To invest in an index fund you need an index fund platform account. In this guide, we will explain what an index fund is, how they work, how you can pick the best ones and highlight where you can buy them.

What are index funds?

The rise of passively managed investment funds has been the standout story of the last 25 years in the fund business. Estimates differ, but as much as 30% of the money managed by funds globally is now believed to be invested passively in one way or another. The two most common types are (a) index funds and (b) exchange-traded funds (known as ETFs).

What does investing in indices mean?

The traditional way to manage an investment fund is for a qualified professional manager to choose a portfolio and monitor it on a daily basis, buying and selling individual securities on the basis of research and judgment, taking into account a range of factors, such as valuation, profitability, management competence and dividend potential. In contrast passively managed funds use a computerized approach to portfolio management, aiming to replicate the performance of a market index or to construct a portfolio with a pre-determined set of investment criteria. This is a simpler and much cheaper method that academic research has shown often works just as well as actively managed equivalents.

What is the difference between index funds and exchange-traded funds?

Index funds are open-ended funds which issue units in the traditional way, directly to investors in response to investor supply and demand. They are typically valued and units issued or redeemed once a day. Exchange-traded funds, in contrast, often have similar objectives but can be traded continuously like shares during market hours, with the portfolio being managed by investment banks and brokers rather than by a fund management company. Another popular type of ETF are so-called “smart beta” funds which put together collections of securities that meet specified characteristics, such as a high dividend yield, low volatility or strong momentum.

What makes a good index fund?

Two qualities in particular are essential – low costs and low tracking error. You should expect a FTSE 100 index fund, for example, to mirror the performance of the FTSE 100 index very closely. That after all is its purpose. In order to do that, as well as tracking efficiently, the fund will need to have very low charges – in general, the lower the better. The running costs of an index fund are much lower than those of a fund run by a human and competition to provide index funds has become very fierce in recent years. Some tracker funds and ETFs charge as little as ten basis points as a management fee (in other words, the fee is equivalent to 0.1% or less of the value of your investment, compared to 1.0%-2.0% per annum for an actively managed fund).

What kind of performance should you expect from an index fund?

The whole point of an index fund is to provide you with the same return as whichever market, sector or type of investment you wish to own. The more mainstream the market, the more likely it is that you will be able to find a tracker fund that does what you want. For index funds that track leading developed market indices, the evidence is that the average index fund will produce reliable second quartile performance – that is to say, not among the very best performers in any one year, but normally ranked in the top 25% to 50% of comparable funds over longer periods.

The reason indexing has become so popular is the evidence that only a small minority of actively managed funds are capable of bearing their benchmarks consistently over periods of five years or more. Funds that do well in one year tend not to repeat the outperformance in future years. Persistence of outperformance, in other words, is poor. You have to be either skilled or lucky as an investor to pick the ones that do outperform consistently over longer periods. When taken together with their much lower costs, the reliable second quartile returns from an index fund make them an attractive practical alternative.

The Financial Conduct Authority, the City regulator, has published a number of studies emphasising the advantages of indexing as a strategy, based on academic research. Remember though that an index fund is only a means to an end; how well your portfolio does will depend on its composition – how much you have in equities, fixed income, commodities, property, gold and so on. That decision remains down to you, or your financial adviser if you have one.

Are there index funds for all kinds of investment?

No. There are very few index funds that aim to track the performance of smaller companies and many emerging markets, for example, because dealing costs are too high and many securities are too illiquid to be traded cost-effectively. Index funds work best when they are competing against actively managed funds in liquid mainstream markets and sectors. They are useful as building blocks in a portfolio. This is where competition and transparency are most apparent. There is a broader range of ETFs; while most invest in indices, like index funds, ETFs also invest in commodities, currencies and certain investment styles and characteristics, such as volatility and momentum.

Are index funds rated?

Yes. For many years most brokers and platforms preferred to ignore index funds and ETFs, in part because they were less profitable to provide. However the increasing popularity of indexing as a strategy and the emergence of ETFs has forced research providers of all kinds to start rating passive funds as well, or in the case of platforms to put them on best buy lists. FE Trustnet for example rates 250 passive funds (both index funds and ETFs), noting that while passive funds are designed to replicate an index, “some prove much better at doing so than others”. Hargreaves Lansdown has 10 tracker funds on its Wealth 50 list of favoured funds.

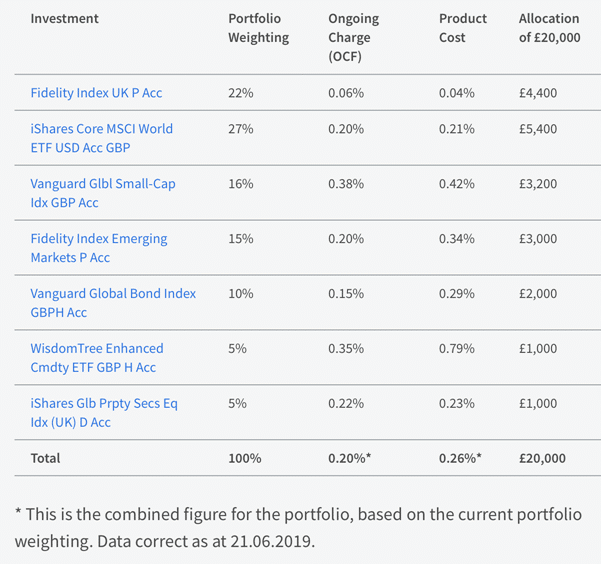

Another way to screen index funds and ETFs is to look at the model portfolios which are now offered by many wealth management firms and platforms. Many of these use passive funds because they are cheap and easy to trade. Here is one of many possible examples you might look to for leads: Interactive Investor’s low cost growth portfolio. (Note that if you ask the firm to manage this portfolio for you, it will cost you additional fees; this is not a recommendation, just an illustration).

Source: Interactive Investor.

Which index funds are most popular?

It is not easy to find reliable figures on the best selling index funds. The market is however dominated by a small number of firms which are large enough to benefit from the economies of scale available from running the biggest funds. The biggest UK sellers include Blackrock, Legal & General, Fidelity and Vanguard. Index funds now account for roughly 15% of all open-ended funds sold in the UK. Their market share has doubled in the last 10 years. Most of their sales are concentrated in funds that track mainstream UK, US and overseas market indices. The same is broadly true of ETFs, judging by the best sellers on specific platforms (examples: clients of Hargreaves Lansdown and Barclays’ Smart Investor service). Notable providers in Europe include Blackrock (which owns iShares), Vanguard, Fidelity and Lyxor.

What is the secret to using index funds?

If you understand their strengths and limitations, passive funds are a simple and cost-effective way to construct a diversified portfolio that meets your objectives and tolerance for risk. Their growing popularity in recent years illustrates how investors have become more aware of the limits of actively managed funds and the importance of minimizing costs to maximize returns. ETFs give you additional options for adding commodities, currencies and specific investment factors to your portfolio, but also carry additional risks: make sure you understand how they work before investing in one.

Jonathan Davis MCSI has been analysing and writing about financial markets for more than 35 years. Initially, as a business journalist on The Times, The Economist and The Independent, more recently as a qualified professional investor and founder/editor of the Investment-Reader.com website. Jonathan has also written several books on investing including Money Makers, Investing With Anthony Bolton, Templeton’s Way With Money and The Investment Trusts Handbook.