-

Reviews By

Richard Berry

Reviews By

Richard Berry

- Updated

| Name | Logo | Options Markets | Commission | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Options Markets 40 |

Commission Included |

GMG Rating |

Customer Reviews 3.8

(Based on 124 reviews)

|

Visit Platform 69% of retail investor accounts lose money |

Account Types:

|

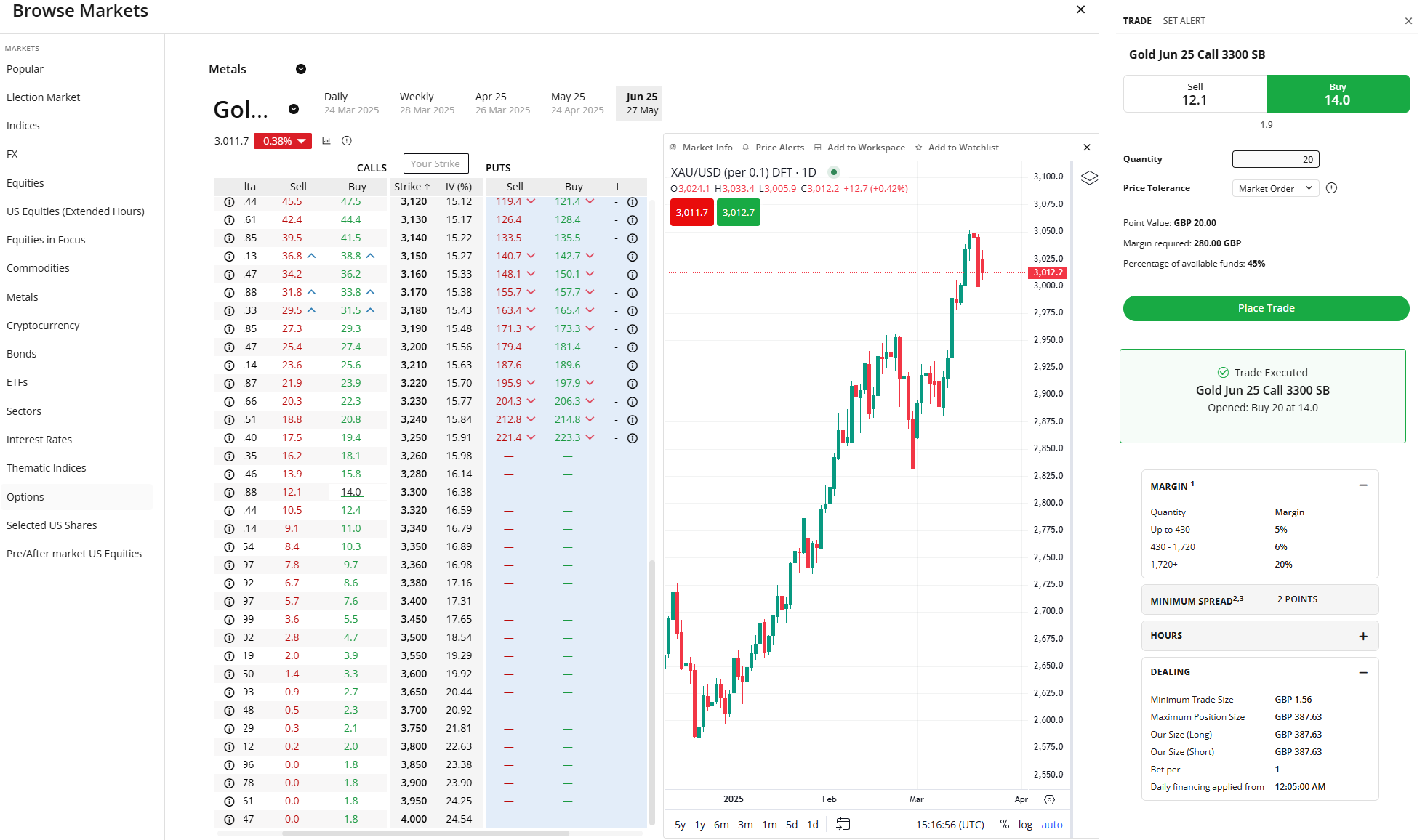

City Index: Good Options Trading Broker For Spread Betting & CFDs Account: City Index Options Trading Description: City Index offer options trading via spread bets and CFDs, the benefit of the course of trading options as a spread bet for UK customers is that profits are free from capital gains tax. Phone trading is one feature that sets City Index apart from other retail options brokers. Is City Index a good options broker? You can trade options with City Index. However, you are limited to trading them as a financial spread bet or a CFD and you can only trade options on some of the most popular major markets like the FTSE or Gold online. If you want to trade stock options, you have to phone the options desk. Which is nice actually becuase most brokers don’t have voice brokerage any more. It’s particulary useful for options trading, becuase it can be, for want of a better word, complicated. Sometime’s it’s much easier to tell a dealer what you want to to and let them take on the risk of making sure they buy and sell the right strategy. It’s really simple to trade options with City Index online, if you just want to take a limited risk directional bet. There are no options strategies available so if you want to trade basic call or put spreads, you have to trade the individual legs. However, as profits from options trading as a spread bet on City Index are tax-free I thought I’d test the platform by trading some Gold options. Jackson wrote some great analysis on Gold’s bull run, as it just topped $3,000 and doesn’t show any sign of stopping. So I’ll go long. When you’re trading Gold CFDs or spread bets you have to worry about high overnight financial charges on long term positions. But that’s not the case with options, you just pay your premium and wait. City Index earn their money on options by widening the spread. I’ve given it till June and hoped that Gold goes up by another 10% and bought some $3,300 June Calls. If the market comes off before then, I’ve lost my premium, but if it pays off, I’ll buy Mrs Berry something yellow and shiny for her 40th Birthday.

