Capital.com Customer Reviews

Leave a review and tell us what you think to help others make more informed financial decisions.

Our annual “Stocks In Your Stockings” competition 🎅 is open so any verified review you leave will enter you into the prize draw to win a £500 JISA.

5/5

5/5

Pros:

Offer good stock good selling point timing of entry

Cons:

Low risk

5/5

Pros:

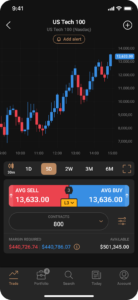

UI, pricing, execution, trading experience

Cons:

Increase number of instruments (especially cryptocurrency pairs), improve pricing and execution further

5/5

5/5

Pros:

A lot of markets

4/5

Pros:

It has more information about other platforms, as well as being easy to understand and use for a quick decision

Cons:

to be able to move the windows that I follow with the cursor from the follow option

5/5

Pros:

More information

Cons:

Corses for beginners

5/5

Pros:

They are user friendly.

Cons:

To have more actions with zero or tight spreads, zero commission and extended hours

5/5

Pros:

UI, support, educational and news feed

Cons:

–

1/5

5/5

Pros:

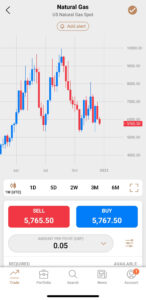

Natural Gas

Cons:

logo for an asset

5/5

Pros:

weekly and monthly reports

Cons:

Add more analytics

5/5

5/5

Pros:

the application is very simple and easy to understand with smart information

Cons:

Nothing all is good

5/5

Pros:

Easy, fast, futuristic and professional

Cons:

Nothing to add

5/5

Cons:

Variety of deposit options

5/5

5/5

4/5

Pros:

fees and spreads

Cons:

make the analysis of transactions/trades more informative

5/5

Pros:

transparency

Cons:

everything is quite good

Capital.com Alternatives

| Trading Platform | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 13,500 | £100 | See Platform* | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform* | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 10,000 | £1 | See Platform* | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,000 | £100 | See Platform* | 80% of retail investor accounts lose money when trading CFDs with this provider. | |

| 17,000 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 12,000 | £1 | See Platform | 68% of retail investor accounts lose money when trading CFDs with this provider | |

| 9,000 | £1 | See Platform | 65% of retail investor accounts lose money when trading CFDs with this provider | |

| 7,000 | £1 | See Platform | 60% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,976 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 5,000 | £1 | See Platform | 74% of retail investor accounts lose money when trading CFDs with this provider. |

Expert Capital.com Review

Capital.com Review

Name: Capital.com

Description: Capital.com was founded in 2016 and is a CFD trading platform and spread betting broker with offices in the UK and around the world. Since then, they have grown to offer over 3,700 tradable assets to 300,000 active monthly traders. Capital.com won “Best Trading App” in our 2023 Awards.

Summary:

Capital.com has an easy-to-use and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros

- Innovative and intuitive app

- Set your own leverage

- Proprietary technology

Cons

- Trading only, no ISA or SIPP

- No options markets

- Not currently accepting new UK customers

-

Pricing & Spreads

(4)

-

Market Access

(3.5)

-

Apps & Trading Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(3.5)

Overall

4Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Capital.com News, Reviews & Interviews

Meme stop loss trading surges over the summer on Capital.com

Meme stock trading in companies such as GameStop and AMC once again experienced a surge in popularity over the summer, according to data from platform Capital.com. The data — based on the trading activity of 33, 500 global traders between 18 June and 18 September this year — shows GameStop (GME) was the third most traded stock

Capital.com adds Newsquawk – trading voices

Recently Capital.com added the voice box Newsquawk so that traders can hear what is going on the market. The feature blasts out news and analysis when there are sudden market moves like economic indicator announcements. Through an API integration, Newsquawk feeds will be delivered directly via the Capital.com app and web platforms, so that over

Capital.com stops on-boarding UK accounts

Capital.com has paused the onboarding of new UK client accounts. The broker, which is based in London but has offices and operations around the globe, made the announcement via a notice on its website. In which it said: “We have made the decision to pause onboarding new clients in the UK for now” Adding that

