This guide looks at the best UK stocks and shares to buy now. In it we have highlighted which are the most popular UK stocks on the major investment platforms, which UK shares are best for day trading, and also how to pick the best companies and sectors to invest in.

Top UK shares bought on II, HL & AJ Bell

This is a good representation of the best shares for UK investors because the people buying these companies are investing in them for long-term capital growth and income. Hargreaves Lansdown, AJ Bell and Interactive Investor are investment accounts, rather than trading platforms which means that customers buying these stocks believe in their long-term future to produce profits and income.

| Hargreaves Lansdown | AJ Bell | Interactive Investor |

| Vodafone Group plc | Lloyds Banking Group PLC | Barclays |

| Lloyds Banking Group plc | Aviva PLC | Lloyds Banking Group |

| Scottish Mortgage Investment Trust plc | Glencore PLC | Glencore |

| Legal & General Group plc | Vodafone Group PLC | Aviva |

| BP Plc | Persimmon PLC | Rolls-Royce Holdings |

| Aviva Plc | BAE Systems PLC | BP |

| GSK plc | Legal & General Group PLC | M&G Ordinary Shares |

| Glencore plc | Taylor Wimpey PLC | Tesla Inc |

| British American Tobacco plc | GSK PLC | |

| ASOS plc | Phoenix Group Holdings PLC | |

| Diageo plc | HSBC Holdings | |

| Rolls Royce Holdings Plc | ||

| Barclays plc | ||

| Palantir Technologies Inc | ||

| National Grid |

A few things to consider about this list, Hargreaves Lansdown’s top stocks are from the previous week ranked by most shares bought. AJ Bell’s top buys are from the previous month and Interactive Investor’s top UK shares are the most bought in March 2023.

