows you to choose where you invest your pension savings. With this product, you’re in control of how and where your money is invested, and make the decisions that determine how your pension pot performs. You can track your investments online and make changes to

Is AJ Bell share dealing safe?

Yes, we rate AJ Bell as a very safe share-dealing platform. AJ Bell are regulated by the FCA and customer funds (cash) are protected by the FSCS up to £80k. Shares you hold in AJ Bell nominee accounts are held in CREST safe custody accounts and will be transferred to another broker if they were

AJ Bell Junior ISA (JISA) Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

AJ Bell Fund Investing Review

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

AJ Bell Investment Trust Investing

Expert opinion: AJ Bell reviewed & rated Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker

AJ Bell wins Best Stocks & Shares ISA at the Good Money Guide Awards 2024

AJ Bell won Best Stocks and Shares ISA for their broad range of UK and international shares, funds, bonds, and investment trusts, all offered on a low-cost platform. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career

AJ Bell wins Best Investing Account at the Good Money Guide Awards 2024

AJ Bell won Best Investment Account this year because of the broad range of UK and international shares, funds, investment trusts, and the variety of accounts they offer, including SIPPs, ISAs, and General Investment Accounts Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison

Who is AJ Bell?

“The invisible thing called a good name is made up of the breath of numbers that speak well of you.” These worthy words of Lord Edward Wood, Earl of Halifax, apply very well to stockbroker AJ Bell; a company which passed half a million customers this year, as well as the man who gave the

Ready-made pension plans allow AJ Bell to challenge digital wealth fintechs

AJ Bell’s move to launch four new Ready-made pension portfolios earlier this year is a challenge to the digital wealth management sector. The investment platform’s move to provide three risk-rated growth funds with annual management charges of just 0.45% puts it in a competitive position against the likes of J.P. Morgan-owned Nutmeg, Moneyfarm, and Aviva-owned

Is AJ Bell expensive for investing?

Not really, compared to other brokers like Hargreaves Lansdown and Interactive Investor is is cheap. But not as cheap as Interactive Brokers, AJ Bell is committed to transparent and fair charges that offer investors excellent value and are among the lowest in the market. On the AJ Bell website, there’s a handy feature that enables

AJ Bell cuts its dealing charges

AJ Bell has reduced the commission it charges for share dealing and as one of the country’s largest D2C investment platforms so when it changes its fee schedule, the market usually takes note. With that in mind, AJ Bell will be reducing share dealing charges in three key areas: Dealing charges in shares ETFs, investment

AJ Bell share price falling as FCA warns on client cash interest

The AJ Bell share price has taken a battering today as the FCA announced plans to curb the way investment platforms can profit from client cash interest. This is in contrast to yesterday when AJ Bell (LON: AJB) shares were up by +14.20% over the last month. The direct-to-consumer or D2C investment market is growing,

AJ Bell increases ESG offering with a sustainable fund of ETFs

ESG and sustainability investing have become ever more popular throughout 2020 no doubt helped by the outperformance of stocks and funds which have high ESG scores. Investment platform AJ Bell has not been deaf to the clamour and has announced the launched a sustainable fund of ETFs, the Responsible Growth fund. What is the AJ

AJ Bell FAQs:

AJ Bell is a stockbroker and investment platform that lets you invest in UK and international shares, funds and bonds. They were established in 1995, currently have around 350,000 customers and look after over £65 billion of client assets.

Yes, in our awards survey and analysis of investment accounts AJ Bell is consistently at the top of the customer service rankings. They also provide access to a wide range of investments with low account costs.

Yes, AJ Bell has put together a series of low-cost, easy to use and diverse selectio of investment funds to invest in. AJ Bell funds cover growth markets, responsible investing in sustainable companies and funds that generate income rather than focusing on capital growth. You can also invest based on risk from cautious to adventurous and global growth.

Yes. AJ Bell is regulated by the FCA (Financial Conduct Authority) in the UK and your funds are protected by the FSCS guarantee.

AJ Bell differs from Vanguard in that AJ Bell is a full-service stock broker where you can invest in shares, bonds and funds. Whereas Vanguard in the UK only sells it’s own funds. You cannot invest in individual shares with Vanguard. You can also buy Vanguard shares on the AJ Bell platform.

If you want to buy individual shares you need a stock broker.

Yes, AJ Bell is one of the few investment platforms to offer Lifetime ISAs. To transfer a LISA to AJ Bell, you need to open an account and instruct the transfer.

AJ Bell is a public company listed on the London Stock Exchange with the ticker (LON:AJB), which means anyone can own part of it.

Yes, it is safe to invest with AJ Bell because they are FCA regulated, funds are protected by the FSCS, they are a public company and well established.

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com