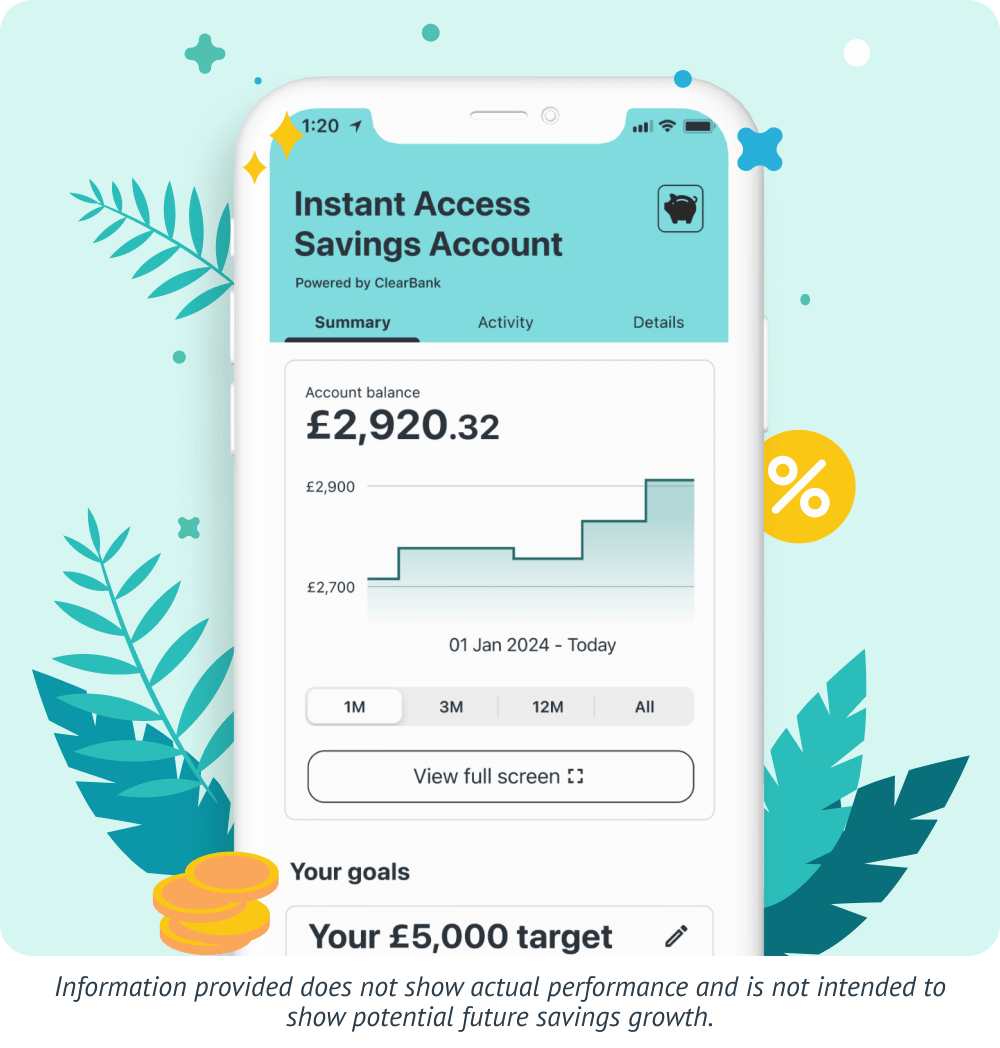

Up until now, your only option was to risk your money in the stock market with Wealthify. But now, digital wealth manager has launched an instant savings account that will pay +4.91% AER interest on deposits from £1 upwards. And there is no upper limit on deposits into the account. The instant savings account is undergoing a soft launch, though it is featured prominently on Wealthify’s website.

Interest rates

The current rate of interest is +4.91% AER. or an annual equivalent rate, which equates to a rate of +4.80% annually. The rate will be variable and will track changes in UK base rates.

Wealthify even provides a link on its website allowing users to monitor interest rates set by the Bank of England.

A deposit of £1000.00 in the account would earn £49.08 in interest over 12 months, assuming base rates remain unchanged.

The account is open to UK residents who are 18 years of age or older and are UK taxpayers.

For now, at least clients will only be able to open one instant savings account with Wealthify.

Easy access

Customers will be able to access their funds at any time without restrictions via the Wealthify website or app.

Transfers can take up to three hours to process and withdrawals will be paid into the client’s nominated bank account.

This will normally be the account from which the funds were deposited in the first instance.

Clearbank

Wealthify is not a bank and its new instant savings account is powered by ClearBank a fully regulated UK bank.

As such customer deposits will be covered by the UK FSCS, up to a value of £85,000.

ClearBank operates purely online and does not have any physical branches, nor will Wealthify customers be able to withdraw funds from their savings account via an ATM.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.