P&F daily price breakouts occur when an instrument reverses its trend, as determined by the point & figure chart. Bull breakouts occur when an instrument’s price rises one box above the prior column of “X”s. Bear breakouts occur on a move to one box below the prior column of “O”s. Targets are determined from a multiple count of three times the move from the low or high. Stop levels are set at the point at which the P&F trend would reverse.

UK Shares with Daily Breakouts

Price breakouts and their significance

In the lexicon of market analysis, an often-used term is a ‘breakout’. But what is a breakout? In short, it describes the moment a stock trades at a new price level, relative to its own history.

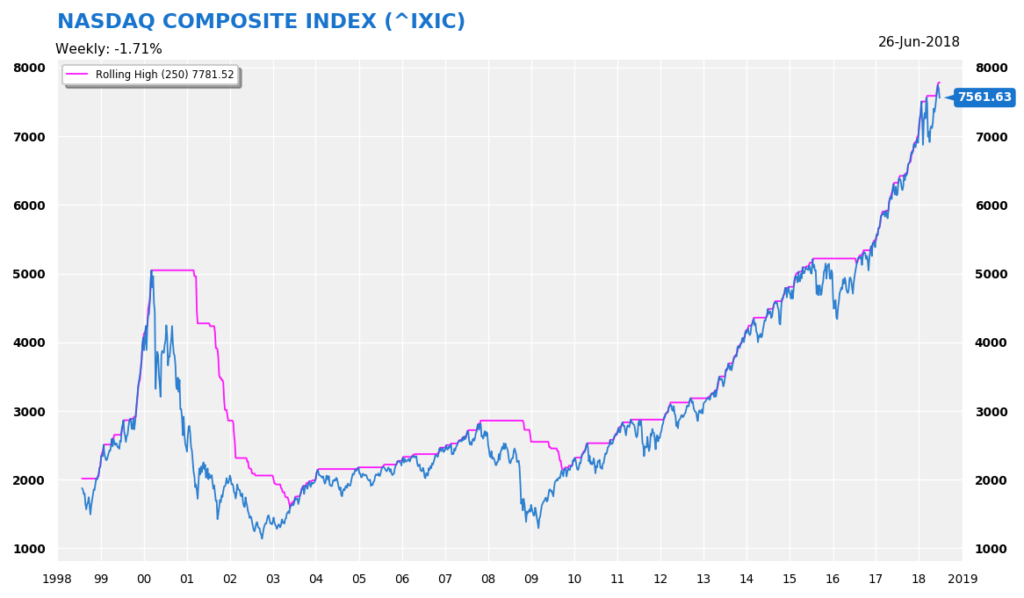

Consider the Nasdaq Composite Index. It has been breaking out to new all-time highs. This means the index is trading at a level that has not been traded before. New 52-week highs led to many subsequent breakouts.

Knowing a breakout is only the first step. For a breakout to be actionable, we need to know what type of breakout we are looking at. For example, is the breakout significant? Is the breakout the 25-th one this year? Are the breakouts short- or long-term ones?

| Breakout | Significance |

| New All-Time Highs/Lows | Very, very important |

| New Long-term Highs/Lows (say 52-week) | Very important |

| New Medium-term Highs/Lows (say 12/26-week) | Some importance, depending on trends |

Also, I would pay attention to the manner a stock breaks out. Was it forceful? Was it accompanied by good results? etc.

Why, you may wonder, is a long-term breakout significant?

The Psychology Impact of New Highs

In financial markets, psychology matters. Investors are all too human – driven by greed and fear.

Anything that boosts the psychological makeup of markets is positive. And the best booster is in-the-black position, propelled higher by all-time breakouts. How so? When a stock is hitting all-time highs, every investor in that stock is sitting on sizeable profits. Profits generate excitement – and greed. It hits front-page news. New highs bring out the feel-good factor.

Another thing that an all-time high breakout generates is FOMO: Fear Of Missing Out.

Imagine this all-too-familiar conversation between two traders. Trader A: “I’m in XYZ. It’s unbelievable, up 40% last month! What – you’re not in?! Listen to me…” Immediately, peer pressure will force other traders to pile into stocks that are breaking out. Similarly, fund managers will have to justify why they did not buying stocks that were at new highs and up 100% last year. FOMO will create additional price momentum – until the last available buyer is in.

Of course, if a stock is breaking down to new all-time lows, the psychological impact will be different. Investors are haemorrhaging capital. Fear – known or unknown – is stalking the company. Staring at a potential calamity, investors have three options: Do nothing, cut losses, or average down. If a significant number of investors choose to bail out of the stock, price pressure will increase, leading to more price declines, which lead to more stop triggers, creating more price pressure…..The vicious cycle is set.

How To Use Price Breakouts

There are many ways to use a price breakout. We highlight two. (1) buy (or sell) on a price breakout. (2) wait for a reaction to initiate trading buys.

For example, if a stock breaks out to new highs at $50, you either buy at market price or wait for a pullback to buy. There are pros and cons for each. If you buy immediately, you may not get a good execution price because of high demand. But this guarantees that you’re in the stock.

However, if you choose to wait for better prices, you may not get the chance to buy at $50 again. For example, the stock was range trading at $40-49 for months. Once it broke $50, it immediately jumped to $55. The $50 level may not be seen again after the stock completes its bull run. This may take some months (or years). By then, there is no point in buying the stock any more.

You could combine (1) and (2) – by buying half on a new breakout and half on retracements. This will ensure you’re at least in the instrument. Or you could set buy orders at certain prices, when the stock is nearing a breakout. Obviously, to do this you must do your homework before hand.

Conclusion

Financial markets are dynamical. While fundamentals matter, perception matters even more. A new-high price breakout can change the perception towards the stock overnight – even though the fundamentals have not. A breakout can even trigger a self-reinforcing loop. So, as a rule of thumb, when a stock’s fundamentals have not confirm its rising stock price, I would emphasise the latter. After all, you trade market prices, not fundamentals.