For more sophisticated options traders, Interactive Brokers or Saxo offer direct market access on a wider range of equity options (but no financial spread betting for tax-efficient trading). Pros

Cons

Overall4 |

||

|

Options Markets 10 |

Commission Included |

GMG Rating |

Customer Reviews 3.7

(Based on 146 reviews)

|

Visit Platform 76% of retail investor accounts lose money |

Account Types:

|

Plus500 Expert Review 2026: A user-friendly platform with access to global markets Provider: Plus500 Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Is Plus500 a good broker? Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks. Opening a Plus500 account is really simple:

Pricing: It’s dynamic so moves with the market for minimum spreads. Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

Withdrawals are free of charge no matter how many you make per month. Deposits are also free of charge. Market Access: Very good, Plus500 are always first to try new asset classes With Plus500, you can trade CFDs on a range of assets and instruments including:

Overall, there are over 2,800 assets you can trade with CFDs. The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital. Plus500 margin rates:

Platform & Apps: Basic execution, but it does the job well Plus500 trading apps and platform also offers several tools to help traders manage risk including:

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered. It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week. If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

The premium service is invitation only. To become a premium customer, you must have a real-money trading account. However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares). To be eligible for a professional account, you must meet two of the following three criteria:

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

Pros

Cons

Overall4.6 |

||

|

Options Markets 10,000 |

Commission $0.15-$1 |

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Visit Platform 59.7% of retail investor accounts lose money |

Account Types:

|

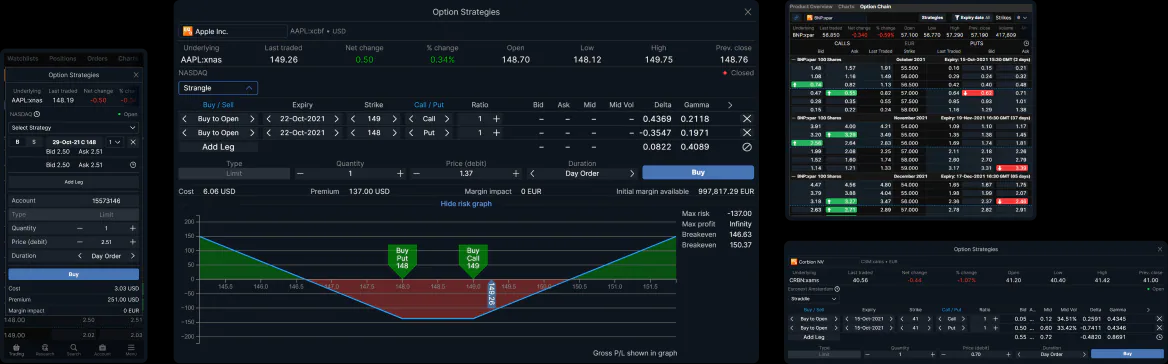

Interactive Brokers: UK's Best Overall Options Trading Platform Account: Interactive Brokers Options Trading Description: IBKR has one of the best options trading platforms for all types of clients because of their market range and strategy builders let you create options trading strategies visually and with AI. Is Interactive Brokers good for options trading?

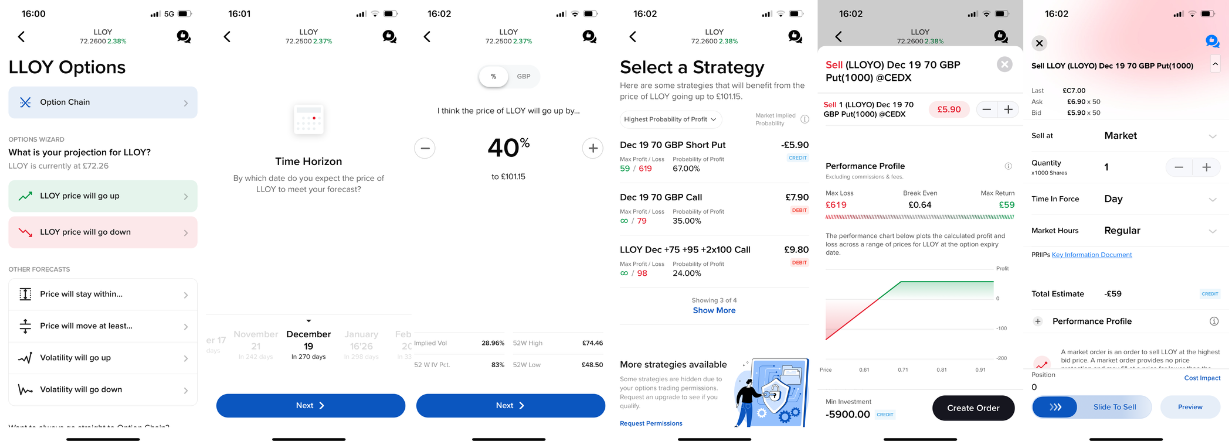

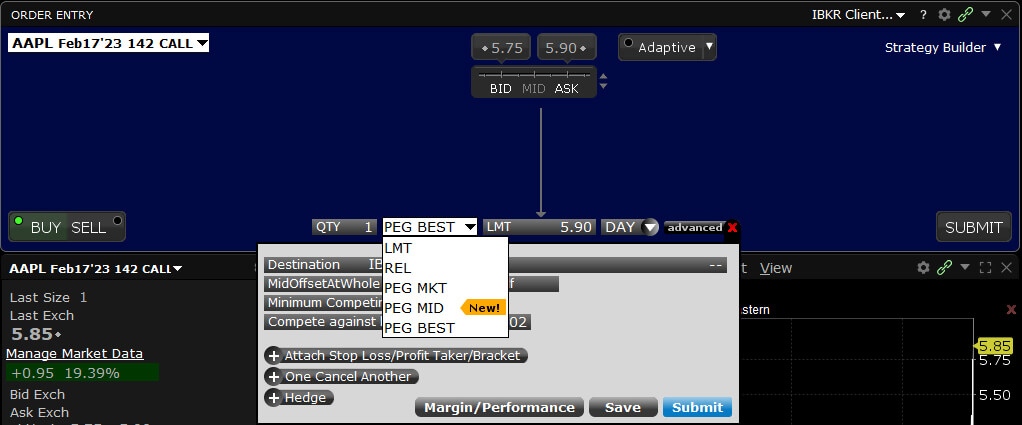

IBKR offers one of the most, if not the most, advanced options trading platforms for private clients, both for derivatives markets (indices, commodities, and forex) and stocks and shares. They provide access to a huge number of UK and international stock options, but where they really win business is through their execution capabilities. Their strategy builder tool automatically creates the legs for spreads based on what you think is going to happen to the market and you can set your profit and loss visually through drag and drop charts. For this review, I spent an hour or so talking to Steve Sanders, who runs product development for IBKR and it’s epic. There is far too much to go into for a short piffy review and even an a options broker myself I found some of it overwhelming. If you are a professional options trader, I would say there is no better platform out there. However, if you are just getting started trading option, IBKR has a new options tool called Options Wizard, which identifies options strategies according to market outlook, as well as the ability to add option chains into layouts and customise the data that is shown. What’s great about this is that it will create strategies around what you think will happen in the market rather than having to work it out longhand yourself. For exmaple, one of the most popular pieces of analysis we write is about whether or not the Lloyds share price will reach £1 in 2025. So to test IBKR’s Options Wizard I asked it on the GlobalTrader app to to come up with an options strategy that would make me the most money if Lloyds reached £1 before the end of the year. Users can also now make use of options screeners, which sort and scan for option data within new dedicated sections and sub-tabs. Options Wizard: Identify options strategies that match a market outlook. Option Chain in Custom Layouts: Add one or multiple option chains into layouts and customize data columns to show option-specific data, such as the Greeks or Implied Volatility, and use color grouping to connect to other tools in the custom layout area, such as the Rapid Order Entry, to create trades. Options Screeners: Sort and scan for option data with new dedicated sections and sub-tabs that offer complex combination strategies volume and trades for the day, among other features. Pros

