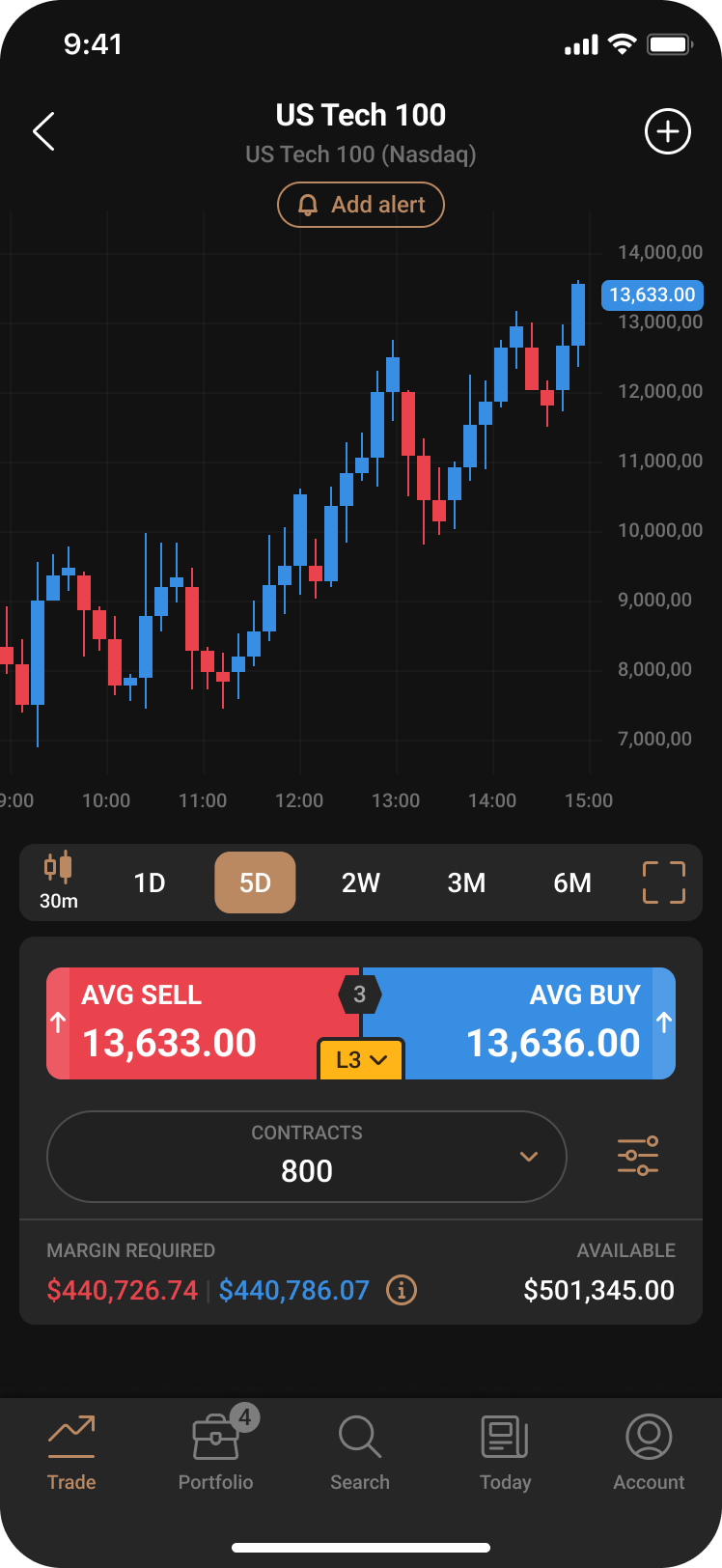

Capital.com adds level-two data to its trading platform and publishes research on its client’s trading performance. The fast-growing CFD broker adding a new feature to its trading platform, that will allow users to see the average price of an execution before they submit their order.

Average Execution Pricing

The new feature is part of a wider upgrade to Capital.com’s trading platform. As well as average execution prices traders will now be able to view dynamic bid-offer prices that react to changes in order size. Clients will also be able to view market depth in a security.

This means that a customer can see the amount of liquidity, or interest at a given price point, in an instrument, on both sides of the order book, and the changes to that market depth, as they occur.

The average execution price that customers see will be the Volume-Weighted Average Price or VWAP.

A tool that institutional and pro traders have had access to for many years, but which is only now being made available to retail traders in an order book setting.

Having visibility over this type of level-two data should allow Capital.com clients to make more informed trading decisions, and to get a better handle on how the market is feeling about a specific security at a given point in time.

Examining its trader’s behaviour and performance

Capital.com has analysed the behaviour and performance of 100,000 active traders in a study that ran between May 2022 and April 2023.

The results are quite eye-opening, for example, traders who traded across five separate asset classes, closed 60% of their trades with a profit, on average.

Whilst those that traded just one asset class closed just 48% of their trades profitably.

The majority of Capital.com’s traders are multi-asset traders, though only 15% of them, trade in five or more asset classes. Whilst some 65% trade between two to four different assets, 20% of the customers studied, traded just one asset class.

The research also revealed a correlation between the length of time that traders held their positions open, and profitability, with 44% of trades held open between 30 minutes and 6 hours being closed for a profit.

Traders who held positions open for less than 30 minutes experienced an average of 41% profitability.

And those holding positions open for 24 hours or longer closed just 39% of their positions with a profit. Interestingly more than 50% of traders, who held their position for 24 hours or more, did not use a stop loss.

First-time traders fared better in FX Indices and Commodities on average, Capital.com’s first-time traders made a profit on 58% of their trades when they traded commodities, compared to 56% in FX, 54% in index trades and just 46% in equity trades.

The new features introduced by Capital.com are a further sign that it’s listening to what its clients want from their trading tools, however, the firm is also feeding back useful information to its clients, both of these initiatives should help those same clients, to improve their trading outcomes.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.