eToro Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

What's in this eToro review?

eToro Awards

eToro won best alternative investment platform and best cryptocurrency platform in our 2023 awards.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Overview

eToro Review

Name: eToro

Description: eToro is a social trading platform that lets their users share new and existing CFD positions and their investment portfolios. eToro was founded in 2007 in Tel Aviv, Isreal and has grown to offer investing and trading on 3,000 global assets (including real cryptocurrencies) to 30 millions users worldwide.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro a good broker?

Yes, eToro does have its flaws for experienced investors, but if you are just getting started eToro is a great introduction to financial markets. eToro is actually a very innovative trading platform offering copy trading, social networking and unleveraged CFDs.

Pros

- Really simple to use

- Social and copy-trading

- Set your own leverage

- Pre-built sector portfolios

Cons

- Can only trade and invest in USD

- No SIPPs or ISA

- No direct market access

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1Ratings Explained

- Pricing: Even though eToro is commission free there are high FX conversion fees between 1.5% and 3%. Overnight financing is also expensive for CFD positions compared to competitors.

- Market Access: For the majority of investors you can trade the most popular markets, but lacks access to small-cap stocks and exotic derivatives.

- Platform & Apps: Very good, nearly gets top marks for intuitiveness, but misses out because of no sophisticated order types

- Customer Service: No phone number available to non-premium clients, but generally quick responses to chat and email queries.

- Research & Analysis: A mixed bag here – some good social investing fees on the platform and digestible guides, but no direct actionable research.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Facts & Figures

eToro Total Markets | 2,976 |

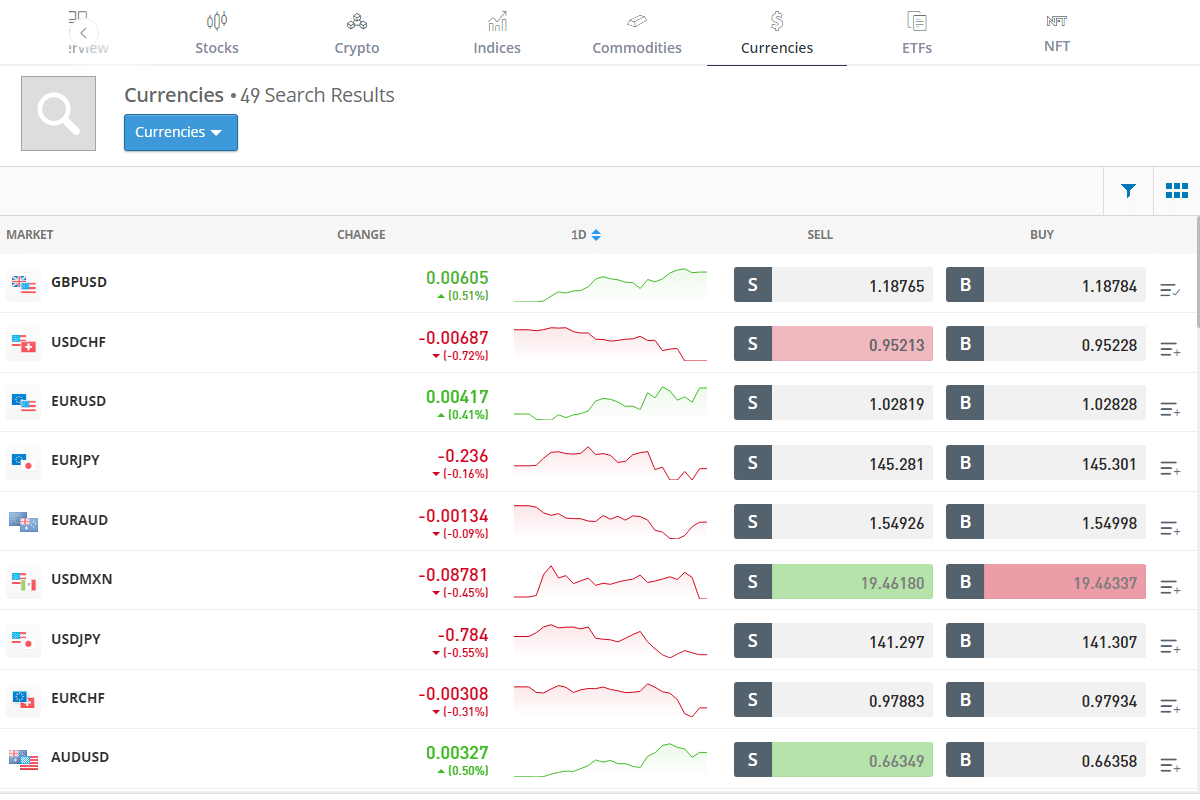

| ➡️Forex Pairs | 41 |

| ➡️Commodities | 32 |

| ➡️Indices | 13 |

| ➡️UK Stocks | 313 |

| ➡️US Stocks | 1104 |

| ➡️ETFs | 263 |

eToro Key Info | |

| 👉Number Active Clients | Over 1.5m |

| 💰Minimum Deposit | $50 |

| ❔Inactivity Fee | $10 per month |

| 📅Founded | 2006 |

| ℹ️ Public Company | ❌ |

eToro Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ✔️ |

eToro Average Fees | |

| ➡️FTSE 100 | 1.5 |

| ➡️DAX 30 | 2 |

| ➡️DJIA | 6 |

| ➡️NASDAQ | 2.4 |

| ➡️S&P 500 | 0.75 |

| ➡️EURUSD | 1 |

| ➡️GBPUSD | 2 |

| ➡️USDJPY | 1 |

| ➡️Gold | 4.5 |

| ➡️Crude Oil | 5 |

| ➡️UK Stocks | 0.09% |

| ➡️US Stocks | 0.09% |

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Video Review

In our video review we test the platform with real money and show some of the good and bad features on the eToro trading platform.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Expert Review

Ever since I sat in The Angle pub, next to the Silicone Roundabout opposite where I was a stockbroker (at Walker Cripps Weddle Beck) 15 years ago discussing the merits of eToro as a forex broker, I’ve been fascinated with their journey. I’ve interviewed the founder, the UK MD and watched (despite the industry’s loathing) as they have shrugged off the masquerade of day trading, into becoming a global investment platform sensation. In this review, I’ve tested them year after year and pontificated on what sort of customer should be using them.

In the past, I’ve been very rude about eToro, I didn’t like the way they’d gamified trading and along with Plus 500, they almost made it too easy for inexperienced traders to play the markets.

But are times changing?

