Can you use the “January Barometer” to discover the best time to buy stocks?

One of the most tantalising market questions is this: Is there a ‘good time’ to buy stocks? Investors have always been fascinated by the timing aspect of investing. Exploitable calendar patterns give investors a ‘risk-free’ bet on markets without assuming more risk. All they need to do is to figure out the pattern and pick up additional returns!

But, is it that easy? The January Effect, for example, tells investors to buy stocks at the end of December, especially smaller capitalisation stocks, and hold them for a month. This is to pre-empt the wave of buying in January after investors harvested their tax losses at the end of the year. Psychologically, a new year often results in renewed optimism and causes many fund managers to add new positions.

However, is January the best month to buy stocks? Not necessarily.

January Effect in the UK

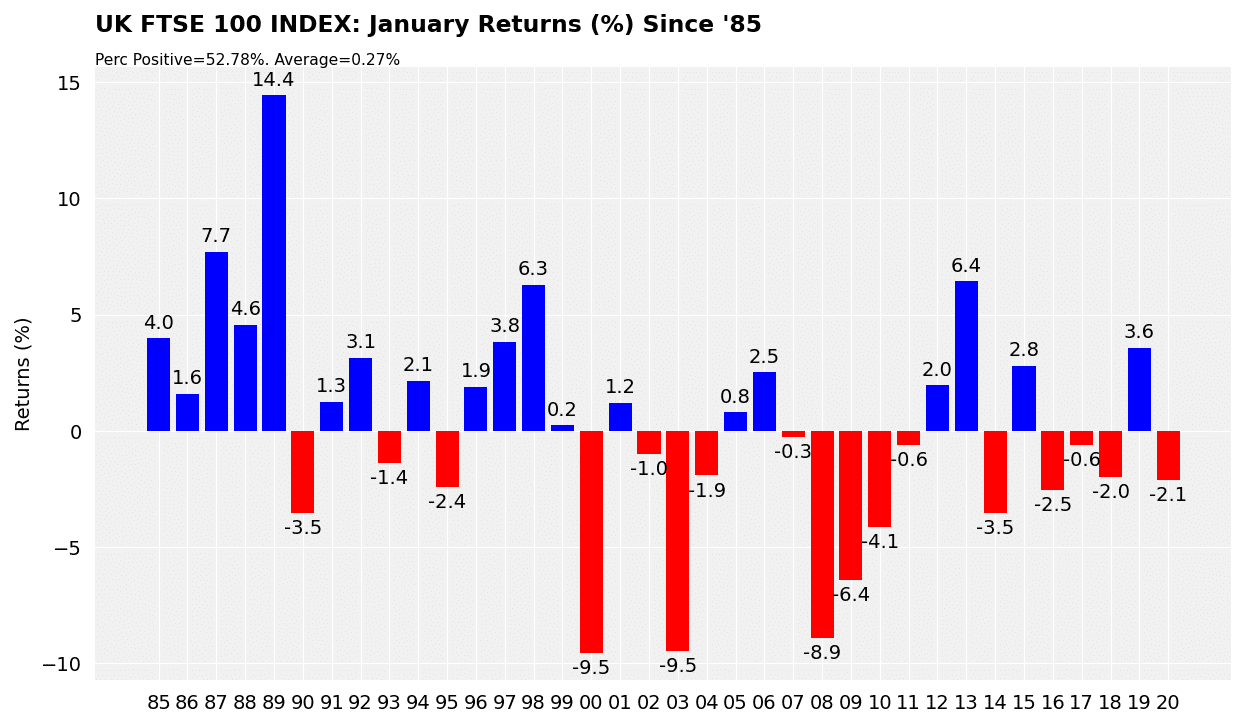

In the UK, for example, I looked at the FTSE 100 Index since its inception in 1984. Yes, the January Effect was quite pronounced in the mid-eighties. But this pattern, somehow, became more unpredictable over time.

Half the time, January is a positive month; the other half it is not (see below, as of 30 Jan 2020). The average return is about 0.27% after 35 years. Not much upside if you take transaction costs into account. In the last decade, for instance, there were four positive January months and six negative ones.