Cons

Overall4.9 |

||

|

Options Markets 6 |

Commission Included |

GMG Rating |

Customer Reviews 4.3

(Based on 257 reviews)

|

Visit Platform 61% of retail investor accounts lose money |

Account Types:

|

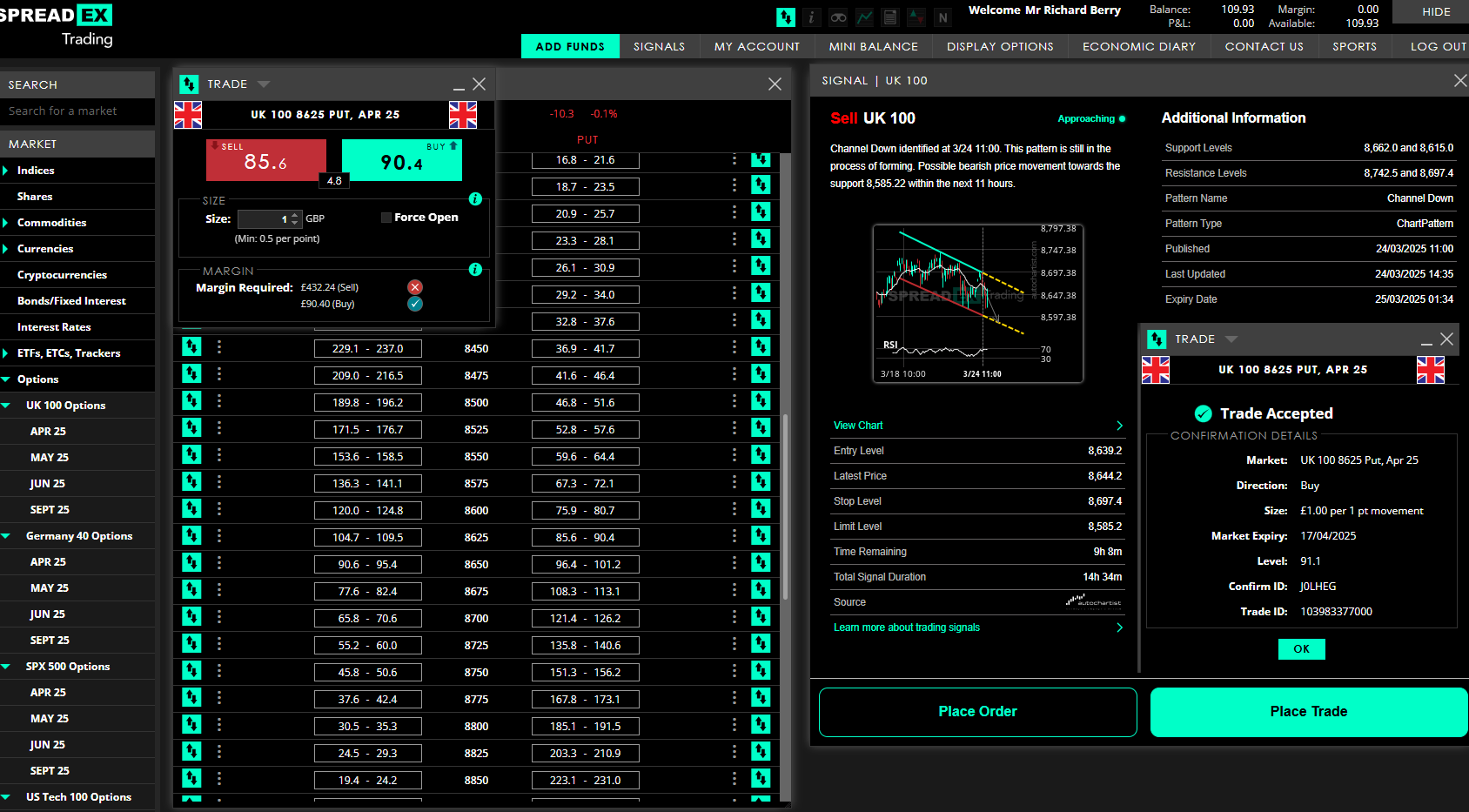

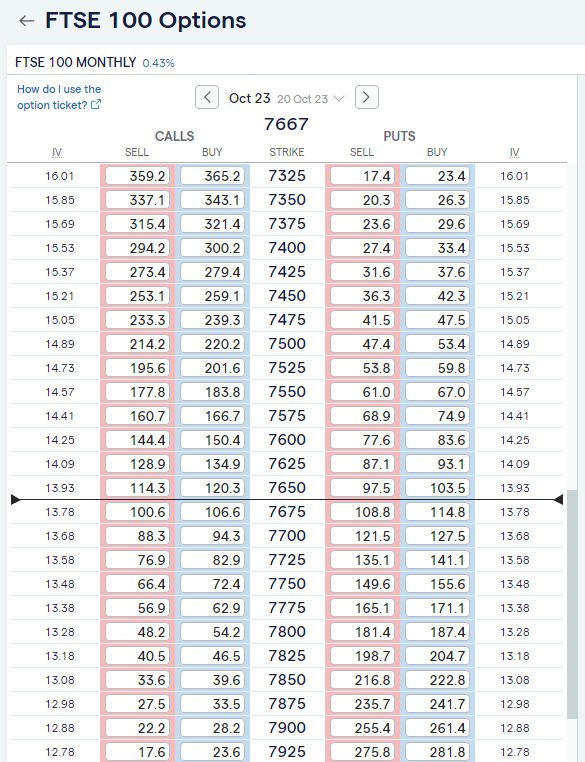

Spreadex: Good For CFD Options Trading On Major Markets Account: Spreadex Options Trading Description: With Spreadex you can trade options as a CFD of spread bet and spreads for UK 100 and Germany 30 start from 4 points with a minimum stake of £2. Whilst you are limited on what you can trade online, Spreadex will let you trade options on the major markets. Is Spreadex good for options trading? Yes, you can trade options with Spreadex, but you are limited to only a few indices, but profits are tax-free if you trade as a spread bet and commission is built into the spread. If you want to trade options as a spread bet, then you are much better off with IG. Or if you are a more sophisticated trader, Saxo and Interactive Brokers offer DMA on exchange options trading across all asset classes. I really like Spreadex and I really like options, I much preferred it when you could trade shorter-term options, but the FCA no longer allows retail investors to trade binary options, so you have to take a slightly longer-term view. It’s been a long day testing options trading platforms, and I’m a little tired so when I logged into my Spreadex account after 4 pm with only 10 minutes till the close, I wasn’t sure what to trade. However, thankfully, Spreadex has recently integrated trading signals from Autochartist, which gives you an ever-updating list of trading ideas. These are mainly for going long or short on spread bets, but still give you an idea of where the market may be going. There was a bearish signal for the FTSE, and whilst I wouldn’t normally bet against Britain, the UK markets have been sliding a bit recently from all-time highs. Plus I won £500 from Spreadex on the Cheltenham Gold Cup, so I don’t mind having a punt on the markets falling further. I bought some April 8625 Puts which is just below where the market is trading. If the FTSE goes down, I’ll add my winnings to this years Ascot kitty. If the UK market continues to rise, my max loss is £90, but everyone else wins. That’s a pretty good hedge by my book, I’d say.

Pros

Cons

Overall4 |

||

|

Options Markets 1,000 |

Commission Included |

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Visit Platform 68% of retail investor accounts lose money |

Account Types:

|

IG won “Best Options Broker” in the 2024 Good Money Guide Awards as they now integrate the TastyTrade options platform into client accounts.

IG offers options trading via financial spread betting or CFDs as daily, weekly, monthly and quarterly markets. If you have a professional account, you can trade short-term limited-risk options as well, with time-frames as low as 1 minute.

IG TastyTrade: Widest Range Of Options Trading For CFDs & Spread Betting Provider: IG TastyTrade Verdict: A good choice for traders looking for low commission, trading ideas and a followers of trading on social media. tastytrade stands out as a top choice for options traders with its low commission rates. When comparing commission fees for various lot sizes, tastytrade offers highly competitive rates. For 1 lot, the commission is $1.20, which is lower than E*TRADE ($1.30), Fidelity ($1.30), Interactive Brokers ($2), Schwab ($1.3), and TD Ameritrade($1.3). This trend continues as the lot size increases, making tastytrade an appealing option for traders looking for cost-effective options trading solutions. Is IG/Tastytrade good for options trading? I’ve always loved options trading, but is it really for UK traders? Can we grasp the Americanness of them? Or should we stick to good old fashioned financial spread betting and CFDs to hedge? IG is betting big on options at the moment, particularly after their acquisition of TastyTrade in the US. IG even took over the advertising spots on The Drain (the Waterloo & City Tube Line) that ushers finance types to the square mile every morning, with the hope, I assume, of enticing sophisticated traders to take a position on the US election. Side note – when I took The Drain the following week, it was a different advertiser, which was a shame because I happen to know that if no one is booked in after your slot, the Underground will just let you leave your ads up there – potentially doubling or even tripling your return on investment.