Kypros Zoumidou takes over from Peter Hetherington as Capital.com CEO

Margin trading brokerage Capital.com has announced some changes to its senior management lineup. What changes has Capital.com announced? Capital.com has announced some changes to its senior management lineup with news that industry veteran Peter Hetherington is to step down as Group CEO effective immediately. Capital.com’s Chief Commercial Officer, Kypros Zoumidou moves into the vacant CEO

Capital.com Introduces Cheaper Guaranteed Stop Loss Premiums

Capital.com has reduced the fees it charges for using guaranteed stop losses (GSL), giving clients a cheaper way to protect their positions from large market gaps. GSL spreads have been narrowed across four separate asset classes, Forex, Equity Indices, Commodities and individual stocks and shares. The fees or premiums charged for GSLs at Capital.c… To

Capital.com Introduces Average Execution Pricing

The new feature is part of a wider upgrade to Capital.com’s trading platform. As well as average execution prices traders will now be able to view dynamic bid-offer prices that react to changes in order size. Clients will also be able to view market depth in a security. This means that a customer can see

Capital.com adds dynamic widgets and VWAP indicators

Fresh from winning best trading app in our 2023 awards Capital.com has improved functionality further by personalising their client’s trading experience through the introduction of dynamic widgets and adding VWAP indictors. Dynamic widgets Capital.com’s customers can now benefit from a personalised home screen on their trading platform, using a series of tools or widgets, to

CEO Laura Lin, one of the top 25 leaders in financial technology tells us what Capital.com offers CFD traders in Australia

Over the past few years, Capital.com has been growing rapidly worldwide. In Australia for example, they saw a 1,300% increase in client trading volumes for 2022, and so far in 2023 have reported a 53% rise in client trading volumes in Q1 2023 compared to Q4 2022. As part of the recognition for that growth,

US banking crisis helped to drive Q1 CFD volumes at Capital.com

Capital.com has published data and insights on its CFD turnover, which reveal that the regional banking crisis, seen in the first quarter of 2023, drew retail traders into the CFD market. Banks down, brokers up… Capital.com publishes quarterly trading highlights and other information in the Pulse report. The latest release of which shows that CFDs

Capital.com improves overnight financing charge transparency

Capital.com says it will now publish the rates of how overnight funding was charged. Capital.com is, in fact, one of the growing trading platforms that show overnight funding charges on trading tickets. Funding charges are an integral part of CFDs, rolling spot Forex, and certain Spread Betting contracts that are not priced as futures, such

Capital.com unviels its new London HQ

Fast-growing CFD trading platform Capital.com unveiled a new office this week located in the heart of London’s upmarket St James’s district. The new headquarters comprises 21,000 square feet of accommodation, which is described as cutting-edge and has been custom designed for the firm, with more than 20 meeting rooms, acoustic pods, quiet zones and even

Capital.com acquires the OvalX (ETX Capital) client base

OvalX (ETX Capital) has agreed to sell its client base to rivals Capital.com OvalX the margin trading, CFD and Spread Betting broker, formerly known as ETX, has agreed to sell its clients to rivals Capital.com, where ex-IG CEO Peter Hetherington recently took over the reins. No financial details about the sale have been disclosed and

What makes Capital.com different? Thumbs up, literally

Do you know what the most impressive thing about Capital.com is? They put the buy and sell buttons at the bottom of the app. I don’t mean that in a facetious way, it’s genuinely a brilliant feature. This may not sound like much but it’s a good example of how Capital.com has integrated decades of

Peter Hetherington joins Capital.com & Currency.com as group CEO

Last week we reported on the departure of Jon Squires from Capital.com and speculated that his replacement would a financial service insider, somebody with plenty of operational and hands-on experience in the sector, on their CV. We were spot on as Capital.com has signed Peter Hetherington as their new Group CEO. Mr Hetherington is best

Viktor Prokopenya takes over as interim CEO as Jon Squires leaves Capital.com

Capital.com the FCA, ASIC, and CYSEC regulated, forex trading platform, which was founded by Belarusian entrepreneur Viktor Prokopenya, has unexpectedly lost a key member of staff. Capital.com’s CEO Jon Squires has resigned from the broker and its sister company, crypto exchange Currency.com. The resignation comes as something of a surprise given that Capital.com had been

