American technology companies are often excellent stocks to invest in. Very few equity markets in the world have developed a technology industry as successful as Silicon Valley. Many countries tried to emulate its virtuous ecosystem; but few succeeded.

Four main reasons are usually cited for Nasdaq’s success:

- Leadership – US tech companies are global leaders in their respective sectors and they derive much of their revenue globally.

- Earnings – gargantuan profits flow to these tech companies annually; more importantly, this high profitabilities are sustained over long periods of time.

- Liquidity – undoubtedly the US stock market is the world’s largest. Moving billion-dollar trades among tech stocks is easy. Plenty of venture capital firms scour the market to invest in promising tech enterprises.

- Valuation – the success of tech firms means that many stocks are valued highly. Many tech firms around the world chose Nasdaq to list, from Alibaba (BABA) to ARM (IPO soon).

Ergo, many young and dynamic US tech startups emerge from nowhere to become a ‘unicorn‘ – a term referred to a startup worth more than a billion dollars. Investors are always searching for the ‘next Apple’ or ‘next Microsoft’. This is because returns are tantalisingly large if you just made one right bet. Imagine – just imagine – you had invested in Apple or Amazon back in 2005. You just don’t want to miss the boat.

Splunk Inc (NASD:SPLK) is a tech firm at the right place. Its stock seems to be on the cusp of another bull run. As one of the rising stars in the cybersecurity and data subsector, the firm IPO’ed in Nasdaq back in 2012 at $17. Then, it commanded a market valuation of a mere $1.7 billion. Now, SPLK’s shares trade north of $100; its market cap is a good $19 billion.

So impressive were Splunk’s second quarter results this year (released on 23 August 2023) that traders stampeded to buy its shares. Prices surged that week by a stunning 18.9%.

Even more spectacular was the rally above the $110 level – a ceiling that has prevented a bull run in SPLK for over a year. The sudden rally, on high volume, may be the catalyst for an extended bull run. Technicians often called a forceful rally like this as a ‘breakout’.

Is Splunk a good investment?

Based on the market’s bullish reaction to its results, the answer appears to be yes. When the market suddenly turns positive on a company, it means that the stock was under-owned previously. SPLK shares were loitering under $100 before the 2Q result, suggesting a mildly negative sentiment towards the security. SPLK’s explosive rise tells us the security is ripe for a bullish re-rate.

Data management and cybersecurity is a growing industry

When deciding whether to invest in a stock for the long run, always research the sector in which it is operating. Recall Warren Buffett’s quote:

When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

Fortunately, Splunk’s industry – data management and cybersecurity – is a growing one. Total addressable market for both subsectors is estimated at about $100 billion. And fundamentally, the firm (www.splunk.com) is in a fairly good position.

