Today’s Volvo share price is kr 269.4 (as of 17:29 14-Jul-2025) which is a change of -3.6 or -1.32% from the last closing price of 269.4 with 1,599,316 shares traded giving STO:VOLV-B a market capitalisation of kr547,987,335,784. The most recent daily high has been 271.1 and daily low 268.9. The STO:VOLV-B share price 52 week high has been 344.4 and the 52 week low 220.8. Based on the most recent STO:VOLV-B share price opening of 269.4, the current STO:VOLV-B EPS (earnings per share) are 22.72 and the PE (price earnings ratio) is 11.86.

How to Buy Volvo Shares

Volvo shares are traded on the Nasdaq Stockholm, Sweden stock exchange, so you’ll need an FCA-regulated stock broker that provides access to Swedish stocks. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling SEK stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

🧑🎓Follow these to buy Volvo shares from the UK.

- Open an account with a share dealing platform that lets you invest in Swedish stocks, like Hargreaves Lansdown

- Decide how much you want to buy and deposit GBP your account

- As Volvo is a Swedish stock and traded in Krone you need to convert your funds to SEK. You can either do this before trading or the share dealing platform will do it automatically for you.

- In your share dealing platform type in Volvo or their stock symbol (VOLV-B) and click “buy”. You can be given the option to buy at the currency price (market order) or set a maximum price at which you want to buy at (limit order).

🤔Note: Good choice for income hunters

Volvo, much like their cars is a moster of a company, and just again like their cars, the share price has always performed well. A few dips, but generally bullish over the last 5, 10 and 20 years. Volvo is also a good dividend play and those who buy Volvo shares can share in their profits through a healthy dividend payment.

⚠️What to watch out for! SEK Exchange Rates

When you buy SEK stocks like Volvo, a hidden cost is often the exchange rate a share dealing platform charges for converting GBP into SEK. You also have to factor in that Volvo is a Swedish company so the Krone exchange rate will have an impact on the price too.

Volvo Share Price Chart

Volvo Share Price Analysis 12/12/2020

Analysis by Jackson Wong PHD

Volvo Cars (VOLCAR-B), based in Gothenburg, Sweden, is one of the largest car manufacturers in the nordic region. Before I delve into Volvo Cars’ prospects, a quick recap about Volvo Cars’ chequered past is in order. Originally a car division within Volvo Group (www.volvogroup.com), Volvo Cars was sold to Ford Motors (US:F) in 1999. But as losses swelled during the Global Financial Crisis, Ford offloaded the company to an emerging Chinese car company Geely (HK:0175). After a few years of ownership, Geely IPO’ed the company in Nasdaq Stockholm in October 2021 (listing document). A total of 380 million shares were sold to the public during the listing.

Is Volvo Car (VOLCAR-B) a good investment in the long term?

Here’s how the stock performed since the IPO. From the offering price of SEK56, the stock surged to near SEK90 shortly after amidst a booming equity market. From that peak, VOLCAR-B collapsed by almost 50 percent to SEK40 this year (see below). At current prices, the company is worth about US$14 billion.

Source: Financial Times

Looking ahead, will Volvo Car survive as a thriving auto stock? A car stock these days is common. I have already covered a few in Good Money Guide, eg NIO & Tesla. The pros of Volvo is that it is a known car brand globally. And Volvo cars are perceived to be durable. So it has a following in the market. Moreover, the company is moving into a new direction of hybrid or full-electric drivetrain in the near future. In September, for example, 12 percent of Volvo cars sold were electric. There is no doubt that progress is being made to advance the volvo car models into the new post-ICE era.

However, it is worth bearing in mind that the automobile market is very competitive. There are many car companies in existence now, and the list of new entrants is growing. Not all will survive in the long run. Before you invest a dollar in any auto stock, please have a look at the wiki list of defunct automobiles companies in the US. The A-Z list is long and scary. It serves to remind you that picking a long-term stock winner, even in a booming industry, is harder than you think.

Source: Wikipedia

But what has that got to do with Volvo, you wonder? More than you think. In the past century, the number of car owners in the US had increased by hundreds of millions – yet so many car companies had fallen by the wayside. In 2009, two out of three biggest US car companies went bust. Even Volvo Cars itself was untenable back in 2010 and had to sold to another buyer.

Is Volvo Car a good bet, then? Perhaps. But remember that it is not Tesla and so it wouldn’t be valued like them. I would temper expectations when buying shares of Volcar-B. If it is doing well, you may even consider buying the stock of its owner Geely in Hong Kong. And if you’re searching for a pure EV play, Polestar (NAS:PSNY) – a EV unit listed by VolvoGroup earlier this year – may be worth a look.

When is the best time to buy VolvoCar shares?

The car industry is a cyclical one. When times are good, consumers will buy newer cars more frequently. Right now, the global economy is moving down a gear as energy prices surged due to the war in Ukraine.

