In this guide, we look at how to predict a stock market crash and what you can do about it, including the key warning signs of when the market may crash. What quantitative, fundamental and technical market barometers to use to spot them. How to position you portfolio for a correction and proactive and speculative opportunities around a crash.

We are horns deep into a bull market cycle in US equities, the indices on which have recently reached new all-time highs, many other asset classes like (Bitcoin) have also enjoyed solid gains during 2023 and 2024. But, a bull market is often likened to a giant party, this party may last for some time. However, markets are cyclical in nature and it’s said that the best time to leave a party is just before the end.

So how can the retail trader look for signs that the stock market could crash?

Don’t try to pick the top

Trading guides will often caution against traders trying to pick tops and bottoms in the markets and that’s good advice. However, rather than looking for specific levels to trade against we can and should look for signs and signals that the market is turning.

Now let’s be clear about one thing which is the fact that spotting the signs that the market is about to make a rapid change of direction, which is what crashes normally amount to, is no easy feat, particularly if you are caught up in the middle of the bull run, which after all, market structure is designed to perpetuate.

In the worst cases that can lead to bubble psychology under which investors of all shapes and sizes get swept along in classic crowd or herd behaviour. They stop listening to contrary views and only seek out like-minded opinions. They take increasingly riskier positions, believing that they can make money out of these riskier positions, just as they did in safer trades and investments earlier in the bull run.

During a bubble, the crowd adopts tunnel vision and never even sees the warning signs that signal the cliff edge ahead.

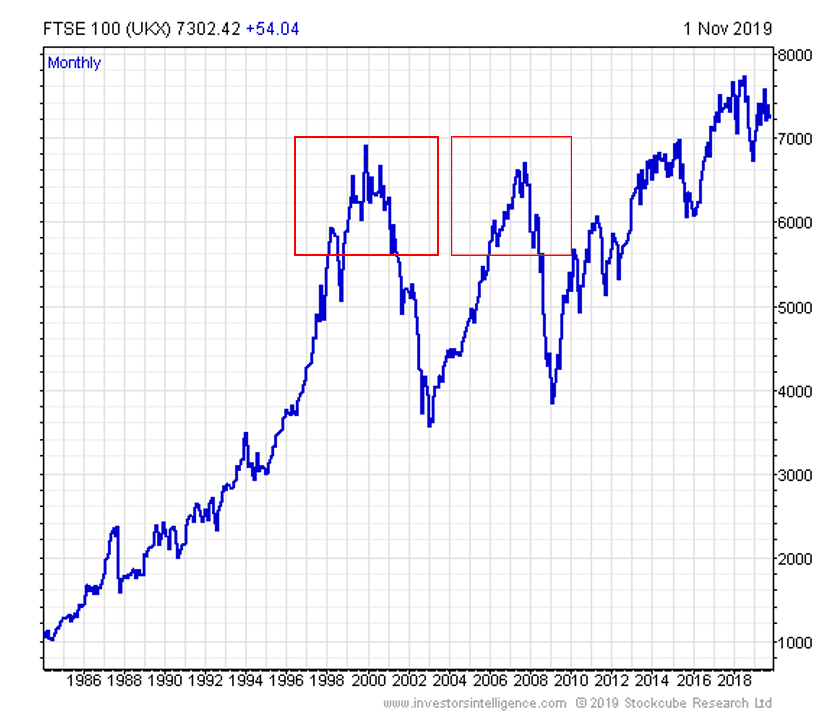

In the past we have clearly seen two such cliff edges highlighted in the FTSE 100 chart above (source Investors Intelligence) these are the two great market corrections of the past 20 years both happened quickly and in the midst of a bull market, the simple line chart above provides few signals if any that these events were about to unfold.

The first step in trying to predict a market crash is to detach yourself or take a step back from what’s going on around you because without some clear reasoned thinking you are likely to remain part of the crowd.

How to tell when the stock market is running out of steam

We can and should look at several types of indicators and metrics for clues about the underlying health of the market and the trends within it, and in truth, it’s good practice to look at a wide range of these metrics in order to form your opinion.

Technical indicators

Firstly, we can consider some technical indicators, trends are made of up of a stream of repetitive price action. In the case of an uptrend that is the posting of an ongoing series of higher highs and higher lows in the price of an instrument.

As long as we keep posting those higher highs and higher lows then the uptrend remains in place, but if we see this momentum start to falter, perhaps with the price failing to make a fresh high and then subsequently posting lower highs and lower lows, that can be a clue that the balance of power in the market is shifting.

