Today’s Walmart share price (NYSE:WMT) is $69.78 (as of 26/07/2024 16:00) which is a change of 0.24 or 0.34% from the last closing price of 69.78 with 16,789,306 shares traded giving NYSE:WMT a market capitalisation of $561,278,420,721. The most recent daily high has been 70.24 and daily low 68.83. The NYSE:WMT share price 52 week high has been 71.33 and the 52 week low 49.85. Based on the most recent NYSE:WMT share price opening of 69.78, the current NYSE:WMT EPS (earnings per share) are 2.34 and the PE (price earnings ratio) is 29.84.

Pricing data automatically updates every 15 minutes

How to buy shares in Walmart (NYSE:WMT) from the UK

If you want to speculate on Walmart shares in the short term you can use our table to compare the best brokers for trading Walmart shares. All brokers in this list are authorised and regulated by the FCA. CFDs & spread betting carry a high level of risk and losses can exceed your deposits.

Or, if you are a longer-term investor from the UK, you need an FCA-regulated stock broker that provides access to US stocks. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling US stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

To buy shares in Walmart (NYSE:WMT), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Walmart from the UK:

- Decide if you want to buy Walmart shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

Buying one NYSE:WMT share costs $69.78. However, as well as the $69.78 cost of buying the shares you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Walmart Share Price Chart

Walmart (NYSE:WMT) Share Price Analysis 12/11/22

Whenever you have doubts about investing in supermarket stocks, take a quick look at Walmart’s long-term share chart. It will instil in you some confidence about the advantages of long-term investing even in a boring sector.

In 1969, Sam Walton started the retail revolution from a single store in Arkansas, US. From there, he squeezed other rural merchants with his Walmart system (economies of scale, ruthless management and cutting-edge technology) before overwhelming the big boys. Now, Walmart has more than 10,000 stores in operation and has yearly revenue of $580 billion. Its market value is a staggering $387 billion – making the Walton family one of the richest in the world (worth more than $240 billion).

And Walmart’s secret? “Pile ’em high, sell ’em cheap”. Lured by cheap prices, customers flocked there over the decades. Many other retail discounters copy Walmart.

Critics of investing in Walmart will point out that its days of high growth are over. They look at WMT’s chart and point out that most of its share price appreciation had already occurred during seventies and eighties. Moreover, Walmart hardly ‘excites’ any investor anymore due to its gargantuan size. Growth will not be easy to come by. The risk is to the downside. To some extent, all these points are valid.

But its huge size also means that Walmart has a stable operation in the foreseeable future and is far likely to survive future economic crisis than, say, a loss-making tech company. It pays dividends (1.5%) too, and is not terribly expensive (price-earnings ratio 28).

Remember, during the Global Financial Crisis in 2008 when the whole market tanked by 40-60%, Walmart merely dropped 10-20%. Its relative strength appears durable and is highly valued during a bear market. This character was revealed again this year. Walmart shot up to new multi-year highs in April while many stocks sank. It is a ‘safe haven’ stock.

Therefore, Walmart has a place in any portfolio.

Survivor

The best time to buy Walmart shares is when they’re down, during a bear market.

Walmart is a survivor of past economic crises. But it can’t defy the market all the time. Its share price will move along with the general market sentiment.

Currently, it is clear that the US stock market is under great stress due to a tightening of monetary policy arising from the ‘non-transitory‘ inflation. This is impacting the entire retail sector greatly.

Having peaked at $160 earlier this year, perhaps one may wait for some price weakness before buying the stock. Historically Walmart did not exhibit deep drawdowns. So I would not expect too much decline from current prices.

Margins

After a shocking set of results earlier this year, the market is now awaiting another update on its operation this week. If Walmart’s margin continues to deteriorate, another sharp drop in its share price is to be expected.

