The latest Spot the Dog report, published by Bestinvest, has shed light on the underperformance of 151 equity investment funds which manage around £95.0 billion of investors’ wealth.

A sharp increase in underperformance

This figure marks a staggering +170.0% increase in the number of underperforming funds when compared to the previous Spot the Dog report.

Which recorded just 56 funds consistently underperforming their benchmarks, over the previous three years.

Global equity funds are feeling the pinch

The Bestinvest data highlights the growing challenges that investors face in keeping their investments afloat, amidst shifting market conditions.

- The latest report shows that 49 Global Equity funds were underperforming.

- A figure that is more than double the previous tally of just 24 funds.

Even funds managed by superstar investors, such as Terry Smith and Nick Train have recently been lagging behind broader market returns.

An unusual market backdrop

The last three years have played out against an unusual market backdrop, which has been characterized in turn by sharp gains in oil and gas shares and dramatic price rises in a narrow band of US mega-cap growth companies.

A combination that has left large parts of the stock market and many funds lagging behind.

The rise and fall of the Energy sector

If we measure its performance over the last three years, then the energy sector has been among the best-performing global industries.

With the MSCI World Energy Index delivering a total return of +125.0%, according to the BestInvest data

And as a result, funds that failed to capitalize on this trend, and which were underexposed to the energy sector struggled to keep up with their benchmark index.

More recently, however, energy prices have fallen. The S&P 500 Energy sector, growing by just +1.61%, for example, over the last 52 weeks.

Despite that decline in recent performance, almost half of the global funds on the Spot the Dog list, have a focus on sustainable investing, and therefore did not participate in the sharp rise in oil and gas-related shares.

What’s more the renewable energy sector faced its own challenges. with the MSCI Global Alternative Energy Index declining by -45.0%, finishing in negative territory in three consecutive years, 2021, 2022 and 2023.

For comparison, the MSCI Global Alternative Energy Index, fell by -25.23% in 2023, while the MSCI World Equity Index rallied by +24.42

The emergence of the Magnificent Seven

The leadership in equity markets switched from Energy stocks to the so-called ‘Magnificent Seven’ – a group of high-flying US tech companies – have significantly influenced the overall returns in equity indices, such as the S&P 500 and Nasdaq 100. Thanks largely to the buzz around AI and the growth of these businesses.

Microsoft, Apple and Nvidia now all have market caps that are above $2.0 trillion. Making these individual stocks larger than many national stock exchanges.

Microsoft has now become the world’s largest company when measured by market cap.

Many fund managers missed out on the initial gains in these stocks, believing that the Technology sector was already overvalued, and that value, rather than growth stocks offered better opportunities.

Over the last year the S&P 500 Information Technology sector, has rallied by +61.60% and the Communications Services sector by +58.81%.

Whilst the S&P 500 Value index is up by just +20.16% over those 52 weeks

Even the big guns can get it wrong

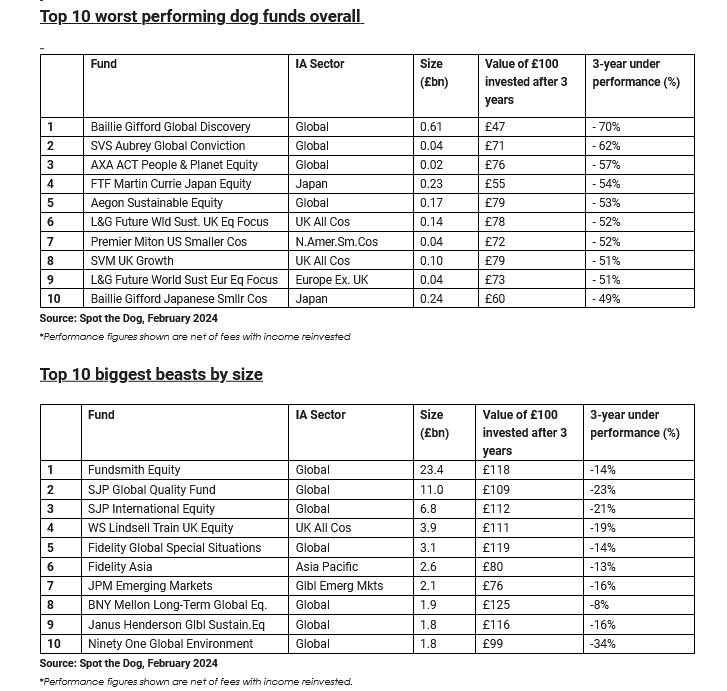

Two of Britain’s most prominent fund managers, Terry Smith and Nick Train, have seen their funds – Fundsmith Equity and WS Lindsell Train UK Equity funds – make an appearance in the Spot the Dog list, for the first time ever.

Though it’s true to say that despite their recent underperformance, both funds have delivered returns, that are significantly ahead of their relevant benchmarks, over the longer term.

For example, since November 2010 Terry Smith’s Fundsmith Equity, has delivered a total return of +563.0% to its investors.

In doing so, it comfortably outperformed the MSCI Word index, which returned +351.0% over the same period.

The importance of staying the course in fund investing

While it’s crucial for investors to monitor their investments and understand why certain funds underperform, it’s equally important to maintain a long-term perspective.

Shifts in market conditions and short-term underperformance do not necessarily indicate a need for drastic changes in investment strategies.

Investors should carefully consider the reasons behind a fund’s underperformance before taking action.

Factors such as changes in the management team, process, or fund size may have contributed to the weaker performance.

Ultimately, investors should view the Spot the Dog report as a starting point for further investigation rather than a definitive ‘sell’ list.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.