NB I would suggest that weekly or even monthly charts would be appropriate for this purpose given the longevity of the current bull run and that candle charts are likely to be the most informative.

We can also look at other technical indicators such as RSI or Relative Strength which attempts to quantify the performance/momentum in an instrument relative to its historical performance.

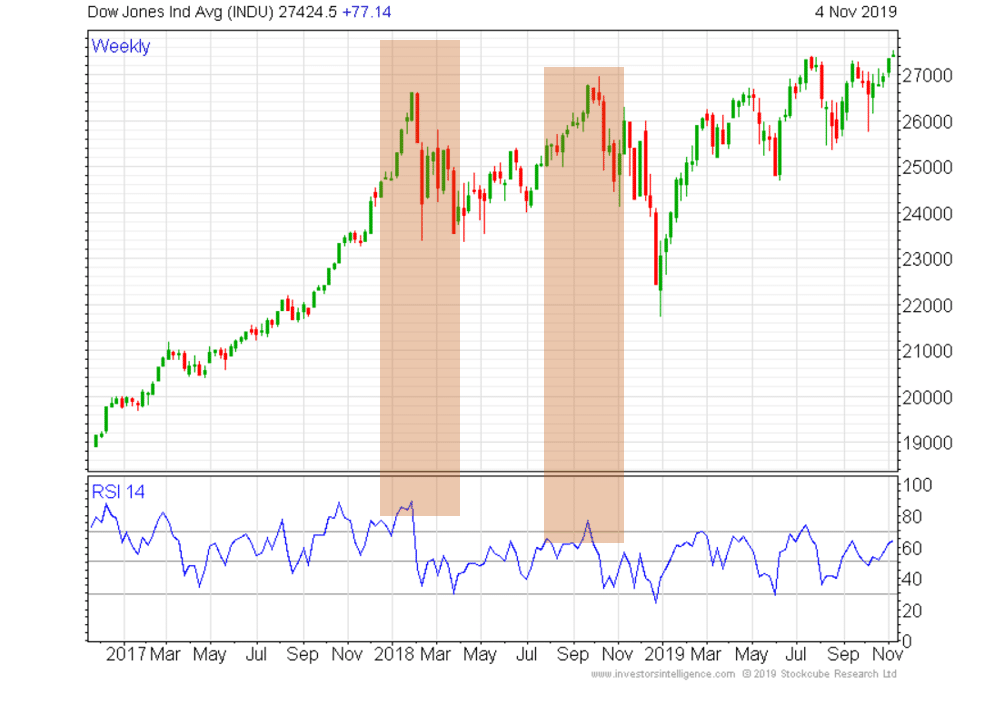

In the chart above (source Investors Intelligence) we have highlighted two points where the Dow 30 index sold off hard when its RSI extended above 80. Bear in mind that the overbought reading for the RSI indicator is classically set at 70. So, by that definition, the Dow was very overbought on those occasions. Note though that RSI readings can and do extend beyond 80 without a correction in price.

That said we are not looking for absolutes here, instead, we are looking for clues, that when combined tell us a story

Qualitative indicators

One metric that can be very informative is volume traded particularly when it’s compared to historical averages.

If we find that daily volumes are consistently falling below a benchmark, for example, their rolling 30-day average and that these volume declines are happening in an index which is rising then that’s a sign of waning interest or declining momentum within that index.

Studies of volume can be combined with other studies such as leadership or breadth.

Here we are talking about the comparative performance of all the constituents of an index or sector.

In a healthy market, most stocks in the index will be making gains, however, if we see that an increasingly narrow group of stocks or sectors is driving an index higher, then that’s another warning sign

We can think of these kinds of studies as being able to highlight divergence, so for example, if daily volumes are falling and leadership or breadth is contracting and yet the index in question is still rising that is divergent behaviour. The question then becomes is the index rise justified?

Fundamental indicators

One way to monitor that is through the use and study of the fundamentals in the market. Perhaps the most obvious metric to look at is the PE or Price-Earnings ratio which measures the multiple of earnings that investors and traders are prepared to pay to own an individual share, sector or equity index.

The higher the PE multiple the more expectation there is priced into the market and the bigger the potential margin for disappointment

For example, if we look at the S&P 500 index as of the close on October 25th 2019 the index was trading on a 12-month forward-looking PE of 17 times earnings. That compares to the previous five-year average of 16.6 times earnings and the ten average of just 14.9 times earnings, according to FactSet data.