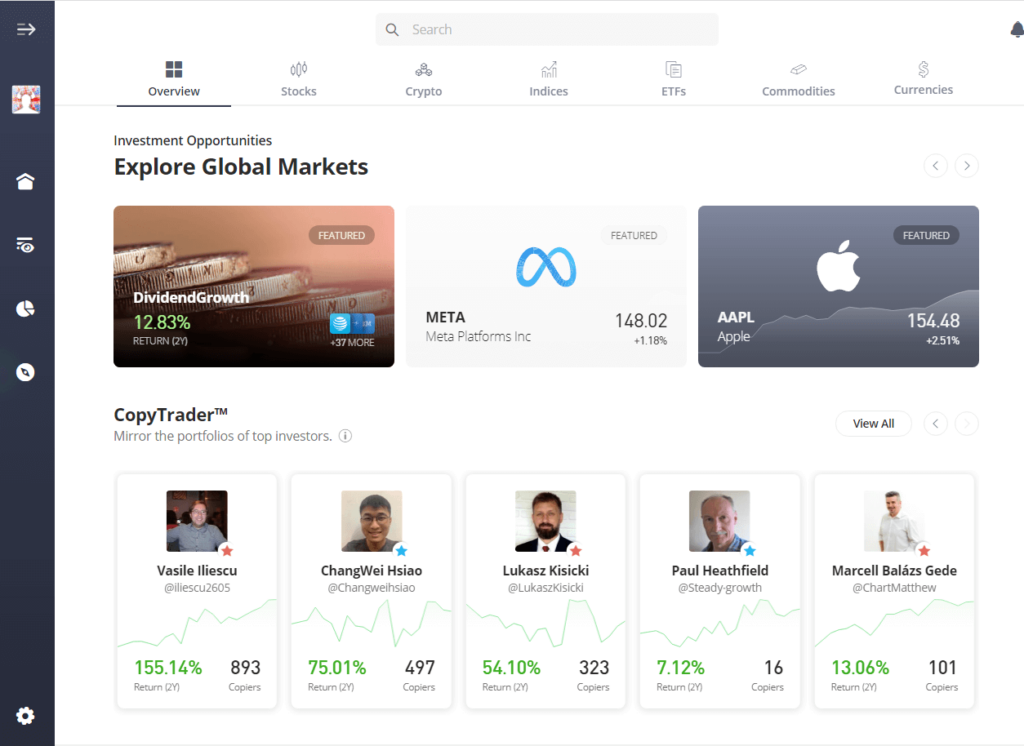

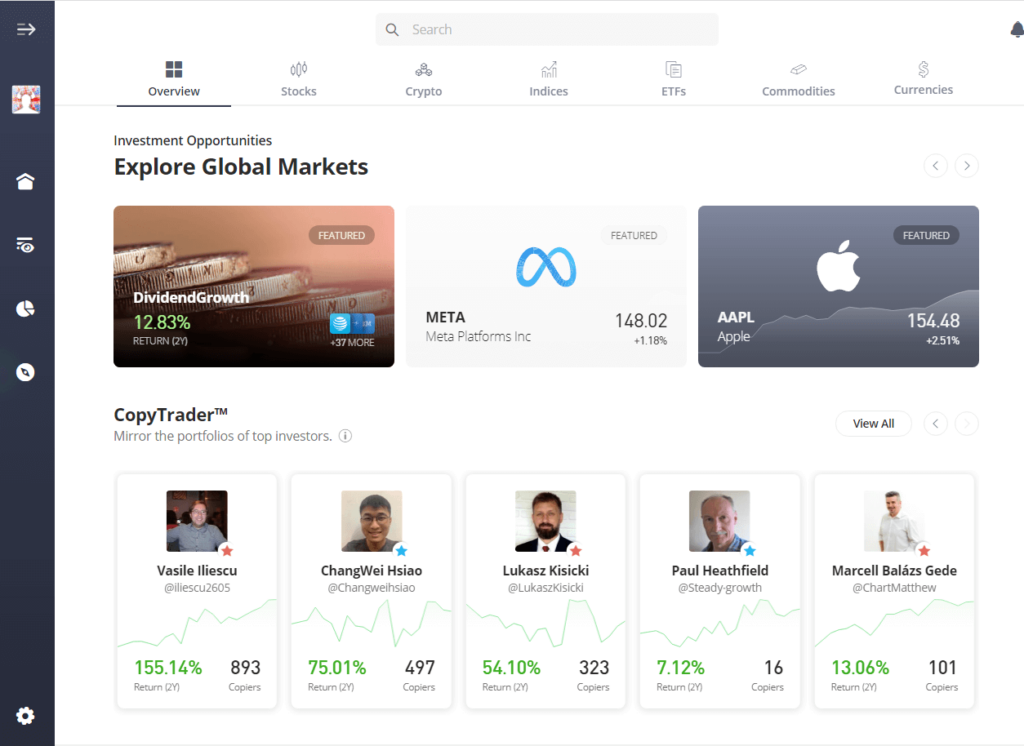

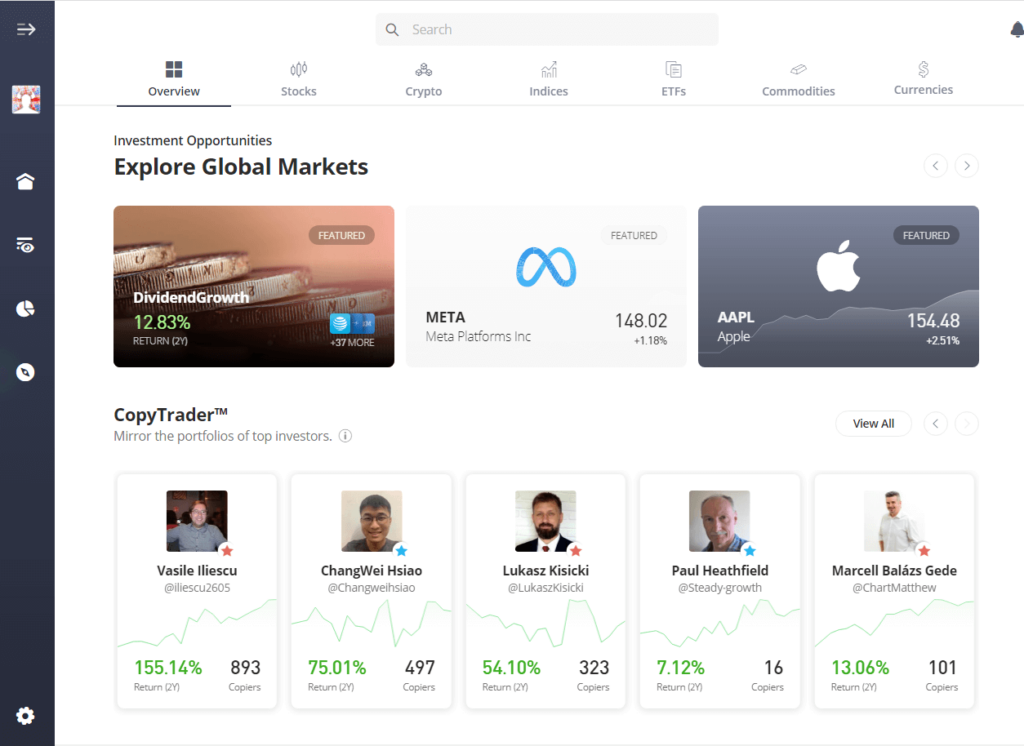

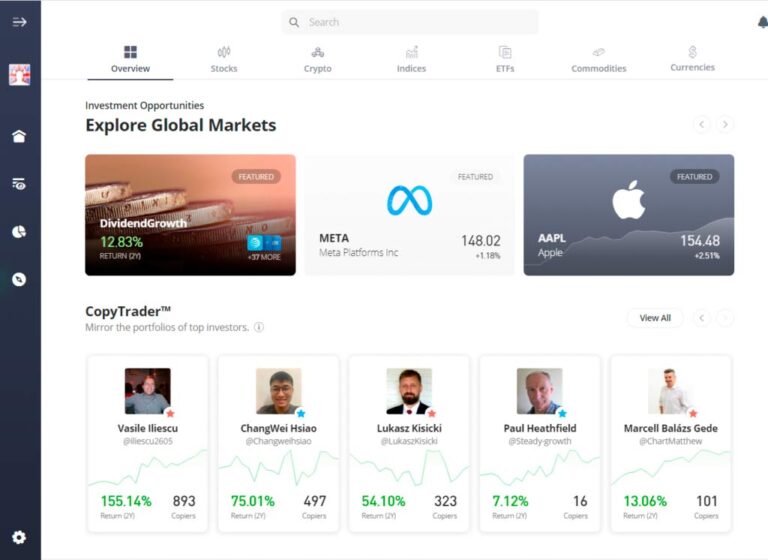

Social & Copy Trading

A while ago, we published an interview with the founder of eToro Yoni Assai, about whether or not copy trading could be a challenger to traditional fund management. Copy trading is not new, it’s been around for years, whereby investors will copy the positions of an amateur trader in the hope of making money.

I first came across the concept about 15 years ago, when traders would follow futures traders on Strategy Runner. This of course was for professional regulated advisors to make it easier to have a wider client base and helped with execution allocations. The Strategy Runner technology was later bought by MF Global before its demise. Then came MT4, again, focussing on high-risk markets, like forex and index trading.

But one thing these platforms lacked was a community.

Trading Communities

This is odd because the trading and investing community is one of the most focal out there. There are some hilarious bad pontificators and some very good ones across the entire investment landscape. Seeking Alpha, has some excellent lay contributors looking at stock fundamentals. LSE.co.uk (“London South East” and absolutely no relation to the London Stock Exchange) still have a vibrant community of share chat for UK small-cap stocks. Reddit, has it’s meme’s for pump and dump schemes, and even Saxo Markets, the professional trading platform, tried to introduce a social network for traders called tradingfloor.com where you could link your trading account and see and copy other traders. Covestor tried the concept for stocks in the US, but couldn’t make it work.

One very interesting aspect of eToro’s social trading offering is that they now have a huge amount of data from a broad range of successful investors and traders. They have packed this all together into something they call the GainersQTR smart portfolio which aggregates the investments of the best popular investors on the platform.

But eToro keeps on going from strength to strength. So what is the appeal and why do they have over 20 million users and growing?

Investing for growth

The first thing eToro is keen to point out, when I spoke to the newly appointed UK MD, Dan Moczulski, is that eToro is not a trading platform anymore, they want to be an investing platform. I’ve known Dan for years, he knows the markets and the technology inside out and is well respected within the industry. So I spent an hour with Dan on Zoom, whilst he explained what eToro was all about and where they want to go.

When you execute a trade, unlike other trading platforms where max leverage is automatically given, the default leverage setting on stocks is zero, you can opt for more if you want. However, even though eToro buys the stock in the underlying market, you don’t get voting rights, can’t transfer the stock out, but you do receive your entire dividend entitlement (after it’s been taxed at source). For index and forex trading, though it reverts to form and leverage is set at 20x for indices like the FTSE and 30x for Forex pairs like EURUSD.

Day trading

eToro is not very good for day trading. For a few reaons, the main one being they don’t want to be. My mate Dan, the UK eToro MD told me that they want to be an investing platform rather than a trading platform. He was actually quite put out that we’d included eToro in the trading section, rather than the investing category.

But, whilst I still think there are better options for longer-term investors (although their copy trading track record is doing very well), I don’t think eToro is any good for day trading. There isn’t enough order functionality like, algos, DMA, OCOs, or even limit entry orders. Prices, even though they mimic the bid/offer cannot be tightened up with DMA access. Yes, there is an opportunity to take intra-day positions on indices and forex pairs, but it just doesn’t “feel” like a day trading platform to me.

Brokers like IG, CMC Markets, and City Index are much better for short-term trading. You can compare what we think are the best day trading platforms here, and see how eToro fits in.

Diversfication

But they say, that what they are actually trying to promote is diversification in portfolios by giving new investors the tools to explore the markets. One way they try and do this is through fractional shares and the way people buy stocks. They say they want to give people the opporuntiy to buy lots of little amounts of lots of different stocks (encouraging diversification), If you have £1,000 to invest, you can buy £100 of 10 shares instead of having to figure out how many shares of company A, B & C equates to £100, if at all.

USD account balances

One thing though, that has always irked me about eToro and one of the reasons I’ve classified it as a trading platform rather than investing account is that all trades are settled in USD. In my mind, they fall at the first hurdle as an investment platform, because, how can you have an investing account where you don’t actually own stocks, you can’t invest in an ISA, there are no SIPPs and you are hit with dreaded foreign exchange fees on every trade you make. All those things are key to an investment account.

But, Dan was quite keen to explain why this was the case. It’s a one size fits all solution. If they want to offer free trading, they have to keep things as simple as possible and using USD as a default currency solves two issues.

One, USD is a global currency and most of the trades on the platforms would be settled in USD anyway, even in the UK.

Does zero commission equal zero costs?

The second issue is how they make money when they have zero commission. eToro makes money on foreign exchange (roughly 0.5% per trade) and they make money from withdrawal fees. There are also some stocks that are not zero commission and CFDs are exempt where eToro makes money on the bid/offer spread. Zero commission may be a loss leader of sorts in the UK, as whilst they earn 0.5% in conversion fees, they lose

As an eToro trader you used to be able to offset that FX charge, because if you ought UK shares, you were not charged stamp duty. But eToro has recently announced that they will no longer be absorbing the stamp duty tax. eToro said they absorbed this as part of their simplicity and low-cost model. But unfortunately, that is no longer the case.

Essentially, you get what you pay for and if you want all this for free you have to compromise on something, which is everything being dealt in USD.

20 Million Users

Perhaps, eToro’s most valuable asset is its client base. 20 million users, all with differing opinions and sentiment. Afterall, that’s what makes market. Opinion, it drives buy and it drives sellers. When more people buy the market goes up, and viceversa.

eToro has built a community of almost 20 million accounts, traders or investors. And when you open up the platform it definitely has more of a social media platform instead of a trading platform.

There are two types of community.

The first is the opinion-based, where the feed is populated with the latest views from eToro clients.

The second is copy trading. You can copy anyone you want (as long as their account settings permit it). Or you can copy what eToro call “Popular Investors”, these are investors who have applied to join eToro’s copytrader platform and aim to earn money from it.

