If you are new to UK Real Estate Investment Trusts (REITs), throughout this guide, we will go through the basics of REITs and how they can serve your investment needs. By the end of this guide, you will be confident enough to buy your first REIT.

What is a REIT?

A Real Estate Investment Trust (REIT) is a corporate vehicle that owns and manages rental properties on behalf of shareholders.

This type of investment trust was popularised in the UK about a decade ago due to changes in legislation. Many listed property firms have sought – and converted – into REIT-status. Firms such as Land Securities (LAND), British Land (BLND) and SEGRO (formerly Slough Estates, SGRO) – all of which belong to the growing REITs club. According to the government, there are around 130 REITs as of 2024.

To become a REIT is fairly straightforward. Simply, the firm’s rental income must be its major source of profits, and the bulk of this income must be distributed to shareholders (see government’s guidance here). This untaxed cash flow to investors will be treated as property income. It used to be a condition for a REIT that a listing in a recognised exchange, such as the London Stock Exchange, is required. No longer. This rule was relaxed in a recent amendment.

- Related data: List of UK REITs on the LSE

How to invest in REITs

To invest in REITs you need a stock broker like Hargreaves Lansdown, Interactive Investor or AJ Bell. You can use our comparison of what we think are the best accounts for investing in REITs to compare how much it costs to buy and sell REITs, the costs of holding a REIT as an investment and in what type of account you can hold the RIET. As well as also buying REITs in general investment accounts you can also hold them in a wide range of tax efficient investment accounts like stocks and shares ISAs and SIPPs.

- Related Guide: Compare the best investment platforms in the UK here

Compare the best UK accounts for buying and investing in REITs:

| Share Dealing Platform | Share Dealing Fee | Account Fee | Min Deposit | GMG Rating | More Info |

|---|---|---|---|---|---|

| £5.95 | Shares: £0 Funds: 0.45% | £1 | Visit Platform Capital at risk |

|

| £3-£8 | £24 per quarter | £250 | Visit Platform Capital at risk |

|

| 0.10% (min. GBP 8) | €10 per month or 0.12% | £1 | Visit Platform Capital at risk |

|

| £1 (or 0.05%) | £0 | £1 | Visit Platform Capital at risk |

|

| £3.99 – £5.99 | From £4.99 a month | £1 | Visit Platform Capital at risk |

|

| £4.95 – £9.95 | 0.25% (capped at £3.50 pm) | £500 | Visit Platform Capital at risk |

|

| £4.95 | 0.2% to 0.4% | £1 | Visit Platform Capital at risk |

|

| £0 | 0.15% | £1 | Visit Platform Capital at risk |

You can even leverage up with financial spread betting and CFD trading. The harder bit, however, is knowing when to do so.

How does a REIT work?

A UK Real Estate Investment Trust (REIT) is just like any other listed company traded on the London Stock Exchange (LSEG). Any investor can:

- Buy and sell a REIT throughout a trading session;

- Prices of a REIT fluctuate just like any other listed securities depending on supply and demand

The biggest difference between a REIT and other property companies is what they do with the rental income.

Broadly speaking, according to the UK government’s REIT rules (originally under Finance Act 2006), a REIT vehicle must have most of its assets in property and the majority of its rental income must be distributed to shareholders. Specifically, a REIT must

- distribute 90% of property rental business must be paid to shareholders each year

- have most of its assets used for generating property rental business

This removes the problem of ‘double taxation’ (tax at a corporate and then on a personal level). Now, REIT investors who received income from them are only taxed once.

Recently, there were some minor amendments to the REITs rules (Finance Bill 2023-24) but these changes have limited impact on general retail investors.

Why Invest in REITs?

The structure of a Real Estate Investment Trust is tax efficient.

- First, REITs offer investors access to a wide portfolio of properties at a corporate level. A REIT save investors the hassle of direct property ownership.

- Second, rental income within the REIT are tax-exempt.

- Third, you can buy and sell major REITs throughout a trading session, like any other stock. Investing £1,000 or £1 million in a REIT will earn a proportional amount of income. Unsurprisingly, many pensions and large investors are dependent on REITs for their yield.

Some REITs have a wide portfolio of commercial and residential properties, assembled by an experienced team and managed professionally on the behalf of shareholders.

Due to the nature of UK commercial leases. REITs offer the prospect of a stable income for owners.

Lastly, the ability to trade major REITs throughout a normal trading session like any other stock should not be overlooked. Liquidity is fairly good on a large FTSE REIT. Unlike some property funds, REIT investors are seldom ‘gated’. In 2022, for example, two fund managers gated nearly £8 billion of property funds. Redemptions are suddenly halted in some property funds to prevent a fire sale.