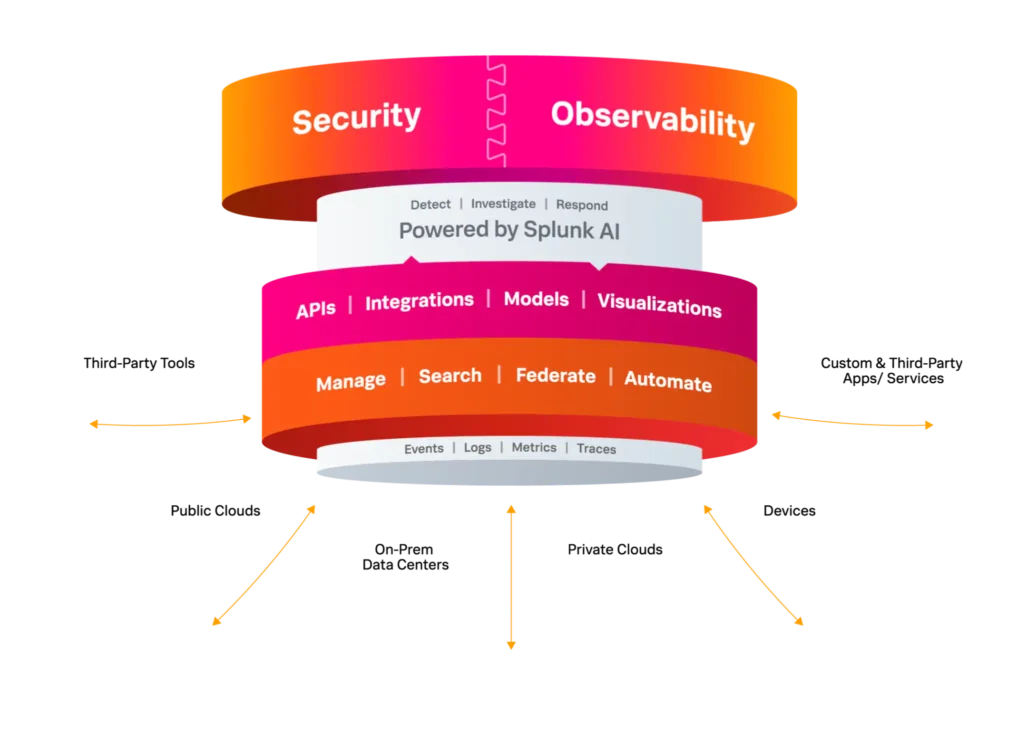

Its products are subscribed by hundreds of Fortune 500 companies. Data analytics (now called ‘observability’) and web security are two of Splunk’s strong points. Splunk’s customers base are global, underscoring the popularity and strength of its products. Even Tesco (UK:TSCO), UK largest grocer, used Splunk (case study here) to improve its product visibility and tracking productivity.

Splunk Cloud Platform is another highly-valued niche offered by the company. As more and more data are migrating online, this creates a secular trend that is likely to sustain for years to come. The potential pool of revenue can sustain the company’s high growth.

Interestingly, Splunk’s products seems adaptable to the newest advances in artificial intelligence (AI).

For example, in Splunk’s most recent quarterly results, the firm touted Splunk AI as “a collection of new AI-powered offerings to enhance its unified security and observability platform“. The data firm seems to be able to keep abreast of the latest tech improvements to improve its suite of products.

All in all, the main bullish theses for buying the California-based company are:

- Growing total revenue – as more customers use its platform to improve their IT system, security and data management

- Growing recurring revenue – especially from its current suite of products like Cloud

- High adaptable – to new advances in the technology, incorporating methods like Blockchain and AI into Splunk’s products

As a result of its high growth, free cash flow is increasing. This strengthens Splunk’s balance sheet.

But a word of caution – an exciting and relatively high-margined industry attracts new competitors. There are many companies offering similar products, companies like Datadog (NAS:DDOG). Any mishaps by Splunk’s management will result in an erosion of its competitive edge. As such, when investing in high-growth stocks like Splunk always keep an eye on its competitors to see how they are faring.

Moreover, compared to those tech behemoths, Splunk is tiny. Its $19 billion in market cap is only worth 1.1 percent of Google’s. It may even be bought out before its full potential can be realised.

Bull or bear?

Despite the improving fundamentals, should we buy Splunk shares now?

To answer this we have to analyse SPLK’s long-term chart (see below). Two observations stand out.

First, Splunk Inc enjoyed a multi-year bull market during 2018-2021. The stock rose from $60 to $220 to bag a 250% gain. Second, Splunk had suffered a massive bear market along with 2022 tech rout. Its share prices slumped by nearly 70%.

However, the latest rebound has definitely stopped its negative momentum. Some may even call this rally a ‘base breakout’ – as the stock has developed a floor at around $70-80.

From a trader’s perspective, the stock certainly carries bullish near-term momentum. There is no notable upside resistance until $150. This means there is room to run, especially as the long SPLK trade is not a very crowded one (yet).

Can it reach new highs? That would be a bit too ambitious. When a stock like Splunk is recovering from a steep drawdown, new price highs take some time. This is because many investors who bought above $150 are now waiting to sell out once the stock to reach their breakeven prices. This creates additional selling price pressure above $150.

Further, the uncertain macro picture may derail Splunk’s positive trend.

In sum, Splunk’s chart is bullish and may be worth a punt. Buy watch to take some chips off the table near previous pivot points.

Splunk is a growth stock. Traditional valuation metrics like profits are often overlooked in these companies.

What the market wants to hear is how many new customers have they acquired. On this account, SPLK is doing fine. Clients are increasing every single quarter for the last 10 quarters.