Popular investors

Popular investors can earn up to 1.5% of AUC (assets under copy), or however much money other investors on the platform have chosen to allocate to copy their portfolios. However, eToro is keen to point out that once you have $15,000 copying your trades, you are vetted (not endorsed) by eToro and have to stick within risk parameters. Otherwise it would become a scammers paradise.

The thing about investing is that it’s actually quite easy, any fund manager will tell you that the key is to do your research, buy some good stocks, and then do nothing for a very long time. So as long as you do your research and pick some good investors to follow, who are following the same principle then you “should be ok”. BUT, fund managers have oversight, they have compliance officers and risk committees, so they can’t just change their mind about how and what they invest in. Of course, with some notable exceptions, cough, cough Woodford.

When you look at a potential trader to copy, you can see their trading history, their risk parameters and also what they are invested in. Which if nothing else is a good place to start building a portfolio, because you can see where the best performing investors are putting their money. Which is actually a good strategy in the fund management world as well. Morningstar for instance shows the top ten holdings a fund holds. Take a look at Blue Whale for example, you can see what they are invested in and either copy them by buying the fund, or just buy the top ten stocks they hold in your own investment account. If you want to know how fund managers actually invest we have a couple of good interviews with Stephen Yui from Blue Whale and Jamie Ross from Henderson.

If you don’t know which unregulated amateur traders to follow, you have the option to buy a portfolio of aggregated “Popular Investors” diversifying your risk further, or can opt for a smart portfolio that has been put together by a professional investment firm.

Or if you want exposure to sectors there are Thematic funds, like, for instance, if you want to invest in the Metaverse, which is a hot topic right now. eToro have a selection of what they call Smart Portfolios, where they have selected stocks relevant to sectors, a bit like buying ETFs. So if you want to invest in the Metaverse, but don’t know where to start the MetaverseLife Smart Portfolio contains a basket of stocks and crypto that has exposure to the Metaverse.

Cryptocurrency

This brings me quite nicely onto Cryptocurrencies. In the UK Crypto derivatives are banned by the FCA for retail traders. If you want to invest in cryptocurrency in the UK you either have to be classified as a professional trader, or by them on a crypto-exchange or platform like eToro on a fully paid-up basis.

One thing eToro has always been really good at is being first to market with new assets, they offer quite a wide variety of cryptos compared to other regulated fintechs, but also vet which cryptos they add by demand, liquidity, the tech behind them and also overall due diligence. Cryptocurrencies are too big to ignore and accounted for roughly 73% of eToro’s commission during the second half of 2021. So you can’t trade crypto derivatives, but you can invest in them with eToro, you can buy them, sell them and transfer them out to an external wallet with eToro money.

Customer Service

If you are one of the masses, customer service can be a bit of a pain, there is no telephone helpline and the support enquiries that we have made have generally taken a day or so to be responded to.

But with 20 million customers, a great proportion, who are no doubt beginners that is no surprise. If you have enough money on account ($25k upwards), you do get access to a dedicated desk of dealers in Europe and Canary Wharf.

So, who is eToro for?

So if you are a small trader, eToro does offer a very innovative way to access the financial markets. It’s quite jolly on the social media feed on the platform, and it is what it is. This is what people want, obviously, as they have 20 million customers. The largest incumbents still have only hundreds of thousands in the UK and in the US a few million.

The key difference between investing in trading, is that investing is a long-term thing, trading is speculation for short-term profits.

However, even though eToro may be positioning itself as an investment platform rather than a trading platform, I’d still consider the investments on offer to be high risk, for your fun money.

I genuinely enjoyed playing with the platform and testing what was on offer. It’s game-changing, but I still think they have a long way to go before you’d allocate more than a small percentage of your overall investment portfolio with them. Your longer-term investments are in my view better off with a boring investment platform like Hargreaves Lansdown or Interactive Investors. But, it will be interesting to see how eToro matures over the years, along with their customer base.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Ways to lose money on eToro

There are four main ways you can lose money on eToro, making bad investment decisions, trading with leverage, overnight financing fees, FX conversion fees and currency exposure. I’ll explain a little about each, and how you lose money because of them.

Bad investments

The most obvious way you can lose money on eToro is to make bad investment decisions. eToro is an execution-only broker and not regulated to give you advice on what to invest in so you must choose your own investments. One of the most common investments, particularly for new investors is the S&P 500. Mainly because of social media, and the mighty Warren Buffett being endlessly quoted saying that most investors should just buy an SPX tracker and be done with it.

But, even though the S&P 500 has had a stratospheric +3,000% rise since inception there are many moments when you would have lost money. For example, if you invest on the 21st Feb 2020, by the 30th of March you would have lost, nearly 40%! A bad month for anyone.

Trading on leverage

In the UK, the FCA requires that all CFD brokers display the percentage of their clients that lose money. We keep a record of the risk warning percentages here. It is no secret that people lose money trading CFDs, and the figure across various trading platforms range from around 50% to 85%.

So by trading CFDs with leverage on eToro, there is a very high percentage chance that you will lose money.

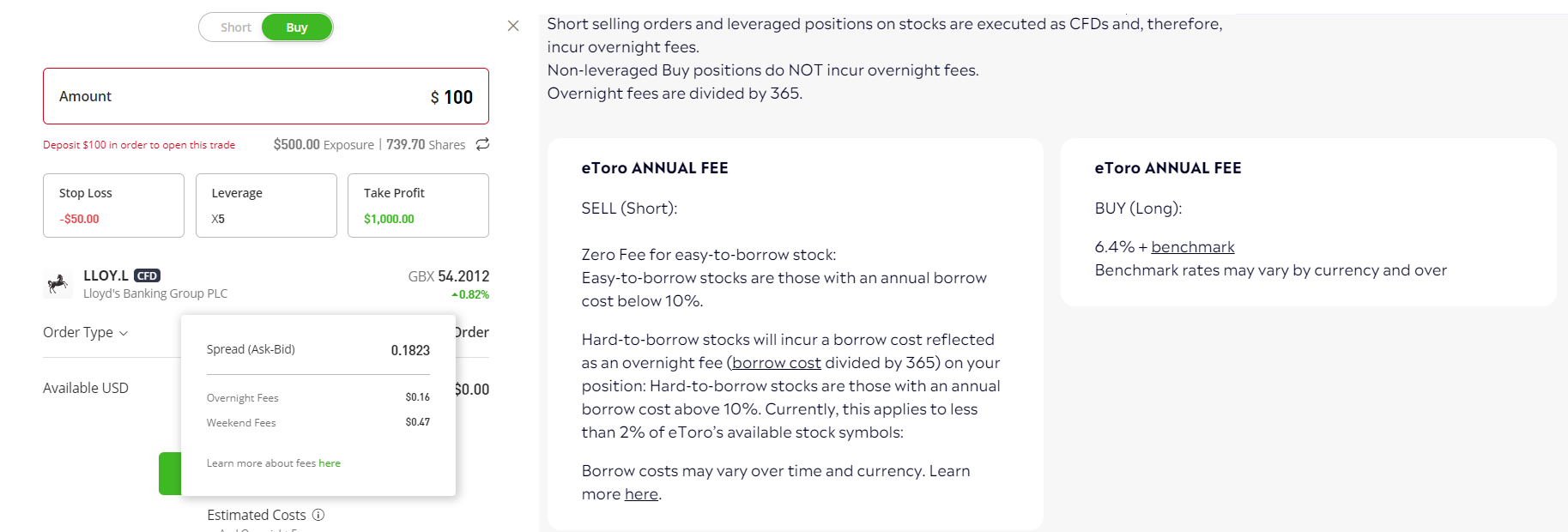

Overnight financing rates

If you trade with leverage you also have to pay overnight funding for keeping a position open longer than intra-day. This is because if you are trading on margin your broker is essentially lending you money to get more exposure than buying a stock outright.

For example, if you trade Lloyds shares with leverage, you can put down $100 to trade $500 worth of stock. For this you will be charged $0.16 every weekday and $0.49 on the weekend. So if you keep the position open in the long term you will lose a lot in overnight fees. Also, eToro charges a staggering 6.4% over the benchmark which is a lot more than most other CFD brokers, 2.5% over/under SONIA is fairly industry standard. Plus, you don’t earn money on short positions, so if you hold a short position you are losing money owed to as opposed to using a broker that pays interest on short positions.

FX conversion fees

Every time you deposit GBP into your eToro account you have to change it to USD. This is one of the most annoying things about eToro and one reason, they score quite low as an investment platform. I’ll go into more detail when I talk about currency exposure next, but essentially, you are losing 1.5% of your money every time you convert GBP into USD, you also lose another 1.5% when you withdraw it. Although you can deposit for free if you have an eToro Money Account, but this is a separate app.

Currency exposure

You can also lose money on eToro due to currency exposure, as you are only allowed to trade and invest in USD.

Let’s say for example you want to invest in Lloyds shares, which are priced in GBP on the London Stock Exchange. To do that through eToro you first of all have to convert your GBP into USD, so you lose money there, but I’ve already discussed that.

In this example, we’ll say we are going to buy $10,000 worth of Lloyds shares.

Now, if the price of Lloyds shares goes up by 5% that $10,000 is going to be worth $10,500.

However, if the GBPUSD exchange rate moves against you and is now 1.2575 that $10,500 is only worth £8,349 instead of £8,416 if the rate had stayed at 1.2475

If you had been able to invest in a GBP-denominated stock, in GBP rather than USD you wouldn’t have lost that difference.

Obviously, the reverse is also true, if the rate moves in your favour you can be better off.

How to make money on eToro

There are four ways to make money on eToro. You can either buy investments, short the market with CFDs, copy another investor portfolio or become a popular investor. In this guide, I’ll explain what each one is, their pros and cons and how you can profit from them.

