What is Climate Tech?

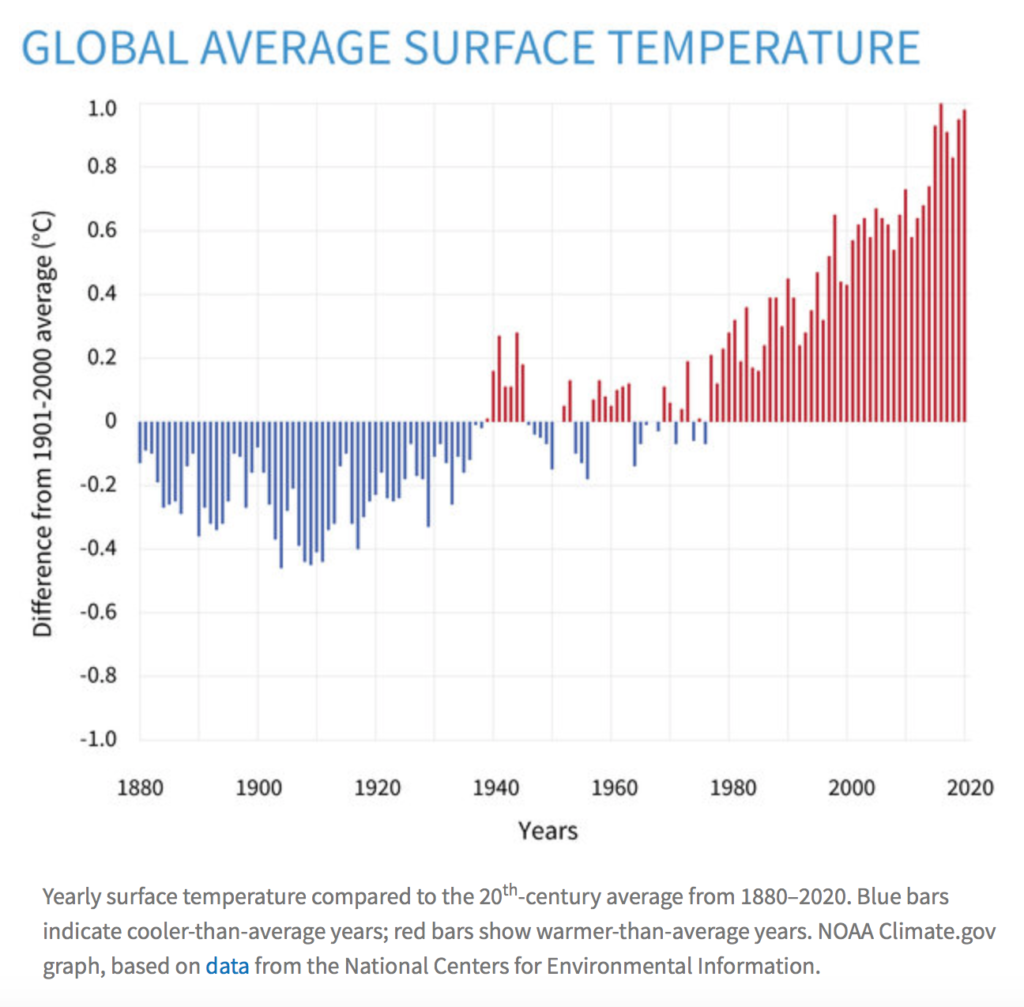

Climate tech is the technology that helps the climate and is one of the most trending topics these days. A consensus is being formed among nations that something must be done to halt the process of climate change, particularly the persistent rise in global temperature.

The COP26 conference in Glasgow, and the Paris Climate Accord in 2015, are a strong testament to this effort. Top officials have worked together to achieve a concerted climate policy palatable to most nations, such as stopping deforestation.

Once governments lead the way, corporations follow. Many innovative companies attempt to generate solutions to tackle climate change while making profits. In the past, these sectors were known as ‘clean energy‘. Now, they are rebranded as ‘climate technology’ companies.

