interactive investor Customer Reviews

Tell us what you think of this provider.

Customer Reviews

5/5

Pros:

easy to use

Cons:

instant buy and selling availability

5/5

Pros:

flat fee structure, cost effective for larger portfolios

Cons:

further improve portfolio information & management tools

5/5

Pros:

Trading, ISA and SIPP all in one platform

Cons:

More intuitive UI

4/5

Pros:

Website is easy to access and navigate

Cons:

Add more historical date to my portfolios

5/5

Pros:

Ease of use

Cons:

Simplify

5/5

Pros:

Functionality/ clarity/ease of use/fast

Cons:

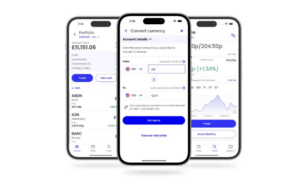

Improve their f/x rates which are greedy

5/5

Pros:

Good all round investment coverage

Cons:

Allow credit monthly fee to be transferable between accounts

5/5

Pros:

Value for money

Cons:

It’s already pretty good.

5/5

Pros:

I like that they are progressive

Cons:

Nothing. I like that they take care of their customers

5/5

5/5

Pros:

Standard Fee regardless of amount invested

Cons:

Better App and Web site

5/5

Pros:

Fixed fee rather than %, as I have high value account with them

Cons:

Reduce costs more

5/5

Pros:

Value

Cons:

.

4/5

Pros:

low fees

Cons:

more international markets

5/5

Pros:

Regular market information

Cons:

Clarity of investment portfolio

5/5

1/5

Pros:

always works, ”does what it says on the tin”

Cons:

make pages pdf printer friendly (less ink use)

5/5

Pros:

Fixed charging – flat monthly fee as opposed % based

Cons:

very happy at present

4/5

Pros:

easy to see investments

Cons:

insert a delete button on notice messages

5/5

Pros:

VALUE FOR MONEY

Cons:

NOTHING

1/5

Pros:

Online articles

5/5

Pros:

Reminders about voting

Cons:

Improve the mobile app

5/5

Pros:

voting rights for equity holdings, even in an ISA wrapper

Cons:

pretty happy with them so n/a

5/5

Pros:

Amazing value compared to others

Cons:

Faster response to queries

5/5

Pros:

Excellent choice of possible investments abroad. Detailed user interface.

Cons:

More international funds

5/5

Pros:

COST

Cons:

NOTHING

5/5

Pros:

Easy to use

Cons:

Ok at the moment

5/5

Pros:

value for money

Cons:

research by criteria eg ftse 100 by dividend

5/5

Pros:

Good Information

Cons:

It satisfies my wants

5/5

Pros:

cost free regular monthly investing

Cons:

analysis of overall portfolio performance

5/5

Pros:

Quick and easy

Cons:

Allocate new cash quicker to account

2/5

5/5

Pros:

I like the emphasis on low cost most of all

Cons:

There’s always scope for improvement on the website

5/5

Pros:

Best value best information

5/5

Pros:

research

Cons:

faster response to customer questions on website

4/5

Pros:

Value

Cons:

Allocate reinvested dividends quicker

5/5

Pros:

Insights

Cons:

On line questions/answers

5/5

Cons:

Modernise user interface

5/5

Pros:

Easy to use, very good & interesting independent investing information

Cons:

Quicker up dating of Corporate actions that are relevant to my a/c

5/5

Pros:

The ease of use and the information available.

Cons:

Don’t know.

5/5

Pros:

Simple pricing plans that are very good value

Cons:

Nothing springs to mind, find the platform simple and easy to use

5/5

Pros:

Easy to use

Cons:

Return of the investor bulletin boards that where removed.

5/5

Pros:

Low and fixed fees

Cons:

Can’t suggest anything

5/5

Pros:

it works

Cons:

why do i have to sign into your web site then sign into the research side

5/5

Pros:

EFFCIENT

Cons:

very little

5/5

Pros:

FLAT FEES

Cons:

DO NOT ABBREVIATE NAMES OF FUNDS ON STATEMENTS

5/5

Pros:

Excellent range of investments to choose from, markets.

Cons:

Make it clearer to find documents on the website.

4/5

5/5

Pros:

Clear content, easy platform

Cons:

More calculators

3/5

Pros:

Information, research and learning tools

Cons:

Nothing

4/5

Pros:

Good supply of tips and information

Cons:

No comments

2/5

Pros:

Access to global equities

Cons:

The account area is badly in need of updating – it’s difficult to use.

5/5

Pros:

Cost

Cons:

Have prices and details on stocks similar to Hargeaves plus trades

5/5

4/5

5/5

Pros:

Ease of investing

3/5

5/5

Pros:

Online access

Cons:

Cheaper transaction fees

5/5

Pros:

Low fees for larger portfolios; wide set of investments available

Cons:

Make web UI easier to use; make Android app more functional

3/5

Cons:

Better customer service and more transparent fees

5/5

Cons:

Nothing

1/5

Cons:

criminal FX rates, archaic online system with arbitrary settlement times.. will soon leave them

2/5

Pros:

Research materials

Cons:

Online web interface is clunky and old fashioned. Not particularly easy to use or intuitive. T212 far superior

4/5

Pros:

multicurrency accounts

Cons:

reduce fx fees. 1.5% is too much

4/5

Pros:

Ease of use

4/5

Pros:

Wide range of investment choices.