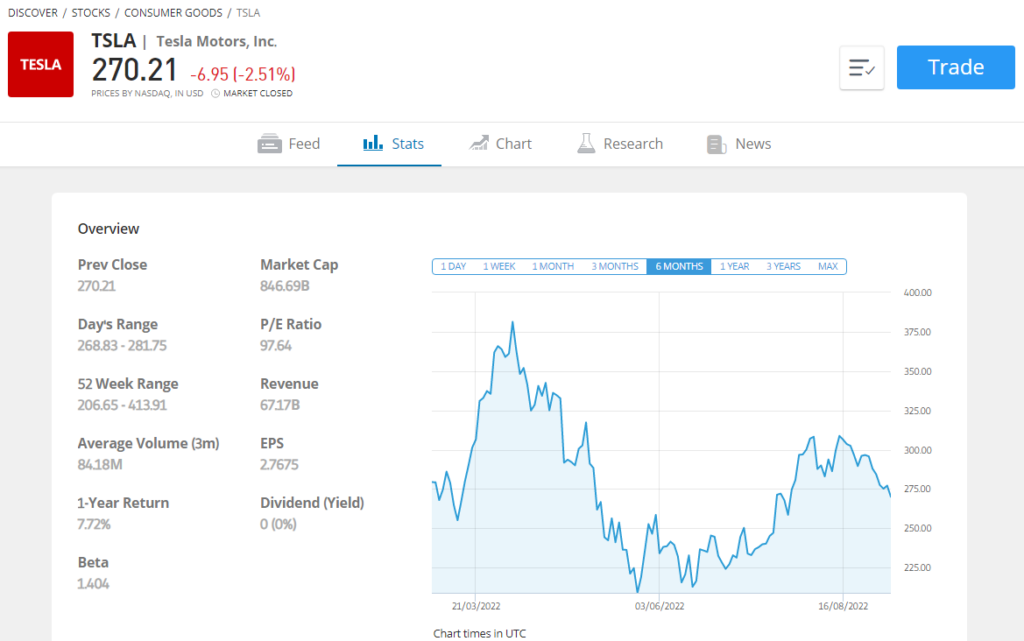

#1 Buying investments

This is the the most common way people try and make money on eToro. If you think that a share price will go up you can buy shares in a range of over 3,000 stocks from 17 stock exchanges. The most popular stocks that people invest in are the main market US stocks that everyone has heard of like Tesla and Netflix.

One good thing about buying shares with eToro is that they are commission-free, but they are not completely free. For UK investors you have to pay stamp duty (0.5%), you also get charged when you deposit GBP into your account (0.5%) and are also charged if you withdraw your money ($5).

You can also try and make money from buying shares on eToro if you do not have a lot of money to invest as you can buy a fraction of a share. So instead of buying 1 Tesla share for $263 (as of 11/10/23) you can buy $100 of Tesla shares. This can help you diversify your portfolio and reduce your risk. The old saying, “don’t keep all your eggs in one basket” applies here.

⚠️However, on the downside, it is hard to make money investing in single stocks as prices are volatile. So if you time the market wrong you will lose money.

Another way to make money investing with eToro is to buy an ETF like the VUSA Vanguard ETF (LON:VUSA) which tracks the price of the S&P 500. These are the 500 biggest stocks in the US. Over the past 5 years the S&P 500 index is up around 57%. But beware, over the last month the index is down nearly 3%. So if you are considering investing you should take a long-term view, rather than trying to make money in the short term. It is not possible to make money quickly on eToro without being a professional trader, and even then not guaranteed.

⚠️Warning – as with all investing – past performance is no indication of future returns. When you invest your capital is at risk.

- Related guide: How to invest in the S&P 500

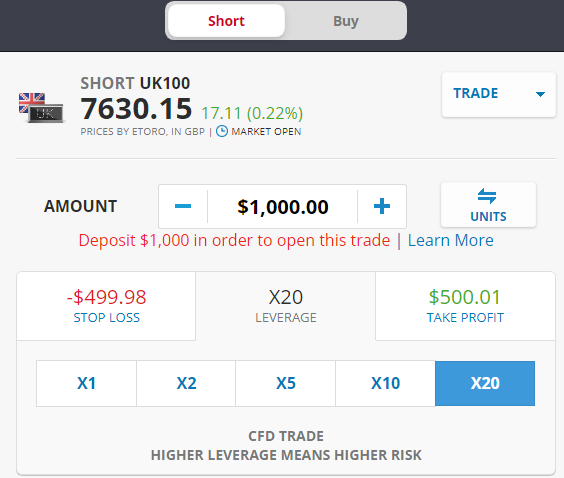

#2 Shorting the market

You can make money on eToro when the market goes down by shorting stocks, indices, or commodities with CFDs. CFDs are contracts for difference, where your profit or loss is based on the opening and closing price of a trade. But in practice, it is the same as buying or selling stocks. For instance, if you wanted to buy Lloyds shares, if you were investing in physical stock you would buy 10,000 shares, and to get an equivalent CFD position you would buy 10,000 CFDs.

The main advantage of CFDs is that you can sell stocks without owning them and profit when their share prices go down. You also don’t pay stamp duty (saving 0.5%) when you buy the shares back and you can trade on leverage, which means you can buy £5,000 worth of shares with only £2,500 on account.

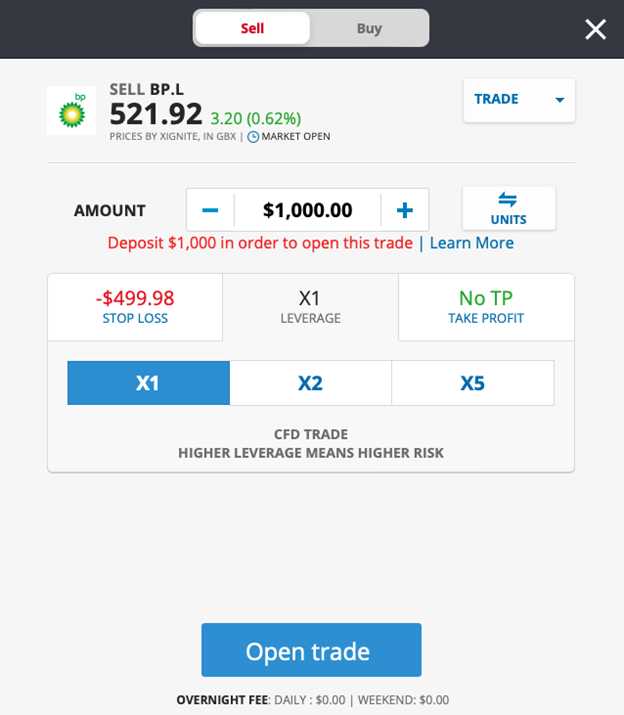

If you want to reduce your risk eToro actually lets you reduce your margin rates. This is particularly good if you are hedging your portfolio by shorting the market. Say, for example, you have a portfolio of $1,000 of UK-listed stocks, and think the market will go down in the short term, but don’t want to close your positions. You can sell $1,000 worth of the FTSE (the index that tracks the 100 biggest companies on the UK stock market).

⚠️Risk Warning: Trading with leverage involves high risk!

In this scenario, you can make money when the market goes down and that will offset the losses from your portfolio. You can also set your leverage from either 1x (if you want to be fully hedged with cash) or 20x if you want to free up your risk capital to be used elsewhere as you’ll only need $50 to open the position.

⚠️There are two significant disadvantages when using CFDs though. The first is that because you are trading on margin, the risks of loss are multiplied. Plus, if the market continues to go up, you will lose money if you are not long underlying stocks. Or if you are short the market on CFDs to hedge a long portfolio, you won’t make money on your investments because you will be losing on your CFD positions.

⚠️Final warning on shorting, with shorting you only make money if the market goes down, so if it goes up you will lose money. If you have a professional trading account with no negative balance protection, your losses could be unlimited.

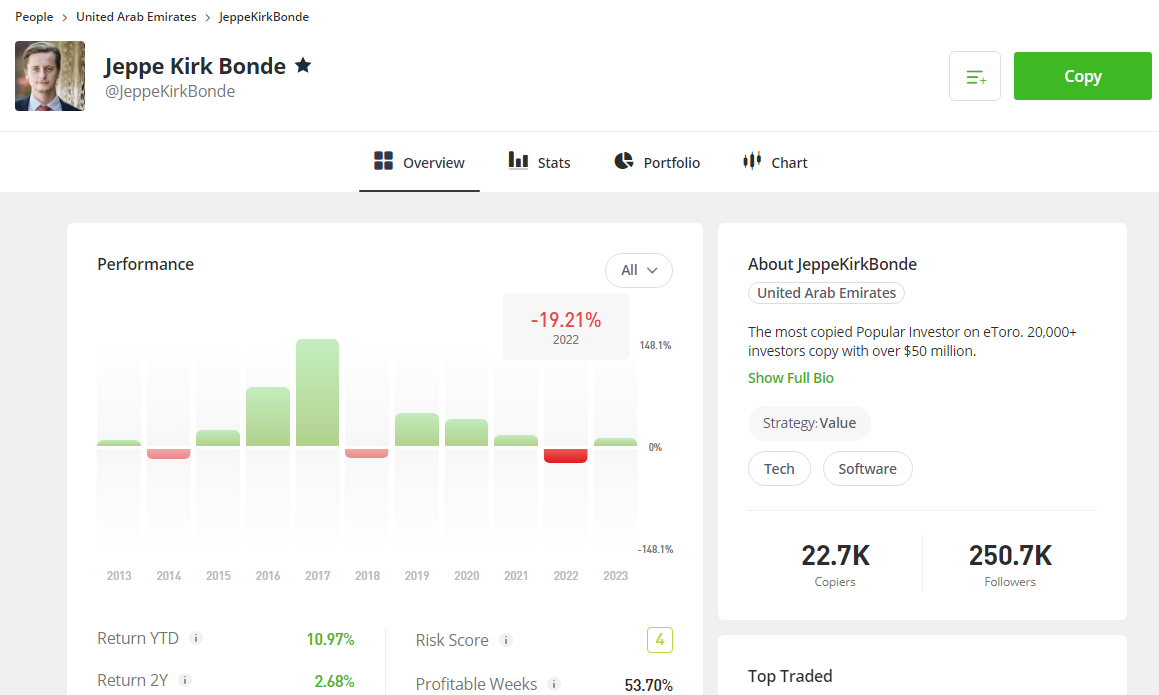

#3 Copying other investors’ portfolios

One of the main selling points of eToro and what draws many new clients in is the ability to make money by following other people’s portfolios. I was listening to a great podcast from Jeppe Kirk whose eToro portfolio has made on average 25% a year over the past 10 years. So if you had followed him and copied his trades from the beginning you would have made pretty decent money.

But making money from social trading on eToro is just as hard as picking stocks. Historical performance is no guarantee of future results. For instance, even though his portfolio has done well over the last 10 years on average, if you had followed him during 2022 you would have lost 19% of your money. This is slightly more than if you had invested in the S&P 500 which was only down 18.01%.

Also in 2021, the S&P returned 28%, whereas his portfolio only returned 15%.

Plus, the S&P 500 is an index run but Standard and Poors, a huge institution. The most popular S&P ETFs like the SPDR S&P 500 ETF (SPY) are managed by State Street Advisors, one of the largest asset managers in the world that looks after $3.8 trillion in assets.

