There are essentially two main ways Spread betting/CFD/FX brokerages make money. Most firms run both methods.

I think the industry understands the various models pretty well, but clients, and sometimes regulators deem one way to be superior, and the other to be less desirable.

These methods are usually referred to as the “A” book or the “B” book.

What is the A Book?

In the A book, the broker acts as their name implies, as a broker to an underlying trade wanted by the client, profiting from charging some kind of mark-up on the asset in question.

This could be a mark-up in spread, commission or financing, but essentially the broker is profiting by charging more than it costs them to acquire the asset in question.

- Related guide: How to make money from financial spread betting

Why the B book is different.

Essentially the broker takes the other side of the trade, at least for a period of time.

Why do they do this, and does it mean they are in conflict with you the client?

After all in this situation if the client “wins” on the trade, then by default the broker must “lose”, and vice versus.

Well it’s not as easy as that.

A broker always, no matter what the model, wants scale; the more trades the better, whether they are long or short. In the instant that a client buys £/$, another client may, seconds later, chooses to sell £/$.

An “A” book operator, will be purchasing £/$ for the first client, only to sell it for the second client seconds later, incurring two lots of costs for an eventuality where they are flat, the individual client trades having cancelled each other out.

A “b” book operator would be in exactly the same positon, but will have avoided the costs in executing the underlying two trades. So – whereas the A book operator has a cleaner business model, it’s the b book operator that can offer a cheaper service.

With regulation requiring best execution, the outcomes of both clients’ trades, no matter what the model, would be the same.

A B book operator can offer liquidity when there is none, whereas an A book operator needs to be able to secure the underlying asset. A b book operator can offer a guaranteed stop, and A book operator will struggle to.

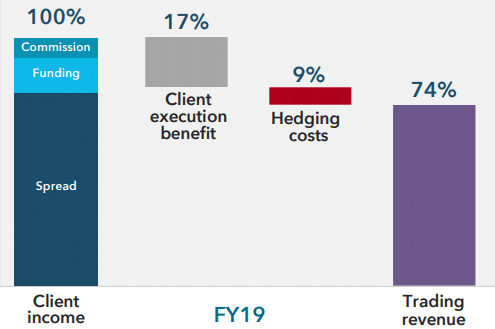

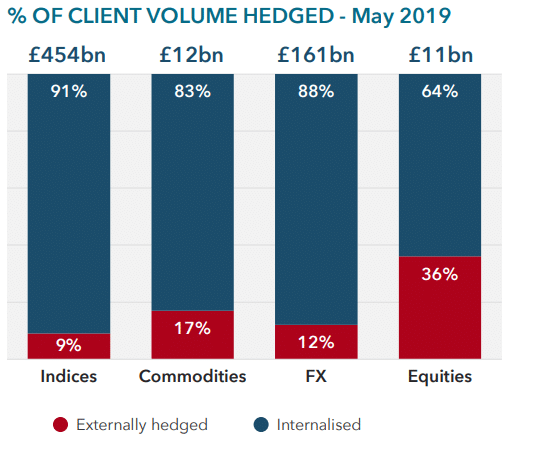

The benefits to the client are highlighted by recent analysis by IG Group, in their Investor Presentation (Annual results, Presentation Deck 23/07/19), and really highlight the underlying benefit to a client of a broker having a flexible approach to risk management. Here you can see that “clients execution benefit” of 17% of total revenues, where fills to the client, are better than that achieved by IG in their own trading, and therefore would not be achieved by the A book approach alone. And does this 2 way business really exists? Well the second slide shows you it does. You can see IG is able to internalise up to 91% of FX flow, and Equities up to 64%, reflected the variety, and trend based trading of the asset classes.

It really does seem that the contrary to what some clients and regulators believe the “B” does not have to stand for Bad……

Dan Moczulski is a veteran of the trading industry having run buy and sell-side teams at various different brokerages over the years. Dan is currently UK MD of eToro.