No, I would say that eToro is not a good platform for long-term investing. There are many things that eToro is good at (like social trading), but if you are a long-term investor there are much better options. In this guide, I’ll explain why eToro is not great for longer-term investors, and where else you should look.

Why eToro is not good for long-term investing

The main reasons why eToro is not good for longer-term investors are because their accounts are in USD, you can’t invest through tax-free wrappers, or into a pension and there is limited access to bonds and funds.

eToro also used to be good for long-term investors as they absorbed the stamp duty on UK shares. But now you have to pay the 0.5% UK stamp duty tax when investing in UK companies so the tax breaks are no longer there.

But as I will go on to explain if you are investing in the long term, here is why these are issues.

USD Account Balances

With eToro your account balance has to be in USD. This is part of how they make money (when they convert your GBP into USD) but it means that if you buy UK shares, then over time your profits can be eroded away by differences in the GBPUSD exchange rate.

Granted this can also work in your favour, but you’re not trading FX, you’re investing and if the exchange rate moves 5% and you have a £100,000 portfolio, that’s £5,000 lost.

No ISA or SIPP

With an ISA you can invest up to £20k a year and no pay tax on the profits. With a SIPP, you are investing for your pension and also don’t have to pay tax on your profits. But with eToro you can not invest in an SIPP, so if you are buying shares and aim to hold them for decades, your tax bill at the end of it could be unnecessarily high.

You can of course invest in an ISA with Moneyfarm, in partnership with eToro. But Moneyfarm doesn’t let you invest in individual stocks, it’s more of a managed robo-advisor, so you may as well just open a separate account with Moneyfar, it will at least help you resist the temptation to speculate with your long-term investments.

- Related guide: How to make money on eToro.

No funds or corporate bonds

eToro is great at giving investors access to popular markets like US stocks, cryptocurrency and commodities, but their market access is actually pretty limited. You can’t invest in small-cap growth stocks in the UK for example.

Plus if you are building a long-term portfolio it should be diverse so you should add in some corporate bonds (fixed-income investments) and some funds that spread the risk and invest in lots of shares and bonds for you.

This is a shame really, because eToro generally does give people what they want. However, it would be great if they could focus a bit more on what people need.

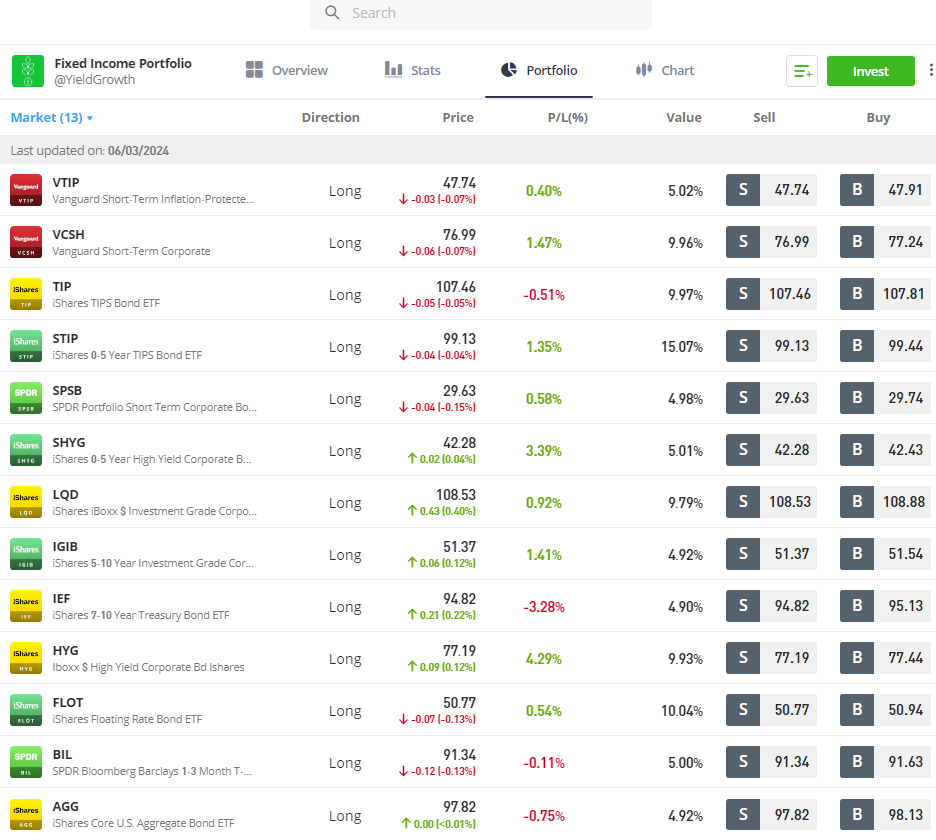

However, eToro does let you invest in bonds through bond ETFs or fixed-income portfolios like YieldGrowth which contains a range of 13 bonds from Vanguard, iShares and SPDR.

eToto altneratives for longter-term investing

If you are investing in the long run, below is a comparison of UK investment platforms and what types of accounts they offer.

| Account Types |  |  |  |  |  |  |  |  |  |

|---|---|---|---|---|---|---|---|---|---|

| GIA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| ISA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| SIPP | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Pension | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Junior ISA | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Junior SIPP | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Lifetime ISA | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.