US Securities Exchange Commission shook the crypto market in early June as it filed charges against Binance, the world’s largest crypto exchange. This is the most significant event for crypto market since FTX’s collapse last November. But is this a threat or opportunity for crypto investors? Here’s my quick take on the event.

Binance Pursued by SEC

Just when crypto investors project bumper returns (Bitcoin up 50% year-to-date) with no further shattering bankruptcies à la FTX, SEC threw sand into the crypto market.

Specifically, on 5 June, 2023 the securities regulator charged Binance, the world’s largest crypto exchange, for “unlawfully” soliciting “U.S. investors to buy, sell, and trade crypto asset securities through unregistered trading platforms available online at Binance.com and Binance.US.“

The US SEC claims that the “defendants BAM Trading and BAM Management defrauded equity, retail, and institutional investors about purported surveillance and controls over manipulative trading on the Binance.US Platform, which were in fact virtually non-existent.“

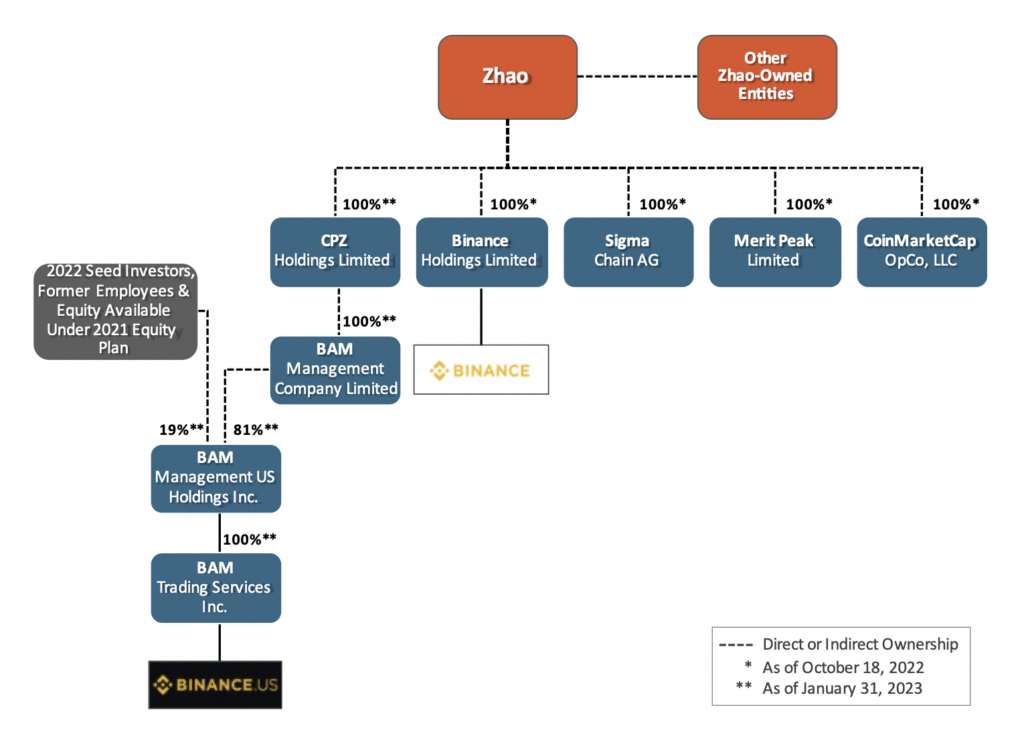

In total, the SEC files 13 charges against the crypto exchange. In the charge document, the SEC detailed how Binance was run by a web of corporate entities and how trading violations occurred between these companies (see below).

According to the SEC document, trading between Zhao-owned entities was deliberately concealed. Customers’ funds were directed to companies controlled by the founder. As a result of “lacking regulatory oversight”, Zhao and Binance were “free to and did transfer investors’ crypto and fiat assets as they [Defendants] pleased, at times commingling and diverting them in ways that properly registered brokers, dealers, exchanges, and clearing agencies would not have been able to do“.

According to a recent New York Times article, Signature Bank and Silvergate Bank (delisted and in the process of liquidation) were used to move billions of dollars. These are hefty and serious charges.