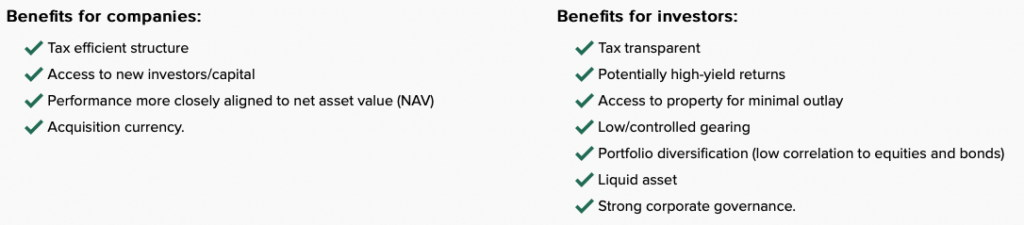

In summary:

Source: London Stock Exchange

Types of Real Estate Investment Trusts

In the UK, most REITs belong to the ‘equity’ type. An equity-REIT may own, among others, offices, shopping complexes, apartments, student accommodation et cetera, to produce the required income for shareholders. The other major type is a mortgage-REIT (see their difference here), which derived its income from mortgage-related activities.

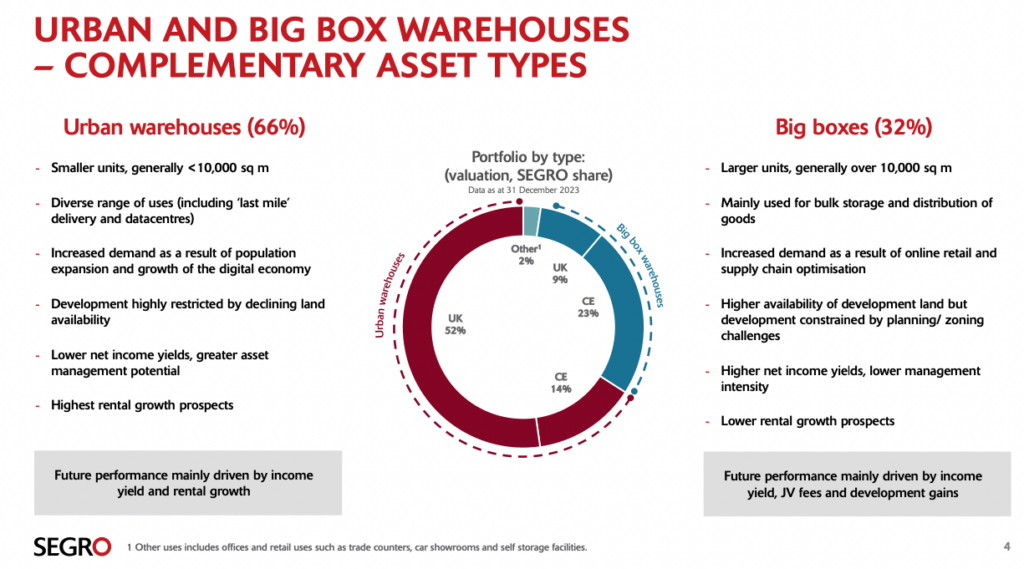

A REIT may specialise in certain property sectors. For example, Segro (SGRO) concentrates on industrial properties and warehousing – a sector on the rise due to the popularity of online delivery. Its £20 billion worth of prime property propels it to the largest UK REIT and allows the firm to increase dividends over time.

Unite Group (UTG) is another specialist REIT (conversion in 2017). Its core competency is student accommodation and the firm has achieved excellent progress in the sector. Its 2023 earnings topped £180 million and fetches a market capitalisation of more than £4 billion.

Source: SEGRO plc (2023)

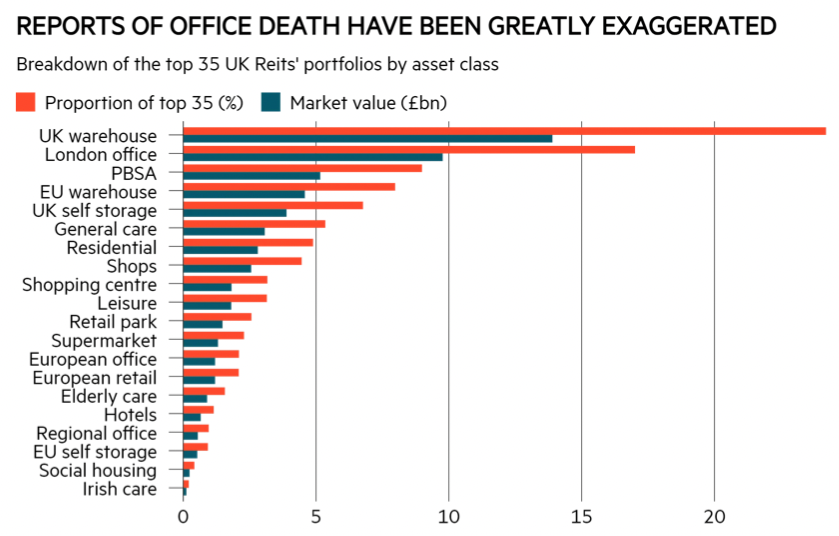

A recent analysis from the investment magazine Investors’ Chronicle below shows a few types of property subsectors where major REITs are investing their resources (see below). UK warehouse is the number one sector, followed by London office. There are a few points to remember about these property sectors:

- Property sector performance vary over time. Some sector may grow faster than others due to a boom in demand (for example, student numbers)

- This will impact REITs’ financial performance and its assets valuation

- All these factors will, in turn, affect a REIT’s share price

Source: Investors’ Chronicle (2024)

How to Profit from REITs?

Investors can benefit from REITs in two ways. The first is through share price appreciation. Remember, REITs trade like stocks and their prices can go up (or down) significantly.

For example, you bought British Land for 350p in 2020. A year later, prices rose to 500p. You pocketed a capital gain of about 42 percent (excluding dividends).

Secondly, you can benefit from a rise in rental income. This means higher income distribution via dividends/income.

In practical, however, be aware that REITs is not a one-way street for investors. Companies that pay the rent can – and do – go bust. For example, since 2018 some retail REITs had been slammed by a ‘perfect retail storm’ – covid, then a boom in web shopping. This led to a persistent drop in rental income from their property portfolios. As a result, dividends are slashed which hammer share prices.

What to Look For in UK REITs?

Before you invest in any REITs, you need to know a few things specific about them. Not all REITs are equal. Some have more attractive properties and better financial stability.

- What are their properties? The ability to generate rental income is dependent on the quality of property assets, tenant mix, and the sector demand.

- What is the geographical tilt of the REIT?

- Is the REIT trading at a premium or discount to their property value (called Net Asset Value)?

- Is the REIT profitable?

- What is the REIT’s current dividend yield?

Some REITs are only operating in a niche sector or area. Shaftesbury (SHC), for instance, is a REIT focussed mainly in London West End (see below). Some concentrate on Healthcare; others on industrial.

How to choose which UK REITs to buy?

Once you have done some basic research about REITs, you should then stick with these principles:

- Be selective

- Ride with long-term uptrends

- Include stops in all your dealings.

Since you can’t buy every single REIT for your portfolio, you have to choose. And you choose according to some favourable yardsticks. For example, invest in the property sector/area that you know best (see above questions). Then, choose REITs with prices that are performing the best, ie, 52-week highs. If, for example, you buy a REIT that is falling consistently to new 52-week lows, it tells you firmly that the market is bearish on the security. Avoid.

Once you have narrowed down a list of REITs, look at their long-term trends. Buy the ones that are doing well, or have seen a change in their long-term trends. For example, I use the 200-day moving average as a simple yardstick to tell me their long-term trends. If a REIT’s trend is bullish, prices should trade above this trend line. In investing, timing is an important factor. Be consistent with these filters.

Point three is equally important: Property is cyclical. Property prices go up a lot and then correct. The fortune of REITs is thus cyclical, too. Boom and bust is a recurring feature of the property market.

Using stops to protect yourself is thus immensely helpful. Investing without stop losses is like driving without seat belts.

Look at the long-term chart of Land Securities (LAND). Prices of this REIT has not made new highs since 2015. Technical stops to reduce exposure here should have been triggered at 1,200p, or 1,000p or 900p. After selling out, capital would have been better deployed elsewhere.

Sometimes, even REITs struggled to survive. A case in point is Hammerson (HMSO), which nearly folded in 2020 when its shrinking cash flow couldn’t service the mountain of debt. Only a fire sale of its European assets and a deeply discounted rights issue (read: 95 percent) pulled the company back from the brink. Investing always carries risks.

As a general rule of thumb, REITs must only be part of one’s diversified portfolio. Buying is recommended after a cyclical downturn when many property funds are trading at a substantial discount to their net asset values.

One REIT ETF to watch

If you are not an expert in any of the REIT and still want to gain exposure to the sector, perhaps buying a diversified ETF is a better choice.

In the UK, the largest ETF that invest in REITs is the iShares UK REIT (IUKP). Its benchmark index is the FTSE NAREIT UK Index and the fund has a decent £660 million assets under management (see factsheet here). The portfolio contains 40 REITs, diversified enough for any investor. The ETF’s top three holdings are: Segro (21 percent weighting), LandSec (8.7 percent) and LondonMetric (6.9 percent).

Technically, the ETF is trying to find a floor above 400p right now. The instrument had tested this support a few times and managed to stay north of it. Should UK’s macro conditions improve, a rally from the current level is a distinct possibility. But it is a bit premature to say if this will happen anytime soon.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.