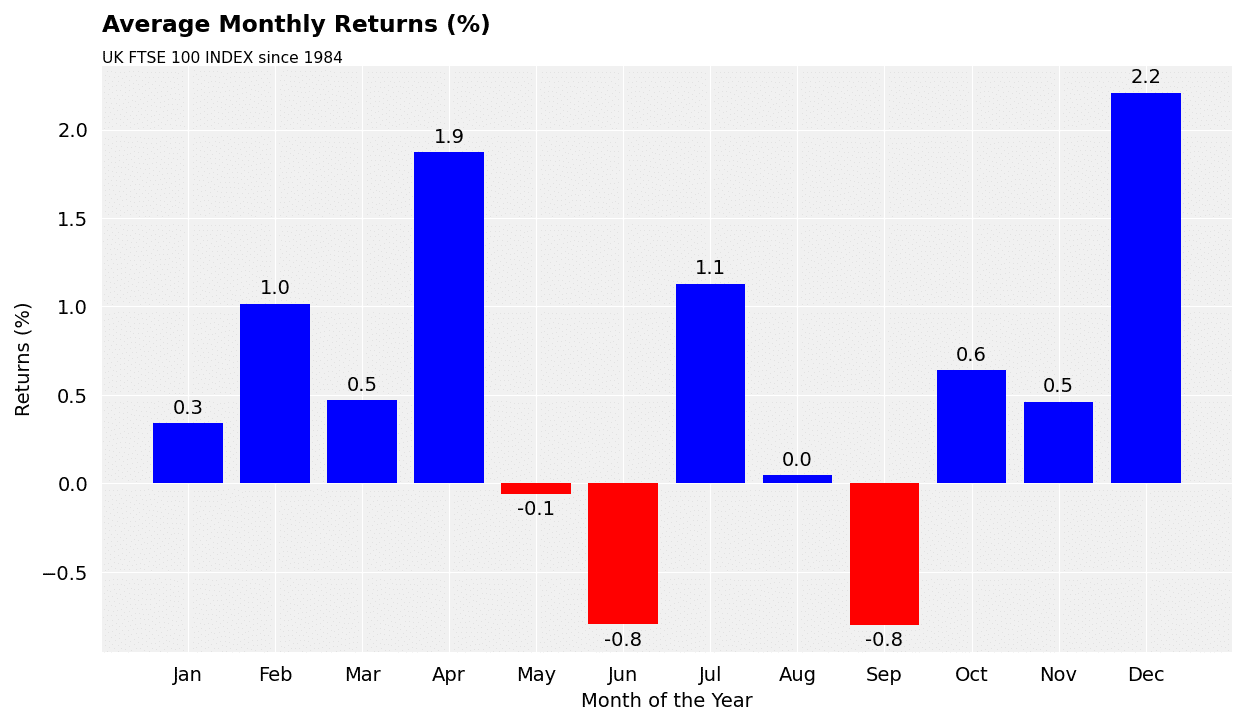

And when I compute the average return of each calendar month of the year, January does not seem like a ‘strong month’ to me (see below). By far the strongest month is December, which, at 2.2% is about ten times as strong as January.

As a matter of fact, the ‘Santa Rally’ documented in an GMG earlier post, appears to have a stronger calendar impact than the January Effect.

Also worth noting is that September is the weaker month of the year. The adage ‘Sell in May’ certainly applies here.

