- ASOS ‘confident in outlook’ after stronger-than-expected Christmas trading

- ASOS balance sheet held up better than market expectations; shares up 20% swiftly

- Still the most-shorted stock (LON:ASC) on the London Stock Exchange – more upside potential?

When ASOS burst into the retail scene back in 2000, internet-based fashion was still in its infancy. ASOS (AsSeenOnScreen) was founded by Nick Robertson et al to capture this fast-expanding sector. In the years following the 2008 crisis, ASOS became a darling of the stock market. The company was new and the sector was hot. ASOS’ share price soared more than 60x during 2007-2014 and peaked at an astounding £70.

Phenomenal price trends like these, unfortunately, don’t last forever. That 2014 peak was only marginally broken in 2018. Not even the pandemic in 2021 could propel the online retailer’s share price to a higher high.

Are ASOS shares a good investment in the long term?

With the loss of upward momentum, dangers mounted for ASOS. Soaring costs, management reshuffling (former CEO left in 2021) and the deepening macro challenges led to a series of profit warnings during 2021/2. As a result, ASOS share prices collapsed last year.

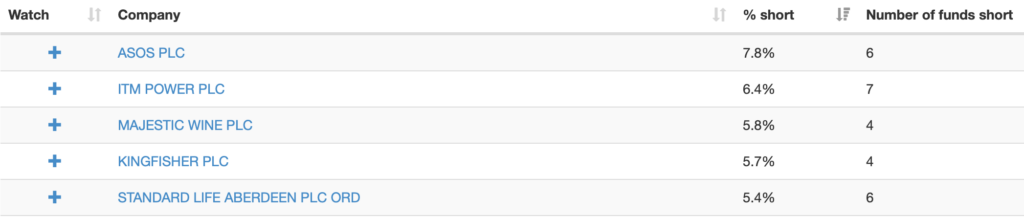

Predatory funds circled the troubled retail stock like sharks in blood-filled water. ASOS is now the most-shorted company in the London Stock Exchange.

- Related guide – What is short selling, and how does it work?

Source: shorttracker.co.uk (Jan 23)

However, is ASOS share price about to turn lower? Not necessarily.

Much of its downside risks have already been priced in. Remember that in 2022, ASOS’s share price had plunged from £24 to £5 (-79%). Unless the firm reports a massive drop in revenue, cash flow or profits, chances of another steep price drop are low.

That’s why ASOS shares rocketed a fifth in January on better-than-expected results.

But what’s next? Is ASOS still a long-term buy? Yes and no. Yes because the company has built a system to profit from the fashion and beauty industry. Some of the macro factors are cyclical and may recede in the future. This may restore the company’s margins. And the outlook for the company is still quite bearish. An improvement in the market sentiment could unwind some of the short bets. Danish fashion group Bestseller still holds a 26% stake in the company.

However, ASOS has changed markedly over the decade. It was much smaller back in 2010 and the online sector less competitive. You can not expect ASOS’ share price to appreciate like it did before. Moreover, there are a lot more ‘stale bulls’ trapped in the stock waiting to exit. Whether prices will ever return to £50 is questionable. And who knows, the cost-of-living crisis may drag on further and be exacerbated by a property crisis.

Therefore, anyone buying the stock now must accept a degree of risk that’s outside the parameters seen during 2010-2020. There may even be a structural change in the market that renders former market leaders obsolete.

According to ASOS’ chart pattern developed over the past few years, the best time to buy the stock is when prices have collapsed 60-70% from its cyclical peak. For example, the stock found support at £20 a few times and then surged from there.

The only problem with this pattern is that it stopped working last year. Prices broke the £20 support and then promptly halved – and halved again to £5. Currently, prices are trading in the vicinity of £7.0.

In other words, the structural forces battering the stock overwhelmed most technical pivot points and support levels. Still, I expect a modest rebound from a major round number like £5. Whether these levels can hold back the tide remains questionable.

Technically, a sustained break above £8 (not a tail pattern) would confirm higher high and a reversal of the downtrend since Jan’22.

Right now, it is hard to say if the company is valued properly. What matters is sentiment. And the sentiment towards the fast fashion industry is awful.

A quick look at ASOS’ results shows that its revenue, margins, and profits are coming under increasing pressure. For example, while ASOS’ gross margins are in the forties its profits figures are nowhere near that level.

