Revolut Customer Reviews

Tell us what you think of this provider.

Amazing

Very good bank to be with which can be used internationally

Amazing

I’m very happy since I’m enjoy Revolut team, it’s very awesome bank and costumer service, they always with you doesn’t matter in which part of world you are, it’s very handy and easy to use, I want say keep go same like you are, you will be the best company on the world.

Outstanding

Straightforward and simple to navigate. Excellent support and great services

AWSOME APP

This is an excellent app for money transfers, investing and international travel insurance. Well worth joining !

Perfect

Perfect

Outstanding

Efficient and trusted

Revoult is a good app

Way better then any other app easy to bank transfer

The best banking app ever

So friendly so quick so efficient

I love Revolut

Always no problem

Since when I joined to Revolut I don’t have any problems with transfers money!👏👍

Revolut Expert Review

Revolut is an all-in-one banking and investment app loved by millions

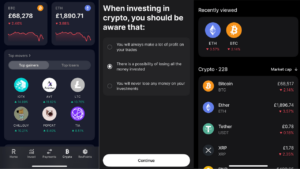

Is Revolut good for investing?

Revolut is a good choice for investors that want to buy and sell major shares and cryptocurrencies. No funds, or smaller cap stocks, but a good entry-level account for most investors.

One of the most commonly asked questions about new banks and fintech is if they are a safe place to keep your money. The answer is generally, yes, if they are regulated by the FCA as funds are protected by the FSCS up to £85,000. But, Revolut, is regulated as an e-money institution and not as a bank so you do not get the FSCS protection.

Revolut says that if they were to go bust, client funds would be paid out of a “safeguarding” account which is a type of ringfenced account where client funds are held. When funds are in this type of account, Revolut cannot (in theory, at least) lend them out or use them to run the business. This is how banks traditionally made money, they pay you a smaller amount of interest than they receive on the money they lend out and make a profit from the difference (among other things).

For small money transfers, Revolut is safe enough, but as with all currency conversions if you are sending over £10,000 abroad you should be using a currency broker. You’ll get much better rates, more control over when you buy and sell, help with all the AML (anti-money laundering) issues that may come up, and the ability to lock in the currency exchange rate for up to a year in advance (if you think it will move against you).

- Sending a small amount of money abroad? Compare the best money transfer apps

Pros

- Easy to use

- Low cost

- Innovative product

Cons

- New company

- Limited Range of investments

- App only

-

Pricing

(5)

-

Market Access

(4.5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4.7

Revolut X cryptocurrency app lets you trade 400 pairs with 0% maker fees

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Revolut Staking Lets You Earn Rewards On Your Crypto Investments

Richard BerryRichard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape. Having worked as a broker at Investors Intelligence and a multi-asset derivatives

Revolut raises interest rates to 5% for £540 per year Ultra account holders

Revolut has raised the interest it offers on cash held in its Instant Access Savings accounts to a maximum of 5% AER. The newly-increased rates given by the all-in-one finance app, revealed on Thursday, are tiered according to the plan its customers subscribe to. Subscribers to the app’s Ultra plan, which charges £45 a month,

Revolut credit card instalments coming to Europe

All-in-one finance app Revolut is rolling out a new feature allowing its credit-card customers in Ireland to pay through instalments, which it plans to shortly expand to other markets Under the new feature customers will be able to space payments out over three, six, nine or 12-months at a discounted interest rate. Multiple purchases can

Revolut adds in-app calls after criticism for scam response

Revolut has introduced in-app calls, allowing personal customers of the finance platform to contact members of its customer service team securely. This offers a secure method to call Revolut Customer Support, directly through the Revolut app, and represents a new security measure to help customers uncover impersonation scams. It also makes contact between customer support

Crowdfunding wins big as Revolut backers in line for 40,000% profits

The first wave of crowdfunders who backed banking fintech Revolut could receive a payout worth 400 times their initial investment. Roughly 4000 users of crowdfunding platforms Republic and Crowdcube will have the opportunity to sell their stakes in the company for $865.42 per share, City AM reported earlier this week. In a letter to investors,

Revolut plans to offer AI assistant, mortgages and ATMs next year

Revolut has unveiled plans to overhaul its offering with the addition of a host of new features, including mortgages and physical cash. At its Revolutionaries event in London on Friday, the banking fintech revealed its intention to introduce an AI-powered assistant, mortgages, ATMs, and develop its business-to-business offering in 2025. In a statement, the firm

UK and EU stock trading is coming to Revolut

Revolut is set to enable UK and EU stock trading on its platform, after receiving relevant authorisation from the Financial Conduct Authority (FCA). But how does it compare to other UK share investing apps. The London-headquartered fintech has been authorised by the FCA to operate as an investment firm, allowing it to expand its services

Revolut fraud response comes under Panorama spotlight

Revolut has come under the spotlight over its response to customers being defrauded, following a BBC Panorama investigation which aired yesterday. Panorama interviewed a man named Jack who had £165,000 stolen from his Revolut business account, in which he held multiple different currencies. Jack was tricked into authorising payments to scammers impersonating the company. After realising

Revolut Alternatives

There is no doubt that Revolut is one of the fastest-growing financial brands in the UK, but at the moment, they do not have an active partnership with Good Money Guide, so we do not currently refer commercial users to them. However, if you would still like to visit Revolut, you can do so here

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com