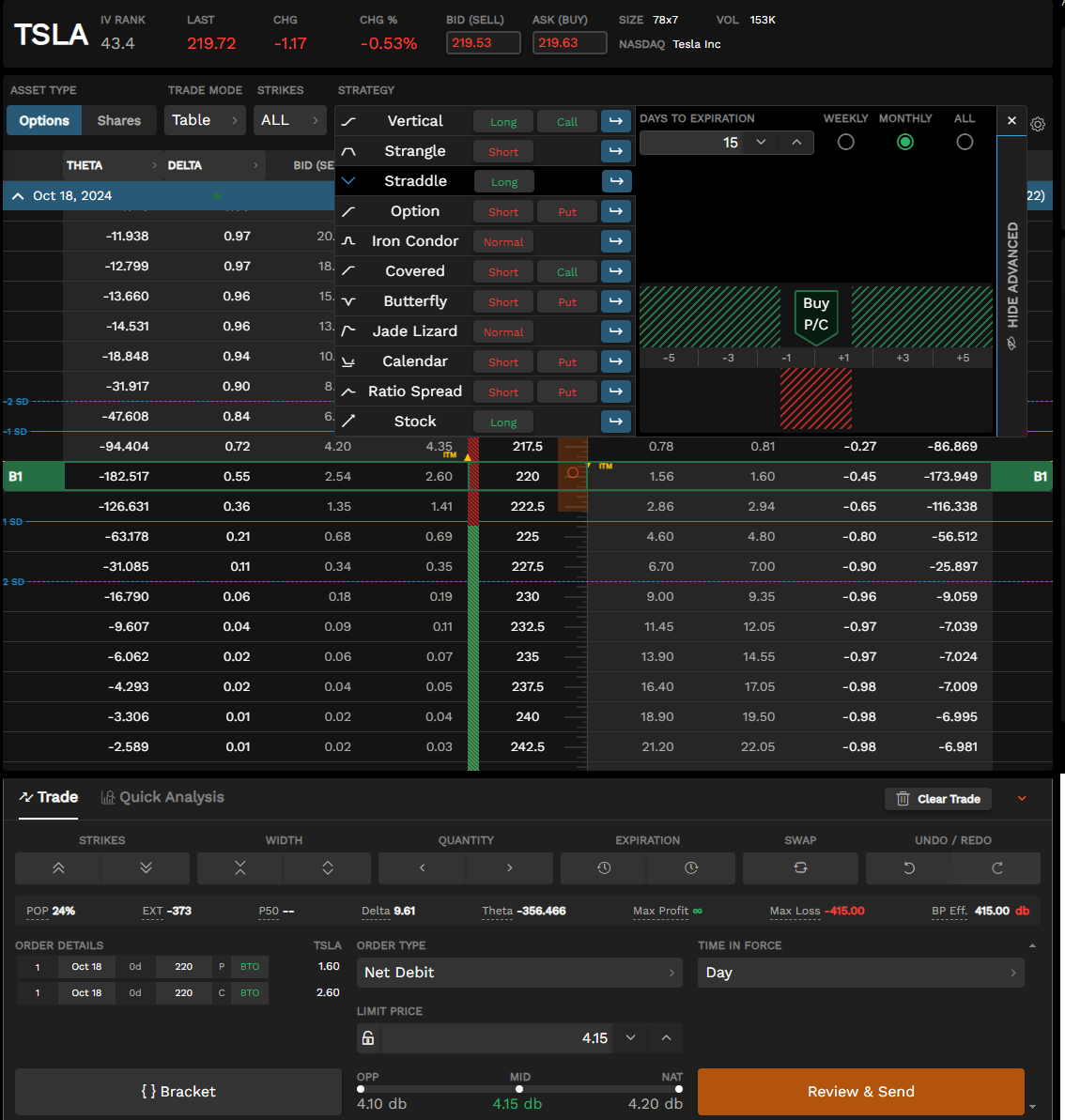

I’m not going to go on an advertising rant here, but when I flicked on Margin Call the other night on Amazon Prime, I got probably one of the most highly targets ads I’ve seen. I’d been researching options, and IG, and was also about to watch a film about the dangers of highly leveraged positions – so what advert came on before hand? That’s right – IG’s new option trading offering… But is options trading on IG any good? Well, in the past, if you wanted to trade options with IG, you could do so as a spread bet or a CFD, on major indices currencies or commodities (and some US stocks). This was good because if you wanted to hedge your portfolio, you could buy a put as a financial spread bet, and if the FTSE took a tumble, you wouldn’t have to pay tax on your options spread bet profits, or CGT from liquidating any long-term holdings. But now, IG options trading has got a little tastier, as they say in EC, you can now access the mightly TastyTrade options platform through your IG account. Until recently, you had to sign up directly with TastyTrade in the US, but you can’t do that anymore because of the FCA & SEC, which is actually fine because it’s an absolute nightmare funding a US account from the UK. It takes ages. Even in the world of instant bank transfers, it can still take days before your deposit is eligible for trading. But now as TastyTrade sits in your IG dashboard alongside your spread betting, CFD, GIA, ISA and SIPP account when you deposit funds via debit card, they are available immediately. If you don’t know what TastyTrade is and how important it is for options trading just check out Tom Sosnoff on Youtube. What started out as essentially an educational social media channel about options trading that ushered customers onto a white label soon became a stand-alone platform and was then acquired by IG for over $ 1 billion. Now, I like options trading. I’m a natural bear, so if I think the market is going to tank, I’d rather buy a put, that short sell an index as your risk is limted to the premium you pay, which means I can sleep at night. I’ve been an options broker back in the days when customers would phone through the individual legs of a spread and you’d have to get on the phone to a market maker to do they deal – trying you best not to get it the wrong way round. Which I often would, ensuing much hilarity as I tried to trade out of the errors. But thankfully, options trading is much easier these days. TastyTrade is an epic platform and far too big for me to explore on my own, so after interviewing Matt Brief, the head of IG UK about why they are bringing options to Blighty, I spent a good hour or so going through the platform with Hannes Bruwer. Hannes found his niche as an options sales trader at IG after joining their graduate program following his Masters in economics. Niche here is I think the right word. Becuase in America everyone loves options because for some reason they understand them. Maybe because they don’t have CFDs and financial spread betting. But in the UK, options trading is not all that popular, and that’s something that may change with the introduction of TastyTrade and all the educational content that comes with it. Because for some reason, everyone wants to be like Mike, or maybe now Tom… But anyway, What does Tastytrade do? Well, three things: it lets you trade US stocks, futures and options – yes, you could do this with IG before, but this is a whole other level. The platform will automatically build options strategies like Vertical, Strangle, Straddle, Butterly and Ratio spreads etc. So if for example you expect the Tesla share price to move because you think that Elon Musk is about to go bonkers on Twitter/X again – but are not sure in which direction, you can use Straddle to buy both a put and a call simultaneously. Or you can execute a short straddle if you think that Musk has become a boring old man and the Tesla share price is due a dull period as there are no earnings out for a while.