The PE ratio alone may not tell the whole story, however, as it can be distorted or influenced by large share buyback programs. For example, earnings at a company may stay the same but if the number of shares it has outstanding is reduced through buybacks and cancellation, then the PE ratio, which is the share price divided by the earnings per share, can be reduced.

In these circumstances, we should look at metrics such as sales growth, profit margins etc. in order to try and judge if traders and investors are overpaying to own the index constituents. I.E. are they increasingly paying more to own less?

In summary, then there are few if any definitive signals that a market is going to crash but what we can look for are signs of excess and or market stress that indicate it may be.

Of course, we need to try and do this ahead of time because we don’t want to be heading for the exit at the same time as everybody else

How to protect your portfolio from a stock market crash

Though spotting the exact turning point in a market is very difficult protecting ourselves against a sharp downturn or market crash is somewhat easier and we can build some protection into our trading or investing strategy at the outset. Firstly, through diversification, that means having a variety of uncorrelated positions or investments at any one time.

If we are trading on leverage we should always make sure that we never have the majority of our capital in the market, because in a crash situation the equity/free cash value of our account can quickly be diminished and if we don’t have a cash buffer we can be quickly stopped out of our positions.

In recent times we have seen a number of so-called flash crashes, short sharp shocks which have caught traders out. So, we need to trade with the possibility of these kinds of events in mind, that’s sensible risk management.

Proactive measures

We can also look to be proactive and protect our positions and capital using CFDs and other derivatives which allow traders to hedge their exposure to the downside.

If we have a portfolio of leading UK stocks worth say £100,000, we can protect ourselves by selling a similar-sized position in FTSE 100 CFDs or spread bets.

Being able to trade on the short side and hedge positions is one of the often-overlooked benefits of CFD trading and spread betting

The thinking here is that if the market does crash then the short CFD or spread bet position will become profitable and help to offset any losses incurred in our equity portfolio. The object here is not so much to make money but rather to minimise our losses.

Of course, by going short of the index through a CFD or spread bet we open ourselves up to risk on the upside as well, and if the market moves against we will need to have sufficient free margin to maintain that position, for as long as want it to be in place.

Options hedging

Options provide option buyers with the right but not the obligation to buy or sell a given amount of an instrument at a fixed price (the strike price) over a given period.

Options on indices are typically cash-settled and options trades on any instrument effected as CFDs or spread bets will by nature be cash-settled.

Options come in two main flavours the right to buy known as the call option and the right to sell known as the put option.

To protect ourselves on the downside or to potentially profit from downside moves traders and investors could look to buy put options.

Option pricing and valuation involves some quite complex maths however, an options’ value is largely determined by two factors

Firstly, the length of duration or the lifetime of the option before it expires, this is known as time value. An option with three months to expiry will be worth more than the equivalent option with only a month to expiry.

The other factor is its position relative to the price of the underlying instrument it is over, which is known as its intrinsic value.

So, for example, if an option allows you to sell an instrument at £1.10 when the underlying price is £1.00 that option has 10p of intrinsic value and it is said to be 10p in the money.

The benefit of hedging through buying put options, the right to sell an instrument at the option strike price, is that we pay a known and fixed amount, the option premium, at the outset of the trade. That sum is our total liability.

If our option comes into or moves deeper into the money, in the case of a put option that happens when the price of the underlying instrument moves below the option strike price. Then our option will rise in value.

Risk lies in the timing because options have a finite life.

That is, they expire and something like 75% of all options will expire worthless with no time value and no intrinsic value within them. In that case, we will have “wasted” our premium.

The way to think about options in this situation, however, may be to consider them as an insurance policy that is you pay the premium hoping you will never need to claim but are happy to do so because you are protecting yourself from worst-case scenarios.

Options are sophisticated derivatives which are not considered suitable for all investors/traders You should ensure you have a good understanding of how they work before you start trading them, as ever if you are in any doubt you should seek appropriate advice.

What to do?!

In summary then as traders and investors, we should keep our eyes peeled regularly checking a wide range of market barometers

You should have a well-structured and diversified portfolio or spread of largely uncorrelated trading positions which are sensibly sized and money-managed.

Above all, you should not become complacent, after many years on the upside that is easier said than done. But one thing is for certain all bull markets eventually come to an end we just need to be prepared for that event, even if we can’t be sure of the timing.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.