Dropbox (NASDAQ:DBX) is a $8 billion tech company that focuses on ‘global collaboration’. Founded in 2007, the company grew rapidly as internet-based business practices proliferated. If you want to drop a few pounds into the dollar box and buy shares in Dropbox (NASDAQ:DBX), you need a US stock trading or share dealing account that will let you buy US-listed stocks.

Follow these three steps if you want to buy shares in Dropbox from the UK:

- Decide if you want to buy Dropbox shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

What is the live Dropbox (NASDAQ:DBX) share price?

The current NASDAQ:DBX share price is $22.94 which is a change of 0.02 or 0.09% from the last closing price of 22.94 with 2,653,999 shares traded giving NASDAQ:DBX a market capitalisation of $7,765,944,906. The most recent daily high has been 23.08 and daily low 22.72. The NASDAQ:DBX share price 52 week high has been 33.43 and the 52 week low 19.55. Based on the most recent NASDAQ:DBX share price opening of 22.94, the current NASDAQ:DBX EPS (earnings per share) are 1.62 and the PE (price earnings ratio) is 14.15.

Pricing data automatically updates every 15 minutes

How much does it cost to buy Dropbox shares (NASDAQ:DBX)?

Buying one NASDAQ:DBX share costs $22.94. However, as well as the $22.94 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Is Dropbox (NASDAQ:DBX) a good investment in the long term?

The Dropbox share price is down over 20% since they first listed on the NSADAQ in 2018, is now a good time to buy Dropbox shares?

While there is some long-term value in the business, this view is not validated by the market right now. The stock is “boring” and not attracting major buyers. I would wait until buying interest increases before buying Dropbox shares.

By March 2018, the firm was confident enough to IPO – selling 36 million shares at $21 per share. Dropbox was one of the larger tech IPOs of the year. After five years in the public area, how did Dropbox perform?

In comparison to other tech stocks, Dropbox’s share price chart seems tamed, or perhaps forgotten? From its post-IPO high of $40, the stock sank to $15 during the pandemic. The wild exuberant market last year failed to lift Dropbox to fresh highs. At $22 per share now, Dropbox’s share prices are no higher than its IPO level. Long-term shareholders are likely to be disappointed.

Dropbox’s business is global. It has about 700 million registered users and 16 million paying customers. The company is innovative and is able to hold on to the majority of its clients year-on-year. In other words, DBX’s products are ‘sticky’ enough to generate millions in recurring revenue. Many corporations also use Dropbox as a collaboration tool (Dropbox Business).

However, Dropbox’s business model is not unique; nor its barriers to entry high enough to deter new competitors. Google (Google Drive) and Microsoft (OneDrive) are all wedging into Dropbox’s territory. On top of that Slack (taken over by Salesforce) and Zoom (:NASDAQ:ZM) are also encroaching into its business. As there are many cloud-based choices for users these days, Dropbox’s position is not that secured over the long term.

When is the best time to buy Dropbox shares?

Dropbox’s shares have been trading sideways for many weeks. This is both good and bad.

On the good side, Dropbox shares may outperform the general tech sector as other tech stock slumps deeper into the red. Amazon (NASADQ:AMZN), for example, is flirting with new 52-week lows. Tesla (NASDAQ:TSLA), Facebook, Nvidia are all suffering from intense selling pressure. By comparison, Dropbox is like a ‘safe haven’ stock.

To the downside, there is simply no major buying interest in the stock. It lacks ‘excitement’ to drive the stock higher. If there is a market recovery down the road, traders may simply buy the most beaten-down stocks instead of Dropbox.

As such, the best time to buy Dropbox shares is when prices break out of its base range at $18-$25 to the upside.

Is the Dropbox share price overvalued or undervalued at the moment?

Overall, it seems Dropbox is ‘undervalued’ by the market. But as we all know, what is undervalued can stay undervalued for some time – unless some positive catalysts change investors’ perception of the company.