The unpredictability of the January Effect

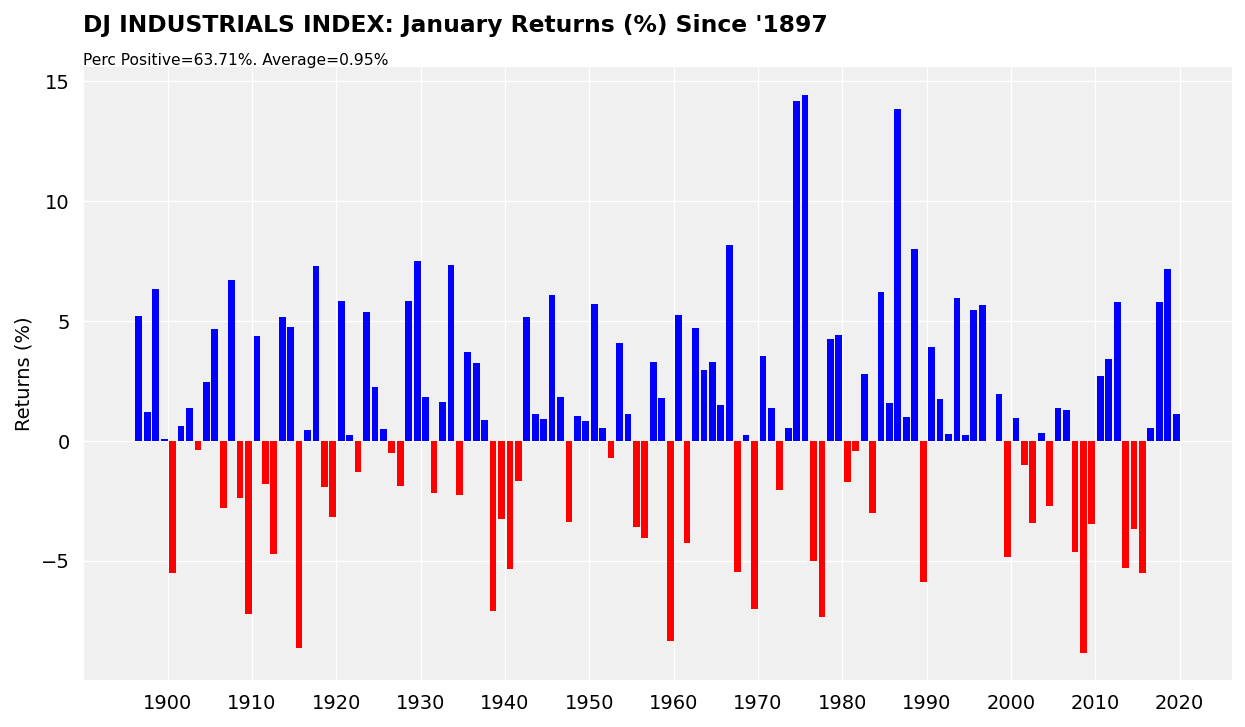

Some traders, however, may object to my observation. The January Effect in the US, for example, is stronger. This is somewhat true. In analysing the January returns from the Dow Jones Industrial Index since 1896, the percentage of positive January returns now rises to 63.7%, with an average return of nearly 1%. And the last few January returns are positive (see below).