Source: Securities Exchange Commission (SEC)

In the war of words between the two parties, Binance unsurprisingly called SEC’s action “extremely aggressive and intimidating.”

On top of Binance’s lawsuit, the securities regulator also filed charges against Coinbase (US: COIN) the very next day for “operating as an Unregistered Securities Exchange, Broker, and Clearing Agency“. Coinbase is another large crypto exchange listed on the Nasdaq with a market cap of $12.8 billion.

As a result of these regulatory actions on the crypto industry, fear and uncertainty have increased markedly. Crypto prices dropped sharply in the wake of the charges.

But more importantly, will these charges cripple or help the crypto industry? What are the next steps for these exchanges after these charges? Will Binance Coin survive?

Making predictions is a hazardous business, let alone on a fast-development sector like crypto.

So far, price action on Bitcoin (BTC) and Ethereum (ETH) have stayed relatively resilient.

For Binance Coins (BNB), however, selling pressure has increased following SEC’s action. Prices dropped by double digits over the past few sessions as its legal woes mount. Technical support levels normally identified by chartists can no longer serve as important floors reliably since Binance’s corporate events determine price action.

What is Binance?

Binance, founded by Zhao Changpeng (‘CZ’) in 2017, is currently the world’s largest crypto asset exchange. While the company traced its origins to China, it migrated from the country due to a local regulatory crackdown on the crypto sector. Currently, the Cayman Islands-registered company provides crypto services in more than 100 countries.

Binance rode the 2021 crypto boom to the hilt. As traders and investors bought and sold vast amounts of crypto coins on the exchange, massive fees flowed to Binance’s coffers. In 2022, Binance’s revenue is estimated to top $12 billion (Binance is privately owned so few accurate are available). So lucrative is the platform that in early 2022 some news outlets name CZ one of the richest entrepreneurs in the world worth more than $90 billion.

However the development of Binance is not one of smooth sailing. Its has a chequered history with regulators around the world. It struggles to maintain a corporate headquarter.

Moreover, in March this year, the US Commodity Futures Trading Commission (CFTC) charged Binance with “willful Evasion of Federal Law and Operating an Illegal Digital Asset Derivatives Exchange“.

