City Index Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

69% of retail investor accounts lose money when trading CFDs with this provider

Expert City Index Review

I opened my first City Index account way back in 2008, when they were one of only a handful of spread betting firms catering to high net worth traders in the City of London. Back then when I was a derivatives broker at MF Global, City Index used to hedge their CFD business through us so I could see they always had a fairly sophisticated client base. But over the years, as traders and investors have become more educated and akin to taking more risk, City Index now takes on more and more private clients.

If you’re thinking about trading with City Index, but haven’t quite made up your mind yet, I’ve tested all their trading platform’s features, visited their offices and interviewed their senior management for my review to hopefully provide enough information for you to decide if they are the right broker for you.

City Index Review

Name: City Index

Description: City Index is one of the oldest spread betting and CFD brokers based in the UK. They were founded in 1983 and offer trading in over 13,500 financial markets, to around 126,000 active clients. City Index is currently owned by StoneX, a US brokerage listed on the NASDAQ valued at $1.75bn.

69% of retail investor accounts lose money when trading CFDs with this provider

Why we like them:

City Index offers some of the best trading tools and analysis to help traders perform better. Their unique post-trade analytics and voice brokerage service make it an excellent choice for large and frequent traders.

Pros

- Excellent trading tools

- Post-trade analytics

- Publically listed (part of StoneX)

Cons

- Trading only, no investment account

- Limited options markets

- No direct market access

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.3Ratings Explained

- Pricing: Always competitive.

- Market Access: Excellent coverage, especially for small-cap stock and exotic currency pairs.

- Platform & Apps: Some excellent added value trading signals and portfolio analytics (even though the desktop version can be a bit fiddly).

- Customer Service: Lots of experienced dealers to help with any issues.

- Research & Analysis: City Index excel here, lots of education, signals and analysis.

I’ve always liked City Index, it’s been a stalwart of the London CFD broker scene since it was founded by Chris Hales and Jonathan Sparke in 1983 as a way for institutions to hedge their exposure through spread betting and CFDs. But soon became popular with more retail traders. Always advertising on billboards in the City, always having a colourful client base, always being bought and sold at the whim of billionaires and bigger boys. But in recent years, it had gone off a bit from its glory days. Back in the good ol’ days, you could open an account and put on a million-dollar trade over the phone with no ID, no deposit, and no idea. Well, you could if you happened to be on a yacht with Michael Spencer (the then City Index owner and City grandee), who was convinced he knew which way the Euro was headed and goaded one of his guests into putting the trade on, as the story goes away.

But those days are long gone and incumbent brokers have to fight hard to differentiate themselves against the fintechs nipping at their heels, as well as provide more trader tools to lure new customers back to traditional markets away from the wild west of Crypto.

City Index seems to have matured nicely though, it’s grown out of its lumbering adolescence under the ownership of Gain Capital and is now owned by US Behemoth StoneX (previously INTL FCStone). Since then, the platform has had a few upgrades and long-term investment products will hopefully be added shortly.

Trading Platform

The City Index platform used to have a slightly off-the-rack feel about it, instead, the business relied on word of mouth and friendly referrals from HNW clients who would use experienced dealers to work large orders over the phone. Whilst voice brokerage still forms part of City Index’s offering, they are, as with everyone else, doing the majority of their business online and working hard to make their platform stand out.

- Further reading: Is City Index a good trading platform?

Pricing & Spreads

City Index has always been competitive with it’s pricing. As City Index is an OTC broker they charge customers by widening the spread rather than adding commission after you trade. They are one of the cheapest around for trading UK stocks with the bid/offer being widened by only 0.08% (20% less than the industry standard of 0.1%) and for US stocks they only charge 1.8 cents per share (industry standard is 2 cents per share). Overnight financing rates are also inline with what you would expect 2.5% over/under SONIA rates.

Stocks, Forex, Indices and Commodities

You can buy over 4,700 stocks on City Index as a CFD or financial spread bet, however, you can’t trade equity options or invest in physical shares.

Obviously, they have access to more than the usual forex, index and commodity markets and add value with some nice thematic-themed indices (like ESG), and a good pool of sectors to speculate on. You can also trade options (CFD or spread bets thereof) on a good range of indices and commodities like Natural Gas or EU stocks. Plus, you can trade on synthetic markets. Everyone loves a bit of volatility speculation in choppy markets.

Further reading:

- Is City Index commodity trading CFDs, Spot, DMA or Futures?

- What indices can you trade with City Index?

- Is City Index or Forex.com better for forex trading?

Spread Betting

Spread betting is City Index’s forte, and it’s the product that a lot of their high-net-worth customers use for trading stocks. As one of the original spread betting brokers City Index offers access to one of the widest selections of UK, US and European shares (as well as the major indices). The key advantage of spread betting of course is that profits are free of capital gains tax.

- Further reading: How does City Index spread betting compare to CMC Markets?

CFD Trading

Unlike spread betting CFD profits are subject to capital gains tax, so are less popular among UK traders. Historically, City Index would offer CFDs to more professional traders and spread betting to smaller clients. CFDs and spread betting are similarly priced with City Index, with the commission being included in the spread, which is slightly wider than the underlying market bid/offer. The main reason why both products are on offer is that spread betting is only available to UK residents, whereas City Index can offer CFD trading to its global client base.

- Further reading: Is City Index CFD Trading DMA (Direct Market Access)?