It gives you an excellent representation through the advanced tab’s bull/bear visuals where you can see your max profit and loss. There is also a quick analysis tab that calculates probability. You can also see how you have done on every asset you have traded since you opened your account – which comes in quite handy as being able to see your individual P&L may guide you towards stocks or indices you do well at and hopefully help you avoid currencies where you constantly lose money. Mainly though, people trade SPX, SPY, top stocks, covered calls, and long options to take positions, but interesting, apparently the most successful traders are those that short options accumulating premium. But stop losses aside, naked options selling can potentially mean unlimited losses, so you really need to know what you are doing for that. If you are just interested in covered calls, which are one of the most popular options strategies on the platform where you sell calls against a stock you own, the platform automatically recognises that you hold the stock on account and adjusts your margin to free up as much buying power as possible. IG has always been good at collateral as you can use stock for margin trading with a normal IG account, but you need a professional account and special permission from the risk department for that. On the downside, there is no strategy builder where you can decide where you think the market is going to go, where the system will work out which strategy is most appropriate like Interactive Brokers does with Capitalise.ai. But, and I cannot stress this enough, this is where IG stands out, if you don’t know what you are doing, you can phone IG up and ask and someone will talk you through your trades over the phone, or even do them with or for you. You can have all the best tech in the world, but if you can’t get a hold of someone when you need to, it doesn’t matter. If you’re starting small, IG has micro lots, and cash-settled options on indices, and if you add the $ sign before a code, it will show you the continuation chart of a future, rather than the quarterly charts, which makes historic performance easier to understand. Or if you like the quarterly contracts, you can trade one futures month against another, which is futures spread trading, as opposed to financial spread betting, if you’re looking for allusive arbitrage opportunities or like a punt on divergence. If you’re executing “lots”, commission is capped at $10 per strategy, otherwise it’s $1 a contract, which is relatively expensive for small trades, but good for bigger ones. It’s a lower margin (for want of a better word) product for IG, but they say they are intent on offering a full suit of products with the aim of being able to cater for every sort of investor and trader. There are no options on UK stocks, unless they have an ADR like Lloyds, so you can hedge your bigger UK longer-term equity holdings. Charting is drag and drop; you can backtest a range of strategies and ideas without risking real money.