But the climate technology sector is a complex one. These companies originate from a diverse group of sectors, from renewable energies to green transport, from plant-based food to engineering. There is no definitive description of what a climate tech should be. This follows from the fact that to achieve decarbonisation of the environment, a complex set of solutions encompassing a wide range of industries is required.

Climate tech companies are not new. In fact, many far-sighted entrepreneurs have started their companies as early as two decades to tackle climate change. One of the most famous companies is Tesla (TSLA), the electric car company.

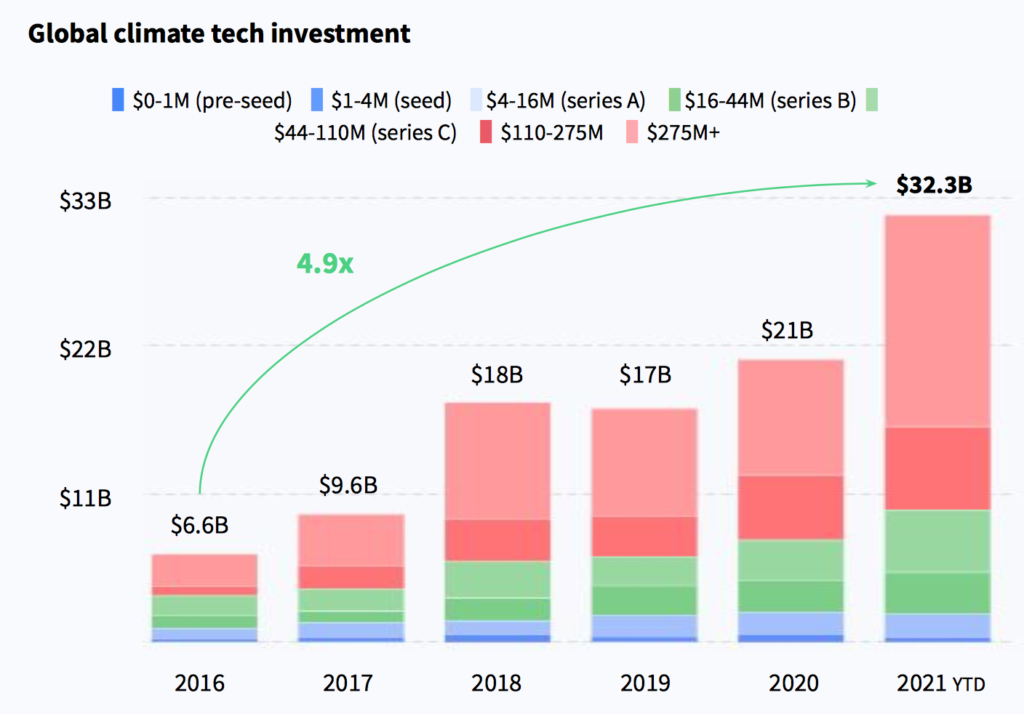

Due to the urgency of climate change, investment in the technology that addresses this problem have soared. According to a consulting firm, more than $30 billion of venture capital have poured into new climate tech firms. Even Bill Gates have recently predicted that climate tech will produce 8-10 Teslas over the long term.

Therefore, forward-looking investors should deploy capital into these new and innovative industries that help to make the world a better place to live in.

How to invest in climate tech

The basis for investing in climate tech firms is clear. They will be a major part of the future investment world. But how should we invest in them?

Investing in climate technology companies is just like any other investment endeavours. There are many choices for investors. The most conventional approach is to find stocks are developing technologies that tackle climate change, technologies that aim to reduce the carbon footprint.