- Related guide: How to invest for a monthly income

Best UK Stocks For Day Trading

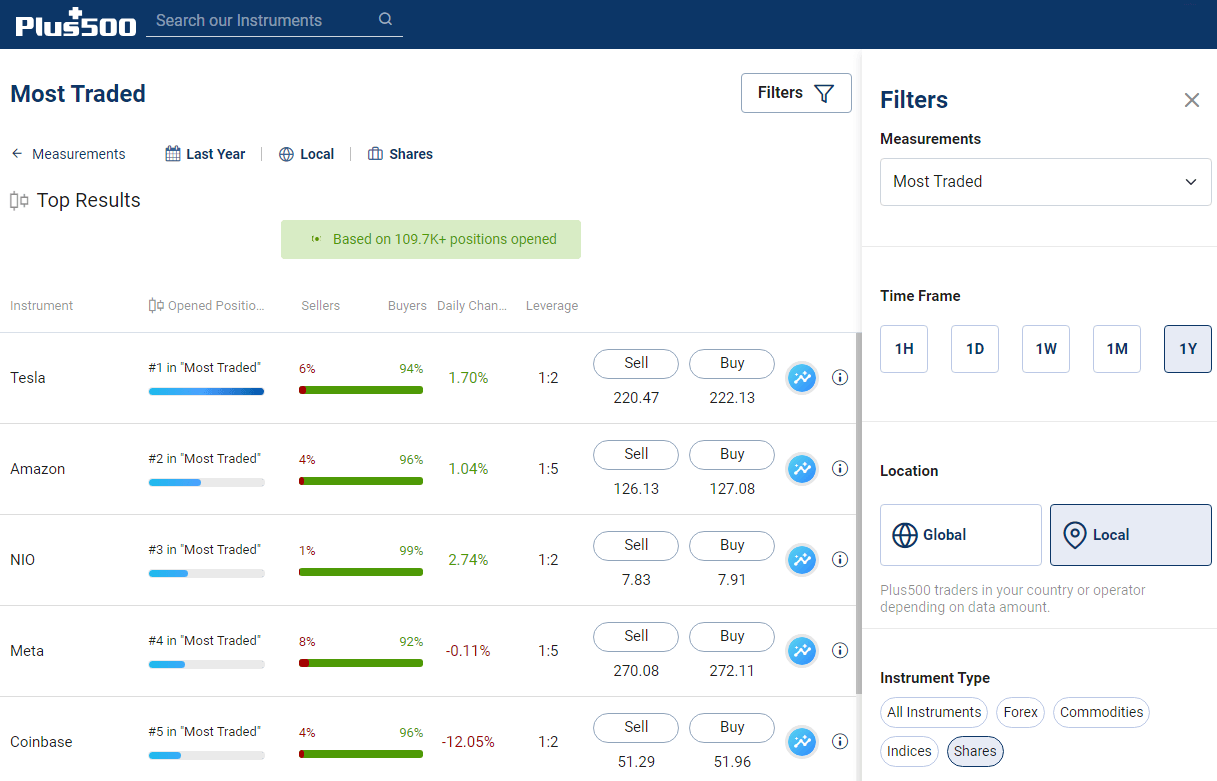

According to a recent report by CFD broker PLUS500 the most popular shares traded by their UK customers (and they claim to have 24 million of them globally) are not British at all. In fact, they are all American, which is hardly surprising because the London Stock Exchange is not only being ignored by new companies wanting to IPO (even by English brands like Lotus), but also by UK traders, who see greater opportunity across the pond.

I get lots of random press releases sent to me with interesting facts that are not really interesting but I read them anyway. This one came from journoresearch.org, which is actually a trading name of Search Intelligence which is a link-building agency. So I suppose they are sorting of doing their job well because I am writing about, it, but I’m not going to link because a. we are an affiliate to PLUS500 and b. we are actually not currently approved to refer traffic to PLUS500.

Anyway, here is what shares PLUS500 traders in the UK have traded most over the last 12 months.

The 10 most bought & sold shares from traders in the United Kingdom

According to PLUS500 clients, which means they are are traders not investors, which is why they are all American…

| Rank | Share |

| #1 | Tesla |

| #2 | Amazon |

| #3 | NIO |

| #4 | Coinbase |

| #5 | Meta (Facebook) |

| #6 | Apple |

| #7 | Snap |

| #8 | Aurora |

| #9 | Rivian |

| #10 | Uniper |

- Related Guide: How to buy shares in Tesla.

This data is from PLUS500’s +insights tool, which shows what people are trading, but, as of 6th September 2023 their risk warning stated, 84% of retail investor accounts lose money when trading CFDs with them, so should you really take any notice? I think it would be worth paying more attention if you could whittle down the data by clients that make money or lose money (like CMC Markets). Then it would be really useful because you could look at the sentiment indicators and decide if you should go with the flow or against it. You also can’t break it down by region, it would be good to see what are the most popular stocks traded on the LSE.

What are UK shares, and why do they make such good investments?

A share represents a partial ownership of a company. Each ticker represents the company, and each firm has its own unique earning cycles, sector movements, and management styles. Many traders forget this because they are too focussed on the day-to-day movements of the stock price.

In the London Stock Exchange, there are hundreds of shares available to investors to buy. At the end of March 2023 there were 906 UK-based companies listed on the LSE, that is down from 922 in September 2021 . A further 108 international companies (down from 207 in Sept 21) have their shares quoted on the LSE platform. The total market capitalisation (number of shares x price of each share) of both segments totalled £3.659trillion (down from £4,396 trillion). UK domestic stocks are worth £2.5 trillion! According to data from the London Stock Exchange there are more than two thousand individual equities listed or quoted in London, that’s a big list for anyone to track and make sense of.

A stock market is an essential part of the investment landscape. It is the throbbing heart of a capitalistic economy, a place where companies raise funds and where millions of shares of public-listed companies are traded daily.

In the UK, the largest stock exchange is the London Stock Exchange. The exchange itself is a listed company with the ticker LSEG. Another equity exchange, albeit much smaller, is the Aquis Exchange (ticker: AQX). The London Metal Exchange (LME) is yet another exchange, but it specialises in commodities. These days, most stock exchanges are for-profit organisations.