I had a little play about and put some trades on after the demo with Hannes as it’s always nice to have a punt on the market in a relatively limited-risk way. And by that, I mean long options and if I lose money, marking it through the business as part of the research and development budget. You have to go through a little bit of KYC and answer a quiz about options to get your account activated and do the aweful Onfido ID verification process, which means getting up and going to look for your drivers licence or passport. But it, literally only takes 5 minutes. Especially if you copy and paste the suitability questions into ChatGPT because you’re in a hurry and becuase, that is simply how every exam, question or anything that requires a bit of effort will be done from now on. For the test trades, going back to my earlier point, I personally think that Tesla can go bananas at the founder’s whim so I bought a straddle that basically meant that if the price moved by more than $3.20 in either direction by the end of the day I’d make money. A fair bet, seeing as Tesla, can move between 2-3% or $5.50 on average for no apparent reason. But typically, it didn’t. Musk must be planning another ludicrous update – so I lost $185 on that trade. I was keeping an eye on it all day via the app, which is much easier to use than the desktop version (as all apps are). I closed the position out before the end of the say as I just don;t need the hassle of being assigned. Although IG say they can walk you through your options if that does happen. My mate, Darren reckoned that Southwest Airline, Norwegian Cruise Line and WYNN Resorts looked good in the short term. Now, as I personally think that the Wynn has the best poker room in Vegas and despite sitting down with pocket rockets earlier this year they still have some of my rake. I’d like a bit of it back, so went long and bought some November 120 calls. That gives them a few weeks to break out above last year’s highs. Jackson is quite rightly bearish on Aston Martin and whilst I think there is money to be made by owning a classic DB6, two clear-cut depreciating assets are a new Aston Martin or AML shares. So I was going to buy some puts to see if they have another profit warning, as they say they come in threes. But can’t becasue even though they have an ADR, it’s not on the platform. But if there is one thing you can rely on, it is the unreliability of British car marques, so I picked on Lotus (LOT) instead, who have done terribly since their IPO, as we expected. But, as I can’t trade options on those either I’ve had to reduce myself to the indignity of shorting the stock as a vanilla margin trade. LOT US is hard to borrow too, so the sort interest is going to be high (75% a year) so it definitely won’t be a long-term position.

Ed, is bullish Uber in the medium term, and I personally think that if there was ever a consumer case for monopolies, Uber would be it. It has made my life immeasurably easier and cheaper over the years, so I’ll “ride” that wave and hopefully “share” in their profits. They’ve come off a little bit, but overall I think bullish, I bought some November 90 calls, hoping the rally will continue. Maybe a potential hedge against the Lotus short as it is slightly car related. Fingers crossed… Pros

Cons

Overall4.8 |

||

|

Options Markets 6 |

Commission Included |

GMG Rating |

Customer Reviews 3.7

(Based on 149 reviews)

|

Visit Platform 64% of retail investor accounts lose money |

Account Types:

|

CMC Markets: Suitable For CFD Options Trading on Main Markets Account: CMC Markets Options Trading Description: CMC Markets has added spreading betting options to its product library. The new options sit alongside the firm’s existing over-the-counter (OTC) options, which include CFD options. Is CMC Markets good for options trading? CMC Markets lets you trade options on major US and European indices including the S&P 500, Nasdaq 100, FTSE 100, DAX, CAC 40 and Euro Stoxx 50. More stocks and markets will be added soon, but the key differentiator is that they are fractional options so you can take a position size as small as a hundredth of an option (0.01 of a unit). CMC Markets CFD options trading also gives you a bit more flexibility with either daily or longer-term time options expiry for yield enhancement strategies and the ability to trade in non-volatilie markets and protect your downside and mitigate potential losses to an existing portfolio. However, as you can options with CMC as a spread bet they can be used to hedge your exposure with tax-free profits. CMC doesn’t charge commission on the trading of options, but makes money from the difference between the ask price and the bid price of instruments as well as a currency conversion fee of 0.5%. It doesn’t really matter that CMC Markets don’t offer loads of options markets because that’s not their target market. CMC Markets traders are generaly active day traders in the UK and other regions where options trading hasn’t really become a thing.

Pros

Cons

Overall4.3 |

||

|

Options Markets 3,100 |

Commission £3 |

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Visit Platform 62% of retail investor accounts lose money |

Account Types:

|

Saxo: Best For On-Exchange Stock Options Trading Account: Saxo Options Trading Description: Saxo is one of the better value brokers for larger trades – you can trade stock options from USD 0.85, EUR 1 or GBP 1. Saxo Markets provides access to 1,200+ listed options from 23 exchanges worldwide, across equities, indices, interest rates, energy, and metals. Is Saxo a Good Options Trading Platform? Yes, Saxo is one of the better value brokers for larger trades as you can trade stock options from USD 0.85, EUR 1 or GBP 1. Saxo Markets provides access to 1,200+ listed options from 23 exchanges worldwide, across equities, indices, interest rates, energy, and metals. Saxo options trading is one of the best things about the platform’s range of markets. You can trade options with Saxo DMA on exchange on indices, commodities, forex and equities, or as a CFD. Saxo is one of a handful of options brokers to offer this, and it has the best market range. What is the Platform Like to Use?

The key difference between CFDs and options trading is that options can limit your risk to the premium you’ve paid. However, it’s possible to take on more options risk, which isn’t for “retail” clients who can only hold (buy) options. If you upgrade to a professional trading account, you can buy and sell (write) options in the hope that they expire worthless. You Can Exercise Options Early Another key benefit of trading options through Saxo is that you can exercise options early (rather than just closing off your options position). To exercise an American option early on Saxo you just need to request it in your account summary tab and a position in the underlying asset will be added to your account. Risk Ladder Saxo is also one of the only options brokers to offer a risk ladder calculator. This calculates the present value change as well as Delta, Gamma, Vega and Theta (commonly referred to as “Greeks”) for a range of spot values. The calculations make it possible for traders to get a quick overview of their portfolio’s risk exposure relative to different values at manually set time ranges of the underlying spot. It’s a really useful tool for traders with complex portfolios. Pros

Cons

Overall4.8 |

||

|

Options Markets 200+ |

Commission $0 |

GMG Rating |

Customer Reviews 5.0

(Based on 4 reviews)

|

Visit Platform Capital at risk. |

Account Types:

|

|

If you are a beginner options trader in the UK it is worth starting with a demo account and utilising a brokers trading academy, webinars, and insights for learning and to understand the risks involved.

Methodology: The Good Money Guide team selected the best options trading platforms based on:

- First-hand testing: Our reviewers’ own experiences testing the options trading platforms with real money

- Customer feedback: Over 30,000 customer votes in the Good Money Guide annual awards.

- Feature analysis: In-depth comparison of the features each option broker offers

- Insider insights: Exclusive interviews with CEOs and senior management from leading platforms.

What is an Options Trading Broker?

Options brokers offer options trading platforms so you can hedge and speculate on the price of financial markets through buying or selling puts or calls. There are 2 types of options broker:

- DMA options brokers. They connect you directly to the exchange to buy and sell options

- OTC options brokers. These let you trade options as CFDs or through spread betting

Options trade on exchange or OTC for example UK single stock options trade on what was the LIFFE exchange now owned by the ICE or intercontinental exchange.

