The best currency pairs for most traders to trade are those with good round-the-clock liquidity that are liable to trend. That is the price following a particular direction for a fixed period of time. The more illiquid currencies whose prices move erratically are less desirable, though some active short-term specialist traders known as scalpers can prefer this type of instrument.

Most Popular Currency Pairs

These are the top ten FX pairs by volume traded and news flow, two contributing factors to being the best:

| No. | Symbol | FX Pair |

| 1 | EUR/USD | Euro vs US Dollar |

| 2 | GBP/USD | British pound vs US dollar |

| 3 | USD/JPY | US Dollar vs Japanese Yen |

| 4 | EUR/GBP | Euro vs British Pound |

| 5 | AUD/USD | Australian Dollar vs US Dollar |

| 6 | USD/CAD | US Dollar vs Canadian Dollar |

| 7 | USD/CHF | US Dollar vs Swiss Franc |

| 8 | NZD/USD | NZ Dollar vs US Dollar |

| 9 | EUR/JPY | Euro vs Japanese Yen |

| 10 | EUR/AUD | Euro vs Australian Dollar |

Source Good Money Guide Research

For most forex traders though liquidity is the determining factor. The most liquid of all FX pairs is the Euro versus the US dollar (EURUSD). The British pound against the US Dollar (GBPUSD)

The US Dollar versus the Japanese Yen (USDJPY) and the Australian Dollar versus its US counterpart (AUDUSD) are all very popular and widely traded FOREX pairs.

As with all trading, you need a decent broker if you are going to stand half a chance at successful forex trading. You can compare the best forex brokers here and read expert and client reviews of these popular brokers for forex trading.

Best Currency Pairs To Trade At Night

The best forex pairs to trade at night are the ones on the other side of the world from where you are located as liquidity will be higher.

FX markets operate 24 hours a day 5 days a week they are truly global trading starts in Asia moves across the Middle East and into Europe and London in particular and then onto New York and the USA so, night time trading for those based in Europe might be the early evening when the New York session is underway but the London session has closed. Traders operating at night time are unlikely to notice too much of a difference.

However, we should acknowledge that once London has shut up shop for the day there will be fewer market participants, that’s offset to some extent by the fact that many of the biggest players in the FX markets are the major American banks.

Generally, though, markets can become less liquid after the US close into the Asian open.

In short trading in the liquid majors is likely the best strategy, though as we saw back in January 2019, with the flash crash in the Japanese yen. Even one of the most widely traded currencies can suffer from limited liquidity out of hours, which in this case was exacerbated by an extended New Year’s holiday in Japan.

Most Predictable Currency Pairs

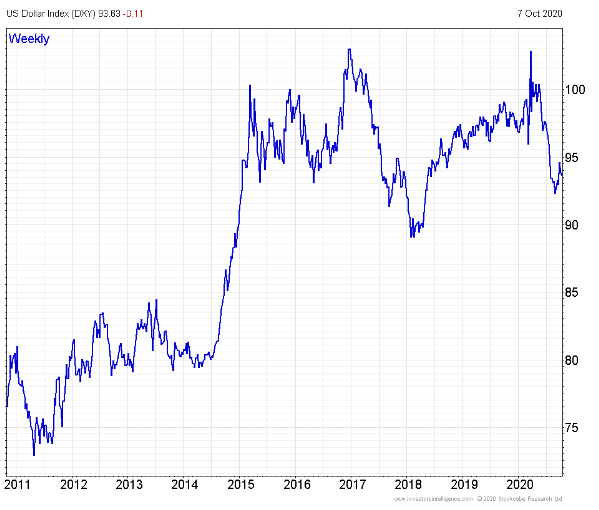

The instrument that has had one of the strongest long-term trends over the last eight years is not a currency pair but rather a trade-weighted basket. That is a currency compared to the performance of the currencies of its major trading partners, In this case, the dollar index.

Source Investors Intelligence

The dollar index had trended higher since early 2011 however it peaked in March 2020 and sold off as COVID-19 disrupted the US and global economies the full effects of which are still playing out.

Predictability is not something that is often associated with the FX markets there are currencies which are pegged to a benchmark such as the US Dollar or indeed to a basket of other currencies, the most famous currency peg of recent times was that of the Swiss franc to the euro. Under which the Swiss national bank sought to limit the appreciation of the Swiss currency to maintain the competitiveness of Swiss exports. Yet despite imposing negative interest rates and selling their own currency, the Central bank was unable to stem the flow of funds moving into the franc, and famously in January 2015, the SNB pulled the plug letting the franc find its own level against the Euro.