As Napoleon once said about England, it is a ‘nation of shopkeepers‘. When these businesses grew into national icons, they needed more funds to expand. To do this, companies sell part of the ownership to the public via shares. For example, Tesco (TSCO, GMG analysis) was floated on the London Stock Exchange in 1947 and was oversubscribed 130 times.

How to choose the best UK stocks to buy

Given this large number of stocks in the market, investors naturally ask: How do we sort the market into a more coherent system?

The first thing the exchange did was to rank each share by size (ie, rank a stock’s market capitalisation). The 100 largest stocks are grouped together, called the FTSE 100 (called the ‘footsie’). This is then followed by the next largest 250 stocks, the ‘mid-caps’. In summary, we have:

- FTSE 100 – top 100 largest companies in the LSE, ranked by market capitalisations

- FTSE 250 – next 250 largest companies

- FTSE All Share – companies outside the FTSE 100 and FTSE 250

There are speciality index providers that tracks the movements of, say, the FTSE 100 stocks and turn them into a simple-to-follow index.

One example is the FTSE 100 Index, an index that tracks the price movements of the FTSE 100 constituents. This index was started back in 1984 and is currently worth £1.9 trillion.

In the US, the three most-followed indices are the Dow Jones Industrial Index, the S&P 500 Index and the Nasdaq Composite Index.

Right now, the largest company in the UK is the pharmaceutical giant Astra Zeneca (AZN). The company fetches a market capitalisation of £146 billion. The second largest is the consumer stock Unilever (ULVR) at £100 billion.

There are many investors who only buy and sell the largest 100-150 companies. Why? One reason is better liquidity. Larger stocks tend to have tighter bid-ask spreads because more investors buy and sell the stock. You can move millions in and out of a large FTSE 100 stock easily. The other reason is lower volatility. Large companies have earning streams that are more predictable.

In recent years, many exchange-traded funds (ETF) were created to track the FTSE 100 Index. These funds hold all the constituent stocks in the index (the process is called ‘replication’).

The largest ETF that tracks the FTSE 100 is the iShares FTSE 100 (ticker: ISF). The fund has £10 billion of assets under management and you can buy this ETF in your ISA accounts.

One of the largest ETFs that tracks the FTSE 250 Index is the Vanguard FTSE 250 ETF (VMID, Interactive Investors link).

Choosing the best UK shares to buy by sector

Apart from that, the LSE exchange also groups companies by sectors. There are 11 industries as agreed in the Industry Classification Benchmark – Industrials, Financials, Utilities, Communications, Technology, Health Care, Consumer Staples, Consumer Discretionary, Energy, Real Estate, and Materials.

But in the UK stock market, we do not have equal representation of each sector. The basic makeup of the sectors in the LSE is this:

- Financials (banks, insurance, speciality finance) have a large representation on the LSE

- No global tech stocks like FAANG – and certainly no $1 trillion company

- Mining stocks are fairly active in the UK market

- Property (stocks & REITS) is a significant industry

- Privatised national corporations (e.g., Royal Mail LON:IDS) are a small but significant area of the market

- Retail sector represents a fairly large sector

- Some newly listed companies (e.g., Darktrace, Hut Group, Moonpig etc)

Given FTSE 100’s reliance on many corporations from traditional sectors such as mining that traces its roots from the halcyon days of the British Empire, the fund manager of SMT recently remarked that the “FTSE 100 is really a 19th century and not even a 20th century index.”

As the old adage goes, ‘birds of the same feather flock together’, stocks in similar industry often trend up or down together.

One example is the banking sector, which is made up of Barclays (BARC), HSBC (HSBA), Lloyds (LLOY), Natwest (NWG) and Standard Chartered (STAN). These companies tend to bottom out and rally at roughly similar periods, albeit with varying strength.

