The history of E*Trade can be traced all the way back to 1982, and the founding of TradePlus by William Porter and Bernard Newcomb. Porter and Newcomb took start up capital from TradePlus to found E-Trade Securities in 1991. The company then expanded aggressively through the 1990s to become one of the largest discount brokerages in America. It now offers a wide range of online, mobile and telephone-based broker services to investors who want to manage their own portfolios.

About E*Trade

The range of products that E*Trade offers to investors is fully comprehensive. Stocks, exchange traded funds, mutual funds, bonds, options, futures and foreign exchange are all available for people to invest in through E*Trade’s platforms. For investors who would like to delegate the task of managing their portfolio to a professional, E*Trade offers this service to customers who invest more than $25,000 via their platform. Advice and guidance is also available to all investors via email or telephone.

Margin trading is available via E*Trade for stocks, ETFs and options. The rates range from 4.3% above base rate for investments with a debit balance of up to $24,999, down to 0.25% below base rate for investments of more than $1,000,000.

E*Trade Regulation

E*Trade Securities is a member of both FINRA and SIPC. The E*Trade Bank is a member of FIDC.

The customer service provided by E*Trade have been given maximum ratings by various reviewers in recent years, including Kiplinger’s and StockBrokers.com. If there’s a weak point in their approach to dealing with customers, it’s the level of cover for their 24/7 service at weekends. In general, though, the service offered by E*Trade has a reasonable claim to be the best in the industry.

The fully featured service offered by E*Trade comes with a price tag. Relative to some of the discount online brokers, the company charges commissions that are relatively expensive with $9.99 per trade being their rate for stock investments. For options the price is $9.99 plus $0.75 per contract. Given the high quality nature of the service provided by E*Trade, many consider these commissions a price worth paying. Discounts are available for high volume traders.

One form of trading where E*Trade’s commissions undercut their rivals is mutual funds. Here, E*Trade offers a commission of $19.99 per trade where many of their competitors charge twice as much or more. E*Trade also offers a decent, although not market-leading, range of commission free exchange traded funds.

What can you trade with E*Trade?

E*Trade offers access to four third party news providers so that investors can conduct their own research. These include Thomson Reuters, Standard & Poor’s, MarketEdge, and SmartConsensus. The charting functions provided by E*Trade are intuitive and flexible enough to allow traders to display information in the way with which they feel most comfortable.

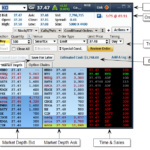

The standard tool for tracking real time market quotes that E*Trade provides is MarketCaster. This is a well-designed, easy to use piece of software that should prove sufficient for the majority of traders. More fully featured real time quote clients are available in the form of MarketTrader for the web and E*Trade Pro on the desktop. These can be accessed by traders who either pay a $99 per month subscription or make at least 30 trades per month. E*Trade Pro is an extremely impressive tool, but is possibly a shade off competing offerings from TD Ameritrade and TradeStation.

How does E*Trade compare to it’s peers?

E*Trade has achieved first place in several categories on an annual basis in the awards ceremonies of magazines covering the brokerage industry. StockBrokers.com awarded them the top online broker award in 2011, along with second place finishes in 2012 and 2013. Kiplinger’s ranked them as their number one online broker in 2012. In 2014 other competitors caught up with the company, although they are still achieving top ratings for their offerings for mobile devices and aspects of their online platform.

E*Trade was the first online broker to start pushing mobile trading. It has retained a lead in this area, with its mobile platform being widely regarded as the best available. It is the only mobile platform that includes education along with CNBC TV, level II quotes and a range of other advanced features.

As an all round offering, E*Trade makes a lot of sense for a wide range of different traders. There are cheaper brokers out there, but they don’t offer the same range of services and many of the smaller brokers suffer from occasional bouts of unreliability, where trading via their platform can become sluggish and thereby cost you money. E*Trade offers security and features that should satisfy most investors.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.