What happens if a trader you are following loses interest, or changes tactics? I know who I’d rather invest my money with…

⚠️ Be careful here too, if a popular investor starts losing money, so will you! You will copy their losing trades and portfolios as well.

#4 Become a popular investor and make money from your followers

The final way to make money on eToro is be become a popular trader like Jeppe Kirk and make money when people copy your portfolio (as well as from your own investments).

However, not anyone can become a popular trader. When I interviewed an old friend of mine Daniel Moczulski the UK eToro, Managing Director, he told me that they put a lot of effort into ensuring that popular traders are vetted and have a solid track record before people can copy their traders.

Using Jeppe as an example again, you can see from his profile above that he has over $50m and 22,000 traders copying his portfolio. That is a huge responsibility for an unregulated individual, especially as $50m is actually bigger than some regulated funds.

To make money as a popular trader on eToro you need to get qualified as a “Cadet” by being active on eToro for more than two months, setting out your strategy, having a visible profile, and not losing money. Once you have progressed to a “Champion” you can start to earn up to $500 a month from your followers (based on how much money is following you). But the real money-making ability comes from being a popular trader on eToro comes when you are classified as an “Elite” investor where you can earn up to 1.5% a month of annual AUC (accounts under copy).

⚠️Keep in mind that it’s also possible to lose money as a popular investor. If you are investing do become a profitable trader and you don’t pick winning investments will lose money and your capital will be at risk.

If Jeppe Kirk has $50m following him then he should be earning $1m a year from his eToro copiers…

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro’s smart portfolio capital-guaranteed investment adds Tactical-Edge

eToro also offered investors access to capital-guaranteed upside-only social trading when they invested in the firm’s @Tactical-Edge smart portfolio. The 100% capital guarantee, effectively means investors can’t lose if they hold the position until the 30th June 2026. If the portfolio goes into the red eToro absorbs any losses made by the Tactical BigTech Exposure smart portfolio, and clients get to keep any profits the fund makes on their investment.

The portfolio tends to change each year.

What is the Tactical-Edge smart portfolio?

The Tactical-Edge Capital Guarantee Smart Portfolio covers key sectors like cloud computing, AI, e-commerce, and semiconductors, investing in bonds from leading companies that drive industry futures and the US Government.

The current Tactical BigTech Exposure includes two ETFs managed by iShares:

- iShares $ Treasury Bond 0-1yr UCITS ETF (20.05 of the portfolio)

- iShares iBonds Dec 2026 Term $ Corp UCITS ETF (79.95% of the portfolio)

Previous eToro 100% capital guarantee offers

The last offer was the GainersQTR smart portfolio that copies the investments made by various traders across the eToro platform.

The decision of which traders and trades to follow is made algorithmically by looking at active, high-quality traders with solid track records. A machine learning program then sifts that list of traders to produce a short list of the very best most consistent traders to follow.

GainersQTR has performed very well recently, up 21.33% in 2023 and up 8.76% in 2024 so far, although it did have a bad year in 2022 and was down 8.31%.

It’s important to note though that past performance is absolutely no indication of future results.

What are capital-guaranteed investments?

Capital-guaranteed and upside-only products are nothing new, I helped to structure and sell similar products myself twenty years ago.

eToro doesn’t break down the mechanics behind the new capital-guaranteed investment product, and I am not sure how that complies with the FCA’s new consumer duty rules but that is another conversation.

However, reading between the lines, it looks as though it’s based on a strategy of dynamically hedging the portfolio’s underlying exposure, most likely using a derivatives overlay.

Effectively that would mean the more money that the GainersQTR smart portfolio makes for investors in the scheme, the more hedging of its exposure eToro will need to do.

However, if the GainersQTR smart portfolio doesn’t produce positive returns, then eToro doesn’t need to hedge its exposure as much, or perhaps even at all.

What’s the catch?

Well firstly there is a minimum investment amount of $10,000 and then there is a lockup period that extends to 30th June 2026.

Looking at the terms and conditions associated with the product investors can opt-out by unfollowing the traders the Tactical Edge smart portfolio is tracking, but doing that will negate the capital guarantee.

The other thing to consider is that by investing in this product you are taking on eToro’s counterparty risk. If you are an existing margin trading client of the broker then you are doing that already.

However for new investors that might be an additional consideration, particularly if you invest a sum larger than the UK FSCS insurance limit of £85,000. The upside limit for individual investments in the capital-guaranteed product is $2.0 million.

If you invest in this product you are effectively buying into the wisdom of the crowds in the belief that the leading traders on the eToro platform can continue their positive track record and if they can’t, that others can take their place.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Shorting stocks on eToro

One of the big advantages of eToro is that the platform allows you to trade stocks in both directions. Not only can you take ‘long’ positions in order to profit from rising share prices, but you can also take ‘short’ positions in order to capitalise on falling share prices. If you are interested in shorting stocks on eToro? This guide covers everything you need to know.

How to short stocks on eToro

Shorting stocks on eToro is a relatively straightforward process. Here are the steps involved.

- Login to the platform and fund your account.

- Search for the stock you wish to short and then select ‘Trade’.

- Select SELL.

- Enter the amount of money you wish to trade on the stock or the number of units of stock you wish to trade.

- Set the stop loss and take profit parameters.

- Select the amount of leverage you wish to use (1X, 2X, etc.)

- Select ‘Open Trade’.

What is shorting?

Shorting (also known as ‘short selling’ or ‘going short’) is a trading strategy that aims to profit from a decline in a security’s price. An advanced strategy that’s typically undertaken by sophisticated investors (e.g. hedge funds), it involves betting against stocks and other securities in the hope that their prices will fall.

You can think of short selling as the opposite of regular investing. Whereas regular ‘long’ investors profit from rising share prices, those going short profit from falling share prices.

- Related Guide: Best Brokers For Shorting Stocks

How shorting stocks works on eToro

Traditionally, in order to short a stock, you had to borrow it from a broker and then sell it on the open market. The idea was that if the stock’s price fell, you could buy it back at the lower price, return it to the broker, and pocket the difference between the price it was sold for and the price it was bought back for.

This is not how shorting on eToro works, however. With eToro, the main way to go short is via Contracts for Difference (CFDs). CFDs are financial instruments that enable you to profit from a security’s price movements without owning the security itself. With these financial instruments, you can trade securities in both directions and use leverage to increase your exposure.

It’s worth noting, however, that there are a few other ways you can go short on eToro. One way is through ‘inverse’ exchange-traded funds (ETFs) such as the ProShares Short QQQ ETF. This aims to profit from a decline in the QQQ ETF, which tracks the Nasdaq 100 index. eToro also offers the ‘Short-ETFs’ Smart Portfolio. This comprises short positions on major global ETFs meaning its value is likely to rise if the prices of the ETFs fall.

What securities can you short on eToro?

It’s possible to short a wide range of securities on eToro including:

- Stocks (Apple, Lloyds, Tesla, BP, etc.)

- Indices (FTSE 100, S&P 500, Nasdaq 100, etc.)

- Commodities (oil, gold, copper, etc.)

- Exchange-traded funds (Vanguard S&P 500 ETF, iShares Core MSCI World UCITS ETF, etc.)

- Currencies (GBP/USD, AUD/USD, etc.)

What are the benefits of shorting stocks on eToro?

The ability to go short can be valuable at times.

For a start, shorting allows you to benefit from a decline in a security’s price. This can be valuable if you believe the security is overvalued or its fundamentals are deteriorating.

Shorting can also allow you to hedge against market weakness. For example, if you believe the market is set to fall, you could open some short positions to protect your portfolio.

What are the risks of shorting stocks on eToro?

Investors need to be careful when shorting stocks as it’s a risky strategy.

If you short a stock and its price rises, you are going to generate a loss. And losses can be significant. While a stock can only fall to zero, there is no theoretical limit to how high it can go.

One big risk short sellers face is short squeezes. A short squeeze occurs when sentiment towards a heavily-shorted stock improves, and short sellers rush to close their positions. This can push the stock’s price up substantially, resulting in large losses for those with short positions.

What are the costs of shorting stocks on eToro?

eToro offers commission-free trading. However, there are several hidden fees to be aware of when shorting stocks on the platform. These include:

- Trading spreads (the difference between the cost to buy and the cost to sell a security).

- Overnight or ‘rollover’ fees. These may apply if you hold a CFD position overnight.

- FX conversion fees. On eToro, all trades have to be made in USD.

eToro also charges a $5 withdrawal fee.

Shorting on eToro summary

- Shorting is a trading strategy that aims to profit from a decline in a security’s price.

- You can short a range of securities on eToro including stocks, indices, ETFs, and commodities.

- Traders should be aware of the risks involved in shorting.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

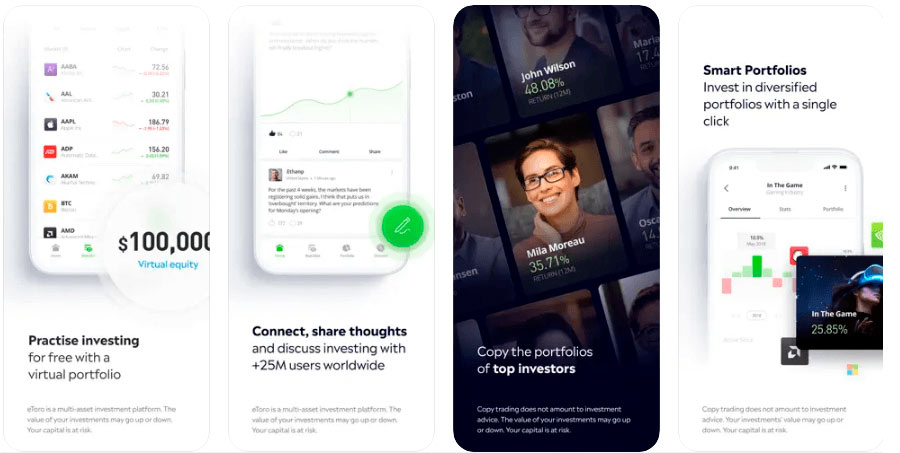

Is eToro good for beginners?

Yes, eToro is good for beginners as the platform is really simple and they offer access to the most popular and trending investment. but there are also some downsides and significant risks for those new to investing. In this guide, I’ll go through why eToro is good for beginner traders, why it’s not, and also what better options there are for new investors. I’ve covered in my main eToro review what I like and dislike about eToro and if the trading platform is good, which is based on my experiences using the platform and interviews with founder and CEO Yoni Assia and UK MD Dan Moczulski, but here, I’ll focus on if they are right for beginners.