Most Traded Currency Pairs

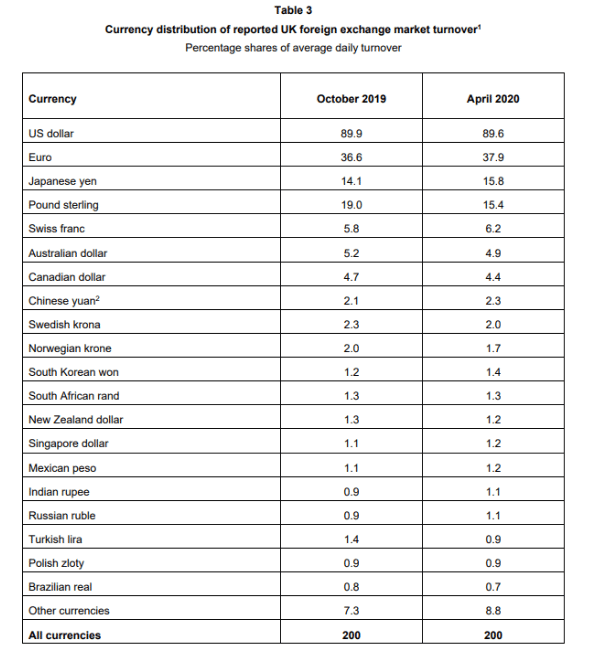

There is no central exchange or counterparty in FX markets and detailed volume figures are published sporadically at best and even then, not necessarily by all participants. However, we can get a good idea about which were the most traded currencies in a given year thanks to surveys conducted by the Bank of England among the major FX players in London. Which is the largest FX marketplace in the world. The table below is drawn from just such a survey, that was conducted during April 2020 the table shows the percentage of average daily turnover by currency in both October 2019 and April 2020 we can see that the dollar was involved in around 89.6% of transactions, the Euro in just over 37% and both the British pound and Japanese yen in around 15.5% each, during early 2020

Source the Bank of England semi-annual FX survey April 2020

What Are Currency Pairs?

Currency pairs are classically defined as exchange rates that include the US Dollar as one of their components. However, since the launch of the Euro or European single currency, the definition has been extended to include FX rates that include the Euro (Other FX rates that don’t contain the Euro or the dollar are known as crosses).

FX pairs are delineated by a combination of two, three-letter mnemonics or codes.

For example, USDJPY 105.75 is the notation for the dollar-yen rate.

These currency rates are known as FX pairs because they consist of two elements, which are known as the base currency and the quote currency.

Base currency

The base currency is the first-named currency, in the above example, the US dollar, USD.

Quote currency

The quote currency is the second named currency which in this example is the Japanese yen, JPY.

FX rates are simply an expression of the comparative worth of two currencies and the figures 105.75 tell us that it takes 105.75 yen to be able to buy 1 US Dollar.

Major Versus Minor Currency Pairs

FX rates are further categorised as being either major or minor pairs or crosses, the distinction between these two groups is based on the size of their respective underlying economies and the level of turnover in that currency within the FX markets. FX majors represent those currencies from the world’s largest economies, and which have a high turnover in FX markets. The minors are currencies from smaller economies which are less actively traded.

FX majors are generally more liquid and well researched and there is usually plenty of information and news flow to keep traders active in them. Against that FX majors tend to be widely followed and can be crowded places to trade. Given their popularity, it can be hard for individual traders to find an edge.

Minors, on the other hand, are often less liquid and not so well researched or popular, that means that it may be easier for traders to find an edge or advantage in the minors.

However, it may not be as easy to enter or exit trades in the minors, particularly in sessions that are well away from their home markets.

- If you are in the UK you can trade currencies with tax-free profits through financial spread betting. Here’s where you can compare spread betting brokers for forex trading.

Best Forex Pairs For Trading Sentiment

The good news for currency traders is that certain FX rates have become synonymous with particular economic and political influences, for example, the AUDUSD is sensitive to changes in sentiment around global trade. Australia is a large trading partner of China and the USA.

By the same token, as we saw in 2018 the South African Rand is sensitive to issues that affect emerging markets. Such as changes in commodity prices and or sentiment towards them. This can show up in its exchange rates particularly against the US dollar (in which most commodities are priced) dollar rand has the ticker USDZAR.