Are the best UK shares to buy the most heavily traded?

FTSE 100 – Top 10 Most traded shares by volume on the LSE 7/7/23

- VODAFONE GROUP PLC

- LLOYDS BANKING GROUP PLC

- LEGAL & GENERAL GROUP PLC

- AVIVA PLC

- BT GROUP PLC

- BARCLAYS PLC

- HSBC HOLDINGS PLC

- GLENCORE PLC

- TESCO PLC

The best stocks to buy are not necessarily the best-performing shares in the FTSE 100

One way to look for the best shares to buy in the UK is to use performance tables to look at past performance (however this is not always a guide to where they may go in the future)

Ranking the returns of stocks gives investors a quick overview of what the market is focussing on. More importantly, it tells us where capital is flowing into. It is a crude gauge of the market sentiment.

For example, if we rank all the FTSE 100 stocks by their performances over a defined period – say, year-to-date (2021), the top stock is the industrial group Ashtead Group (AHT), followed by the gambling stock Entain (ENT) and newly-listed cyber security stock Darktrace (DARK). The financial group Intermediate Capital Group (ICP) and Spirax Sarco Engineering (SPX) are doing well too.

- Ashtead Group (AHT) 84.4%

- Entain (ENT) 73.9%

- Darktrace (DARK) 64.9%

- Meggitt (MGGT) 59.3%

- Glencore (GLEN) 56.1%

- Croda International (CRDA) 51.0%

- Spirax Sarco (SPX) 50.6%

- Segro (SGRO) 42.9%

- St James (STJ) 38.6%

- Intermediate Capital Group (ICP) 37.8%

On the other hand, if we ranking the performance figure from the bottom, we will see Ocado (OCDO), London Stock Exchange (LSEG) and Flutter (FLTR) doing poorly. Others like IAG (IAG), Rolls Royce (RR.), BT Group (BT.A) and Pearson (PSON) have also lost investors some money. The covid pandemic has dealt airlines a huge blow.

- Use the table to find out which stocks have performed well over the last 3-6 months. This may give you ideas about what to buy over the medium term because a bullish trend tend to persist

- Be careful about buying stocks that have performed very well over 3-5 years, because you could be late to the party already.

- Find out which stocks are doing poorly over 3-5 years and use (1) to see if a ‘base pattern’ has been established. If the selling pressure is subsiding, a recovery rally may happen.

Large-cap shares versus small-cap shares – and why you should buy small-cap stocks

There is a big difference between the best small-cap shares to buy and the best large-cap shares for investing.

One characteristics of a capitalistic economy is that unproductive companies wither and are slowly phased out of the economy. New, vibrant and more productive companies replace them. This process is called ‘creative destruction’.

The stock market mirrors the business world. New stocks are listed, while old, struggling stocks are delisted. Of the companies that constituted the Dow Jones Industrial Average back in 1896, only one survived to this day – the General Electric (GE). Even this iconic company is about to be broken up.

There is a case to be made for small-cap stocks, because they are new and vibrant. Many of them represent the future. Amazon (AMZN) was once a small-cap stock, as was Netflix (NFLX). But they grew into corporate giants over time. Chances of you landing a ‘ten bagger’ are much higher in the small and mid-cap space than in the large-cap.

Characteristics of small-cap stocks:

- Young companies that have the potential to grow faster than established ones

- In newly-created industries, the business models of small-cap stocks are uncertain

- Share prices of small stocks are volatile

- Small companies need funding to grow

Because small cap stocks are riskier and more volatile, the potential returns are higher. High risk, high returns.

How to pick the best UK shares for trading

The stock market is a financial ‘jungle’ for the unwary. There many traps that many investors have to learn to navigate through. The first rule, as Warren Buffett puts it, is this: Don’t lose money. The second rule is: Don’t forget rule number one.

The question is, how do you avoid losing money? Easier said than done. Even the sage himself lost billions over the years through carelessness.