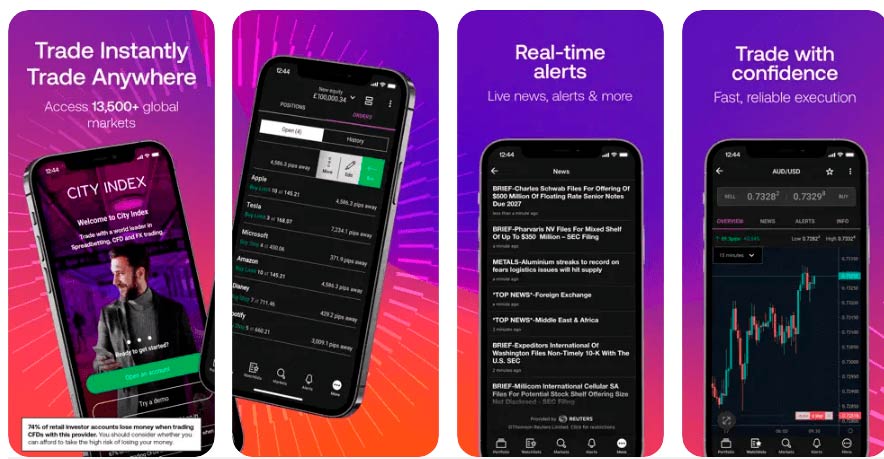

Trading App

I actually prefer the City Index app to the desktop version of the trading platform. Sometimes I can find the desktop version to be a bit clunky, but the app is really slick, and clearly in our mobile-first world, where all the recent development has been focused. And why not, the desktop trading platform is brilliant for research, trading signals and post-trade analytics, but at the point of execution the app is a quick and simple stripped-down version with all the salient features front and centre.

- Further reading: Is the City Index trading app safe?

MT4 (MetaQuotes)

You can trade on MT4 and MT5 with City Index, but functionality and market access is not as good as their main proprietary trading platform or some of their MT4 competitors. You can only trade around 84 markets on MT4 through City Index, but if you just want to trade the major markets, City Index is a good broker for MT4 based on their regulation, service and pricing.

Added Value & Research

One example of how they are populating their platform with new trader tools is SMART Signals. Of course, all, or at least most brokers have Trading Central or AutoChartists, (City has Trading Central) whose signals are used by so many platforms that they almost become self-fulfilling, or a barrel for larger traders to shoot down small fry, depending on which way you look at it.

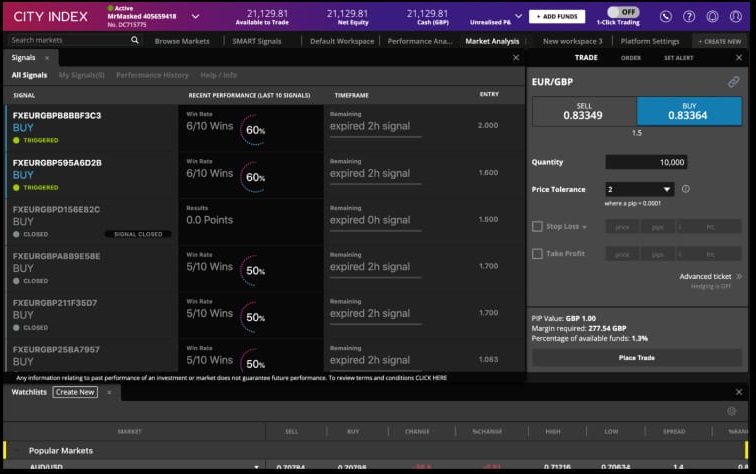

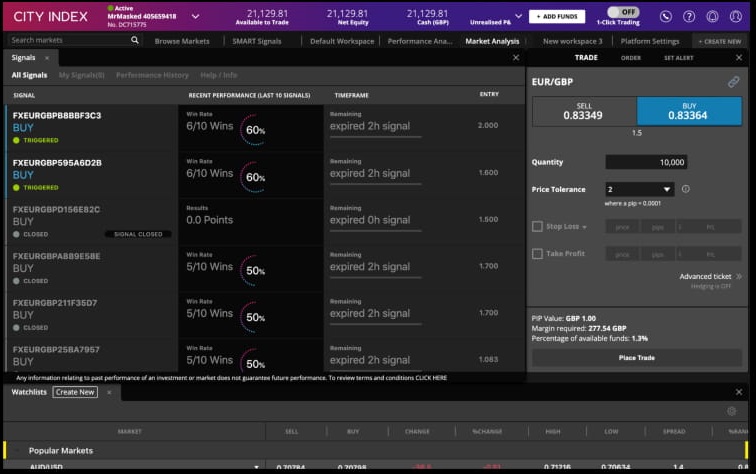

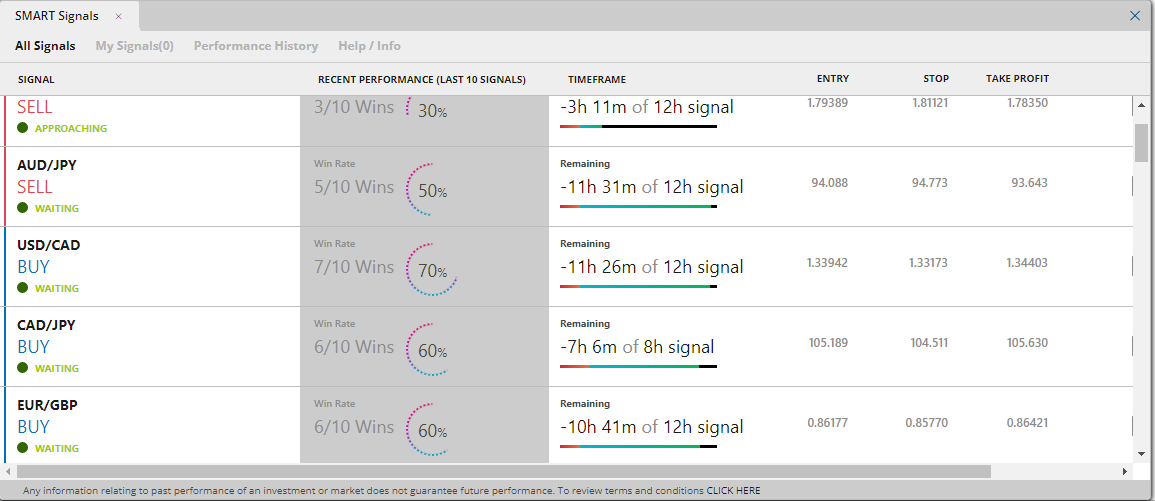

SMART Signals

SMART Signals is a new iteration of GetGo, which I tested and reviewed a few years ago. At the time, it was a stand-alone app, and actually quite fun, and did well highlighting some trading opportunities (full GetGo review here). Now, it’s fully integrated into the City Index platform, so you can look at what trading signals are being spat out by the algorithm and either dive in manually, or opt to trade when the signal is triggered, with corresponding stops and limits in place. It’s a great feature for stimulus and saves you a bit of time if you’re on the hunt for trades.

