- Shell’s oil & gas operations profits soared to a record $40 billon in 2022

- A further $4 billion of share buyback announced in 1Q’23; dividends set to increase as gas division drives profits

- While 2022 was an annus horribilis for many companies, Shell prospered like never before.

This week, the UK-listed oil company reported the highest annual profit ever: a monster $40 billion for shareholders. In other words, Shell is raking in more than $100 million every day. Although Shell’s earnings are a little lower than Exxon’s $56 billion, it is still a phenomenal set of results that was backed eye-watering earnings.

Is buying Shell (LON:SHEL) shares a good long-term investment?

The division driving Shell’s profit machine is gas. That division alone reported $6 billion of profits in the last quarter. Shell’s knows its performance is excellent and boasts its result as ‘robust performance in a turbulent economic environment’. Many would wholeheartedly agree.

Supported by these vast profits, another $4 billion share buyback is in the pipeline, on top of the $18.5 billion buyback in the past year. Dividends are set to increase by another 15%.

Remember, not so long ago (24 months), oil companies were priced for extinction. The pandemic led to sub-zero oil prices; huge losses swelled among oil majors. But war, a return to economic normality and a surge in commodity prices created a far more favourable operating environment for oil companies. To be fair, the oil business and commodities trading is not for the faint-hearted. It is a cyclical industry and when the times are good, profits simply roll in.

Over the long term, Shell’s share price has performed well. While its business did not grow wildly like Tesla (NASDAQ:TSLA), Shell is stable, reliable and most importantly, profitable. Its long-term chart since 1986 attests to this opinion.

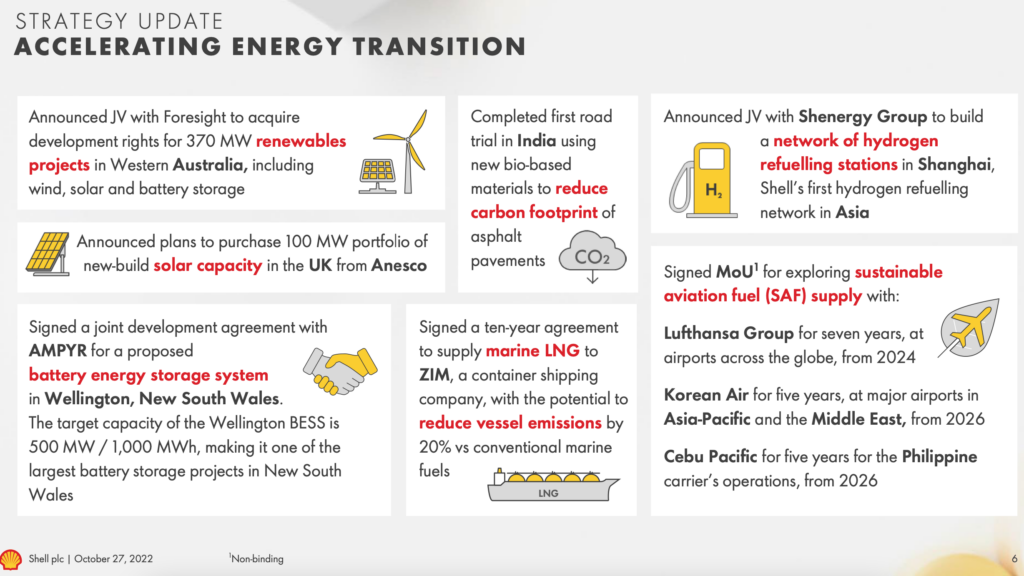

The downside for Shell is that it is facing monumental challenges to its underlying business. The global energy complex is transitioning to a low-carbon system. This threatens Shell’s current operations. To survive this pivotal change, the company is actively diversifying into other new energy businesses, as depicted in Shell’s transition strategy update (see below). In particular, Shell is:

- Investing in renewables like wind and solar

- Staking claims in hydrogen stations

- Exploring sustainable aviation fuel (SAF)

Will this change in strategy work? Perhaps. But the transition will take many years to complete. In the meantime, Shell is generating a pile of growing profits. The company’s outlook is bullish and may stay so for the time being.

Energy is a cyclical business.

