Does the recent announcement from Plus 500 that they may offer physical share trading to investors rather than just CFD trading mean they are turning from poacher to gamekeeper?

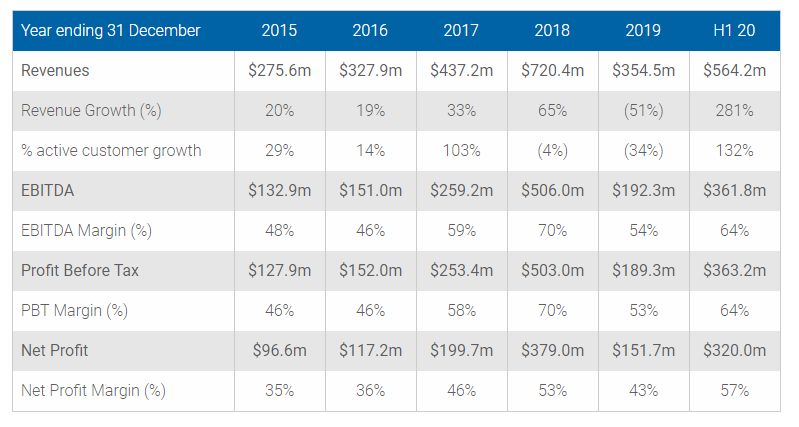

Plus 500 has in recent times been one of the most aggressive brokers when it comes to marketing for new clients. They have recently reported around 200,000 new traders in the first half of the year compared to nearly 50,000 last year. Obviously the market volatility from COVID has had a lot to do with this as traders think that market volatility leads to opportunities to speculate on.

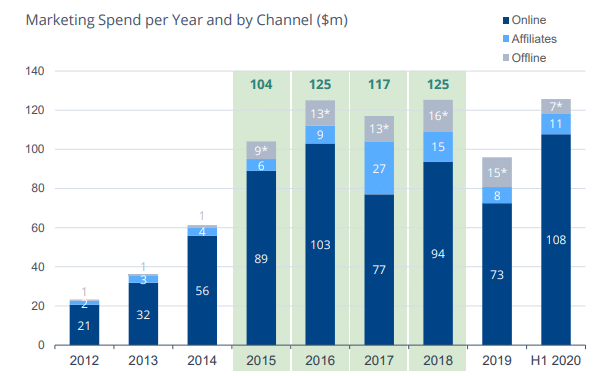

Since 2015 Plus 500 has spent roughly between 22% and 38% of revenue on marketing for new business.

Plus 500 also runs a B-book, which means they profit when their clients lose money by not hedging client trades in the underlying market. Plus 500 also make money from spread around their CFD quotes and on overnight financing. One thing to point out though is that Plus 500 does not offer the tax efficient financial spread betting product, as is often misreported. Presumably because they understand the UK market is saturated as it and there is more growth in the rest of Europe and the emerging markets (only 35,000 of their 200,000 new clients were from the UK).

This means their revenue is up $300million from the same period last year.

CFDs are a high-risk speculative product and not appropriate for the majority of those that trade them. It’s well known that in the UK there are around 150,000 traders who spread betting and CFD brokers would consider good clients. By that, I mean experienced traders that trade regularly in a professional or semi-professional way. From that pool of 150,000 traders, brokers that offer CFDs and spread betting can earn enough revenue from commissions on trades and overnight financing to have a healthy business.

That means these 200,000 new clients that Plus 500 onboarded are simply not valuable enough to generate revenue from the traditional commission model. They probably deposit a few hundred dollars to trade for the first time and discover that building an Instagram lifestyle around Forex trading isn’t actually that simple.

Onboarding is where Plus 500 has revolutionised the CFD industry. They made it incredibly easy to open a CFD trading account. In the past, it would take days with all the due diligence done upfront. Plus 500 salami tactics clients through the process. Allowing them to trade almost instantly, then asking for the required AML documentation in stages before funds could be withdrawn.

And to be fair to Plus 500 they did fill a gap in the market. It’s fairly ridiculous for regulators to tell people what they can and cannot trade. I highlighted the good and bad reasons why the FCA may consider banning crypto trading in the past, but not everyone wants to trade on exchange futures through TT, some just want to speculate on the market.

If Plus 500 are making so much money from CFD trading why would they consider offering physical share trading?

I think the answer lies within the original use of CFD trading.

They may be hedging their bets.

The regulators are almost certainly going to ban all marketing of CFDs at some point.

So the only thing CFD brokers will be able to do with their massive marketing budget is to advertise real investing products and try and cross-sell CFDs.

Trading212, which started off as a CFD broker had an incredibly successful mainstream marketing campaign offering a free share when you sign up for an investment account, but also offers CFD trading.

IG, one of the first financial spread betting firms started offering physical share investing, years ago.

I suspect the regulators have got fed up with all the social media scams around trading and as with margin restrictions and risk warning disclosures, will simply say, “enough is enough, you can offer CFD trading but you can’t advertise it”.

In particular, it’s noticeable that there are now many more affiliates, comparison sites and educational providers referring traders to CFD brokers. The influx has no doubt been from savvy affiliate marketers from the gambling industry that have had to look for pastures new due to tighter regulations and are sending traders to the less regulated offshore providers.

I think the writing is on the wall for the marketing of CFD products to the mainstream.

It’s not a bad thing for the industry, it’s a good thing. It will mean there is a flight to quality for clients to brokers with fewer conflicts of interest.

After all, the hedge fund industry is not allowed to advertise and they do well enough looking after the small pool of clients they are allowed.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.