Whether it can make you money is another thing, but SMART gives a full breakdown of its P&L from previous trading signals, so whether or not you make money will largely depend on what signals you decide to follow and also (as you will know from reading “The Art of Execution”) how you manage the positions once open.

Performance Analytics

Another acquisition from parent StoneX is Chasing Returns, now integrated into the platform as Performance Analytics. Which really drills down into where you are trading well and where you are losing money. Performance Analytics can break down your wins and losses and tell you what markets you trade best, what time of day you are most profitable, if you make money trading in quick succession or, if you do better if you take a break between trades. It’ll even tell you if your first trade of the day is often a winner or loser, or if you are a better bull or bear and also if you are as good at trading volatility as you pretend to enjoy doing, but letting you know if you trade better in calm or erratic markets.

Economic Calendar

One thing though that does let them down is City Index’s economic calendar, it’s terrible. In fact, most brokers, even IG just have a bog standard list of upcoming earnings and economic announcements. But I think you need more from a trading platform these days, especially as when logged into the desktop platform the format is all off. One broker that has absolutely nailed their economic calendar is ThinkMarkets. With TM when you’re logged in you get a really good visualisation of previous data, volatility and most importantly what impact it had on relevant institutions like EURUSD. It’s a great way to see how markets have moved against previous numbers. Honestly, City Index should embed this too as it’s available from Trading Central who they have a deal with anyway.

Extended Hours Trading

You can trade CFDs premarket and after the market closes on a range of US equities in the pre and post-market sessions which bookend regular share trading in New York that takes place between 9.30 a.m. and 4.00 p.m. Eastern time.

The list of 73 stocks available to trade in the pre and post-markets includes leading US shares such as Apple, Microsoft and Nvidia. Widely traded names such as the Ark Innovation ETF, Coinbase, Robinhood and Gamestop.

As well as established blue chips like Bank of America, Boeing, Procter and Gamble, and Walmart, alongside a selection of index-tracking and thematic ETFs.

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Awards

In our latest awards City Index won “best trader tools” 2023 and has in previous years won best trading platform, best trading app & best forex broker in 2022.

Giles Watts, Senior VP of UK & EU at City Index said after winning best trader tools in 2023: “We are delighted to have been recognized for the added value we provide our clients. Delivering actionable post trade insights direct to the platform, is just one of the reasons our clients stay with us over the long term.”

@good_money_guide Check out the top trader tools in the industry! Stay ahead of the game with these award-winning resources for trading, shares, and stocks. Don’t miss out on the latest tools to help you navigate the stock market like a pro. #goodmoneyguide #goodmoneyguideawards #trading #shares #stocks #stockmarket #toptraders #investment ♬ original sound – Good Money Guide

69% of retail investor accounts lose money when trading CFDs with this provider

Inside City Index

As part of our City Index review, we visited their offices in The City and spoke to some of the senior management to find out what makes City Index different.

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Video Review

In our City Index video review we test the platform with real money, put some trades on and highlight some of the broker’s unique features.

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Facts & Figures

City Index Total Markets | 13,500 |

| 👉Forex Pairs | 183 |

| 👉Commodities | 19 |

| 👉Indices | 40 |

| 👉UK Stocks | 3500 |

| 👉US Stocks | 1200 |

| 👉ETFs | ✔️ |

City Index Key Info | |

| 👉Number Active Clients | Over 126000 |

| 💰Minimum Deposit | 100 |

| 💰 Inactivity Fee | Yes – £12 per month |

| 📅 Founded | In 1983 |

| ⬜ Public Company | Yes |

| 🏢Head Office | London, UK |

| 📜Regulated? | Yes – by the FCA |

City Index Account Types | |

| 👉CFD Trading | ✔️ |

| 👉Forex Trading | ✔️ |

| 👉Spread Betting | ✔️ |

| 👉DMA (Direct Market Access) | ❌ |

| 👉Futures Trading | ❌ |

| 👉Options Trading | ❌ |

| 👉Investing Account | ❌ |

City Index Average Fees | |

| 👉FTSE 100 | 1 |

| 👉DAX 30 | 1.2 |

| 👉DJIA | 3.5 |

| 👉NASDAQ | 1 |

| 👉S&P 500 | 0.4 |

| 👉EURUSD | 0.5 |

| 👉GBPUSD | 0.9 |

| 👉USDJPY | 0.6 |

| 👉Gold | 0.8 |

| 👉Crude Oil | 0.3 |

| 👉UK Stocks | 0.08% |

| 👉US Stocks | $0.018 per share |

69% of retail investor accounts lose money when trading CFDs with this provider

Is the City Index trading app any good?

Yes, trading on the City Index app is a safe way to trade as they are owned by NASDAQ-listed StoneX and are regulated in the UK by the FCA and in all the regions they operate in by the local regulator. However, it’s important to note that whilst financially secure, the City Index trading app offers access to high risk leveraged products like financial spread betting and CFDs, which should only be used by experienced investors who understand the risks.

City Index’s mobile app provides access to 12,000 markets through spread betting and CFDs has just had a facelift with some behind-the-scenes improvements as well.

When I traded on the City Index app I was able to able to access asset overviews, news, and alerts as well as key market info. But, one of the stand-out features of the City Index app is the inclusion of SMART signals and Performance Analytics. Having full access to SMART signals means you can keep an eye out for new trading opportunities and place corresponding trades on the move. Performance Analytics also gives the full breakdown how where you have been profitable or not in the past and provides feedback on whether or not you are sticking to your trading plan. Both, mean that the app has a bit more use than just a way to monitor the market when not in front of your normal trading screens.

It’s a well laid out trading app, with the major instruments front and centre, but also the peripheral markets like sectors, thematic indices (like blockchain, NFTs and cannabis), trending markets and options quickly available. The app also has quick access to popular markets, so you can keep an eye on where the days trading volumes are going.