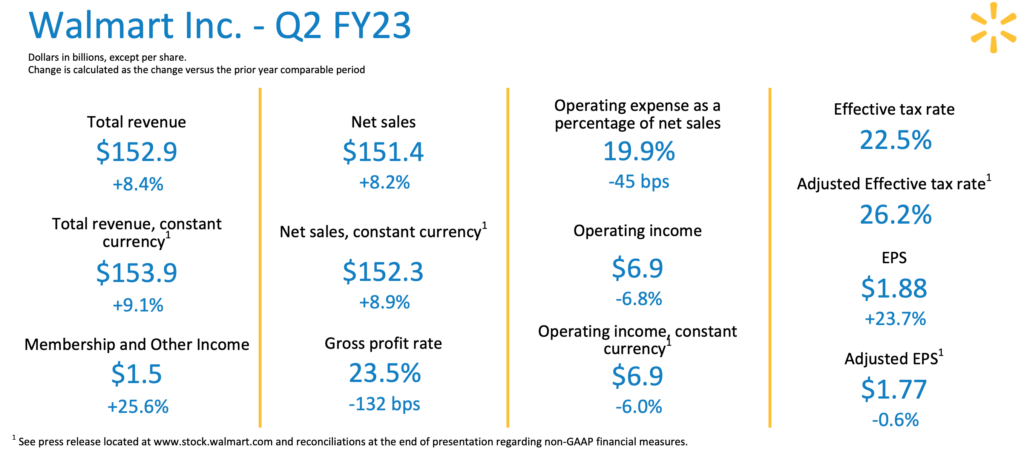

However, I suspect some of the bad news is already priced in. In the second quarter, Walmart’s revenue rose 8% but its margin dropped by 132bps. Total operating income slipped by 6.8 percent to $6.9 billion.

Source: Walmart

At the current price-earning ratio of 28, WMT is valued in between Target (19) and Costco Wholesale (38). In other words, Walmart is neither very expensive nor cheap. Rightly valued in today’s market sentiment.

Income Generation

Despite Walmart’s relative income stability, its share price was knocked back over the summer. The update in May, for example, stunned the market. Prices plunged by more than 12% in two days. Three reasons behind WMT’s 2022 decline are:

- Faltering consumer sentiment – arising from a higher cost of living

- Higher input costs – such as raw materials and transport costs, which are eating into Walmart’s margin.

- Uncertain outlook – that led to a wobbly market and persistent selling

Walmart is such a massive retailer that it can’t escape the general problems facing the nation. Still, the stock has been clawing back some of the losses in autumn and currently trades above $140.

Predictions & Forecasts

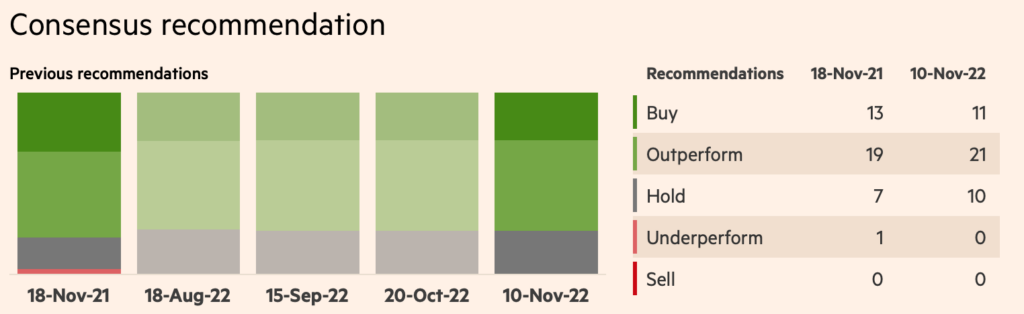

Wall Street is pretty guarded about Walmart’s near-term outlook. Yes there are now more analysts putting ‘Outperforming’ recommendations on Walmart (+2) than a year ago; equally there are also more ‘Hold’ (see below).

Perhaps analysts are now waiting for an update from the company about its sales, margins, and revenue results as visibility about the company has dropped somewhat. The summer past was a very turbulent one that had stung many investors.

Source: Financial Times

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.