On one hand, you may argue the market is valuing the stock about right because investors are expecting the company’s results to trend lower in the months ahead (hence the massive drop in share prices).

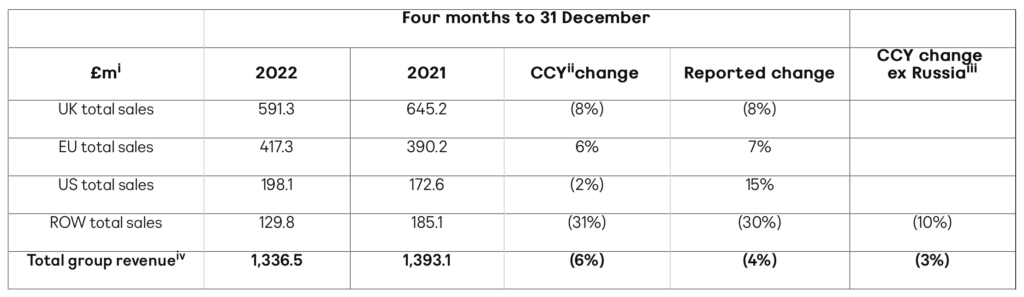

On the other, recent results show some stabilisation in ASOS’s headline sales figure. For example, over the past four months, ASOS’s total revenue only dropped 6% from the previous year (see below). This suggests that the market is overly negative on ASOS and a re-rating of the sector is due.

Source: ASOSplc.com

Before this week, ASOS share price was trading near its multi-year lows because of several reasons:

- Cost-of-living crisis – which decimated consumers’ spending power

- Ballooning costs – due to increased energy, transport and labour costs

- A drop in market sentiment – investors are moving into inflation winners and avoid cyclical sectors like consumer-based industries

However, because the market sentiment on ASOS shares was so depressed any reasonable results can cause prices to rebound. Indeed, ASOS surged following the Christmas updates; share price soared by 20%.

The key now is whether the rebound can be sustained. If macro turbulence emerges again, a drop back to the lows is possible.

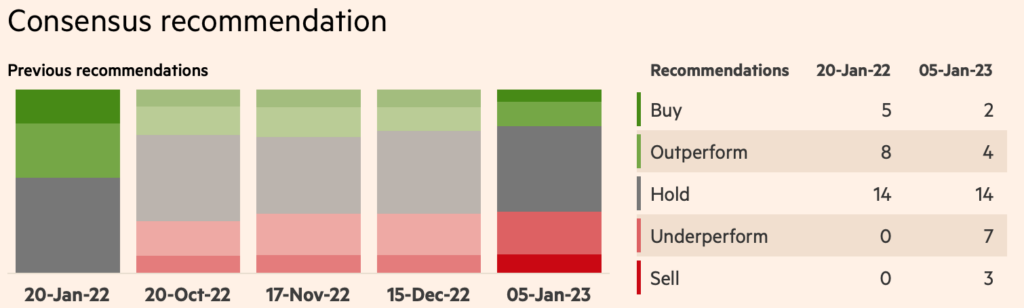

The City is certainly bearish on the fashion stock. Brokers would hardly cheer the most shorted stock in the market.

As you can see from the distribution of the analysts recommendations below, there are plenty of ‘Sell’ and ‘Underperform’ recommendations. Out of 30 recommendations, only 2 say ‘Buy’. That’s how one-sided the rating is.

On price targets, the 12-month median price target is at 660p. So the current share price of 700p is already above this.

This begs the question – will the investment community start changing its bearish stance? Well, if the share keeps climbing, they will have to because their price targets are too low. A less-negative re-rating this year is possible.

Source: Financial Times

How do you buy shares in ASOS (LON:ASC)

To buy shares in ASOS (LON:ASC), you need a trading or share dealing account. Follow these three steps if you want to buy shares in ASOS:

- Decide if you want to buy ASOS shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

What is the live ASOS share price (LON:ASC)?

The current LON:ASC share price is 333.4p which is a change of -9.8 or -2.86% from the last closing price of 333.4 with 437,436 shares traded giving LON:ASC a market capitalisation of £397,860,548. The most recent daily high has been 341.8 and daily low 328.84. The LON:ASC share price 52 week high has been 794 and the 52 week low 320.33. Based on the most recent LON:ASC share price opening of 333.4, the current LON:ASC EPS (earnings per share) are -2.13 and the PE (price earnings ratio) is n/a.

Pricing data automatically updates every 15 minutes

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.