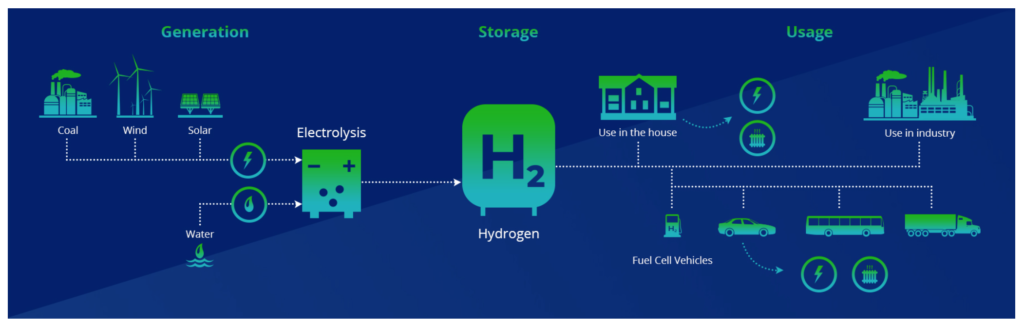

One example is green hydrogen. A hydrogen-based economy greatly reduces harmful greenhouse gases. Because of this, companies that manufacture hydrogen or developing hydrogen stations have surged in recent years. Many expect that hydrogen will be one part of the energy mix that replaces hydrocarbon.

Climate Tech stocks and shares

In the US, stocks like Plug Power (US:PLUG) and Ballard Power (US:BLDP) have relied significantly in recent years. In the UK, ITM (ITM) and Ceres Power (CRW) are favourite green stocks.

Another sector is electric cars. Apart from Tesla, there are numerous electric vehicle companies in the market to choose from . In addition, supporting software, chips, and suppliers also get a boost when the EV market takes off.

Battery makers are particularly sought after. Did you know that Contemporary Amperex Technology (CATL, CH:300750), the battery supplier from China, is now the world’s 47th largest company? In Europe, the most prominent battery-maker is NorthVolt, which has secured $6.5 billion of capital to invest in the next-gen battery.

The automotive chip-maker Nvidia (NVDA) is even more impressive – its market capitalisation of $740 billion is the 8th largest company globally, ahead of Berkshire Hathaway (BRK.A) and JP Morgan (JPM).

And then we have the traditional clean energy stocks, such as wind turbines and solar panels producers. These companies had a roaring rally back in the noughties. That boom and bust episode has been digested and these sectors are ready to move on once more.

Climate Tech ETFs

Apart from individual stocks, investors have access to a large number of funds and exchange-traded funds (ETF) that invest in climate change solutions. For example:

- Wind – First Trust Wind Energy ETF (FAN)

- Solar – Invest Solar ETF (TAN)

- Battery – Global X Lithium & Battery (LIT)

- Hydrogen – Global X Hydrogen (HYDR)

- Clean Infrastructure – Clean Smart Grid Infrastructure (GRID, ETF site)

- Clean Energy – iShare Global Clean Energy (US:ICLN, UK:INRG, ETF site)

- Clean Tech – Global X Clean Tech (CTEC, ETF site)

- Timber – Invesco Global Timber ETF (CUT, ETF site)

- Electric Vehicles – Global X Autonomous & EV (DRIV, ETF site) or iShares Self-Driving EV (IDRV, ETF site)

- Uranium – Global X Uranium (URA)

The advantages of investing in an ETF are twofold. First, you buy into a portfolio of stocks that tracks a particular theme. This way, you diversify the risk that arises from individual stock picking. Second, the portfolio is automatically adjusted to reflect new entrants. You do not need to keep abreast with every subsector developments over time.

Where to buy Climate Tech stocks & ETFs

To invest in climate tech stocks you need a share dealing account that enables you to invest in these UK & US stocks like:

What are the risks of investing in climate tech?

Investing always carries risks. Climate tech companies are no different.