Capital.com recruits industry veterans Kyp Zoumidou & Joe Rundle to grow its UK and US operations

One of the leading Trading apps, and would-be Fintech, Capital.com is continuing to recruit and is taking on some well-known names in the industry, to bolster its team, as it does so. Kyp Zoumidou joins Capital.com from IG as UK Managing director The latest executive to join the group is Kypros Zoumidou, a twenty-year financial

Capital.com saw rapid growth in 2021 due to pandemic volatility

CFD platform and Spread Betting broker Capital.com which is owned and was founded by the Belarussian entrepreneur Viktor Prokopenya, in 2012 grew at quite a pace during 2021. Client numbers at Capital.com rose to an impressive 4.23 million a gain of around +350%. Many forex brokers grew strongly during 2021 as interest in retail trading

Capital.com launches in Spain & Sponsors Valencia CF

Capital.com, the CFD broker which uses artificial intelligence to create a better trading experience has just sponsored Valencia CF. We met up with Capital.com a while ago and as they are now FCA regulated we’ve added them to the Good Broker Guide. It’s probably a sensible move as most other CFD brokers sponsor football teams.

Ivan Gowan, Capital.com CEO on what makes artificial intelligence core to user experience

Over the summer I met Ivan Gowan, the new CEO of Capital.com at their UK offices. From our chat, what’s particularly noticeable is that Capital.com is an app first, tech first, trader first type of broker. What Ivan, and the team ( the big team) of developers are doing is building a trading app that incorporates

79% of retail investor accounts lose money when trading CFDs with this provider

Capital.com Video Review

Watch as we trade live on the Capital.com app and web platform and demonstrate some of the key features including, user experience, leverage and overnight funding.

79% of retail investor accounts lose money when trading CFDs with this provider

Capital.com Facts & Figures

Capital.com Total Markets | Over 3700 |

| ➡️ Forex Pairs | 122 |

| ➡️ Commodities | 19 |

| ➡️ Indices | 21 |

| ➡️ UK Stocks | 328 |

| ➡️ US Stocks | 1432 |

| ➡️ ETFs | 120 |

Capital.com Key Info | |

| 👉 Number Active Clients | 75,000 (monthly) |

| 💰 Minimum Deposit | £20 |

| ❔ Inactivity Fee | ❌ |

| 📅 Founded | 2016 |

| ⬜ Public Company | ❌ |

Capital.com Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ✔️ |

| ➡️ DMA (Direct Market Access) | ✔️ |

| ➡️ Futures Trading | ❌ |

| ➡️ Options Trading | ❌ |

| ➡️ Investing Account | ❌ |

Capital.com Average Fees | |

| ➡️ FTSE 100 | 1 |

| ➡️ DAX 30 | 1.5 |

| ➡️ DJIA | 2 |

| ➡️ NASDAQ | 1.8 |

| ➡️ S&P 500 | 0.7 |

| ➡️ EURUSD | 0.6 |

| ➡️ GBPUSD | 1.3 |

| ➡️ USDJPY | 0.8 |

| ➡️ Gold | 0.18 |

| ➡️ Crude Oil | 0.03 |

| ➡️ UK Stocks | 0.1% |

| ➡️ US Stocks | 0.1% |

79% of retail investor accounts lose money when trading CFDs with this provider

Capital.com FAQs

Yes, if you a UK trader Capital.com is authorised and regulated by the FCA (Financial Conduct Authority) and your funds are protected up to a certain point by the FSCS.

Capital.com offers financial spread betting and CFDs (contracts for difference) on forex, indices, commodities and shares. They also have a Zero commission investing feature on the app.

No, Capital.com is not regulated in the US. However, you can trade US stocks and shares, indices and USD denominated currencies.

The two main revenue streams from Capital.com are spreads (comission) and funding (overnight financing charges) which is charged when you hold positions over night.

No, Capital.com does not charge for deposits or withdrawals.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

79% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com