Using and navigating the app is intuitive, with icon-based menus for markets, watchlists, alerts etc. There is a news feed and economic calendar, as well as technical analysis from Trading Central. You can draw and edit charts on the app and add up to four indicators to them. The mobile charting package includes logarithmic sizing and switches between landscape, there is the usual suite of technical indicators from Trading View, but you can’t execute direct from the chart on mobile yet.

Overall City Index’s trading app is a good addition to it’s main platform and should suit traders looking for stimulus and research on the go.

69% of retail investor accounts lose money when trading CFDs with this provider

Is City Index a good trading platform?

Yes, City Index has a very good trading platform. Based on it being developed in-house, and having proprietary trading tools like performance analytics, and SMART trading signals, plus it’s wide range of markets and advanced execution functionality we rank City Index’s trading platform as one of the best around.

City Index won “best trading platform” in our 2022 and 2023 awards for their trading signals. The trading platform has grown considerably since the acquisition of Gain Capital by StoneX and includes some excellent added-value features like Performance Analytics and SMART signals. When I was testing the trading platform, there were enough signals to discover some additional trading opportunities I wouldn’t have otherwise come across.

On City Index’s trading platform, you can trade more than 13,500 markets, including 40 equity indices, over 10,000 UK and international shares and ETFs, 19 commodities, and 183 FX pairs. This means they offer more markets than most of the other online trading platforms regulated by the FCA in the UK.

Founded in 1983 City Index has a solid and longstanding presence in online trading; its trading platform is a genuine rival to IG and CMC Markets. In major UK markets, City Index pricing is competitive and often market-leading, but can be expensive for Asian markets.

City Index’s free desktop trading platform is web-based, so there is nothing to download you simply log in and trade on your internet browser. You can create and customise your own workspaces and layouts, adding quotes, charts, news and trading signals. However, you can also use City Index’s Market 360 feature to create a top-down view of an instrument in a single click, which contains charts, quotes, news and product information all in one place.

You can trade or place limit orders directly from a chart or you can click on the bid-ask quote at the top of the page in the 360 view. You can instantly access technical analysis, calendars, and newsflow by clicking on the market analysis, but the trading platform’s stand-out features are the SMART Signals, which produces trading ideas based on technical analysis and Performance Analytics which provides constantly updated reports on how to improve your trading, based account history.

Overall the City Index trading platform is very intuitive to use and it has a clean, clearly laid out interface making it suitable for beginners who want a simple platform with trading signals. It is also advanced enough for experienced traders executing large orders and needing post-trade analytics or voice brokerage as backup.

69% of retail investor accounts lose money when trading CFDs with this provider

Can you trade options with City Index?

Yes, you can trade options with City Index, however, you are limited to trading them as a financial spread bet or a CFD. You can also only trade options on some of the most popular shares (like Tesla) and major indices (like the FTSE or DJIA). This should be enough for the majority of traders who want to take corresponding options positions against their long/short trades. However, for more sophisticated options traders Interactive Brokers or Saxo Markets offer direct market access on a wider range of equity options (but no financial spread betting for tax efficient trading).

City Index offer options trading via spread bets and CFDs, the benefit of the course of trading options as a spread bet for UK customers is that profits are free from capital gains tax. Phone trading is one feature that sets City Index apart from other retail options brokers. They provide personal service and can assist with complex options execution strategies.

You can trade options on the major indices and stocks with City Index, and whilst this is fairly limited compared to other options trading platforms, one of the key advantages is that you can trade options as a spread bet.

69% of retail investor accounts lose money when trading CFDs with this provider

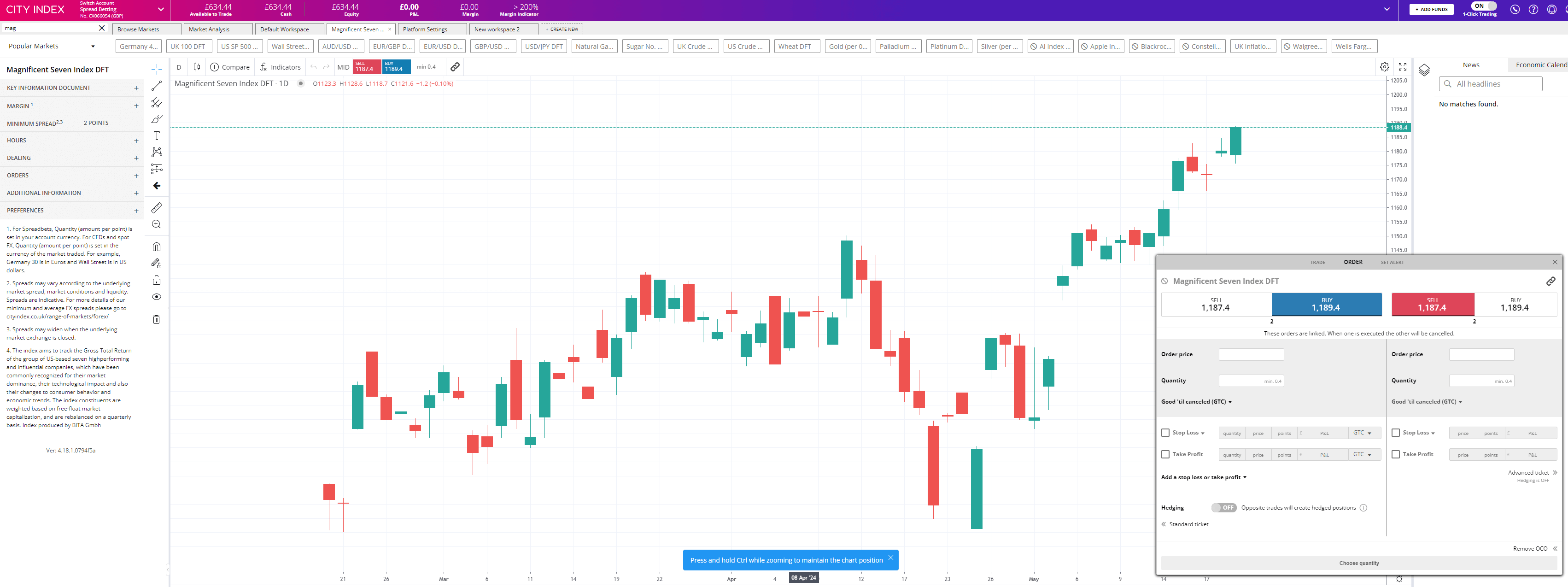

Magnificent Seven basket for index trading

The basket, which contains a “who’s who” of US tech and growth stocks, allows City Index’s clients to get instant exposure to this influential grouping, in a single trade. This means that you can take long or short positions on the Mag 7 stocks in one trade with equal ease.

