Fresh from winning best trading app in our 2023 awards Capital.com has improved functionality further by personalising their client’s trading experience through the introduction of dynamic widgets and adding VWAP indictors.

Dynamic widgets

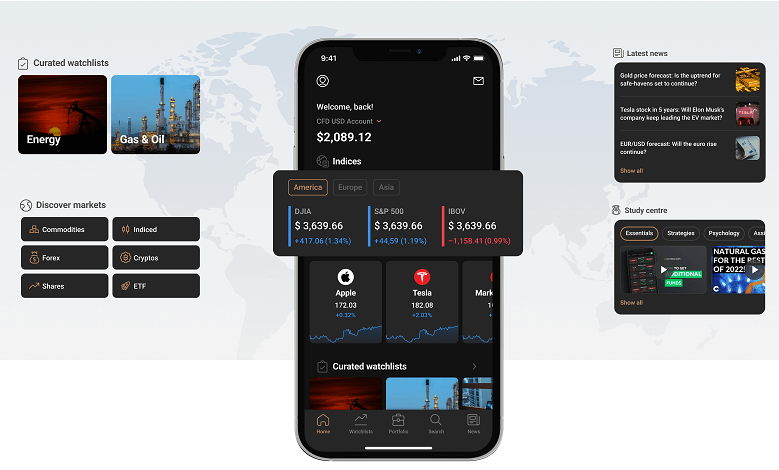

Capital.com’s customers can now benefit from a personalised home screen on their trading platform, using a series of tools or widgets, to curate and display the content that matters to them most. The new, dynamic widgets will provide clients with instant access to trading tools and data.

The widgets functions include the display of real-time market data and prices, personalised watchlists, financial news feeds and educational resources.

Using the new widgets clients will be able to seamlessly navigate between their personalised home screen and other sections of the Capital.com trading platform.

They will also have the ability to trade directly from a news feed or watchlist without the need to change screens and can monitor account balances and margin requirements.

Dana Massey, Capital.com’s Chief Product Officer said of the new tools:

“The new personalised home screen interface enables our clients to easily see the day’s top and trending stories, seamlessly switch between accounts and keep an eye on their favourite markets”

Adding that:

“By making the home screen more customisable, our clients can conveniently access the information they need without navigating away from their page, saving them time and enabling them to focus on making strategic trading decisions”

- Related Guide – Expert Capital.com Test & Review

VWAP Indicators

Capital.com has also added a new indicator to its trading platform, with the introduction of VWAP or Volume Weighted Average Price.

VWAP can be thought of as being quite similar to a moving average, but what it actually tracks is the price level at which most business or volume has been transacted over a given timescale.

The indicator, which is very popular among more experienced equity and CFD traders, is drawn as a line on a price chart and can be used to inform breakout or mean reversion strategies and trades.

The new tools and indicators introduced by Capital.com, which are available on its mobile and desktop platforms, are part of a wider movement within the margin trading industry to tailor tools, and the user experience, to the specific requirements of their underlying clients, rather than relying on impersonal generic trading software, and that’s to be welcomed.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.