The first step for anyone is to have a plan, however crude. A simple plan, well executed, is better than none at all.

The plan could be as straightforward as this – I don’t want to pick any stocks. Instead, I will just invest a small amount in the whole market regularly. Many subscribe to this approach.

For example, investors can buy the FTSE 100 ETF (ticker: ISF) monthly to avoid picking stocks and timing the purchases. Do not sneer at this rule. It is more effective than you imagined.

In 2008, Warren Buffett wagered a $1 million bet that the US S&P 500 Index would outperform the brightest minds in finance for a decade. He won the bet. The market, as a whole, often do better than the majority of the hedge funds.

If you do not want to buy into a tracker fund, then perhaps you should look at actively-managed funds like the Scottish Mortgage Trust (SMT). But this approach has its pros and cons. Active funds that outperform the market are hard to discover early. The other point is fees. You must watch the fees as this will eat into returns.

The third approach is that you pick stocks yourself instead of leaning onto the whole market. If this is the case, then you must know what to do. This is no simple task. The simple investment plan must now be more detailed. Questions like those stated below must be answered, before you start considering investing yourself:

- Which stocks to look at?

- Criteria to buy?

- Criteria to sell?

- Risk management rules to live by? etc etc

If you focussed on UK stocks, then you must learn the market inside out over a period of time.

The UK stock market is a blend of companies of international and domestic exposure. Some companies have the bulk of their earnings derived the rest of the world; some are near 100 percent domestic. You need to understand the companies and follow the rhythm of the sector.

All in all, the five basic principles of picking stocks are:

- Stocks are not random tickers. Behind every stock is a company. If the company is prospering, sooner or later, this will be reflect in its share price. Look at the retailer JD Sports’ (JD.) share price.

- Know what you own. Don’t simply buy shares because it went up! Learn some basic accounting and ratios like yield and P/E.

- Newer industries will have more vitality and growth; older industries will have a harder time growing. A sunset industry is even worse. Stay away from those.

- Stick to your ‘edge’ and stay in areas where you may have an advantage over the rest of the market.

- Diversified into different sectors, not just different stocks in the same industry.

Stock markets are pretty volatile investment. Yes, share prices tend to go up over the long term. But they can also plunge without warnings. Asos (ASC), the online retail company, lost half its value this year. BT Group (BT.A) doubled its value in nine months and then lost 40 percent.

So one last piece of advice, apart from analytic skills, you must have the stomach to weather these drawdowns. As they say, if you can’t stand the heat, then avoid going into the kitchen!

Breaking down the information to find the best UK stocks for trading

Fortunately, some of this work has already been done for us. Stocks are categorised into both indices and sectors, the former is often determined by their market capitalisation or value, and the latter, of course, depends on the type of company they are or the type of business that they are in.

Picking the best stocks to buy from an Index

At the top of this tree in the UK is the FTSE 100 which we covered in our article about The Top Ten Stock Market Indices For Trading & Why

The FTSE 100 tracks the performance of the UK’s top 100 shares, they are the largest UK listed stocks by market cap and usually the most widely researched and followed UK equities.

The next tier down is the FTSE 250, which is comprised of the 250 largest listed equities, outside of the FTSE 100.

If they meet certain strict criteria stocks can be promoted from the 250 into the top 100 as part of the FTSE quarterly index reviews, which take place in March, June, September and December.

If a FTSE 250 stock is promoted in the review, then an FTSE 100 stock is demoted to make room in the topflight and that stock takes the place of the promoted stock in the 250 index.

Stocks can also move between indices after takeovers and mergers or in the event of an insolvency.

Note that these two indices are sometimes combined to create what’s known as the FTSE 350 index.

Finding the best sector stocks to buy

As well as being grouped together into indices equities are often categorised into sectors and industries based on the types of companies they are and how they make their living.