Cons:

Less ‘Jargon’ in help section

4/5

Pros:

Low charges

Cons:

easier research, HL is easier to use (for me)

2/5

Pros:

Nothing

Cons:

Lower prices, better UX

5/5

Pros:

Low cost

Cons:

Madge the interface more user friendly

3/5

4/5

Pros:

Price and coverage

4/5

2/5

Pros:

Nothing

Cons:

Reduce fees for dormant share accounts

4/5

4/5

Pros:

Choice of stocks and funds to trade.

Cons:

Reduce trading costs for regular traders further.

4/5

Pros:

Value

2/5

Pros:

nothing

Cons:

too expensive, lower the price

4/5

3/5

Pros:

Nothing in particular – I didn’t choose them; they were a legacy provider

Cons:

Improved digital UX and UI

2/5

Pros:

Reputable

Cons:

Better website functionality

4/5

Pros:

Flexibility

Cons:

Reduce costs

4/5

3/5

Pros:

Price

Cons:

Ok

5/5

Pros:

Comprehensive access to markets etc

Cons:

Slightly easier layout. OK once you get used to it.

4/5

Pros:

lower fees

Cons:

easier process to buy shares

4/5

Pros:

choice of portfolio presentation

3/5

Pros:

Better when it was TD

Cons:

Lower fees

4/5

Pros:

Good research

5/5

Pros:

Instant transactions

Cons:

Greater flexibility to decide

3/5

Cons:

better interface, lower fees

1/5

Pros:

None

Cons:

Improve digital guidance & advice

2/5

Pros:

Provides an app which enables up to date information about investments

Cons:

More proactive in supporting investors

5/5

Pros:

Flat fee

Cons:

Lower trading costs

3/5

Pros:

broad market coverage

4/5

2/5

Pros:

Free regular investing

Cons:

Drop their fixed flat monthly fee

3/5

Pros:

Very User friendly

Cons:

More advanced charting tools

4/5

Pros:

flexible

2/5

Pros:

Insight

Cons:

Reduce fees

4/5

interactive investor Expert Review

interactive investor offers fixed fee investing on a wide range of investments

Provider: Interactive Investor

Verdict: Interactive Investor’s fixed fee account structure make them one of the most cost effective ways for people with large portfolios to manage their investments, ISAs and pensions. ii are expecially good for high value portfolios and those wanting access to small cap stocks.

What does interactive investor do?

Interactive Investor or II as its known is one of the UK’s largest self-determined investor platforms. II can trace its roots back to 1995 and the startup floated on the London stock exchange back in the year 2000 before being bought by the Australian business Ample in 2002. Today, Interactive Investor is a owned by abrdn with assets under administration of more than £50 billion and 400,000 customers to whom II offers share trading and investment services including, ISAs SIPPs and share dealing, alongside research and analysis. Including model portfolios, selected funds and thematic investments.

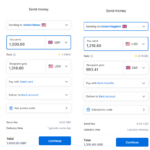

Interactive Investor differs from other investment platforms as it charges a fixed account fee, rather than a percentage of the funds you have on account. Which, over time, could save you thousands in costs.

As a low-cost provider ii competes directly with the likes of Hargreaves Lansdown and AJ Bell offering general investment accounts, ISAs and pensions.

Pricing: Brilliant for medium and large investors, expensive for small accounts.

Market Access: You’ll be hard-pressed to find something you can’t invest in.

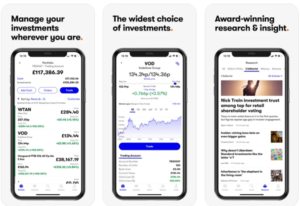

Platform & Apps: Very good, excellent data and usability.

Customer Service: They are massive and mostly online, but you can call them directly, generally good.

Research & Analysis: Loads, daily and weekly updates across all the asset classes they cover, with lots of analysts and opinions. No advice service though.

Does interactive investor pay interest on cash?

Yes, but only 2% for under £10k and you need at least £100k in your account to get their best rate of 3.25%. There are other brokers that offer better rates on uninvested cash, though.

interactive investor versus Interactive Brokers

interactive broker and interactive investor may sound similar but cater to different investor profiles and operate under different jurisdictions and cater for different types of investors.

interactive brokers is a US‑based global brokerage offering a wide spectrum of asset classes and advanced trading tools, often targeting active traders and professionals. interactive investor, by contrast, is a UK‑focused subscription‑based platform offering a fixed‑fee structure suited to medium‑to‑long‑term investors primarily in equities, funds, bonds, Gilts, ISAs, and SIPPs.

interactive investor employs simpler platforms with relatively basic charting tools, while interactive brokers features a more complex interface and lower per-trade costs but with more variable fees. interactive investor is better for large longer term investment accounts because of its simplicity, flat monthly fee and broad UK offerings, whereas Interactive Brokers suits users seeking global market access and sophisticated execution tools.

Can you buy Gilts on interactive investor?

Yes, ii supports investment in government bonds, including UK Gilts, via its platform. This is confirmed on the site, which lists bonds and Gilts as available investments .

Pros

- Fixed account fees

- Easy to use

- Good research

Cons

- No Lifetime ISA

- Expensive for very small accounts

- No derivatives for hedging

-

Pricing

(5)

-

Market Access

(5)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

5

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.