Named after the protagonists in the classic Western of the same name, the Magnificent Seven are seven US based Technology, Communication Services and Consumer Discretionary stocks which have dominated global equity markets since the pandemic.

The Mag 7 group comprises Alphabet, Apple, Amazon, Meta Platforms, Microsoft, Nvidia and Tesla.

These are all household names and account for around 30% of the market cap of the S&P 500 index, which represents some 80% of the total US market cap, and as much as 60% of the total global market cap.

Looking back at the historic performance of the Magnificent Seven we find that they have had an annualised return of almost 31.0% over the last five years.

How is the City Index Magnificent Seven index constructed and traded?

City’s Magnificent Seven index benchmarks the BITA US Magnificent Seven index.

BITA is a German fintech and index solutions provider.

Their Magnificent Seven index is a free-float market cap-weighted benchmark with quarterly rebalances.

The City Index Magnificent Seven basket is traded as an index product during the regular session of the US market, which is open between 14.30 and 21.00 London time.

The product can be traded as a CFD or a spread bet utilising any of City Index’s trading platforms, whether desktop or mobile.

The index will have a 6.0 point spread and margin rate of 10.0%

It could be argued that the influence of the Magnificent Seven has waned recently.

However, they are some of the largest companies in the world and they are intimately connected to globally important themes, such as cloud computing, artificial intelligence and the energy transition.

Being able to trade these stocks in a single deal should be very advantageous for City Index clients, as price movements in the group reflect changes in trading sentiment and Risk-on/Risk-off behaviour in the equity market.

69% of retail investor accounts lose money when trading CFDs with this provider

Does City Index have a demo account?

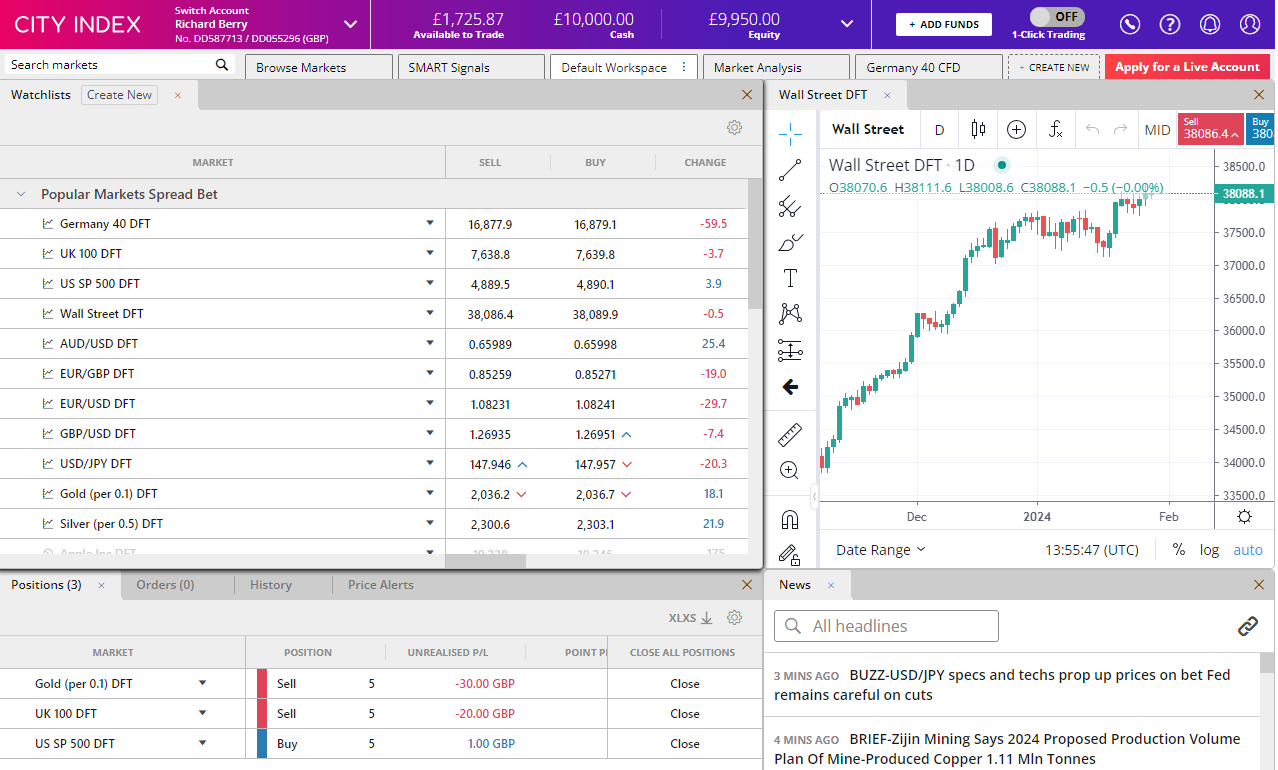

Yes, City Index does have a demo account. We have tested the demo platform and reviewed how similar it is to the live trading platform below. You can also see a screenshot of the City Index demo account to give you an idea of the look and feel.

