Before you invest in the Scottish Mortgage Trust, perhaps it would be good to take a look at some of SMT’s top holdings. The top 10 holdings of SMT comprise more than 46% of its total assets. I take a look at each below.

1. ASML (ASML)

ASML is a European tech firm that could be unfamiliar to many. But its machines are essential to modern computer chip making. ASML is one of the leaders in photolithography, particularly in the niche extreme ultraviolet lithography (EUV). In fact, ASML is perhaps the only supplier of the latest EUV machines in the world. When a company has a stranglehold like this (a ‘wide moat’, so to speak), investors are bound to be pleased (think: Microsoft’s windows). Gross margin is an impressive 49%. And, the company isn’t small – its market cap is worth a staggering $233 billion. The company is also listed in the States.

2. Moderna (MRNA)

Moderna, the biotech firm using mRNA (messenger RNA), was one of the pandemic winners. During 2020/21, the firm raced to invent a new vaccine that protect millions against coronavirus. It succeeded. Now, Moderna is employing the same mRNA technology, of which two early inventors were awarded 2023 Nobel prizes, to create new medicines (to cure rare diseases, flu, among others). This is an exciting area. But Moderna’s share prices are on the slow drift south. How long will it take for MRNA’s share price surpass its pandemic peak is difficult to guess.

3. Nvidia (NVDA)

Nvidia is currently the sector leader in the booming Artificial Intelligence (AI) industry. Its products are heavily subscribed in the world of accelerated computing, data centres, gaming, and AI platforms. So powerful is its future growth rate that the market recently awarded Nvidia the coveted $1 trillion market capitalisation in the summer. However NVDA’s share price is overbought after a massive surge; its price trend is vulnerable to a consolidation. Watch for a break below $400 support.

4. Tesla (TSLA)

This EV car company needs no further introduction. Tesla is spearheading the EV revolution. In 2023, the Elon Musk-led firm is racking up record global sales. Ergo, the market anticipates Tesla to continue enlarging its market share in the competitive world of consumer car market. Its nearest pure EV competitor is China-based BYD (BYDDF). Tesla’s share price is highly volatile, which will filter through to impact SMT’s asset values.

5. Mercadolibre (US:MELI)

Mercadolibre was one of the first Latin American tech stocks to list in Nasdaq. The $63 billion company operates the largest online platform in South America. Formed in 1999, the Uraguay-based company has been expanding throughout the years and now has more than 150 million customers on its system in 18 Latin America nations. MELI’s latest 10Q report shows revenues in the first-half at $6.45 billion and net income of $463 million. Scottish Mortgage first invested in Mercadolibre back in 2020 before the massive price surge to $2,000 (see below).

6. Amazon (US:AMZN)

Amazon is one of original giants of internet retailing. While its founder Jeff Bezos had stepped down from the company back in 2021, the $1.3 trillion company remains as financially strong as ever. Its cloud system (AWS) is a major contributor to Amazon’s underlying profit (quarterly operating income totalled $5.4 billion). The company has a massive locked in on internet spending and this is possibly why SMT is continuing to invest in AMZN shares.

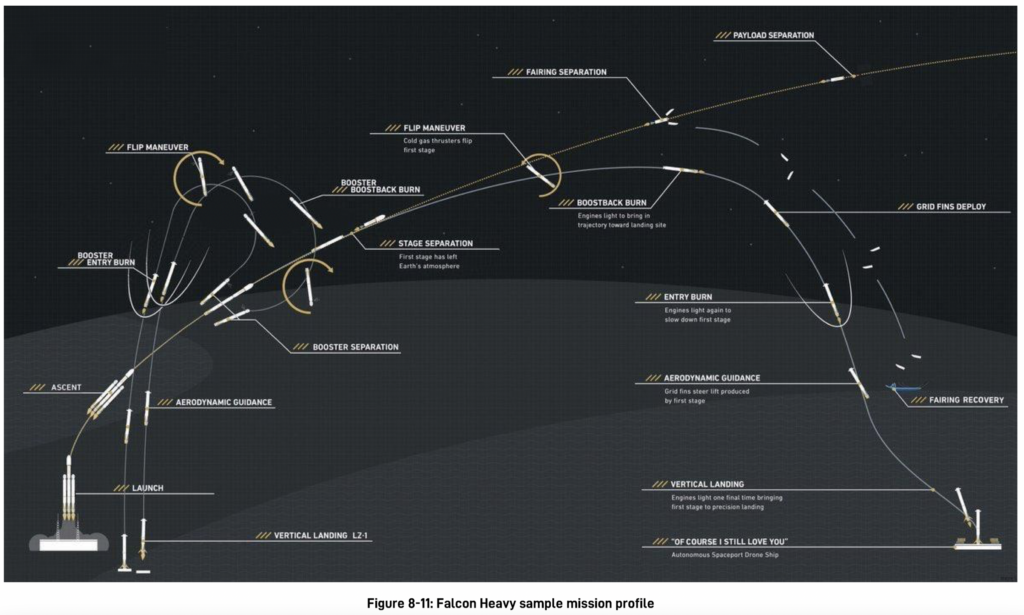

7. Space X

Space X is another Elon Musk-led company. Scottish Mortgage first bought into Space X in December 2018 – at a valuation far lower then. In early 2023, a $750 million funding round saw Space X’s valuation reach $137 billion; and in July ’23, valuation jumped further to $150 billion. So far, Space X has launched 5,000 satellites in low Earth orbit to solidify its Starlink network. This space-based internet connection has 1 million customers. Few private companies have a lead in space-based broadband as wide as this. Reusable rockets (Falcon 9, showed below) is another ‘edge’ that Space X possesses. Right now, SpaceX is ploughing billions into its commercial system. Payday will come later, perhaps via IPO. When this happens, excitement will grow significantly on SpaceX.

Source: SpaceX.com, Falcon User Guide

8. Northvolt

Northvolt (www.northvolt.com) is a Swedish battery company founded by former Tesla executives. Its main business is to serve the EV revolution and the booming energy storage requirements. Just recently, Northvolt raised $1.2 billion convertible note to expand its factory in Poland. It is also setting up the first battery plant in Canada, which will cost $7 billion in the first phase alone, to supply high-performance lithium-ion battery cells to electric automobiles. Total Northvolt customer orders are as high as $55 billion. Scottish Mortgage first invested in Northvolt in 2020. But public valuation data for Northvolt is hard to come by. Perhaps only when the IPO happens will we know for sure how much SMT’s stake is worth.

9. PDD (PDD)

PDD is the abbreviation for the Chinese retailer PinDuoDuo (PDD). Founded only in 2015, the Nasdaq 100 company reported sales of US$12.4 billion in the 1H of 2023 (operating income totalled $2.9 billion). Not bad for an 8-year old retailer! Growth was extremely high in its early years and surprised many big players like Alibaba (BABA). No wonder PDD’s share price rebounded significantly from its 2022 lows. The market likes PDD because it also owns Temu, a fast-growing internet-based retailer which ships products directly from China (www.temu.com) and competes with Shein.

10. Ferrari (RACE)

The company certainly needs to further introduction. Ferrari is the ultimate luxury car that most people dream of owning. The car company’s clientele are extremely wealthy; and they have no trouble waiting for a new Ferrari (some say up to three years for certain models). According to its latest quarter report, Ferrari’s revenue came in at E1.5 billion and its order book appears strong. Many models are sold out. The prancing-horse’s business moat is therefore extremely wide and durable – a business that is likely to prosper in the years ahead. That said, Ferrari’s share price is consolidating its recent rally.

Source: Ferrari

Read next:

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.