Plus500 receives generally positive coverage on Good Money Guide, particularly for its simplicity and accessibility for retail traders. Experts highlight Plus500 as a well-regulated, user-friendly CFD platform offering a wide range of markets, strong mobile trading experience and straightforward account opening, making it popular with beginners. Customer reviews on Good Money Guide are more mixed, with many users praising the ease of use and platform design, while some raise concerns about withdrawal processes, account restrictions and customer support responsiveness. Overall, GMG rates Plus500 as a convenient entry-level trading provider, but one where users should be aware of CFD risks and service limitations.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500UK Ltd is authorized and regulated by the Financial Conduct Authority (FRN 509909).

Plus500 Customer Reviews

Tell us what you think of this provider.

shekhan ali @ 02/28/2020 11:20

classic retail broker. possible to make a profit. personally would stay away

Response From Provider

Thank you for sharing your perspective. Different platforms suit different trading styles and expectations, and trading always involves risk. We aim to provide clear information so individuals can decide whether our services are right for them.

Connor @ 02/28/2020 11:14

Had a decent experience with Plus500, using them for a few months recently. Good mobile and web apps. Good support.

John Rose @ 12/02/2019 09:43

The Plus500 company has an excellent reputation on the internet but the way a care agent works is very detestable. It is known as “traderprofesional” and what it does is that after making an initial deposit, it keeps half of the user’s money for no specific reason. I recommend that you be alert with this scammer.

Response From Provider

We’re sorry to hear about this concern. Plus500 does not retain or take client funds arbitrarily — deposits remain under the client’s control, subject only to trading activity and clearly disclosed fees. We encourage anyone with questions to contact Customer Support for clarification.

Anne @ 11/09/2019 02:56

Anybody considering trading with this company read real customer reviews as opposed to reviews done by marketing affiliates. When a customer makes a profit , withdrawal can become a problem. At times on there platform an instrument becomes unavailable to trade this is supposedly due to low volume. These is done to their advantage and many customers have suffered losses because of this glitch. There spreads are also manipulated and usually increase in their favor during the course of a trade. Plus500 no more than a Casino and I would advise anybody considering them to think again before opening an account.

Response From Provider

We understand why experiences shared online can raise concerns. Withdrawals are processed in line with regulatory requirements and security checks, and trading availability or spreads may change due to market conditions and liquidity. We encourage anyone considering trading to review the platform details carefully.

A very fair trader

Great customer service and a very honest and fair trader

Trading Platform 4/5: nice and clear

Customer Service 5/5

Mobile Apps 4/5: doesn’t give many options

Spreads & Pricing 5/5

Market Range 2/5:  limited options in available forex

Trade Execution Speed 5/5

Added Value 5/5

(Trading forex weekly with PLUS 500 for under 1 year on a weekly basis)

Khangwelo @ 03/01/2018 15:43

Its been a great journey with this broker , they have been good to me with all their service , so i’m satisfied with their services and i learnt many thing with this broker

Trading Platform 5/5

Customer Service 5/5

Mobile Apps 4/5 – They don’t offer all indicators

Spreads & Pricing 5/5

Market Range 5/5

Trade Execution Speed 5/5

Added Value 5/5

(Trading forex and commodities with Plus 500 for between 1-2 years on a daily basis)

Plus500 Expert Review

Plus500 Expert Review 2026: A user-friendly platform with access to global markets

Provider: Plus500

Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Is Plus500 a good broker?

Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks.

Opening a Plus500 account is really simple:

- Submit some documents to the company (identification, residence verification, etc.)

- Read through several documents and complete a questionnaire

- To be able to trade, you will need to fund your account (in the UK, the minimum initial deposit is £100).

Pricing: It’s dynamic so moves with the market for minimum spreads.

Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

- Overnight funding fees – This is either added to or subtracted from your account when holding a position after a certain time

- Currency conversion fee – There is a fee (0.7%) for all trades on instruments denominated in a currency different to the currency of your account

- Guaranteed stop-loss order fees – If you request a guaranteed stop loss on a trade, there will be a small fee

- Inactivity fees – If you do not log in to your trading account for three months, a fee of up to USD $10 per month will be applied to your account.

Withdrawals are free of charge no matter how many you make per month.

Deposits are also free of charge.

