The FTSE All-Share Index, (FTSE All-Share) is a broad-based stock market index that represents the performance of 575 listed companies on the London Stock Exchange (LSE) that range in size from £3.9bn (Superdry) to £1734bn. (Shell). It was formed in 1962 and has an aggregated market cap of £2tn, and overall produces a dividend yield of 3.85%. As it covers more companies, sectors and companies of various sizes it is considered a better guage fo the UK stock market than the FTSE 100 (Which only covered the top 100 listed companies by market cap).

Comprehensive Coverage

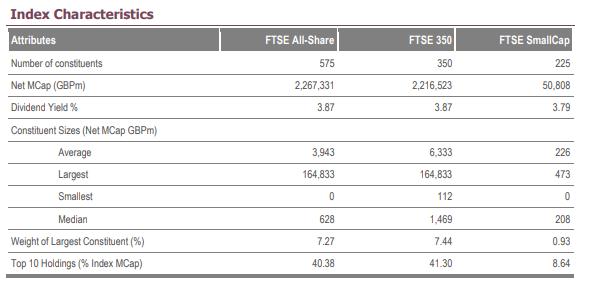

The FTSE All-Share includes not only the companies listed on the FTSE 100 (the largest 100 companies by market capitalization) but also the companies listed on the FTSE 250 (the next 250 largest companies) and the FTSE SmallCap Index (smaller companies). Therefore, it encompasses a wide range of companies, from large multinational corporations to smaller, domestically focused firms. You can see here how the FTSE all share compares to the other major UK indics.

- Related guide: How to invest in the FTSE 100?

Diverse Sectors

The index covers companies from various sectors, including financial services, healthcare, technology, consumer goods, energy etc.. This diversity reflects the overall composition of the UK stock market. The currency breakdown of sectors and companies within the FTSE all share is:

| Sector | # companies | % of index |

| Technology | 17 | 2.96 |

| Telecommunications | 6 | 1.04 |

| Health Care | 12 | 2.09 |

| Financials | 257 | 44.70 |

| Real Estate | 51 | 8.87 |

| Consumer Discretionary | 82 | 14.26 |

| Consumer Staples | 22 | 3.83 |

| Industrials | 85 | 14.78 |

| Basic Materials | 21 | 3.65 |

| Energy | 14 | 2.43 |

| Utilities | 8 | 1.39 |

| 575 | 100 |

Constituents

Like many stock market indices, the FTSE All-Share is weighted by market capitalization. This means that larger companies have a more significant influence on the index’s movements than smaller ones.

Here are the ten largest and smallest companies listed on the FTSE-All shares:

| Biggest Companies | Largest Market cap (m) | Smallest Companies | Smallest Market cap (m) |

| SHELL PLC ORD EUR0.07 | 173,903.87 | SUPERDRY PLC ORD 5P | 38.93 |

| ASTRAZENECA PLC ORD SHS $0.25 | 164,537.10 | POD POINT GROUP HOLDINGS PLC ORD GBP0.001 | 50.24 |

| HSBC HLDGS PLC ORD $0.50 (UK REG) | 123,667.57 | NB GLOBAL MONTHLY INCOME FUND LD RED ORD SHS NPV £ | 51.53 |

| UNILEVER PLC ORD 3 1/9P | 102,546.59 | CT UK HIGH INCOME TRUST PLC ORD 0.1P | 66.66 |

| BP PLC $0.25 | 90,030.36 | VALUE AND INDEXED PROP INC TRUST ORD 10P | 83.43 |

| DIAGEO PLC ORD 28 101/108P | 71,054.57 | MOTORPOINT GROUP PLC ORD 1P | 83.88 |

| RIO TINTO PLC ORD 10P | 65,419.94 | GLOBAL OPPORTUNITIES TRUST PLC ORD 1P | 90 |

| GSK PLC ORD 31 1/4P | 61,548.10 | PALACE CAPITAL PLC ORD 10P | 93.9 |

| BRITISH AMERICAN TOBACCO PLC ORD 25P | 60,829.54 | SCHRODER EUROPEAN REIT PLC ORD GBP0.10 | 94.68 |

| GLENCORE PLC ORD USD0.01 | 57,283.16 | MAJEDIE INV PLC 10P | 96.72 |

- Related guide: How to invest for a monthly income

Performance Benchmarks

The constituents of the FTSE All-Share is reviewed regularly to ensure that it includes eligible companies. Companies may be added or removed from the index based on factors like market capitalization and liquidity.

The FTSE All-Share Index is a commonly used yardstick or benchmark. Investment professionals and analysts look at its performance to understand whether the broader UK stock market is going up or down. By comparing the performance of individual stocks or investment portfolios to the FTSE All-Share, they can assess how well those investments are doing relative to the overall market.

Investment professionals, including fund managers, use the FTSE All-Share as a basis for designing investment products like mutual funds and exchange-traded funds (ETFs). These investment products are designed to replicate the performance of the FTSE All-Share Index. In other words, they invest in the same companies in roughly the same proportions as the index. This allows investors to put their money into these funds and effectively “track” or mimic the performance of the entire UK stock market.

How can you invest or trade the FTSE All-Share Index?

The easiest way to invest in the FTSE All-Share Index is to buy an ETF that tracks it like Vanguard’s FTSE U.K. All Share Index Unit Trust or the SPDR® FTSE UK All Share UCITS ETF where the fund’s primary goal is to replicate the performance of the extensive UK equity market. To achieve this objective, the Fund’s investment strategy is focused on closely mirroring the performance of the FTSE All-Share Index while making every effort to minimize any divergence between the Fund’s performance and that of the Index.

You can also trade the index through derivatives like CFDs, financial spread betting, or futures and options.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.