FX options on the other hand almost exclusively trade off-exchange or OTC. Your choice of trading method and venue will be influenced by what you want to achieve with your options trading.

Some brokers will offer you the ability to trade on exchange options whilst others will make options process to as either CFD or spread betting contracts however these will not be exercisable into the underlying assets the options are over. But if that’s not important to you then you may be better off trading with a margin trading broker who may allow you to trade in fractions of a lot which you couldn’t do on exchange.

If you’re looking for a broker to trade options and want to compare options trading brokers in the UK, here are the main things to look out for:

- Types of options offered. Does a broker offer DMA and/or OTC options?

- Costs of options trading. How much does it cost to trade options?

- Market access. What stocks, indices, commodities, and currency pairs can you trade?

- Dealer experience. Are they capable of helping with strategy creation and execution?

Why Use an Options Broker?

The benefits of options trading include having a fixed and known downside or maximum loss. If you are just long puts or calls then your maximum loss will always be the premiums you pay plus any commissions or fees.

Options are a tool for investing or trading and there is an opportunity to make a profit and lose money. As with all investing, you can make money trading options if you call the market correctly, but in equal measure, you can lose it. Relative to other forms of investing, options trading should be considered high risk and only suitable for experienced and sophisticated investors.

Pros

- Options are cheap to trade

- You can trade on or off-exchange

- Risk is limited to premium (if you’re a buyer)

- High potential returns versus risk when buying out of the money calls

- Lots of strategies to speculate on volatility and price movement

- Can be used to protect your long term investments

Cons

- Options can quickly become illiquid and or worthless

- Risk is potentially unlimited if you write options

- Options are traded in fixed lots so exact exposure is hard

- You have to pay tax on options trading profits (unless spread betting)

✅Our Top Picks are Regulated

All online options trading platforms in the UK need to be regulated by the Financial Conduct Authority (FCA). The FCA ensures that these platforms are well-funded and fair to customers, and have strong compliance systems.

We only feature FCA-regulated options brokers, so you can trade with confidence knowing your funds are safeguarded by the Financial Services Compensation Scheme (FSCS) if the broker fails.

What is the Best Options Broker for Beginners?

tastytrade owned IG is the best options trading platform for beginners based on our matrix and criteria.

The app is simple to use, but what makes tastytrade best for getting started is its social media channels that help educate traders on how to effectively use options trading strategies.

It’s also really easy to set up and execute options trading strategies. For example, when I was reviewing it, I put on a Tesla Straddle to take advantage of its volatility,

It’s important that if you are a complete beginner to investing, you should accept that options may not be for you. However, you can use the below comparison table to see which options trading platforms offer beginner-friendly features.

Options can be quite complex, and in many cases, there is the risk of losing your entire premium. If you don’t fully understand the risks involved in options trading an options broker shouldn’t allow you to open an options trading account.

So, if you are a beginner options trader and looking for a platform, make sure you have significant experience in trading and investing. And most importantly make sure your broker understands that you’re a beginner to options trading.

Many options trading brokers can provide advice on strategy and execution (although not on what to buy or sell). Options brokers also understand the market well, so don’t be afraid to trade over the phone to make sure that you explain exactly what you want to do.

For beginners, it may be more appropriate to trade options where you are limited to buying equity options and have your risk limited to the premium you pay for an option.

Best Options Trading Platform for Advanced & Professional Traders

Interactive Brokers is the best options broker for sophisticated investors as it offers direct market access (DMA) on exchange options, and a robust trading platform as well as CFD option products with algo and API trading.

IBKR also has IBUSOPT which is a new order-routing destination or execution venue, that will enable option order executions at prices that are inside the US National Best Bid/Offer, or NBBO, for both US equity and equity index options.

Interactive Brokers has used its existing smart order routing network to allow clients to peg an options order to the NBBO midpoint, thus avoiding the bid-offer spread, if that order is executed.

Clients can also use a “peg to best” order type that will allow them to directly compete with NBBO bid-offer prices, with their order set to remain a tick inside the bid or offer price.

For experienced traders, it would be more appropriate to trade on exchange options with a DMA broker, where you can work bid/offers inside the spread as well as utilise strategies for more complex options trading.

What is the Best Options Broker for Stock Options?

In the UK, Saxo is the best options trading broker for buying stock options as it provides access to an impressive 26 exchanges. Saxo’s fees per options contract are as low as $1.25 on FTSE 250 and NASDAQ stocks.

You can trade options on most large-cap shares listed on the London Stock Exchange. The smaller the market cap of a listed company, the less likely there will be liquidity or a market maker making prices for smaller-cap shares.

Interactive Brokers does offer cheaper charges on US option contracts, however, Saxo has more of a base in the UK and offers a dealing desk for personal service if you need to put on a complex options strategy.

Where to Trade Options as a Spread Bet Online

There are more and more spread betting brokers offering options trading online these days.

We’re not talking about evil binary options which are now thankfully banned by the FCA. We’re talking about real listed options on the DJIA (as an example in the image).

Traditional options are generally used as a hedging and limited-risk way to get exposure to the markets.

So, how can you hedge your portfolio with index options as a spread bet and not pay tax on the profits?

3 spread betting brokers that offer options:

- IG – a huge range of options as a spread bet on the main platform

- City Index – around 40 markets for options trading – but pretty much any stock through the options desk.

- Spreadex – a few major markets to trade from, but great customer service

- CMC Markets – only 5 options markets as a spread bet

Typical options offered by spread betting brokers

- Index

- Commodities

- Forex

- Some main market shares

The prices are pretty decent and liquidity is fair. Out of the money, options are generally not that liquid anyway so if they can get a price they will probably quote one on screen for you.

At the money options as a spread bet should prove easier to trade, but of course, the big profits come from buying deeply out of the money puts or calls and waiting for the market to come your way.

Of course, there is a certain amount of time value that will depreciate over time the closer to expiry you get. But if you are buying options your risk and downside are already factored in (if you are fully paid up). Always best to check the margin and your account statement to ensure this is the case.

One important point to remember that if you are writing (or selling) options as a spread bet your losses are unlimited. An option can go to zero, but it also (in theory) has no top end price.

There are many ways to hedge a portfolio using spread betting and buying options is a good tax free strategy.

Where Can You Trade Options on the US Markets?

You will need a broker that offers options trading to UK residents. Two of the best brokers for US markets at the moment are Interactive Brokers for professionals and tastytrade owned by IG for retail investors.

Options trading is much more common in America than it is in the UK and as such there is much more options liquidity on US markets for private investors. You can see the different types of options strategies available on US markets below.

Why is options trading so popular in the US?

Primarily this is because derivative products like CFDs and spread betting are not allowed in America.