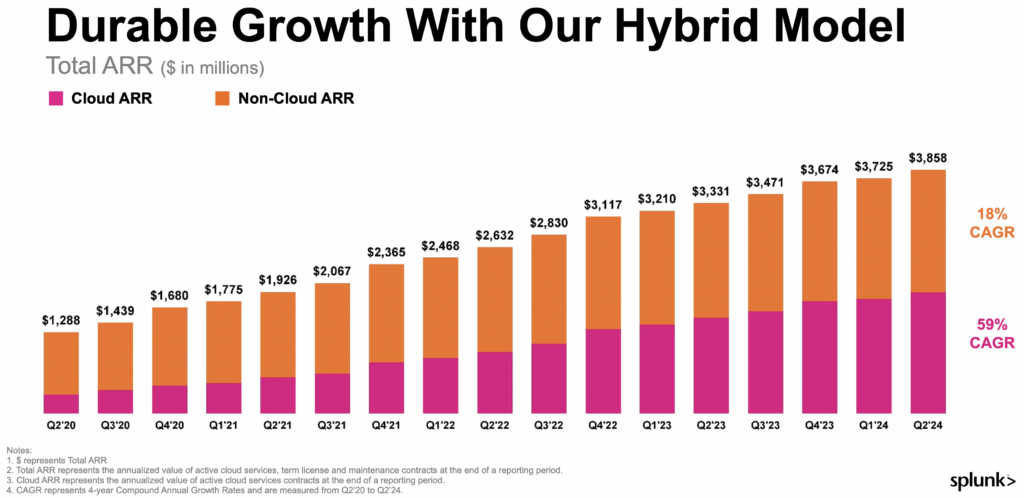

What about revenue? A similar picture. Splunk’s income is growing nonstop from quarter to quarter, thus validating Splunk’s business model. Its cloud business, in particular, is expanding at a CAGR of 59%. Impressive trends here; and investors wholeheartedly agree.

In 2021, for example, major tech investor Silver Lake provided $1 billion to Splunk in funding via convertible notes.

Right now, Splunk’s positive free cash flow (now totalling $800 million) is a far better metric to assess its stock. This is because a company with a positive cash flow is able to navigate tough times better. Two years ago (2021), Splunk was reporting negative cash flow. This swing from negative to positive is certainly a bullish factor.

Now back to the question – is Splunk overvalued? At this point, I think not. The market did not price in Splunk’s recent bullish results. That’s why Splunk’s share price surged as investor play catch up. If, on the other hand, Splunk’s share had slumped on a similar set of numbers, then it tells us that the stock was fully valued.

If Splunk is able to report profits in the near future, this may cause the market to re-value the stock higher since its cash burning days could be near the end. There is a case for a higher valuation as Splunk outperforms expectations.

Source: Splunk.com

Why the recent rise?

Splunk’s shares have rallied sharply in August – a rally assisted by three factors:

- Better-than-expected results – Splunk’s second quarter results were higher than forecast and guidance was excellent. This caused the market to re-rate the stock more positively.

- Steady Nasdaq – Most of the big tech stocks have remained generally steady over the summer and this is helping fundamentally outperforming stocks to rally.

- Technical buying – as Splunk raced to 52-week highs. Many funds buy into year highs.

Taken together, Splunk’s share price is breaking out of a year-long base.

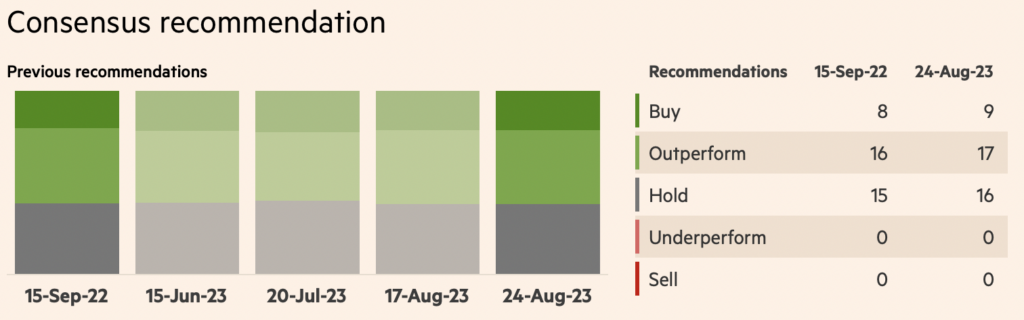

Splunk’s analyst recommendation aggregate is something that you don’t often see among UK stocks.

Out of the 40+ analysts with a recommendation on Splunk, none was putting out ‘underperform’ or ‘sell’. This is such a uniformly bullish take on the company. More impressively, this stance had lasted for a whole year (2022-2023).

This tells you how positive Wall Street is on Splunk. Wall Street’s medium price target on SPLK is just $126 – which, at the current rate of increase, could be reached sooner than expected.

Once this target is reached, I suppose analysts will be raising their price targets again.

Source: Financial Times

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.