Good and bad times rotate like day and night. The primary cause of this is the ebb and flow of the business cycle, leading to economic booms and busts.

Accordingly, the best time to buy energy companies is during the lean years – when the outlook is very bearish and prices cheap.

To give you a recent example. In October 2020, in the dark days before the rollout of the covid vaccine, Shell was trading at sub 900p. Now, prices are north of 2,400p. Investors who bought during the gloom and held would have profited handsomely.

Look at Shell’s weekly chart above, which gives you can an idea how long the cycle last. Peak-to-peak trends are spread around 5-6 years; the average drawdown (prices measured from peak to bottom) is around 45-55 percent.

In sum you should wait for Shell’s share prices to correct (say halve from its cyclical peak) before contemplating buying. After purchasing, however, you have to stick around for some years to reap the benefit of the eventual cyclical upswing.

Shell’s share price has been rising firmly in 2022. But even this had not raised Shell’s price-earnings ratio meaningfully.

According to some calculations, Shell’s PE ratio stands at a reasonable 5. Its dividend yield is at a good 3.81%. Because oil and gas is not a growth business, investors do not place a huge valuation on the company.

However, with profits north of $40 billion, the market may be valuing the company a little cheap. Currently, Shell’s market capitalisation is just 5x its annual net profits.

Relative strength may also play a role. Think about this. If other sectors keep contracting (say, fashion), investors may have no choice but to seek safety in the oil & gas industries, especially when energy prices stay elevated in 2023.

In the nutshell, the company is not hugely expensive and there is scope for a higher valuation.

Since 2020, Shell share prices have rising in a steady trend. There are a few reasons for this:

- Buoyant oil and gas prices – especially after the invasion of Ukraine. Brent Oil, for example, has remained steady above $80, around the level back in February. Natural Gas prices are higher.

- A rotation into commodity-related sectors – mining, oil & gas, and precious metals (like gold)

- Rising profits – which attract conservative investors who like certainty. Even Warren Buffett has taken a large position in a US oil company last year, Occidental Petroleum (OXY:US).

The sentiment towards the sector is currently bullish. Many oil stocks are trading near 52-week highs – a technical fact that will certainly attract more buyers. For Shell, prices are now wearing down the 2,400p range resistance. A break of this ceiling should send prices towards the next resistance at 2,600p.

The City is undoubtedly bullish on Shell’s share price. According to the Financial Times, many analysts are rating Shell as ‘Outperform’ – perhaps attracted by its uncharacteristically large profits. There are no ‘Sell’ or ‘Underperform’ ratings.

This raises a unique problem for Shell: Profits are too large. This is causing concern among investors that a ‘windfall tax’ is being devised to reduce the economic burden on government finances. Should the political wind gathers sufficient pace for this policy, it will happen and reduce Shell’s profits.

On price target, the median target is at 2,973p – a new high. Will Shell reach this level? That depends on oil and gas prices. For now, Shell is on a slow climb towards 2,500p.

How do you buy Shell shares (LON:SHEL)?

To buy shares in Shell (LON:SHEL), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Shell Plc:

- Decide if you want to buy Shell shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

If you want to hold Shell shares in the long term you are best off using an investment platform. But, if you want to speculate on the price of Shell in the short term, you can use a trading platform that offers CFDs, financial spread betting or options trading. Use the below comparison tables to see which is the cheapest broker for your investment objectives.

How much does it cost to buy Shell (LON:SHEL) shares?

Buying one LON:SHEL share costs 2,834.5p. However, as well as the 2,834.5p cost of buying the shares you will also have to pay stamp duty, dealing and custody account fees for holding your shares with a broker. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

What is the live Shell share price (LON:SHEL)

The current LON:SHEL share price is 2,834.5p which is a change of -55 or -1.9% from the last closing price of 2,834.5 with 9,567,765 shares traded giving LON:SHEL a market capitalisation of £227,851,252,951. The most recent daily high has been 2,874 and daily low 2,822. The LON:SHEL share price 52 week high has been 2,952 and the 52 week low 2,214. Based on the most recent LON:SHEL share price opening of 2,834.5, the current LON:SHEL EPS (earnings per share) are 2.29 and the PE (price earnings ratio) is 12.39.

Pricing data last updated 16/04/2024 16:35.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.