To buy shares in Woodbois (LON:WBI), you need a trading or share dealing account that lets you invest in smaller-cap stocks. This is because as of 16/04/2024 16:30 Woodbois’ market cap is only £26,918,754 (as of 16/04/2024 16:30). However, before investing in slightly more illiquid companies, there are a few things you need to know. In this guide, we take you through how to buy Woodbois shares and what to watch out for.

🧑🎓Follow these three steps if you want to buy shares in Woodbois:

- Open an investment account with a stock broker that offers access to the AIM market where Woodboise is traded, like Hargreaves Lansdown, AJ Bell or Interactive Investor.

- Deposit funds from your bank account or debit card.

- Search for the symbol “WBI” on the investment platform

- Enter the number of shares you want to buy (or you can choose to buy as an amount and the platform will round it down to the nearest amount of whole shares. At the moment, you cannot buy fractional shares in Woodbois.

- Click buy, and you will own shares in Woodbois, and they will sit in your investment account

Thinking about buying Woodbois shares? Find out why the Woodbois share price is falling.

🤔Note: Woobois is listed on AIM, not the main LSE market.

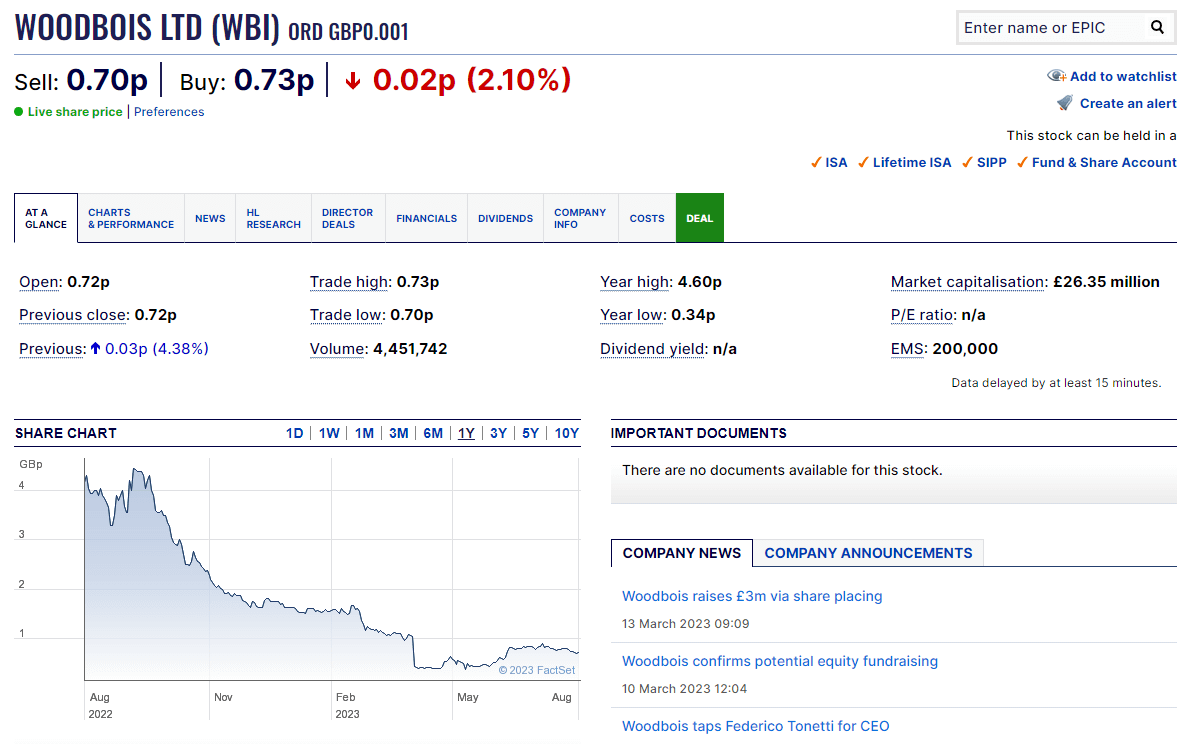

As Woodbois is a small-cap stock, there will be a large spread between the buy and sell price. It may be worth setting a limit price in between to get a better fill. You can see in this screenshot from Hargreaves Lansdown that the bid-offer is 70p to sell and 73p to buy. That’s a difference of over 4%.

How to buy Woodbois shares

There are a few different ways to buy Woodbois shares and some come with very good tax benefits.

- GIA – a general investment account where tax is payable on Woodbois share price gains and dividends

- Investment ISA – a stocks and shares ISA where profits and income from Woodbois dividends are tax-free – (note Woodboise does not pay a dividend)

- SIPP – a self-invested pension where you can buy Woodbois shares for your retirement. Profits are tax-free, but you only get them at retirement age.

What is the live Woodbois (LON:WBI) share price?

As of 16/04/2024 16:30 the current Woodbois (LON:WBI) share price is 0.69p which is a change of 0.02 or 3.31% from the last closing price of 0.69 with 67,544,097 shares traded giving Woodbois a market capitalisation of £26,918,754. The most recent daily high has been 0.7 and daily low 0.65. The Woodbois share price 52 week high has been 1.1 and the 52 week low 0.22.

How much does it cost to buy Woodbois (LON:WBI) shares?

As of 16/04/2024 16:30 buying one LON:WBI share costs 0.69p. However, as well as the 0.69p cost of buying the shares you will also have to pay stamp duty, commission when you buy and sell shares and custody fees for holding your shares on your account. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.