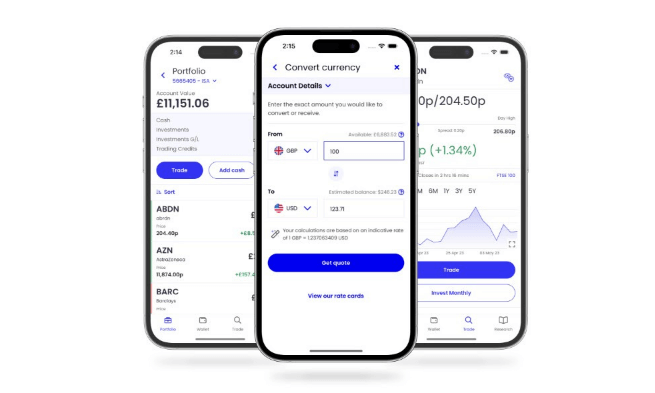

Interactive Investor, the low-cost investing platform now owned by fund manager Abrdn, has introduced a new currency conversion service to its app. II clients can now convert GBP into foreign currencies or vice versa and receive their sales proceeds, dividends or coupon payments from overseas holdings in those currencies. This is good news because it should give clients full control of their international investing.

In-App Currency Convertor

II clients will be able to hold up to 9 currencies in their account, those currencies include US dollars, euros, Canadian dollars, Swedish krona and Swiss francs, among others.

Clients can make currency conversions from midnight on Sunday through to midnight on the following Friday.

II will offer live FX rates during that time for stand-alone conversions, and where a live FX rate isn’t available it will offer an internal house rate instead.

Interactive Investor FX charges

II charges 1.50% on conversions of less than £25,000 or equivalents and that rate scales downward depending on transaction sizes, for example, conversions of between £100,000 and £599,000 attract a fee of just 0.50%.

These fees apply to single-deal standalone FX conversions, but they may not be available in conjunction, with say, a partially filed overseas equity transaction.

II clients wishing to convert currencies simply need to log into their trading or SIPP account, then select cash or transfers, and convert currencies, before choosing which currencies they want to convert between and the amount they wish to convert.

Having previewed their deal they will then be offered a live exchange rate for their transaction which they can execute by clicking on “complete order”.

How do II’s currency exchange rates compare to its competitors?

Hargreaves Lansdown also offers a low-cost standalone currency conversion service through third-party currency broker Currencies Direct, but they don’t publish the fees charged.

However, if we look at Hargreaves Lansdown fee schedule for FX conversions, associated with overseas share dealing, we find that the first £5,000 converted is charged at 1.0%, the next £5,000 at 0.75%, the next £10,000 at 0.50%, with balances above £20,000 charged at a flat 0.25%.

AJ Bell doesn’t offer a standalone currency conversion service, but it does offer FX conversions as part of its international trading business. And once again the fees are scaled by transaction size with the first £10,000 of a conversion charged at 0.75%, the next £10,000 at 0.50%, with balances over £20,000 at 0.25%.

Interactive Brokers, however charge an industry-leading 0.02% for FX conversions.

Why the FX rate on your international investing is more important than you think

Investing successfully is about getting the biggest return for the smallest outlay the more an investor pays away in costs and fees the less of their investments they get to keep.

When trading overseas the FX rate you achieve and the cost of that conversion can make a big difference to the profitability of an investment, for example, if you are paying 0.50% in and out of the currency conversion, associated with an overseas trade, you are effectively down 1.0% on your investment when you begin.

In fact, the maths is worse than that because if your investment is successful and your money grows then the costs associated with the conversion of sale proceeds will be that much higher, when compared to the charges on the way in, as a percentage of the original investment.

Its almost impossible to avoid FX risk when trading internationally, which is why it’s so important to get the best value for money when it comes to currency conversions in your portfolio.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.