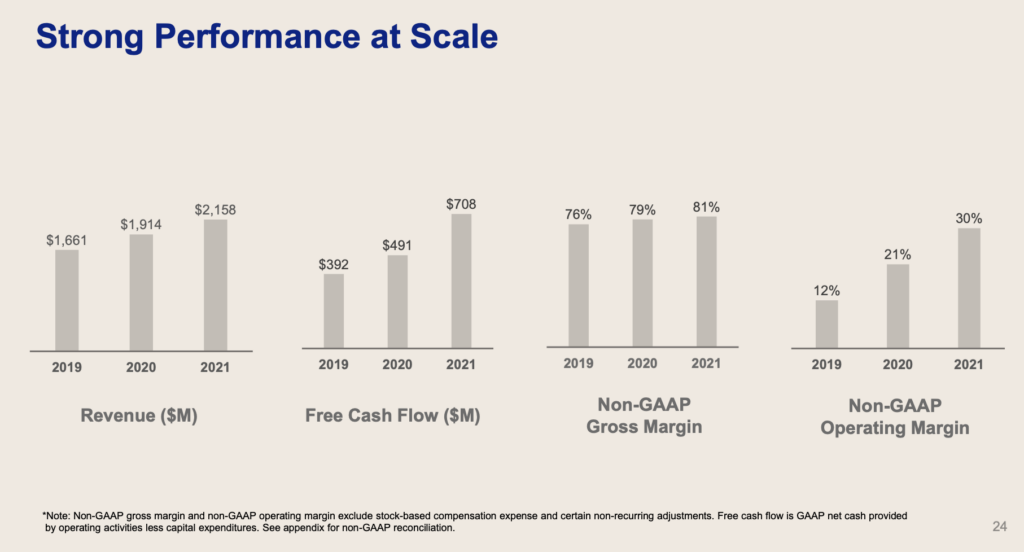

Dropbox is a profitable business. Its revenue stream is growing; as is its pre-tax profits. DBX has some free cash flow, too (see below). In sum, Dropbox is not a shaky tech company.

Moreover, Dropbox’s price-earnings ratio is around 20 – inexpensive compared to other loss-making tech stocks.

Source: Dropbox Inc

Why has Dropbox’s share price risen recently?

Dropbox shares have risen by 20 percent in the past few weeks due to two reasons.

The first is that investors are expecting a less punishing rate of increase in the Fed Funds rate. This means that the monetary policy could be less restrictive in the coming months. This could be good for the economy and the market.

And the second reason is a general market rebound – which saw many tech stocks rally from their 52-week lows. This pulled Dropbox up from the bottom of its range at $20.

Technically, however, Dropbox remains stuck in the $18-$25 range and is still developing the base pattern. To signal a new uptrend requires an upside breakout at $24-25.

What is Dropbox’s share price prediction?

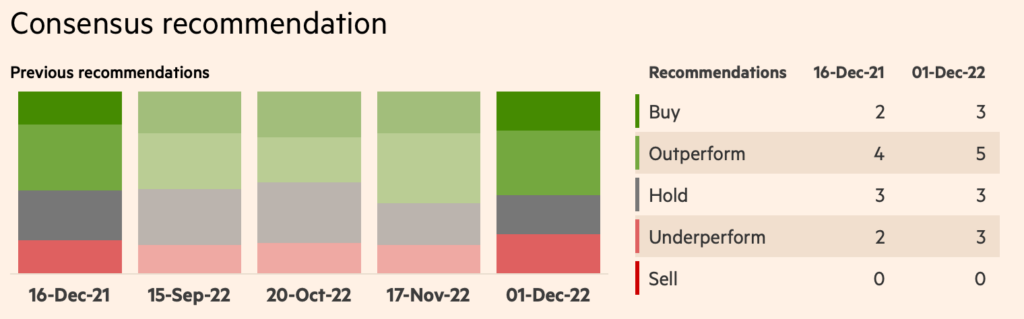

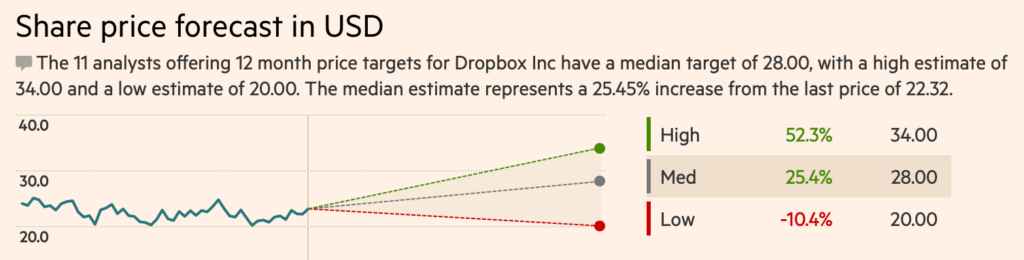

The analysts recommendations show no great change over the past year. This is unsurprising given that Dropbox’s share prices were largely stagnant. No price change means a static market outlook.

However, given Dropbox’s firm price floors, analysts are pencilling rather bullish price targets (some up to $30).

All in all, Dropbox is likely to meander sideways for the time being and avoid the massive price slides elsewhere in the tech sector.

Source: Financial Times

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.