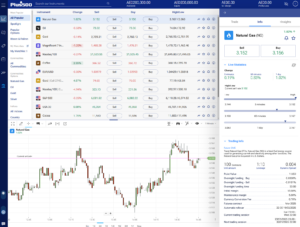

Market Access: Very good, Plus500 are always first to try new asset classes

With Plus500, you can trade CFDs on a range of assets and instruments including:

- Shares (e.g. Lloyds Bank, Tesla, Apple)

- Currencies/forex (e.g. GBP/USD)

- Commodities (e.g. gold, oil)

- Options (exchange-traded options)

- Exchange-traded funds (ETFs)

- Indices (e.g. FTSE 100, S&P 500, ESG indices)

Overall, there are over 2,800 assets you can trade with CFDs.

The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital.

Plus500 margin rates:

- Shares – 1:5

- Forex – 1:30

- Commodities – 1:20

- Indices – 1:20

- Options – 1:5

- ETFs – 1:5

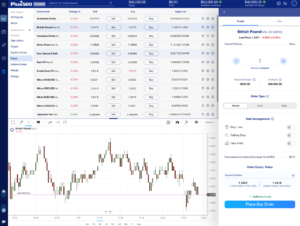

Platform & Apps: Basic execution, but it does the job well

Plus500 trading apps and platform also offers several tools to help traders manage risk including:

- Stop-loss orders – Traders can use these orders to automatically close out a losing position at a specific level

- Guaranteed stop-loss orders – A guaranteed stop-loss puts an absolute limit on your potential loss from a losing trade

- Trailing stop-loss orders – This type of stop loss moves upwards as the price of the security being traded rises

- Take profit orders – Traders can use these orders to automatically close out a winning position at a specific level.

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient

Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered.

It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week.

If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

- A dedicated premium service client manager.

- Periodic emails containing expert analysis of upcoming trading events.

- External trading webinars.

- A premium service customer support team.

The premium service is invitation only. To become a premium customer, you must have a real-money trading account.

However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares).

To be eligible for a professional account, you must meet two of the following three criteria:

- You’ve performed an average of at least 10 transactions per quarter, of significant size, over the previous four quarters on the relevant market (with Plus500 and/or other providers)

- You have a portfolio worth more than €500,000 (including cash savings and financial instruments)

- You have worked in the financial sector for at least a year in a professional position that requires knowledge of the related transactions or services.

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

- Charting tools – Plus500’s platform offers charts with a wide range of indicators and drawing tools to help traders identify and capitalise on patterns and trends (there 13 charting tools and over 100 indicators)

- Market news – On its website, there is a section dedicated to news and market insights

- Alerts – With Plus500, you can set up real-time email, SMS, and push notifications for trade alerts (e.g. price alerts or % change alerts)

- An economic calendar – The economic calendar is designed to help traders prepare for important economic data (e.g. inflation data, retail sales data, job reports, PMI data)

- +Insights – This is a feature that allows Plus500 users learn more about market trends based on the company’s internal data (e.g. most bought stocks, most sold stocks)

- Watchlists – Users can manage multiple watchlists.

- Trading Academy – Plus500’s Trading Academy offers a range of educational products including eBooks, videos, and FAQs

- Webinars – Plus500 offers regular webinars to its professional clients

- A free unlimited demo account – With the demo account, novice traders can learn to trade CFDs without risking real money.

Pros

- With Plus500, you can trade CFDs on a range of assets including shares, currencies, indices, and ETFs.

- There are no commissions when placing a CFD trade on Plus500’s platform.

- Plus500 offers a range of features to help traders navigate the markets and capitalise on opportunities including charting tools, alerts, an economic calendar, and market news.

Cons

- Other platforms offer more markets than Plus500.

- You can only trade CFDs on the platform (you can’t invest in stocks directly).

- You can’t contact the company by telephone if you require support.

-

Pricing

(4.5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.676% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Plus500UK Ltd is authorized and regulated by the Financial Conduct Authority (FRN 509909).

Plus500 News

Another good day for Plus500 shareholders as UK broker Cavendish rate the stock a buy

Another good day for Plus500 shareholders as UK broker Cavendish rate the stock a buy, following upgraded guidance from the business. Which pointed to increasing revenues from its non-OTC activities. Which Plus500 called ” a key growth driver”. And which is said was “supported by positive momentum across global financial markets, as well as with

Plus500 Launches Regulated US Prediction Markets Platform with Kalshi Offering

Plus500 has launched a regulated US retail prediction markets offering, marking a significant expansion of its futures business and a strategic move into one of the fastest-growing areas of event-based trading. The FTSE 250-listed futures trading platform confirmed that US customers on its client platform, Plus500 Futures, can now access prediction markets via contracts provided

Can you trade forex on Plus500 in the US and does it offer day trading reduced leverage?

