The proliferation of social media websites has upended human interaction forever. These ‘digital coffee houses’ allow banter of all sorts to grow and thrive. The impact on the investment world can not be overstated.

Who could, for example, forget the reddit-fuelled Gamestop saga? In a matter of days, GameStop’s share price surged a few hundred percent amidst talks of a short squeeze. Many first-time buyers, lured by the promise of easy money, bought Gamestop as their first share. Never mind that GameStop’s share collapsed soon after. Many professional investors learned to respect the power of social media. When chatters about a stock abound, traders quickly sit up and pay attention.

In a recent study by Plus500 (PLUS), the CFD trading platform, they found that by comparing the number hashtags in TikTok and Instagram and the subsequent stock price movements, some direct correlation can be observed. The most hashtags are generated, the higher the returns.

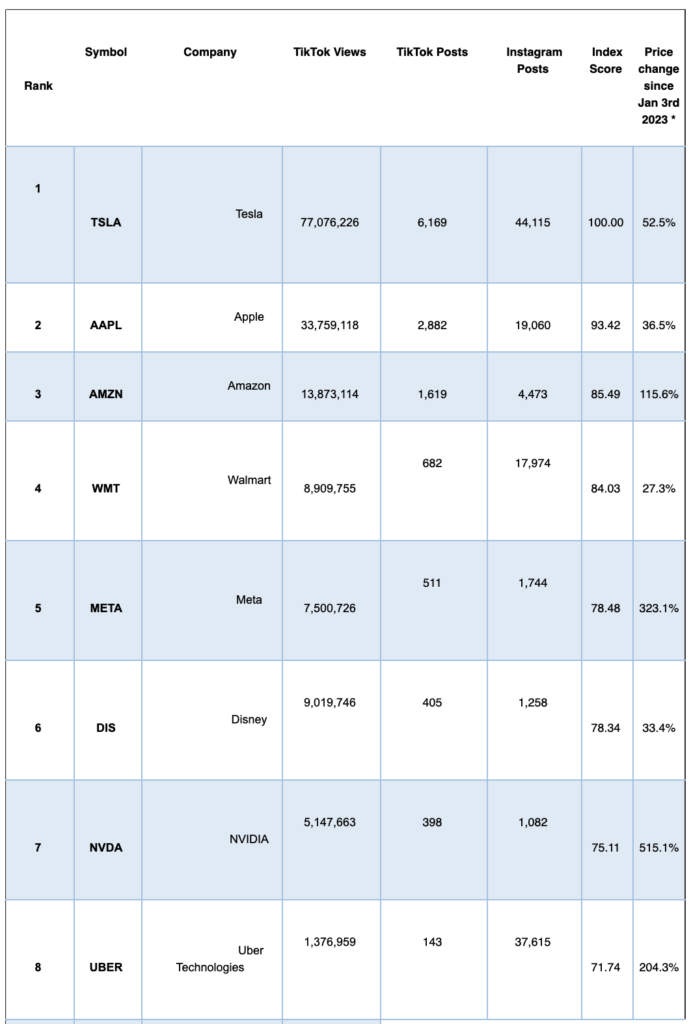

Tesla (TSLA) is the tech stock that has garnered the most TikTok views and posts, while Apple (AAPL) is the second most talked-about company among these two social media sites. The table below summarises the findings for the top eight stocks that have the most TikTok views and TikTok posts, together with their 1-year share price returns. Based on these interesting figures, it seems that the more a stock is featured on TikTok, the higher its share price returns.

This type of association makes intuitive sense, since investor sentiment impacts greatly the day-to-day stock price movements. As more traders know about this company, the more likely they to buy into its story. A stock which nobody knows about would hardly rally due to a lack of ‘interest’.

Source: Plus500 Social Media Analysis

Disentangling the two factors: TikTok Views and Stock Returns

So, the relationship discussed above appears to be this: More social discussions = higher stock returns. But is this relationship actually true?

There is one key causal relationship that these observation data failed to make. Is it possible that the relationship is the other way round? That is, the higher the returns, the more excited shareholders become? We all know that traders tend to ‘brag’ about the winners more frequently on social media. This, in turn, create more TikTok posts and views.

Tesla, for example, has long been a wonder stock that defies bearish investors. The car company was always one of the most shorted stocks in the market. But due to its long bull run, the pain it heaped on these short-sellers was immense. Backers of Tesla, on the other hand, scored huge wins against the naysayers. Numerous ‘Teslanaires‘ – or milllionaires of Tesla stock – emerged. As shareholders attain mega riches, it attracts more envy and hence more social media posts. Elon Musk’s fans, wrote New York Post back in 2020, “believe the wacky billionaire can do no wrong.” When Elon Musk – or Tesla – is under attack, these die-hard fans will go overdrive to defend the company on social media. The company is new, revolutionising the car market, and creating riches beyond imagination. What’s not to like about it?

Look at the table above, it is no coincidence that Tesla’s TikTok posts is 10x that of Walmart’s. People talked about the charismatic Elon Musk much more than, say, the CEO of Walmart (as an aside, can you name him or her?).