This sectorial classification can also be applied to stocks based on their index classification so, for example, we can have the FTSE 350 banking sector, that is, banking stocks within the top 350 UK equities. Or we can we have a wider classification of say, the industrials sector, which could contain all the UK equities that are involved in industrial pursuits.

Being able to slice, dice and group together stocks in this way means that we are able to make comparisons and or screen for certain characteristics among them.

Of course, to be able to undertake these screens we need a reliable source of information which we can access, luckily for us, the London Stock Exchange produces a range of monthly trading statistics including its trading summary fact sheet

Quality and quantity of stocks for trading

When we are considering what are the top UK equities to trade one of the items, we need to think about is liquidity. As traders, we should be largely agnostic regarding the direction in which an instruments price moves (assuming we are on the right side of that move of course) but we should be concerned about our ability to enter and exit a trade in it. A good track record of liquidity goes a long way to confirming those credentials.

Past performance of the top traded stocks

Of course, there are other factors to consider when we are trying to decide what the top UK equities to trade are. Foremost amongst these is performance, after all, there would be little point in trading shares with prices that don’t move.

One trading style or strategy that is always popular among traders is momentum. That is the idea that the more an instrument moves in a particular direction the more it is likely to continue to do so. In effect, when we talk about momentum trading, we are talking about trading price trends.

One way to track those trends is to look for stocks making new 52 week highs or lows, however, if you are interested in shorter-term performance then you will probably want to screen UK equity moves over a variety of time frames.

One way to this is to use a dedicated stock screener the table below is drawn from the performance tables found on digitallook.com but there are many other screeners available online from sites including Yahoo Finance, the London Stock Exchange, Trading View and more.

In this instance, I have looked at FTSE 100 stocks and ranked them by their 7-day performance the image shows the top 11 performers on this basis we can also asses these stocks over other time frames. For example, Experian is up over each of the five periods under observation another example of a stock with momentum in its price action.

Other companies with household names like Tesco have heavily traded share prices

How to buy, sell and invest in the best stocks

View our comparison tables to compare the best, trusted, and vetted brokers for buying, selling, and trading UK stocks

Fundamentals of high market cap stocks for trading

We would be remiss if we didn’t look at one of the most popular methods that traders use to decide what are the top equities to trade and that is the fundamentals of individual stocks.

The fundamentals of a stock are a series of data points and ratios that provide a snapshot of the stock and the underlying business it represents. The fundamentals cover items such as the price-earnings or PE ratio, or a stock’s earnings per share or EPS ratio, its dividend yield and the assets and cash within the underlying business. It’s also possible to look at and screen by other factors such as broker recommendations and forecasts or even directors’ dealings

News flow for liquid trading stocks

The truth is that the composition of the top UK equities to trade will vary perhaps even on a daily basis. Stock prices move around for a variety of reasons though the reasons or factors that drive price changes can often be reduced to changes in market sentiment.

One of the big drivers of changes in sentiment is news flow and that’s something that traders need to keep in touch with.

UK company news is released via what’s known as the Regulatory News Service or RNS announcements but there can be other sources of news flow such as stories in the financial press and market reports, broker research and changes in recommendations and price targets, or news from an overseas or unlisted competitor for example. And these days even social media can be a source of information.

Once again retail traders can keep abreast of this new flow thanks to the internet

Most company news is scheduled and those release dates are known in advance which means that we can track those dates through the use of an earnings calendar such as this one from Bloomberg

Using an earnings calendar in combination with an RNS feed such as this one from InvestEgate means that traders can get ahead of the game and be aware of what events are upcoming and what those company announcements contain. The RNS service is open from 7.00 am in the morning London time so there is an opportunity to read company announcements before the markets open an hour later.

In summary, then the list of the top UK equities to trade will be something of a moveable feast based on market sentiment, news flow, company fundamentals, trade volume and liquidity.

Retail traders are in a better position than they have ever been to make sense of these inputs and there are plenty of online tools available to them to do just that.

Note: This article was originally written in March 2021 by Jackson Wong and has been edited since then with updated data.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.