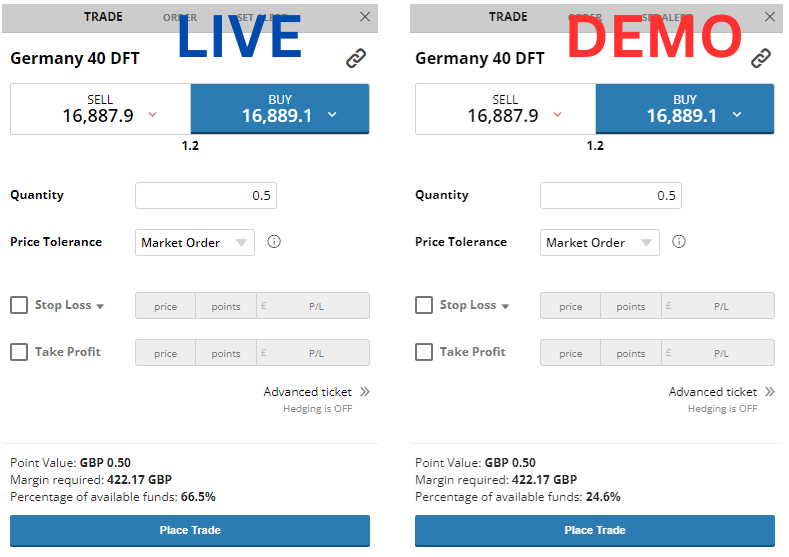

Is pricing different on the City Index demo?

No pricing is the same on both the demo and the live trading account, you also get the same margin rates. you can see this in the screenshot below which shows the exact same DAx pricing in both the live and demo versions. The demo is on the right, and live is on the left, screenshot taken 14:14 29/01/2024

Can you open a City Index MT4 demo account?

No, you can only open a demo of City Index’s main WebTrader platform or app. If you want an MT4 demo, to be honest, there are better options, as in my view City Index’s proprietary trading platform is better than MT4.

Can you trade on the City Index demo with Spread betting or CFDs?

City Index’s demo account is generic so when you log in you see pricing for both spread betting and CFDs where pricing is the same.

City Index’s demo account lets you trade for 12 weeks with a virtual balance of £10,000 on all the 13,500 markets that are available on the live trading platform.

City Index have one of the best demo trading accounts on offer as it is essentially a carbon copy of their live trading platform, which includes trading signals, performance analytics and access to the same broad range of tradable assets.

69% of retail investor accounts lose money when trading CFDs with this provider

Is City Index Commodity Trading CFDs, Spot, DMA or Futures?

When you trade commodities with City Index you are either trading a CFD or financial spread bet as an OTC product. City Index are not a DMA commodities broker. You are not trading on exchange futures with DMA access. However, you can trade spot commodities against the USD, or quarterly contracts that mirror the futures cost of carry.

- Commodity markets available: 20

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Pricing: Gold 0.8, Oil 0.3

69% of retail investor accounts lose money when trading CFDs with this provider

Does City Index offer MT4 & MT5 (MetaQuotes)?

Yes, City Index does offer MT4, but functionality and market access is not as good as their main proprietary trading platform or some of their MT4 competitors like Pepperstone. You can only trade around 84 markets on MT4 through City Index and there are better brokers for trading on MT4. But if you just want to trade the major markets, City Index is a good broker for MT4 based on their regulation, service and pricing.

69% of retail investor accounts lose money when trading CFDs with this provider

Is City Index CFD Trading DMA (Direct Market Access)?

City Index is an OTC CFD Broker, which means it does not offer DMA CFD trading, you can only trade as an OTC CFD or as a financial spread bet. If you want direct market access to exchanges for equities trading you can compare DMA brokers here. However, City Index CFD pricing is tight enough for the majority of traders who do not want to work orders inside the bid/offer spread. The other advantage of trading CFDs “over-the-counter” is that commission is included in the quote as opposed to DMA brokers like Saxo Markets who add commission after you trade.

A good CFD trading platform for traders who want trading signals and post-trade analytics.

- CFD markets available: 12,000

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- CFD pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

Charges and commissions are included in the spread for CFD trading and are very competitive including 0.5 pips for EURUSD, 1 point spreads on the FTSE (UK100 CFDs), 0.8% on UK shares and 1.8 cents per share on USD stocks (2 cents per share being industry standard).

Whilst I was testing City Index’s CFD trading platform for this review there were a few things that make them stand out. Firstly they offer proprietory trading signals on CFDs through SMART Signals. These signals have been developed in-house and enable trades to quickly see upcoming trading opportunities. Signals are ranked based on how successful the type of signal has been in the past for specific assets and you can see the assets signal historic P&L performance based on the pre-determined stop and limit levels.

Performance Analytics is another tool that can help traders improve their CFD profitability. Performance Analytics looks at your CFD trading history and shows you where you do well and when you do not. The idea is to make you a better trader by encouraging you to stick to a trading plan and gives you guidance on when your plan is working and what markets, times and conditions suit your trading style the most.

As well as offering a CFD trading platform and mobile app City Index has always catered to, and still does, to high-value traders over the phone. It is one thing that makes them different from the majority of trading platforms in that you can actually talk to an experienced dealer who knows your account as well as deal electronically.

For new traders, there is a huge amount of educational and informational content from “how-to” videos and articles to more lighthearted CFD, and focussed programming like the Traders Academy.

Overall, City Index offers one of the best CFD trading platforms, on a wide range of markets with low costs and is suitable for large traders who want personal service and new traders how need assistance looking for trading ideas.

City Index offers CFD trading on over 13,500 markets including 40 equity indices, 4,700 international shares, ETFs, 19 commodities, 183 forex pairs, government bonds and interest rates giving it one of the largest market ranges of all the major CFD brokers.

69% of retail investor accounts lose money when trading CFDs with this provider

Is City Index a good spread betting broker compared to CMC Markets?

I would say that overall City Index is a better spread betting broker than CMC Markets, especially if you are trading a broad range of shares, particularly smaller cap shares. CMC Markets is more focussed on the most liquid markets like EURGBP and indices and can have tighter pricing. But, for an all-round service, City Index is a better spread betting broker for most UK traders.

City Index is one of the best spread betting brokers and is suitable for all types of traders looking for a tax-efficient way to speculate on the financial markets. City Index also won our “best trader tools” award in 2023.