But the ‘more TikTok posts-higher returns’ relationship is not linear. Take UBER. While its TikTok posts is only 2.3 percent of Tesla’s, its same-period stock returns is four times higher (204% vs 52%). The number of TikTok posts does not actually move in a straight line against the subsequent stock prices.

The other fascinating point worth noting is this: Could social media like TikTok over-hype a stock?

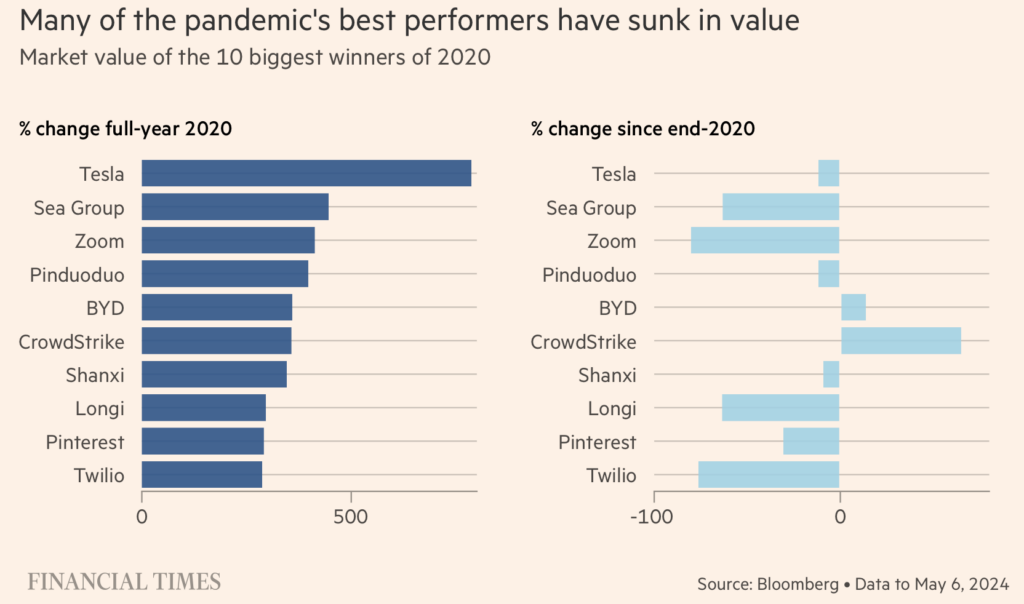

During the pandemic, for example, stock trading was intense. Stock tips overflowed on social media platforms, including Twitter, StockTwits, YouTube, TikTok et cetera. As stock prices went ballistic, over-animated traders asked around ‘which stock to buy next?’

Remember Zoom (ZM), the must-have stock during the 2020 pandemic? Well, once the fad passed, Zoom’s share prices plummeted. Right now, it is trading at a fraction of its peak value (-89 percent).

According to a recent Financial Times article, about $1.5 trillion have evaporated from these pandemic winners over 2021-2024. And this included Tesla, too.

Social media sites do increase ‘excitement’ on a stock, which may translate into positive stock returns. But this excitement is no guarantee to last over the long term. Eventually, fundamentals matter.

Source: Financial Times (paywall)

How to capture social media’s alpha?

In light of the above discussion, how can retail investors capture alpha (excess returns) from these widely communicated social media websites?

This is not easy. First, any mechanism to do so would be proprietary. The ‘secret sauce’, so to speak, would be carefully guarded if profitable.

Capturing social media posts over many platforms, dissecting its meaning, and linking it to stock prices would not be an easy undertaking. If it is simple, then every fund would be doing the same thing. If every fund is taking on the same trades, then excess returns would be hard to generate. RavenPack (ravenpack.com/technology) is one such technology outfit that helps investors to dissect the documents and verbiage.

Second, the crowd moves on over time and migrate from platform to platform. Hence, the need to follow the crowd is important. Remember, that the crowd could also dissipate (ie, post pandemic). Does waning interest on social media suggest a deeper correction to come? Or has the plunging stock price dampen investor sentiment? These questions have no right or wrong answer since the impact differs from stock to stock.

The third question is how to harvest and trade social media posts consistently over time? As seen above, even though a stock boom is over, it can still excite the crowd. “Hodl!” chant the stock bulls. Very often, they haven’t recognised the severity of the correction until it is too late.

Lastly, generative artificial intelligence (gen-AI) may obfuscate and muddle the social media sector. Fake accounts, untrue posts, and purpose-driven words can wreck havoc with data-capture systems.

There is one ETF that attempts to trade on social media data, the VanEck Social Sentiment ETF, aptly tickered BUZZ. According to its the fund info (website, factsheet), the fund’s goal is “to track the performance of the 75 large cap U.S. stocks which exhibit the highest degree of positive investor sentiment and bullish perception based on content aggregated from online sources including social media, news articles, blog posts and other alternative datasets.”

Chartwise, the ETF is doing alright, not hugely spectacular like SMCI or NVDA (see below). This tells that the social media-based trading systems have high barriers.

In summary, trading on social media data is neither straightforward nor simple. When everyone is loaded on the same stocks as they say on TikTok, perhaps it is time to look the other way.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.