It is possible to trade futures, single stock futures are not as common as futures on indices and commodities. So if our American friends want to trade stocks with leverage they tend to do it through options.

Options may seem complicated at first, but actually they are a very useful tool for getting a lot of exposure with a little money. They are also a form of limited risk investing if you are buying options are your risk is limited to how much you pay for the options. On the flip side, if you start selling options, your losses are potentially unlimited.

If you’re new to options trading here’s how to trade options so you can understand the process, benefits, features and pitfalls before you begin.

Finding a broker that offers US options trading

If you are based in America, you need an options broker based in the US. The American regulators are very particular about where their citizens and residents can trade and UK brokers are not allowed to onboard US clients.

If you are outside America, a London based broker can offer access to options trading on the US markets. Most can provide options as a CFD or spread bet, but DMA brokers are your best option as you can buy and sell on exchange options with direct market access.

On-exchange US options vs CFD options

There is a subtle distinction but it can be an important one if, for example, you are intending to pursue buy-write strategies, where you are hoping to take in or deliver the underlying stock on exercise. If so you will need to trade on-exchange options.

However, If you are just looking for economic exposure via options, and have no designs on ownership of the underlying, then CFDs on options could work for you too.

The size of your account may also be relevant, simply because it may limit what you can trade in. Exchange-traded options are only traded in whole lots or multiples thereof.

Whilst CFDs on options (or indeed Spread bets on the same) allow you to trade in fractions of an options lot.

How risky is trading US company options?

Remember that options are complex products and you will need to demonstrate an understanding of how they work and the risks involved in trading them.

You need to demonstrate a working knowledge of geared derivatives to open a CFD or Spread Betting account, and you have to pass a suitability quiz to do so.

If you are not familiar with these subjects, you will need to read up on them in our guide on how to trade options.

What is The Best Platform for Forex Options Trading?

Saxo Markets is the best forex options broker as it has one of the widest range of currency pairs to trade options on an OTC basis.

What are OTC FX options?

In a nutshell, an OTC FX option gives you the right, but not the obligation to buy a certain amount of currency at a certain price, on a certain date in the future.

This can benefit currency traders because if the currency rates move against your position, you do not have to proceed with the transaction.

What are the advantages of OTC FX options?

Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal. With OTC FX options, you pay a premium for the right to buy the currency. If you change your mind, you don’t have to. Your risk is limited to the cost of the premium you paid for the option to do so.

What are the risks of OTC FX options?

Although options can be a limited risk financial product there are still downsides.

Firstly, being an OTC (over the counter) product there is no centralised exchange, you are contracting with your broker. In most circumstances, the broker will hedge the position and mark up your premium. But the financial security of your broker is something to be considered.

Secondly, if you are buying, an option you risk is limited to the price you’ve paid for your premium. But if you are selling options then your losses are potentially unlimited. So it’s vital, that you fully understand what exposure your option may have.

Who should use OTC FX options?

The short answer is only those that understand them. If you don’t, don’t.

If you do they can be a valuable addition to any corporate hedging strategy. Currency traders can use them for speculation and some forex brokers will offer then on an execution only basis. If you are using a currency broker for hedging purposes they may be able to provide you with some strategy advice.

In general, though, currency options should only be used by sophisticated professional investors or corporate clients who fully understand the risks. Also, there are plenty of charlatans out there who are not properly regulated and claim to be experts. The only brokers that are allowed to offer OTC FX options in the UK are regulated by the FCA. You can check a brokers regulator status on the FCA register here.

What are the alternatives to OTC FX options

If you have some currency exposure you need to hedge there are a few alternatives to OTC FX options.

The first and most obvious being “on exchange” currency options listed on the CME. However, these are dealt in lot sizes so you don’t get the flexibility of exact trade sizes. But, as they are listed on the CME you do reduce your counter-party exposure.

If you just want to lock in an exchange rate for a future currency transaction you can use a forward contract. These are great for reducing the risk of the exchange rate moving against you. But, if it moves in your favour, then you do not get the benefits.

The old adage applies:

In foreign exchange, it’s next to impossible to speculate to make money, but very easy to hedge against losing it…

Options Trading Platform FAQs:

US traders are not allowed to trade on leverage through products like CFDs of financial spread betting. There is some form of margin trading permitted through margin loans and ETFs. If a US trader wants to increase their leverage on a position, options are one of the only ways to do it. In the UK, margin trading is readily accessible, so options markets are not as liquid and are therefore more expensive.

There are two types of spread when trading options which need to be considered when using an options broker:

- Options spread strategies – this is the name of an options strategy, the most common being straddles, strangles, condors and butterflies. Some of these can be traded online, but the majority need to be traded over the phone with a dealer. The better relationships your dealers have with market makers, the better the price of your spreads will be.

- OTC bid-offer spreads – unlike DMA options trading where you are charged a commission per lot, if you are trading OTC options via a CFD or spread bet, the commission will be built into the premium (also known as the bid-offer spread).

Saxo Markest offers the most types of options trading as you can trade options as a CFD or on-exchange on a huge range of stocks, indices, commodities and forex pairs. However, Saxo Markets does not offer options spread betting. IG, currently offers 50 markets for options trading as a spread bet or CFD.

All options trading except for financial spread betting is subject to capital gains tax. Financial spread betting is unique to the UK and is free of capital gains tax as trades are structured as a bet. However, it is important to speak to an independent financial advisor or tax specialist as tax can be different based on individual circumstances and is subject to change.

US residents are only allowed to trade options with a US-regulated options broker. UK brokers will not open an account for a US resident.

The most popular markets for options trading include stock indices and individual stocks, commodities such as gold and oil and trading options over ETFs is becoming more commonplace as well. The volatility seen in the markets during 2020 heightened interest in option trading and strategies and the volumes and values of options trading have picked up significantly because of that. Studies show that traders are increasingly attracted to weekly options and are using these short-term instruments to try and capture the momentum of US markets in particular.

Further reading: These are the most popular markets for online trading.

Options are considered to be complex products so a retail trader will need to demonstrate their understanding of the risks involved in trading them of course their suitability tests for all derivative trading accounts these days. But live options trading is certainly not for novices or inexperienced investors. Particularly if you are going to be doing anything other than buying puts or calls.

Interactive Brokers won “best options broker” in our 2025 and 2023 awards. They offer a huge range of markets to trade options on, low fees and platform features that enable you to easily create options strategies.

Interactive Brokers won “best options broker” in our 2025 and 2023 awards. They offer a huge range of markets to trade options on, low fees and platform features that enable you to easily create options strategies.