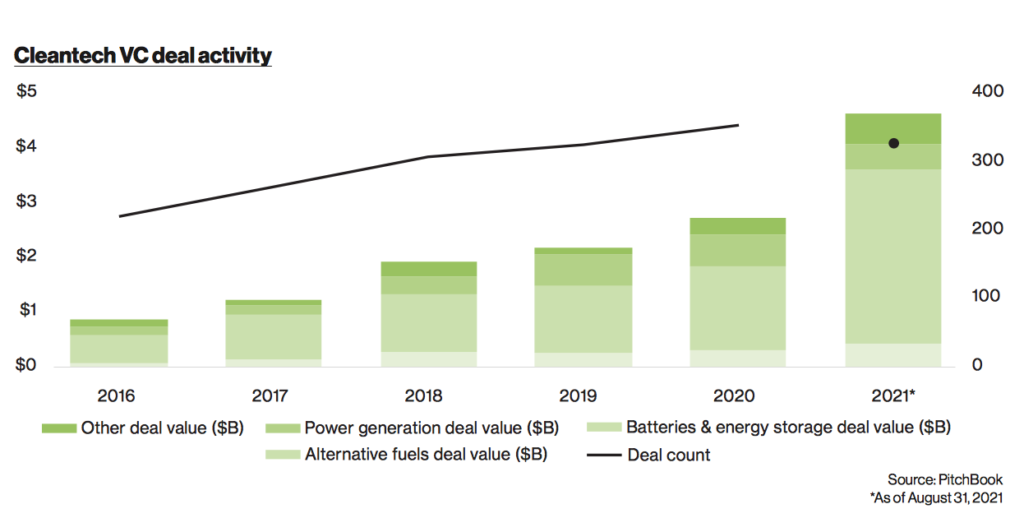

First of all, you have to understand that climate tech is still an emerging industry. This means that no one can predict who the long-term winner will be. Big investors generally spread their risk by buying several start-ups. You should do so too by buying funds or ETFs.

Second, not all climate tech companies will remain solvent over time. This is because some companies are loss-making and will need to find new financial backers to fund their operations regularly. But this is not a big problem if revenue is rising.

Sometimes a start-up will go through a series of venture investments (series A,B,C,D,E etc) before being listed in a stock market. By then, however, the company’s valuation is high and expected returns are not as favourable as before. You have to do some homework before buying into a large IPO.

Generally, because climate tech stocks are smaller, the risk is higher too. To compensate investors for taking the risk, the anticipated returns are generally higher as well.

The third risk is market risk. New industries always attract plenty of capital at the beginning. Think of the dotcom in the mid-nineties. As the sector booms, it attracts even more speculative capital. This creates a massive rally out of proportion to the industry’s fundamentals. Prices soar, then collapse.

If you FOMO into a ‘hot stock’ (Fear of Missing Out), you must be prepared to exit at some point or risk becoming be a ‘bag holder’.

For example, look at Plug Power (PLUG), one of the most-followed ‘green economy’ stock. Prices shot up from $3 to $70 in less than a year and have subsequently collapsed back to $20 again. Anyone who bought above $50 are now ‘bag holding’ for the foreseeable future.

What moves climate tech investing?

Climate change is a long-term issue.

The annual climate summit will remind everyone that the topic requires constant updates and changes to progress in the desired direction.

But what drives the sector forward?

Newly discovered technologies will create a better way of tackling climate change. For example, small modular nuclear reactors could be a solution in generating clean – and stable – energy sources. Romania is looking to install these reactors in a few years time.

Another example is the next-gen batteries that support extreme fast charging (XFC). If successful, this could change the entire calculus of transport.

However, the advancement of technology will not occur at a steady or linear speed, but by leaps and bounds. There will setbacks along the way.

Government policies will also be critical. Subsidies and taxes to prompt household to change their behaviour and enacting nationwide policy to mandate new energy usage are all important factors.

For example, in London the recent expansion of the Ultra-Low Emission Zone aims to remove older, polluting vehicles off the road and to promote the usage of greener cars.

Lastly, the impetus that move climate tech sector is financial. Deep-pocket financial groups, particularly venture firms, that are muscling into the sector. This will propel the climate-tech sector forward at a faster speed because of the intensity of the return-seeking investors.

General Atlantic just raised $4 billion to invest in climate tech firms. Others are catching up too. Soon, we will see a new ecosystem built around firms specialising in providing climate solutions.

The next decade is indeed an exciting one for investors.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com