Yes, Plus500 offers on-exchange currency futures, so when you trade forex with Plus500, you are trading on the CME and ICE. It’s a good platform for new traders to get started as there are mini and micro FX contracts available and you only need $100 to get started. If you are a beginner options trader

Is CFD trading on Plus500 available in UAE?

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Plus500 to Power CME and FanDuel’s New US Prediction Markets with Clearing Partnership

Plus500 has taken a significant step into the fast-growing US prediction markets space after being appointed as the clearing partner for CME Group and FanDuel’s newly launched event-based contracts platform. The deal positions the FTSE 250-listed fintech as the core infrastructure provider behind FanDuel Prediction Markets, the US-facing venue enabling customers to trade contracts based

Plus500 Options Trading UK Expert Review

You should consider whether you can afford to take the high risk of losing your money. You may also be interested in: How To Trade Futures in The UK Financial Spread Betting Fees Explained How much leverage does FOREX.com offer?

Plus500 CFD Trading Expert Review

In this expert review, we test Plus500 with real money and explain if it is a good CFD trading platform in the UK. You should consider whether you can afford to take the high risk of losing your money. Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of

Plus500 added to STOXX 600 index in growth “milestone”

Plus500 has been added to the STOXX 600 index of significant listed European companies, representing what the trading platform called a “milestone” in its growth. In an email to clients, the CFD trading platform said: “This milestone signifies the growing impact and the trust we’ve earned within the financial world.” The STOXX 600 index covers

US Futures trading helps Plus500 onboard 25,000 new customers

Plus500 customer numbers rose nearly 25,000 customers in the three months to the end of September, as its drive to attract customers to its US futures platform bore results. In its latest quarterly trading update, the CFD-focused trading platform announced it had added 24,922 new customers during the reporting period, representing a 21% rise year

Plus500 adds Google Pay functionality

CFD broker Plus500 has enabled Google Pay on its platform, making it simpler for users to undertake transactions. The update allows Plus500 clients to deposit or withdraw funds to the broker without having to use their card details. The option is now available from the app’s deposit screen. “Leave complexity behind and step into simplicity!

eToro Versus Plus500: Which is the better trading platform?

Based on our analysis, eToro is better than Plus500. eToro scores higher overall in all categories. However, there are some aspects of Plus500 that are better than eToro. I’ve been testing each broker for years, for our reviews, and both have come a long way over the past decade. In this guide I’ll tell you

Why can’t the media get it that Plus500 does not offer spread betting

CFD broker Plus500 does not offer spread betting. It only offers CFDs (contracts for difference). So why does the nation’s financial media get it wrong all the time? There are some fairly significant differences between financial spread betting and CFDs. I’m not going to go into them here, but you can watch our video discussion

Can traders on TikTok & Instagram make you money?

The proliferation of social media websites has upended human interaction forever. These ‘digital coffee houses’ allow banter of all sorts to grow and thrive. The impact on the investment world can not be overstated. Who could, for example, forget the reddit-fuelled Gamestop saga? In a matter of days, GameStop’s share price surged a few hundred

Plus500 FAQs

Plus500 is regulated by the UK’s Financial Conduct Authority (FCA) meaning customers’ money must be kept in segregated accounts. So, the platform should be seen as safe. However, CFD trading is risky. With this form of trading, it’s easy to lose money, especially if you use leverage.

Plus500 could be a good platform for beginners as it offers a demo account, and you can start trading in a real account with just £100. However, beginner investors should be aware of the risks of CFD trading. Plus500 states on its website that 80% of retail traders on its platform lose money trading CFDs.

The minimum deposit at Plus500 is £100.

Yes, Plus500 has an app for both iOS and Android. Through the app, you can monitor your positions and place trades. The app only gets a review score of 3.8 on Apple’s App Store, however. Some users have complained that the app crashes at times.

No. In the UK, it’s not possible to trade crypto CFDs due to regulation from the Financial Conduct Authority (FCA).

Plus500 is mainly compensated for its services through the spreads between buy and sell prices on securities.

CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself. With CFDs, you can trade securities in both directions. You can also use leverage to increase your position size.

Leverage can be used to trade a larger amount of money than you have deposited for a trade. Using leverage can potentially increase your trading profits. However, it can also magnify your trading losses.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.