Is eToro is safe for beginners to invest on?

Yes, eToro is good for beginners to invest as they are regulated by the FCA (Financial Conduct Authority) which means they have to treat customers fairly and make sure their investments are safe.

eToro is legit and there is also no doubt that with over 20 million customers signed up, eToro are too big to ignore and are certainly giving people what they want. If you look at the trading and investing industry eToro have out-marketed and out-advertised even some of the best trading platforms, particularly for new traders and investors taking their first step into financial speculation.

Here are a few reasons why eToro is good for beginners:

Very easy to use

Part of eToro’s genius is simplifying a very complex subject. They have won business by making it easy to open an account, and the trading platform and app are both very simple to use compared to some of the more established investing platforms like Hargraves Lansdown and trading platforms like City Index. For example, when you buy stocks, there are no technical analysis tools on the charts, the research tab is fairly basic, just showing the key financial performance indicators, and the news flow links out to third parties with minimal integration.

- Ready to start investing? Compare the best UK investment platforms’ pricing and market access

There is also an emphasis on buying a certain amount of a stock, instead of the traditional number of shares, which reduces the number of calculations new traders need to make before executing a trade.

Access to popular markets

eToro actually offers some of the fewest markets to trade, with just under 3,000 (compared to IG’s 17,000) stocks, indices and commodities available to buy and sell. But, the markets they do offer are the most popular as most beginner investors focus mainly on FAANG stocks with the most news flow. They also provide investing in cryptocurrency, although not cryptocurrency derivatives like CFDs or spread betting, which are only available to professional traders in the UK.

Trading ideas

The social aspect and feed allow beginners to see what stocks and investments other people on the eToro platform are discussing. The copy trading feature means that if you find a particular trader’s portfolio interesting, you can opt to copy it and their future traders. It makes building up a diverse portfolio of positions easier as you don’t have to pick your investments yourself. But, and this is a big but, it’s important to note that most people on the eToro platform are amateur investors, and most profitable portfolios have done well because we have been in a bull market (a rising stock market). If you do not want to make your own investment decisions and want to invest in the long term, you are better off buying a fund run by a properly regulated fund manager which you can do so through these fund supermarkets.

- Related guide: How to make money on eToro.

Set your own leverage

Even though eToro claim that less than 5% of their business last year was done on CFDs (probably because everyone was investing in crypto), they still offer contracts for difference (CFDs). But, CFDs are a very risky and complex trading tool and only suitable for experienced investors as around 76% of retail investors (private clients) lose money when trading CFDs on eToro. But there are advantages to CFDs, such as the ability to short stocks and profit from when they go down as well as up, which can help you hedge your longer-term positions if you think the market will dip or if you think the market is overvalued.

Most of the major CFD brokers in the UK, automatically give you maximin leverage, but with eToro, you are by default given zero leverage, and it is up to you if you want to increase this. This means that if you want to trade $1,000 of Tesla (NSADAQ:TSLA) as a CFD, you need to have $1,000 in your eToro account. But if you want to take more risk, you can set your leverage to x5 which means you can buy or short $5,000 of Tesla stock with only $1,000 on your account.

Having the leverage setting set to zero by default is good for beginners because it means that you are not automatically taking the maximum risk possible without setting it yourself.

Why eToro is bad for beginners

There are some major flaws with eToro which do not make them suitable for beginners at all. Investing and trading is not a game and should be taken very seriously, whilst eToro has gone to huge lengths to open up the markets to new investors, in some cases it is just not appropriate for people to be investing in a certain way.

- Related Guide: The Trading Game by Gary Stevenson Reviewed

No ISA account

There is no eToro ISA, which is a shame because the best way for beginners to start investing is through an ISA account. In the UK you can invest up to £20,000 in a stock and shares ISA, where the key benefit is that you do not have to pay tax on your profits. It is the first sort of account beginner investors should open as over time, if you make money a fair chunk of your profits will have to go to the tax-man. Before trading high-risk products you should consider opening a tax-efficient ISA account with on of these stock and shares ISA providers.

Only trade in USD

This is not only bad for beginners but is also bad for all eToro clients. eToro, only allow you to invest in USD so if you are based in the UK, deposit GBP into your account, then buy a UK share like Lloyds, eToro will make you convert your GBP into USD. This has two downsides; firstly, there is a fee of 0.45% to convert currency and secondly, if the USD falls in value compared to GBP you investment will be worth less.

Derivatives products

Even though eToro allows you to set your own leverage, they market heavily to new investors. As I said before CFDs are not appropriate for beginners, so having the option to switch to a leveraged CFD position on all dealing tickets puts unnecessary temptation in front of those new to the market and may not fully understand the risks involved.

Also, when you opt for more leverage, the dealing ticket doesn’t give you your full exposure, it just shows your deposit. Meaning that you are taking on more risk than you think.

- Related Guide: eToro Alternatives & Competitors

Promotion of cryptocurrency

There is no doubt that cryptocurrency has been one of the most popular investments of the last two years. eToro have said that around 75% of what people are buying and selling on it’s platform is cryptocurrency. But, cryptocurrency is one of the riskiest things to invest in is as they are highly volatile (moves around a lot) and there is no fundamental value to digital currencies, meaning in theory they could go to zero at any time.

The heavy promotion of cryptocurrency will likely end in tears for many first-timers that have taken their first steps into investing online.

- To see how eToro compares to other trading platforms you see our rankings of the best online trading apps in the UK here.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro good for long term investing?

No, I would say that eToro is not a good platform for long-term investing. There are many things that eToro is good at (like copy trading), but if you are a long-term investor there are much better options. In this guide, I’ll explain why eToro is not great for longer-term investors, and where else you should look.

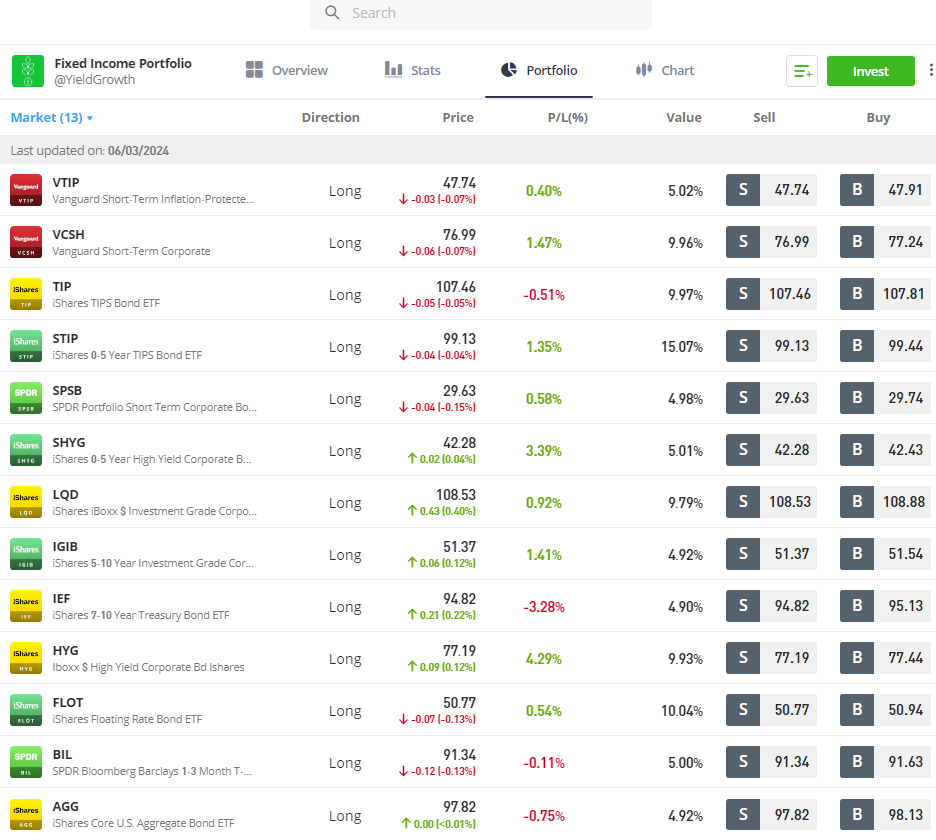

The main reasons why eToro is not good for longer-term investors are because their accounts are in USD, you can’t invest through tax-free wrappers, or into a pension and there is limited access to bonds and funds.

eToro also used to be good for long-term investors as they absorbed the stamp duty on UK shares. But now you have to pay the 0.5% UK stamp duty tax when investing in UK companies so the tax breaks are no longer there.

But as I will go on to explain if you are investing in the long term, here is why these are issues.

USD Account Balances

With eToro your account balance has to be in USD. This is part of how they make money (when they convert your GBP into USD) but it means that if you buy UK shares, then over time your profits can be eroded away by differences in the GBPUSD exchange rate.

Granted this can also work in your favour, but you’re not trading FX, you’re investing and if the exchange rate moves 5% and you have a £100,000 portfolio, that’s £5,000 lost.

No ISA or SIPP

With an ISA you can invest up to £20k a year and no pay tax on the profits. With a SIPP, you are investing for your pension and also don’t have to pay tax on your profits. But with eToro you cannot invest in an SIPP, so if you are buying shares and aim to hold them for decades, your tax bill at the end of it could be unnecessarily high.

You can of course invest in an eToro ISA in partnership with Moneyfarm. But Moneyfarm doesn’t let you invest in individual stocks, it’s more of a managed robo-advisor, so you may as well just open a separate account with Moneyfar, it will at least help you resist the temptation to speculate with your long-term investments.

- Related guide: How to make money on eToro.

No funds, corporate bonds or small-caps

eToro is great at giving investors access to popular markets like US stocks, cryptocurrency and commodities, but their market access is actually pretty limited. You can’t invest in small-cap growth stocks in the UK for example.

Plus if you are building a long-term portfolio it should be diverse so you should add in some corporate bonds (fixed-income investments) and some funds that spread the risk and invest in lots of shares and bonds for you.

This is a shame really, because eToro generally does give people what they want. However, it would be great if they could focus a bit more on what people need.

However, eToro does let you invest in bonds through bond ETFs or fixed-income portfolios like YieldGrowth which contains a range of 13 bonds from Vanguard, iShares and SPDR.

eToto altneratives for longter-term investing

If you are investing in the long run, below is a comparison of UK investment platforms and what types of accounts they offer.

| Account Types |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| GIA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| ISA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| SIPP | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Pension | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Junior ISA | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Junior SIPP | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Lifetime ISA | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro good for dividend investing?

eToro pays dividends when you invest in stocks and shares that pay them. But, even though you can receive dividends when you invest with eToro there are some downsides to dividend investing with them. In this guide, I will go through why eToro may not be the best account for long-term income and dividend investing.