Overall City Index’s spread betting platform is one of the best around with competitive pricing, a wide range of markets to trade, and some very good added value tools to help traders seek out opportunities and improve their trading strategy.

- Spread betting markets available: 12,000

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

Spread bets at City Index are available on 12,000 markets including, 23 equity indices, thousands of UK and international stocks and ETFs, 19 commodities, bonds, and interest rates, and an industry-leading 182 FX pars. City Index also has an options desk for spread betting on index and populare stock options.

When I tested City Index’s spread betting account there were two things that made it stand out, SMART Signals and Performance Analytics.

SMART Signals, is one of the best trading signal services out there and is developed in-house by City Index. The idea is that the algorithm scans the market for price patterns and highlights upcoming trading opportunities. It differs from the standard offerings from Autochartist and Trading Central, by being fully integrated giving you the ability to trade via a single click, as well as being fully transparent by displaying the previous P&L per asset.

The other spread betting tool, that is unique to City Index is Performance Analytics. Whilst other brokers provide post-trade analysis, When StoneX (City Index’s parent company) acquired Chasing Returns, they were able to exclusively provide a huge amount of data to help their customers stick to a trading plan and provide insights into what can make them a better spread bettor.

As with most spread betting brokers, City Index clients trade via two-way bid-offer prices the difference between the bid and offer representing the spread. These vary by product and contract but in the FTSE 100 index City charges a minimum spread of 1 index point and on the Germany 30 or Dax it charges 1.20 points. You can trade Spread Bets on leading equity indices up to 24 hours per day. For stock trading, spreads of 0.8% for UK and 1.8 cents per share are built into the price.

69% of retail investor accounts lose money when trading CFDs with this provider

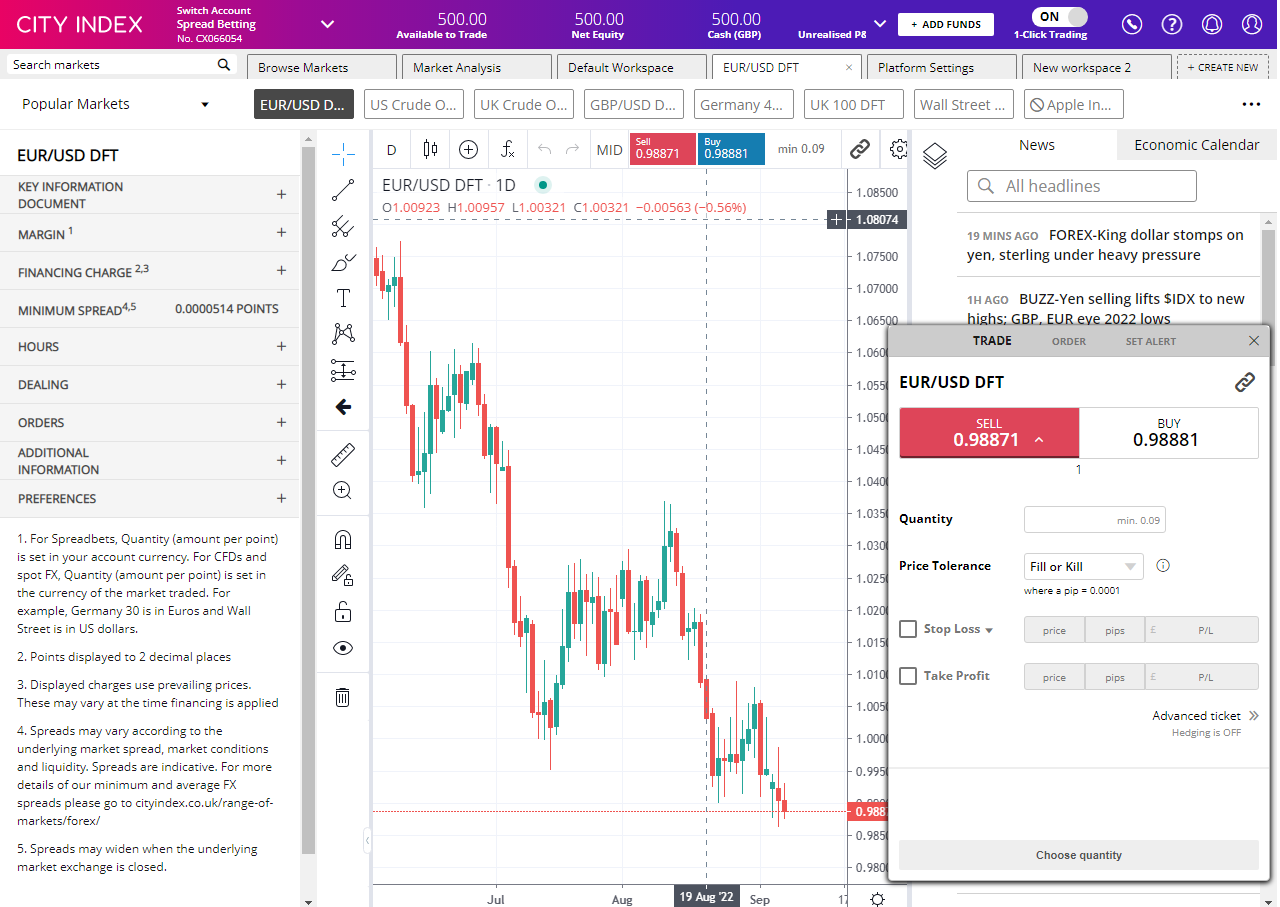

Is City Index a good forex trading platform?

City Index won “best forex broker” in our 2022 awards as they offer a huge amount of forex pairs (182), with tight pricing and a wide range of different account types, including spread betting and CFDs.

Yes, for forex traders that want a bit of added value rather than just a click-and-trade account, they also offer free Forex trading signals through SMART Signals City Index also provides some insightful analysis of your previous forex trading with their Performance Analytics.

Trading Platform:

On the FX trading platform, currency pairs are listed by major pairs and also separated by base currency so you can easily see EUR, USD and GBP FX crosses. You can trade forex options as a CFD or spread bet. As well as trading FX, you can also invest in the currency markets through a range of ProShares and Invesco ETFs. One really nice feature of the platform is that when you trade forex you can set your price tolerance, so if you want to place a limit order rather than market or fill or kill, you will still get filled within a few pips (depending on how many you set) of your limit rather than missing out entirely.

