The post-GFC years saw a wave of mammoth tech giants land on the market, from EV leader Tesla (NASDAQ:TSLA), to social media Facebook/Meta, to gig economy stocks like AirBnB, Uber and Lyft. While the latter is less well known than Uber, nonetheless, it is an interesting company in the ride-hailing sector. Lyft is a decade-old company (formed in 2012) with about 28 percent of the US car-ride market, second to market leader Uber. Lyft was listed on NASDAQ with much fanfare back in 2019. On its first trading day, the gig stock achieved an initial valuation of $22 billion – a fantastic return for Lyft’s financial backers and founders over a short period of time.

What is the live Lyft share price?

The current NASDAQ:LYFT share price is $13.91 which is a change of 0.2 or 1.46% from the last closing price of 13.91 with 6,546 shares traded giving NASDAQ:LYFT a market capitalisation of $5,770,103,000. The most recent daily high has been 13.92 and daily low 13.59. The NASDAQ:LYFT share price 52 week high has been 20.82 and the 52 week low 8.93. Based on the most recent NASDAQ:LYFT share price opening of 13.91, the current NASDAQ:LYFT EPS (earnings per share) are 0.16 and the PE (price earnings ratio) is n/a.

What has happened to Lyft since its IPO?

While Lyft was hyped as one of the top ‘disruptors’ in the gig economy, investors who bought in its IPO failed to make any money. Lyft’s one-day pop lasted, well, just a day. From the IPO peak of $78, its share price has slipped into a severe decline. Last we checked, it changed hands at $14. That’s a staggering decline of 82%!

Is Lyft (NASDAQ:LYFT) a good investment in the long term?

After such a precipitous fall, Lyft could be a good investment for two reasons, it’s oversold and diversification.

- The stock is quite oversold. A technical floor seems to holding at $10. Should the macro environment recover, a large rebound from here is possible.

- The company is diversifying into other modes of transport, which may help to increase earnings.

However, the market sentiment on the Lyft share price remains fragile. The biggest drawback is that the company is currently unprofitable. This may deter investors from buying Lyft shares. Also, there are a few other choices in the sector, such as Uber, which may attract more capital. (Note: Uber’s market cap of $55 billion is about 10x of Lyft.)

When is the best time to buy Lyft shares (NASDAQ:LYFT)?

Normally, we would say during a bear market. But in Lyft’s case, we would wait for two signals.

- a technical improvement. Currently Lyft’s share price is still mired in a multi-year downtrend. The transport stock has been making new lower highs and lower lows since early 2021 and this needs to reverse. For example, a bullish crossover above its long-term price trend – as proxied by the 150-day moving average – could be a positive sign.

- a reluctance to drop on earnings. Just this week, Lyft’s share price plunged nearly 15 percent on third-quarter earnings results. This indicates that not all negative news is priced in.

Thus, we would only watch to buy Lyft shares when all the bad news is out of the way and its share prices start to rise. While we may not catch the bottom, at least we are taking risk with favourable tailwinds.

Is Lyft’s share price overvalued or undervalued at the moment?

Right now, investors are focussing on the question: ‘How bad will things be’?

This week’s 3Q earnings saw a modest improvement in revenue over the previous year (revenue of $1,053.8 million versus $864.4 million). But the company lost a lot more money, as it reported: ‘Net loss for Q3 2022 was $422.2 million versus a net loss of $99.7 million in the same period of 2021‘.

Perhaps this was larger than what the market was expecting. Hence, Lyft’s share price dropped significantly on this news.

The market is now trying to work out if Lyft’s losses will continue to grow in the months ahead. On this basis, the company is probably overvalued because of the increase in earnings uncertainty.

Why has Lyft’s share price dropped recently?

Investors are concerned about a few things in the gig sector.

- First and foremost, the deteriorating consumer sentiment. When consumers are strapped for cash, they will probably spend less on cabbies.

- Second, the increasing costs for transport companies, such as fuel and labour costs.

- Third, the Department of Transport is looking at changing the categorisation of gig workers, including Lyft drivers. This may increase the firm’s underlying costs.

- Fourth, the widening losses at the corporate level.

Taken together, it is clear the ‘gig stocks’ such as Lyft are under intense pressure.

What is Lyft’s share price prediction?

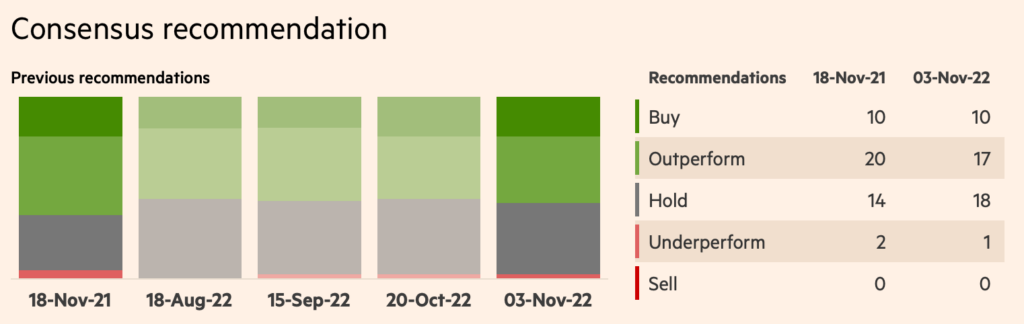

A year of monetary tightening has dialed back investors’ expectations on many loss-making tech shares. This is reflected in the stock recommendation of Lyft.

A year ago, we have a clear majority of analysts recommending Lyft stock. Now about two-fifths are saying ‘Hold’.

Source: Financial Times

What we do not know is whether this negative re-rating was caused by the persistent slide in Lyft shares – or the other way around. In any case, should Lyft’s share continue to drop, we would expect to see further downgrades in the future.

How to buy shares in Lyft (NASDAQ:LYFT) from the UK

To buy shares in Lyft (NASDAQ:LYFT), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Lyft from the UK:

- Decide if you want to buy Lyft shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Lyft shares (NASDAQ:LYFT)?

Buying one NASDAQ:LYFT share costs $13.91. However, as well as the $13.91 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Pricing data automatically updates every 15 minutes

Compare investing accounts for buying Lyft shares (NASDAQ:LYFT) from the UK:

If you want to buy shares in Lyft from the UK, you need an FCA-regulated stock broker that provides access to US stocks. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling US stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

Compare trading accounts for trading and shorting Lyft shares (NASDAQ:LYFT) in the UK:

You can use our table to compare the best brokers for trading Lyft shares. All brokers in this list are authorised and regulated by the FCA. CFDs & spread betting carry a high level of risk and losses can exceed your deposits.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com