When you buy shares in profitable companies like AT&T and Vodafone you are entitled as a shareholder to receive a portion of their profits based on how many shares you hold. Based on their current dividend yields if you own $10,000 worth of shares in AT&T you should get a dividend of $760 (7.6%). If you own £10,000 worth of shares in Vodafone you should get a dividend of around £100 based on their 10.03% dividend.

- Related guide: Dividend investing explained.

You are entitled to the dividend payment if you hold a stock over the ex-dividend date. But, you need to take into account that when a stock goes “ex-div” the share price will often drop by the equivalent amount, to reflect this. Dividend arbitrage is no longer possible for retail investors like it was in the old days. It is still a practice but is largely used by large hedge funds to arbitrage tax rates in different regions. For example, if your account is based in a tax haven you pay less tax when you receive it, and they declare it elsewhere. But that’s a guide for another day…

But for the average eToro investor, when a company pays a dividend (on the dividend payment date) it gets paid into your free cash balance and you can see this in your account history. You will be taxed on this dividend at source, and as we will explain you then may have to pay further tax on it.

Before I get on to why eToro is not good for dividend investing, There are good points about investing in dividend stocks with eToro for instance;

- You can buy shares commission-free

- There is no custody account for holding shares

- You can short dividend stocks with CFDs

But, eToro is not the best place if you are a dividend investor, here I’ll explain why and what better options are available.

No ISA tax-free dividends

So you get taxed more on dividends

Dividend investing is great for long-term investors because it can help you generate regular income from your investments. If you have a large portfolio of dividend-paying stocks, you should receive regular dividend payments throughout the year. However as eToro does not have a proper ISA account, it means that you have to buy dividend stocks and ETFs in a general investment account, which means that you have to pay income tax on the money you receive from these dividends.

If eToro offered an ISA account you could receive this dividend income from stocks in your ISA account and not pay income tax on them.

Note: Toro does have an ISA partnership with Moneyfarm, but it is for managed portfolios rather than individual shares.

If you want to save on tax on your dividend payment income, you should use a stocks and shares ISA account.

AJ Bell is a good ISA account for dividend investing because they charge a low annual fee of 0.25% for holding shares which is capped at £3.50 per month.

No SIPP for retirement dividends income

So you get taxed on dividend income for retirement.

A SIPP is similar to a stocks and shares ISA in that when you invest in it your profits and income are tax-free. So if you want to buy high dividend-paying stocks to generate income for your retirement you won’t get any tax relief. This is a shame, as big established profitable companies usually play a large part in the retirement portfolios of many investors. It would be nice to see eToro introduce a self-investment personal pension investing account. If you want to invest in dividend stocks for your retirement Interactive Investor is a good option and won “best SIPP account” in our 2023 awards.

No dividend reinvesting

So you can’t automatically reinvest your dividend income back into shares

Whenever you invest in funds in the long-term you normally get the choice between an “income” or an “accumulation” fund. The income fund means you get paid dividends out in cash. the accumulation option means that the dividend payments are automatically reinvested back into the fund for you.

So for example, if you wanted to reinvest your £100 Vodafone dividend automatically, whenever your received a dividend your stock broker would automatically buy you some more shares. So, as you receive income from dividends, your position in Vodafone grows.

Dividend reinvesting is an excellent form of compounding returns. Which can grow exponentially over time. Unfortunately, eToro does not offer this, whereas platforms like Hargreaves Lansdown have a feature that will reinvest your dividends for you. You can even set the threshold of when you want dividends investing. i.e. when they reach £10 or £100 or so on.

- Related Guide: eToro Alternatives & Competitors

Dividends paid in USD, inactive & withdrawal fees

This is a major gripe of mine about eToro for UK investors. If you buy UK shares you are forced to do it in USD. This means that every time you deposit money into your eToro account they convert it to USD and charge you 0.5%, so you are immediately losing out. It also means that when you convert this back in to GBP you lose out on the FX. plus they charge $5 to withdraw money, so if you are a small dividend investor these fees can quickly eat into your dividend yields.

Another issue is the fact that dividend investing is normally a long-term game where you don’t need to check your account on a regular basis. eToro say that “After 12 months with no login activity, a $10 monthly inactivity fee will be charged on any remaining available balance. No open positions will be closed to cover the fee.” This means that if you don’t login to check your account, your dividend income can be eroded away from in-activity fees.

No bonds (coupons instead of dividends)

The last point I want to make is about bond investing. Bonds pay coupons rather than dividends, but they are still an excellent tool for generating income from investments, in a similar way to dividends. But unfortunately, you cannot invest in listed corporate bonds through eToro, which is a shame, because a lot of income investors try to build a balance of dividend-paying stocks and bonds on listed companies (that can now be traded on the LSE ORB). I’d like to see eToro introduce some more bonds on their platform to help investors diversify.

If you want to invest in bonds you can visit our guides on:

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

How does eToro earn its money?

eToro makes money through commission on trades, widening bid/offer spreads, FX fees when you deposit funds, withdrawal charges and keeping interest on the funds in your account. In this guide, I will explain how eToro makes money in each of those ways and if there are any cheaper alternatives.

eToro earns the most money from equities trading which accounted for 48% of the firm’s commission income in 2022, commodity spreads accounted for 27% of the total, cryptocurrencies made up 19% of commissions and FX trading accounted for another 6.0%.

- Related guide: How to make money on eToro.

Here is a breakdown of how eToro earns money from it’s customers:

Commissions and Spreads

According to recent press releases eToro earned $631.0 million of commissions or spreads in 2022, that figure was below 2021’s commission levels but + 5.0% above those seen in 2020.

eToro earns money out of each transaction its clients make in CFDs, cryptocurrencies, equities and other instruments, and it does so through the bid-offer spread, that’s the difference between the price at which you can buy, or sell an asset.

The spreads that eToro charges vary by product, for example, if you trade the US Dollar Index you will 0.004 points of spread, whilst if you trade in the Nasdaq 100 index there is a spread of 2.40 points, and on the Niikei 225 index a spread of 10 points.

Trading in CFDs over stocks and ETFs attracts a spread of 0.15% of the underlying price. Whilst a trade in EURUSD has a spread of 1 pip.

- Related guide: What is a pip in trading?

eToro’s pricing is very good for US stocks as the bid/offer should be the same as the underlying market. However, for UK shares the bid/offer is widened by 0.15%. This is more than most other trading platforms. For instance, IG, Spreadex and CMC Markets charge 0.1%, whilst Interactive Brokers charges 0.02% and Saxo Markets 0.05%.

CFD Overnight Financing

eToro charges CFD overnight financing by adding the relevant interest rate benchmark plus 6.40% per annum. For UK or Sterling-denominated CFDs, the benchmark is the Sonia 1-month index, and for CFDs in US Dollars eToro uses the SOFR l-month benchmark. This is very high compared to other brokers.

eToro is very expensive for holding CFD positions overnight. You can see in our CFD broker comparison tables that eToro charge 6.4% over the standard UK SONIA interest rate. Where as the industry standard from brokers like IG, Pepperstone and Saxo Markets is 2.5%. Interactive Brokers is the cheapest as they only charge 1.5% +/- SONIA.

Foreign exchange fees

FX conversion fees are levied at 0.1% on top of the underlying FX bid-offer spread. eToro also charges 0.5% when you deposit funds on account by converting it to USD from GBP.

eToro is about average for their FX conversion fee. however, the downside is that you can only trade in USD, which means you HAVE to convert your money into dollars. You have no control over it. You also have to convert GBP into USD if you are trading UK stocks. Which is daft, becuase it’s an added expense. it was ok when eToro absorbed your 0.5% stamp duty charge, but you now have to pay that. Which means that if you deposit £1,000 to buy UK shares you will be charged 1%.

All brokers have to charge stamp duty, but you can see on our US stock investing comparison tables that traditional investment platforms like Hargreaves Lansdown and Interactive Investor are more expensive for smaller deals (around 1%) the exchange rate mark-up drops to 0.25% for larger deals.

Interactive Brokers remains the cheapest with an FX conversion mark-up of online 0.02%.

- Top Tool: Calculate FX Conversion Mark-Ups

Growing fees for a growing brokerage

eToro is one of the world’s biggest multi-asset and social trading brokerages, with 33.40 million registered users and 2.80 million funded accounts. The majority of which (73%) are held in the UK and Europe. The firm has some $7.80 billion under administration and operations in more than 100 countries.

eToro is a privately held company and as such it typically doesn’t share financial data with the market.

However, in recent years the firm has been more transparent, initially as it looked to list in New York, via a reverse takeover of a special purpose acquisition company or SPAC.

And then, having shelved that idea, subsequently raising money in the private markets from leading VC investors, who injected $250 million into the business earlier this year.

An investment which valued the business at $3.50 billion.

eToro saw a 17.0% rise in the number of funded accounts in 2022, helped no doubt by its brand recognition and penetration in the UK and Europe. Where, according to survey data from Investments Trends, it is among the most recognised trading platforms.

eToro clients have a median age of 35 years, 95% of them have invested in crypto, and 54% trade more than one asset or product type.

The firm is keen to continue expanding its European operations.

According to research from management consultant Oliver Wyman, there could be a total of 20 million new brokerage accounts opened in Europe by 2025. Germany, Italy and Spain are seen as the biggest growth areas, but there are also opportunities in the UK, Sweden and Norway.

Given its asset coverage, brand penetration and popularity among retail traders in Europe, there is no reason to assume that eToro can’t capture a sizeable slice of that predicted growth.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Virtual trading on the eToro demo account

Why is the eToro demo account so hard to use?

eToro does have a demo account, but it’s actually very annoying. eToro has this really irritating habit of ushering you along to things you don’t want to do. I really want to like eToro, as everyone else does, but every time I try to use it, I feel like I’m trying to get through to the British Gas call centre. At every turn, it’s “computer says no”.

I review brokers for a living and I’ve now tried to open two different eToro demo accounts with two different emails. Both times, when I’ve tried to place a demo trade it’s asked me to deposit real money and try and fully verify me for a live account. So both times I have given up. Maybe this is why eToro has so many real accounts because it’s impossible to use the demo and you get salami’d into depositing money to trade.

