Tickmill has two demo accounts you can paper trade on. Either MT4 or CGQ, both are brilliant platforms but the demo versions leave a lot to be desired. In our Tickmill demo account review, I tell you what I like and dislike about them.

Tickmill Demo Account Reviewed

Name: Tickmill Demo Account

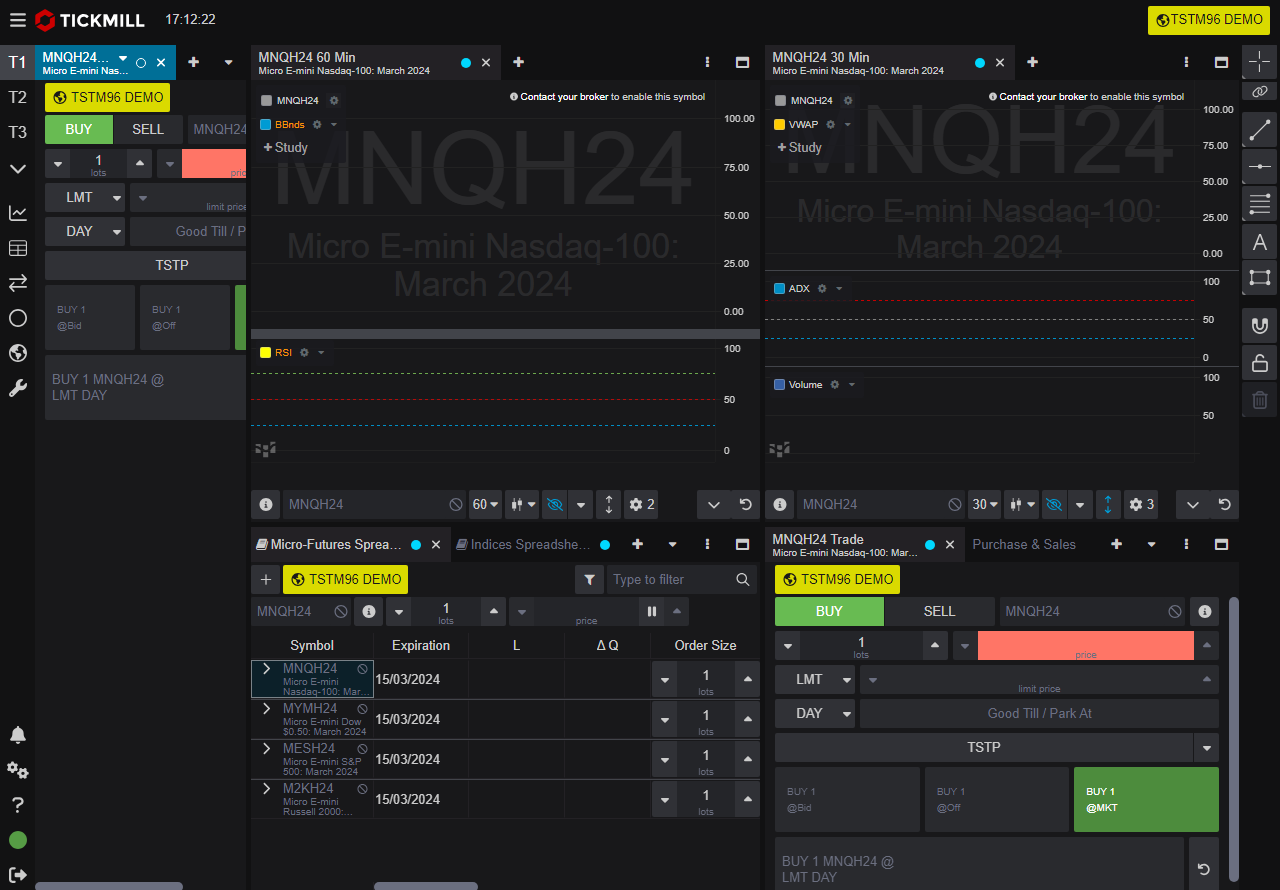

Description: Tickmill's demo account lets you trade via MT4 or CQG with up to £1m in virtual funds on 578 markets for 30 days. 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider

Are Tickmill's demo accounts any good?

No, in a word. Which is a massive shame because both CQG and MT4 are both brilliant platforms, but for some reason Tickmill’s paper trading versions are hopeless. Firstly, I’ve already tested 7 other demo accounts today so I am not going through the rigmoral of trying to set up another MT4 even though you can set your own leverage and virtual balance. So when CQG figuratively spat in my face and refused to show off its brilliance I became even more tired and irritable. CQG is an amazing trading platform. Tickmill’s live version of it is one of the best around. If you are a high-frequency retail futures trader it gives you almost institutional capabilities. But the demo refused to do anything. In summary, if you want a Tickmill demo, don’t bother, just open a real account and see what it’s really about.

Pros

- MT4 for CFDs and forex

- CQG for futures

Cons

- CQG demo not functioning

-

Pricing

(4)

-

Market Access

(2)

-

Online Platform

(2)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

3.3

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.