Trading Signals:

Trading Central is also integrated into the platform, which will show you which currency pairs have the most “market buzz” and see a constantly updated stream of technical analysis highlighting potential forex trades with pivot points, an indication of whether to go long or short, alternative scenarios and key support and resistance levels.

69% of retail investor accounts lose money when trading CFDs with this provider

Extended trading hours for select US equities and ETFs

City Index clients will be able to trade US equities in the pre and post-markets through either CFD trading or financial spread bets, and they can take long or short positions just as they can in the regular session.

Clients can find the extended-hours equities by logging on to their web trader or mobile dealing app searching for a ticker such as BAC (Bank of America) and selecting the extended hours label.

Pre-market trading takes place before the regular session in New York, the pre-market starts trading at 4.00 Eastern time which is 8.00 a.m. GMT.

The post-market session takes place after the regular session closes in New York at 4.00 p.m. Eastern time and runs until 8.00 p.m. Eastern time which is midnight GMT.

Why trade pre and post-market?

Being able to trade pre and post-market allows clients to take a position in a stock, as and when news breaks or new information comes to light, outside of regular trading hours.

That’s particularly relevant during quarterly earnings with most firms reporting prior to or after the close of the regular equity trading session.

The extended sessions allows clients to take a view and potentially pre-empt price changes in the regular session, without having to wait for the opening bell.

Pre and post-market trading is increasingly setting the trend for price discovery in US markets. Traders in the regular session often take their lead from pre and post-market moves.

A word of caution – less liquidity

That said the extended sessions are unlikely to be as liquid as regular trading which means prices/spreads may be wider and it may be harder to enter or exit larger positions, without incurring slippage, and that’s something that traders in the pre and post-markets need to take into account.

City Index is the second broker that has recently added extended trading hours to its list of services. Back in July, we wrote about the introduction after-hours trading from the social trading platform eToro and no doubt other brokers will soon be offering pre and post-market trading of US equities.

69% of retail investor accounts lose money when trading CFDs with this provider

Dedicated Artificial Intelligence (AI) Index

City Index has created and launched an index that tracks the performance of 11 stocks associated with “Generative AI”.

The index is cap-weighted, so the larger members within the basket should, in theory, have a bigger influence on its pricing.

The makeup of the index will be reviewed quarterly, on the third Friday of the month. The current basket of stocks includes Nvidia, Plantir, and Altair Engineering.

Clients will be able to trade long and short on the index during regular US trading hours. They can expect to see a bid-offer spread of 6 points and variable margins, depending on position size. Such that the larger your position, the lower your leverage and the higher your margin will be.

- Related Analysis: 7 AI Stocks That Could Be Huge Winners In The Long Run

Constituents

Given its trillion-dollar market cap won’t the AI Index just track Nvidia?

With a market cap-weighted makeup in the artificial intelligence index, it would be easy to assume that it would just track the price movements of the largest constituents.

However, using the City Index Web Trader platform it’s possible to draw a three-month chart, that compares the AI Index CFD with Nvidia, the stock that has driven the 2023 AI boom.

Interestingly although there is a correlation between the two instruments, the AI Index has not slavishly followed Nvidia over the last three months, and that suggests that there could be arbitrage or spread trading opportunities to be had.

Thematic Baskets

The AI index is one of six thematic baskets that City Index offers to its customers, the others include, the Remote Economy, Cannabis, and FAANG+.

Thematic baskets and indices such as these are useful asset allocation tools and they allow traders to instantly get broad-brush exposure to specific trends or themes in the market. Traders can trade these baskets in isolation, or via pairs trades against another basket or constituent within the individual baskets.

For example, if you wanted to isolate the influence of Nvidia from the AI Index CFD you could go long the basket and short of Nvidia or vice versa.

No doubt we will see the introduction of more thematic and sector-oriented products from margin trading brokers as they seek to keep their end customers interested and their offerings relevant.

That is surely a good thing because it creates choice and opportunity for retail traders.

69% of retail investor accounts lose money when trading CFDs with this provider

City Index FAQs:

City Index offer spread betting and CFD trading on forex, indices, shares and fixed-income products. One of their unique selling points is their integrated trading signals on their app and trading platform.

Yes, based on our data matrix, testing, analysis and the fact they are regulated by the FCA City Index is a good broker. Your funds are also protected under the FSCS with City Index.

You can trade FX on Sunday nights with City Index when the forex markets open around 10 p.m. for UK traders. But you cannot trade indices, stocks or commodities on the weekend. If you want to trade more markets on the weekend you need a broker like IG that offers a wide range of financial markets on Saturday and Sunday.

Yes, City Index is a highly trusted broker as they are well established, well respected in the industry, have a sophisticated and high-net-worth client base and most importantly, are regulated in multiple jurisdictions.

City Index was founded in 1983 and is regulated by the FCA which means they have to keep client funds safe and segregated from their own money. Your money is also protected by the FSCS.

Retail clients trading with City Index get leverage of 5:1 for indices, 30:1 for FX, 10:1 for commodities and 5:1 for UK and international share trading. It is possible to increase your leverage rates if you apply for a professional trading account.

No, City Index is not available to US residents. However, City Index is owned by StoneX, which is a US broker that US citizens can trade through. City Index is also part of the group that own Forex.com which offers forex trading in America.

Yes, City Index does allow scalping for short-term high frequency trading. For more information see our guide to scalping.

Yes, City Index is a good platform for day trading as they have low spreads, access to a wide range of markets and intra-day trading signals provided by SMART Signals.

City Index has its own trading platform called Web Trader but also offers trading via their mobile app, TradingView and MT4.

No, the FCA has banned retail derivatives brokers in the UK from offering welcome bonuses.

City Index makes money through charging commissions (either added to CFD trades or built into the spreads of financial spread bets). Other revenue streams include overnight financing charges, where City Index levies extra interest on top of what it lends you to trade on leverage.

69% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.