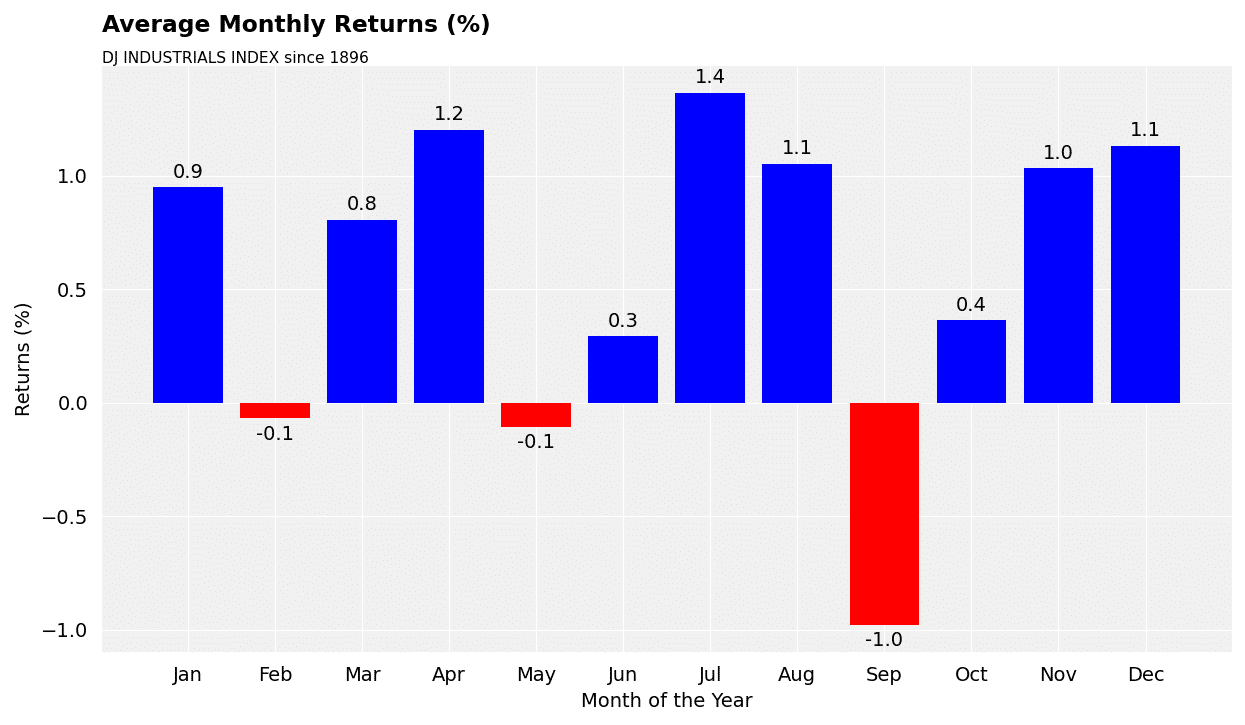

However even for Dow January is not, on averaged, the strongest month of the year. That distinction belongs to July, followed by April and December (see below). Therefore, I am inclined to say that for many large-cap stocks (the Dow is a large-cap index) the January Effect is clearly not that pronounced.

Indicator to watch: January Barometer

While the January Effect is no longer an important anomaly that investors can exploit, I would pay attention to the so-called ‘January Barometer ‘. This is a basic contention that the first month of the year tend to predict the performance for the year.

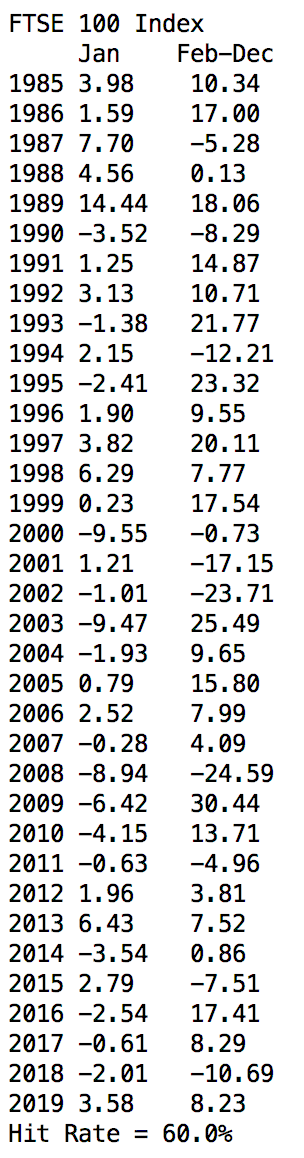

For the FTSE 100 Index, the hit rate is about 60%. I obtained this percentage by comparing FTSE’s January return with the Feb-December return and then aggregate the number of times when both returns are the same sign (see right). For the Dow, the hit rate is about 62%.

Remember that trading from indicators and calendar anomalies is all about statistics. To make money off strategies like this you need to position size correctly to protect the portfolio from losses. In other words, you need to make more money when indicators are right than when they are wrong. Moreover, backtesting the strategy realistically with transaction costs and slippage is also needed to ascertain its profitability.

For 2020, stock markets got off the starting block positively but are now under increasing pressure from a public health crisis in China. Stock returns for the first month are mostly negative, e.g., FTSE 100 down 3.4%. It will be interesting to see how well this January barometer works for the rest of the year.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.