Sterling exchange rates, against both the Euro and the US dollar reflect the markets thinking on Brexit and the prospects for the UK economy thereafter. While USDJPY or dollar-yen is seen as a safe haven and the yen often strengthens when markets are in a risk-off mood, that can be caused by heightened political tensions or economic uncertainty, both of which the markets dislike.

In terms of FX performance year to date the table below shows us the returns of selected pairs and crosses in 2020 thus far.

| FX Pair | Name | Sentiment | YTD | Strength |

| CHFJPY | Swiss Franc/Japanese Yen | Bull | 16.40% | 14 |

| GBPJPY | GBP/Japanese Yen | Bull | 14.70% | 14 |

| EURJPY | Euro/Japanese Yen | Bull | 12.80% | 14 |

| USDJPY | US$/Japanese Yen | Bear | 12.20% | -6 |

| USDZAR | USD/South African Rand | Bull | 11.80% | 14 |

| BRLUSD | Brazilian Real/US Dollar | Bear | 6.90% | -14 |

| AUDJPY | Australian Dollar/Japanese Yen | Bull | 5.40% | 6 |

| USDKRW | US Dollar/South Korean Won | Bull | 4.90% | 14 |

| GBPUSD | British Pound/US Dollar | Bull | 3.60% | 6 |

| CHFUSD | Swiss Franc/US Dollar | – | 3.50% | -4 |

| DXY | US Dollar Index | Bull | 1.20% | 6 |

| EURUSD | Euro/US Dollar | – | 0.40% | -4 |

| CADUSD | Canadian Dollar/US Dollar | – | 0.00% | -4 |

| GBPCHF | GBP/Swiss Franc | Bear | -0.40% | -14 |

| EURGBP | Euro/Pounds Sterling | Bear | -2.70% | -14 |

| EURCHF | Euro/Swiss Franc | Bear | -3.10% | -14 |

| CNYUSD | Chinese Yuan/US Dollar | – | -5.40% | 0 |

| AUDUSD | Australian Dollar/US Dollar | Bear | -5.70% | -14 |

| TRYUSD | New Turkish Lira/US Dollar | – | -30.70% | -4 |

Source Investors Intelligence

Currency Investing

Investing in a currency implies a long-time horizon and ownership of the underlying assets these characteristics are not usually associated with the short-term margin trading of FX pairs. Or you can invest in the performance of a currency pair with an ETF. You can buy these currency ETFs on the stock exchange in the same way you buy company shares.

Currency ETFs

| Symbol | Currency ETF Name |

| BITO | ProShares Bitcoin Strategy ETF |

| UUP | Invesco DB US Dollar Index Bullish Fund |

| USDU | WisdomTree Bloomberg U.S. Dollar Bullish Fund |

| FXE | Invesco CurrencyShares Euro Trust |

| FXY | Invesco Currencyshares Japanese Yen Trust |

| FXF | Invesco CurrencyShares Swiss Franc Trust |

| FXB | Invesco CurrencyShares British Pound Sterling Trust |

| BITI | ProShares Short Bitcoin Strategy ETF |

| FXC | Invesco CurrencyShares Canadian Dollar Trust |

| UDN | Invesco DB US Dollar Index Bearish Fund |

| FXA | Invesco CurrencyShares Australian Dollar Trust |

| XBTF | VanEck Bitcoin Strategy ETF |

| CYB | WisdomTree Chinese Yuan Strategy Fund |

| BTF | Valkyrie Bitcoin Strategy ETF |

| CEW | WisdomTree Emerging Currency Strategy Fund |

| DEFI | Hashdex Bitcoin Futures ETF |

Physical Currency

Or could also consider a deliverable transaction where you take ownership of the underlying currency of your choice. Alternatively, you can buy assets denominated in the currency you wish to invest in and gain exposure to the currency in that way.

Currency Exposure

For example, if you are an Australian investor with Australian dollars and you buy European shares denominated in Euros you have exposure to both the underlying and the euro Aussie dollar exchange rate or EURAUD rate. You can also try to exploit long-standing relationships between stock indices/equities and national currencies. For example, both Dax 30 and the FTSE 100 indices are full of exporters whose share prices often benefit as the pound or the euro weaken and vice versa. Of course, it is always a good idea to seek professional advice before making an investment to establish that they are suitable for your circumstances and appropriate to your needs.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.