That aside, once you are up and running, you can toggle between trading on a live account and practising on a demo account. You just need to click the “switch to virtual account link at the bottom of the app or website when logged in. If you can find it…

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro good for crypto?

Actually yes, I’d say that eToro is a good crypto broker. There are a few reasons for this.

- Firstly eToro has quite a diversified range of other markets to trade, so if crypto only forms a small part of your investing portfolio (as it should do) you can also invest in other things like UK and US stocks and ETFs.

- Secondly, they are regulated by the FCA for these activities, unlike Binance or Coinbase which only focus on crypto).

- Thirdly, you can withdraw cryptocurrency from eToro instead of keeping it on their trading platform, this is particularly important if you want to keep safe custody of your cryptocurrency so you don’t need to worry about, yet another crypto broker going bust.

- Fourthly, there are crypto funds on eToro, so you can invest in a bunch of cryptocurrencies in one go. Which saves you trying to pick out the best coins if you just want exposure to the sector.

There is a downside though to trading crypto through eToro and that’s the fees. Generally, eToro is quite an expensive broker for crypto. eToro is expensive for crypto because quite they do at least some vetting before (as their UK MD told me) they add them to the platform, so you have a smaller chance of being caught up in a crypto pump-and-dump scam.

A good all-around cryptocurrency investing platform, suitable for those wanting to invest in the most popular crypto coins.

I’d say that eToro is better than Binance and Coinbase for crypto trading for the average investor, but for those who want more exotic cryptos and are happy to take on more risk a specialised crypto exchange may be more suitable.

With eToro you can buy and sell cryptocurrency on their normal investment platform in USD or for advanced crypto investors you can deposit and withdraw crypto on the eToro crypto exchange.

Crypto Fees: The 1% fee for trading crypto is included in the buy-sell spread when you trade crypto.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is the eToro trading app any good?

Yes, the eToro app is safe to use for investing and trading as they are regulated by the FCA in the UK. However, there are a few things to be mindful of.

Firstly eToro is a new company that has grown quickly and spent a huge amount on marketing for new customers. When companies grow so quickly they also have a long way to fall if new clients and revenues dry up. But, as eToro is regulated by the FCA, UK customer funds are protected (up to £80k) by the FSCS if eToro were to go bankrupt.

The other thing to consider is that whilst eToro offers investing for longer-term capital growth they also offer leverage products like CFDs and forex trading where it is possible to lose money quickly. These products are not really safe (as they are high-risk) or suitable for new investors and are more for experienced and sophisticated traders.

Overall, eToro has one of the best trading apps for social & copy trading. eToro’s trading app enables you to view and copy the portfolio of other traders. You can also see the social feed of what is being discussed and trade and invest (in USD only) a wide range of markets. Overall, an easy to use trading app to get started with.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Is eToro’s trading platform any good?

eToro’s platform (despite looking very basic) is actually getting better every day, but I’d say it’s nowhere near being one of the best trading platforms out there. For serious and high-volume traders there is not a downloadable desktop version and you do not get direct market access.

But for average and beginner investors it has some really very good features.

The ability to look at the positions (and then copy) of consistently profitable traders is an excellent want for new investors to see how to construct a diverse portfolio is not just an excellent way to invest, it is a fantastic learning tool. I spoke to the founder of eToro Yoni Assia ages ago about whether or not copy trading could be an investible asset class, and there are signs that it perhaps could be.

eToro has a very simple online trading platform and offers a social way to speculate on global markets. Through social and copy trading you can see other traders’ portfolios and copy their trades. You can only trade and invest in USD, but you do have the option to buy and sell cryptocurrency.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Can you trade forex on eToro and what’s it like?

You can trade forex on eToro, but to be honest it is quite expensive and more of an investment/stock trading platform. If you are solely a forex trader there are more specialist FX trading platforms available.

There are two aspects to eToro’s forex trading offering that makes it stand out. Social trading where you can copy other forex traders trades and the ability to set your own leverage. As forex trading is notoriously difficult, and I would say that the majority of eToro’s client are early-stage traders, the ability to reduce the amount of leverage is a very useful.

Forex Leverage Control

When you reduce your leverage it means you reduce your risk, by putting up more margin when trading forex. So, for example, when you open a forex dealing ticket, your leverage is set at 30x, but you can reduce this to 1x. Meaning that if you want to speculate on $1,000 of GBPUSD, on 30x leverage, you would only have to put up $41 in initial margin, meaning you are potentially risking $959 that you don’t have. But, if you set your leverage to 1X yo have to put up the whole, $1,000 which reduces the temptation to take on excessive risk, with money you do not have.

Forex Copy Trading

The other feature that is unique to eToro is the ability to follow other forex traders through copy trading. However, it should be noted, though that if you are planning to trade forex by copying what other traders do it can be as hard as choosing your own trades. Just because a trader has done well in the past or if you think their trading ideas look good it does not mean they will be profitable in the future. Social trading is really only good for idea generation, which means you ultimately have to decide if you agree or disagree with another traders outlook.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Does eToro have commodities trading?

Yes, you can trade commodities with eToro as a CFD or by buying a commodity-based ETF like GLD if you want to invest in gold. eToro is a long way from being the best commodities broker as they only offer a limited range of the most popular commodities like oil (15) compared to CMC Markets (100+) and they do not offer on-exchange futures contracts like Interactive Brokers or Saxo Markets. However, if you are happy to only trade in USD and commodities trading forms only a small part of your portfolio or universe eToro is suitable for most beginner commodity speculators.

- Commodities markets available: 15

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Pricing: Gold 0.9, Oil 1.4

At eToro, trading commodities is straightforward. eToro’s platform is easy to use and enables traders and investors to trade a wide range of commodities. You also get the benefit of being able to set your own leverage when trading commodity CFDs, so you can reduce your risk by increasing your margin rates.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Can you invest in indices on eToro?

Yes, you can invest in indices like the S&P500 through either a CFD or a ETF with eToro. If you want to take short-term speculative positions then trading an index as a CFD lets you bet on the market going up or down. But, if instead you want to invest in an index with eToro in the longer term you can buy an ETF like the SPX.

However, there is a downside if you want to invest in non-USD indices like the FTSE 100 with eToro as you can only trade in USD. So, if you deposit GBP to buy a FTSE100 ETF, you have to convert your GBP to USD, which incurs foreign exchange conversion costs.

- Indices available: 15

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Index pricing: FTSE 1, DAX 1.5, Dow 6, NASDAQ 2.4, S&P 0.75

With eToro you can trade index CFDs or buy index-tracking ETFs. The social trading platform is easy to use and offers traders and investors the opportunity to trade a wide range of major stock indices as well as see and copy other traders positions.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Does eToro have CFD trading?

Yes, you can trade CFDs on eToro (but not if you are in America). As a CFD broker, eToro has a fairly basic offering, but that’s fine because I’d say that eToro is mainly geared towards beginner investors whose CFD trading is not really suitable as it’s a leverage product and you can lose money quickly. But, having said that, it’s really easy to use for new CFD traders who want to take on some risk, but not too much you can reduce leverage on CFD positions.

- CFD markets available: 2,976

- Minimum deposit: $50

- Account types: CFDs & investing in USD

- Equity overnight financing: 6.4% +/- SONIA

- CFD pricing: Shares 0.15%, FTSE 1.5, GBPUSD 2

eToro lets you trade CFDs on major indices, forex pairs and stocks. One advantage of trading CFDs with eToro is that you can set your own leverage and reduce the amount of risk you take on per trade. A good option for new traders who want to see what other investors are trading through their social trading feature.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Does eToro have a stocks & shares ISA and is it any good?

eToro doesn’t have its own ISA, but eToro, the multi-asset trading platform, entered the UK ISA market in March 2023 via a collaboration with online wealth manager Moneyfarm. eToro’s UK clients will now be able to open a stocks and shares ISA, with Moneyfarm via the eToro platform.

eToro ISAs are in partnership with Moneyfarm

Moneyfarm offers a range of globally diversified discretionary portfolios, each of which is risk rated. Which, according to the wealth manager, means that customers are matched with the correct investments.

Dan Moczulski, eToro’s UK Managing Director, told us exclusively:

Despite being a global business, we want to take a local approach to the markets that we operate in, rather than working on a one size fits all basis.

In the UK, this means offering financial products that will help our UK clients to have a more complete investing experience. The stocks and shares ISA will help eToro clients to shield a portion of their investment returns in a tax-free wrapper, something which is more important than ever given upcoming CGT changes. We plan to continue developing this offering in the coming months.

- Want to know more? – Read our interview with UK MD Dan Moczulski

Why has eToro launched an ISA offering?

This is the first project in what’s hoped will be a closer working relationship between the two companies. eToro will look to expand its ISA offering, most likely in conjunction with Moneyfarm.

Daniel Giddings, Moneyfarm’s UK head of business development, said the firms would:

“closely integrate the (ISA) propositions over time”

eToro has more than 3.0 million registered users in the UK and will be hoping to entice them into opening an ISA account through the new venture.

The firm hasn’t disclosed the charges for its new service. However, Moneyfarm has a sliding scale of fees based on the amount of money invested.

For example, those with between £500 and £10,000 in a stocks and shares ISA, pay 0.75% per annum.

Whilst those with between £10,000 and £20,000 pay 0.65% a year, and if your portfolio grows in value your fees can diminish further.

eToro and Moneyfarm have taken a novel approach to ISA investing, one that will differentiate them from the competition.

eToro clients are likely very familiar with social trading and following other people’s trading and investment ideas, so buying into a discretionary ISA may not be that much of a leap for them.

- Need more information? Read our guide on how to open an ISA.

Unlike many other ISA offerings, the eToro and Moneyfarm product will be a discretionarily managed ISA. Meaning that you put your money into the ISA account, but it’s the experts at Moneyfarm that will allocate and manage the investment on your behalf.

ISAs, or Individual Savings Accounts, are tax-free savings vehicles in which UK clients can invest up to £20,000 per annum, under current legislation. Any capital growth or income generated within the ISA portfolio is exempt from capital gains or income tax.

Is eToro’s ISA any good?

Not really, eToro doesn’t have its own ISA so, it’s not an eToro ISA, you are opening an account and dealing with Moneyfarm.

- Need an investment ISA? – Compare the best stocks and shares ISAs

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

eToro Alternatives & Competitors

eToro is on its way to being one of the biggest brokers in the world, they have amassed an almost cult following on social media, their copy trading feature has made millionaires, and the platform shows little sign of slowing down. eToro is great for beginners and has done wonders for getting people interested in managing their money.