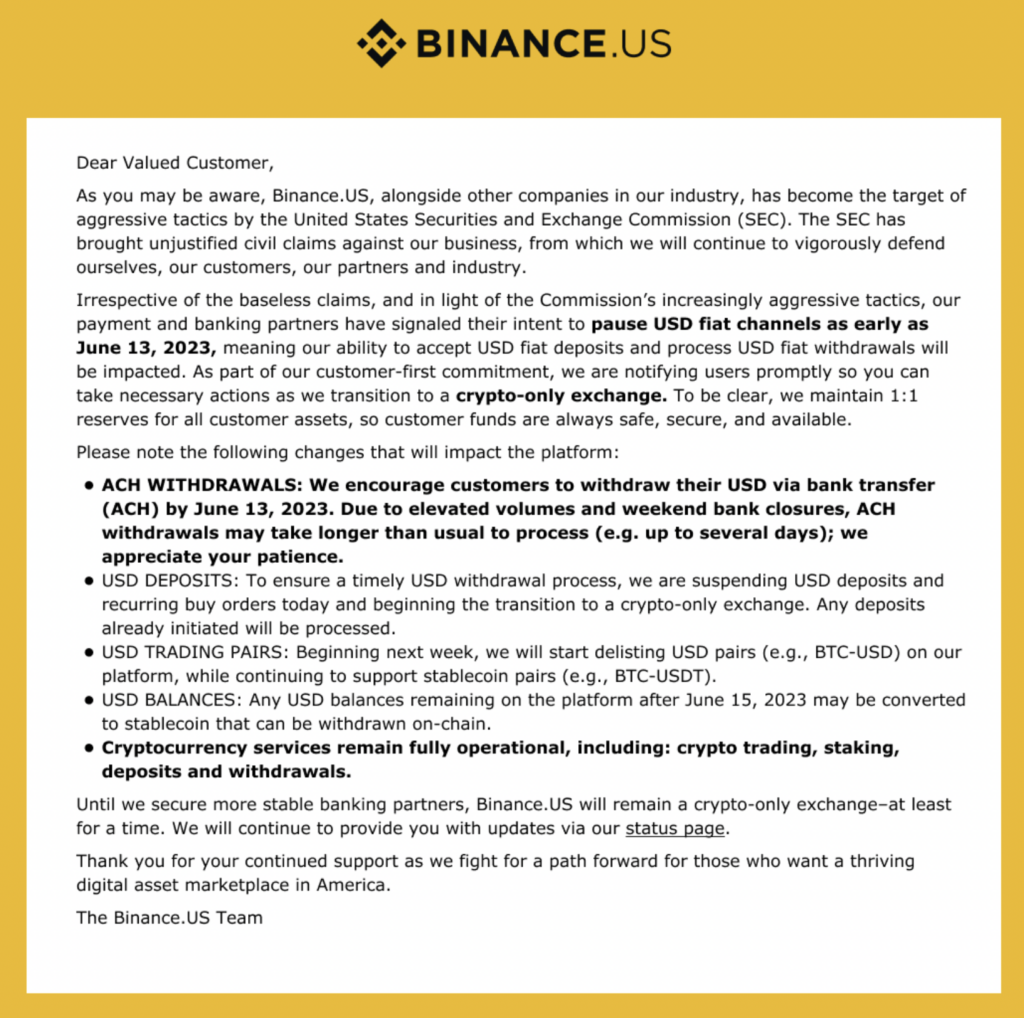

As a result of these legal wrangling, in the 24 hours following SEC’s charge, traders pulled at least $700 million from the exchange. On 9 June, four days after SEC’s charges Binance.US encourages customers to withdraw fiat asset from the platform. It is about to suspend USD withdrawals on 13 June and aims to become a ‘crypto-only exchange’ (see below).

Source: Binance.US Twitter

Crypto Exchange Woes: Threat or Opportunity?

In light of the recent Binance legal action, many investors are asking: Is this a threat or opportunity?

Remember those dark days following FTX’s demise in 2022? When Sam Bankman-Fried’s empire collapsed, the entire crypto market was shaken to the core. Every crypto-related security plummeted. Fear permeated the industry. But those year-end lows proved to be a lucrative opportunity for astute traders.

Bitcoin rose by a third in a matter of weeks in 1Q2023; Coinbase (COIN) doubled. The two largest crypto mining firms – Marathon (MARA) and Riot (RIOT) – jumped by 300-400 percent in the first quarter.

Be greedy when others are fearful, advised Warren Buffett. That advice has certainly served traders well – traders who brave the storm and bought in December. However, have we reached another of that bear-to-bull inflection point yet? This is a million-dollar question that has no clear answers.

In the past seven sessions, many tokens have take a small hit. Seemingly, investors are not particularly concerned about Binance’s legal troubles. This is no FTX 2.0.

There are two ways to look at Binance’s troubles. Either the market has yet to realise the severity of Binance’s situation (bearish tilt) or that the market is very resilient (bullish tone). But as we saw with FTX, matters can turn ugly in a matter of days. No one is sure what will happen if Binance is forced to retreat from the US.

For Bitcoin, after a knee-jerk drop below $26,000 prices have rebounded swiftly. While this is near-term positive, macro concerns like further rate hikes have continued to stalk investor sentiment (see below).

Perhaps Bitcoin’s price action mimicked the economic uncertainties in the wider market. Further choppy action within the defined boundaries ($20,000 -$30,000) is my guess for the crypto coin.

So far this year, I have been impressed by Bitcoin’s rally. But then, most MATANA stocks (MSFT, AMZN, TSLA, AAPL, NVDA, ALPHABET) have staged equally impressive runs. Tesla is up by more than 100% from last year’s lows; Apple is flirting with new highs. The Bitcoin-Tech link remains as strong as ever.

In light of these trends, I give the bulls the benefit of the doubt for now, with stops to protect long positions should further ‘Black Swan’ events emerge.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.