The best time to buy car stocks is during a recession because the outlook is very bearish. Are we there yet? I don’t think so. But after a year or so of uber and increasing bearish sentiment, I wouldn’t discount better times ahead in 2023.

So now is not a bad time to start looking at entry points to buy cyclical stocks.

Is the Volcar-B share price overvalued or undervalued at the moment?

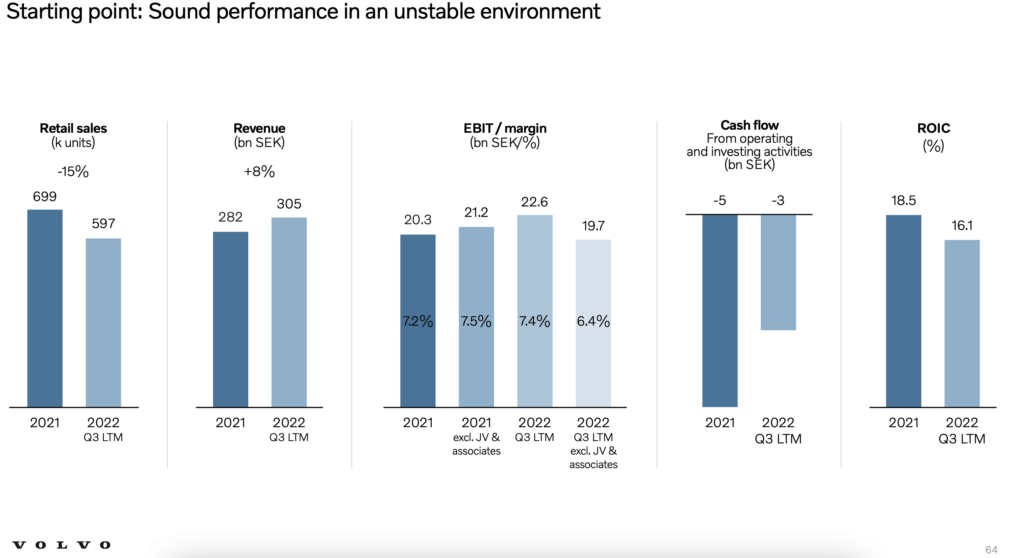

In its latest presentation slides (October), Volvo Car showed that its revenue increased by 8% year to date. But the negative points included: a) the unit of car sold will drop YTD and b) its free cash flow remains negative (see below).

Source: Volvo Car

Perhaps investors are expecting a bigger drop in the next few quarters, hence the sharp drop in Volvo Car share price.

Are Volvo Car shares overvalued? Currently most shares are valued by investor sentiment. And sentiment towards stocks is awful. In that sense, yes, Volvo Car shares are expensive – and you may potentially be able to buy them cheaper in the not-too-distant future.

Why has VolvoCar’s share price dropped recently?

Volvo car shares were steady around at around SEK 75-80 until late August, when prices suddenly took a 40 percent dive. Reasons for this include:

- A significant deterioration in market sentiment – due to a spike in natural gas prices in Europe

- Continuing lockdown in China – which hampered Volvo’s car production

- A drop in near-term revenue – for Volvo due to delivery problems

As such, Volvo shares slumped to near SEK40 in October. Prices have since stabilised and rebounded to SEK50.

What is Volvo’s share price prediction?

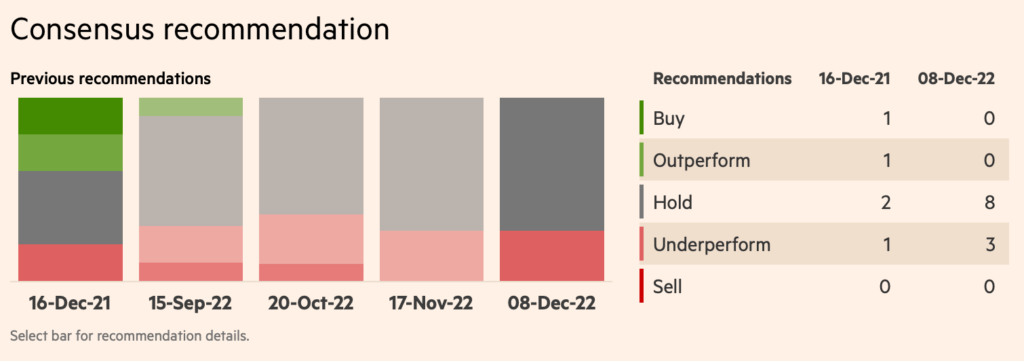

Volvo-car is a stock that has been completely deserted by the brokerage community.

Out of 11 recommendations, all are ‘Hold’ or ‘Underperformed’. This is a very negative opinion. It is like analysts telling fund managers to stay away from the stock. Even Volvo Group AB, its former parent company, is not as bearish as this.

What’s going on? Is the investment community expecting a major cash crunch in the near future? I’m not sure. Looking at VOLCAR’s chart there is some technical support at SEK40. Unless we see a major negative event, the downside may not be as bearish as these recommendations.

Source: Financial Times

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com