- The decline in inflation in the UK and Europe reduces the immediate need for inflation-hedging assets like Bitcoin, though consumer sentiment remains mixed.

- Bitcoin is trading in a narrow range near its historical highs, unusual for its typically volatile nature, suggesting a digestion phase after significant rallies.

- Interest rates are not falling as fast as expected, and the strong performance of AI stocks like Nvidia is attracting momentum traders away from Bitcoin.

UK Grocery Inflation slips further

Bit by bit, inflation is being chipped away. Today, Kantar, the specialist market research company, published the UK monthly grocery inflation data. The May figure came in better than expected; it now stands at 2.1 percent. In particular, Kantar noted that:

a drop in grocery price inflation is leading to improved consumer sentiment. The rate now stands at 2.1%, marking the sixteenth consecutive month that it has fallen. 36% of households described their financial position as comfortable in May 2024, a proportion not surpassed since November 2021.

This figure roughly matches the Bank of England/ONS inflation level of 2.3 percent recently. Perhaps in the near future these inflationary measures will continue to edge lower as food and energy bills slip.

What is interesting, though, is that many households are still feeling the heat from the cost-of-living crisis. In the same report from Kantar, they noted that 22 percent of households in their survey are struggling. This is unsurprising given that many fixed costs, including taxation and mortgage bills, have not really dropped. So, the data trends here are a mixed bag. The FTSE 100 moved up less than half a percent.

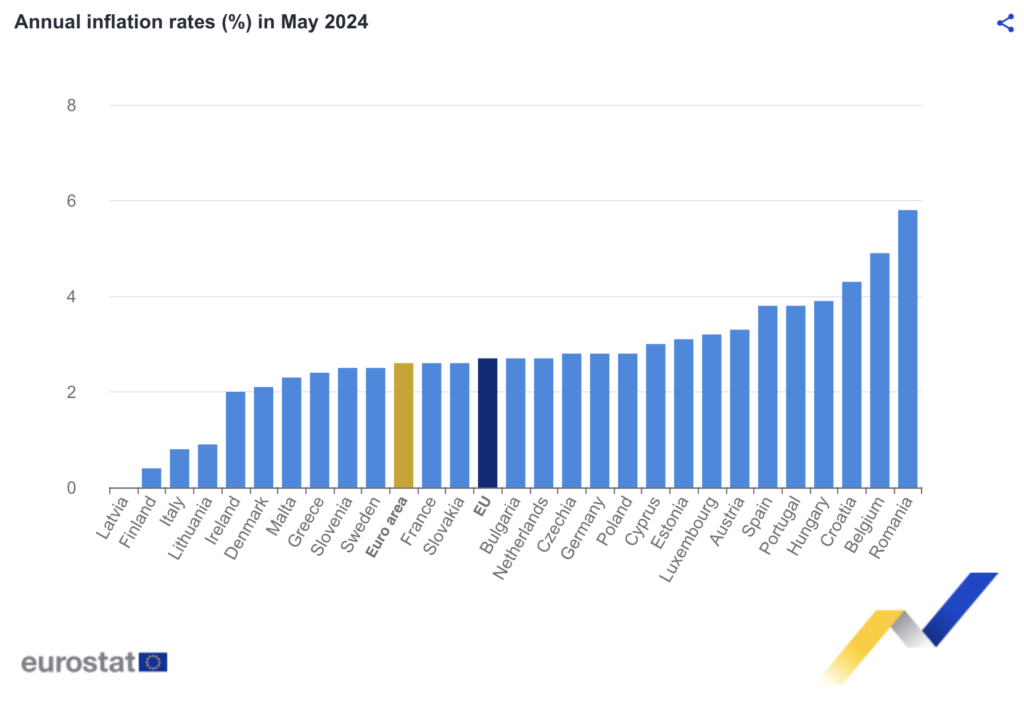

Over in Europe, inflation data released today also stayed in the two percent region, although at 2.6 percent (May) it is slightly higher than the figure recorded in April (2.4). A few Eurozone nations are suffering from inflation close to four percent (eg, Spain).

Overall, inflation is trending lower in many countries. This is a good sign for the European economy as it increases the spending power of cash-strapped consumers. But this fight is not yet over. Prices could easily rebound. Prices need to stay low longer to assure consumers that this inflationary episode is truly over. For now, household are still cautious and rightly so.

Source: EU

Inflation & cryptocurrency

The tangential question is whether lower inflation rates are having a negative impact on crypto.

For some weeks now, Bitcoin (BTCUSD) has stayed in a range, albeit near the highest band of its historical price range ($60-70,000). This is somewhat perplexing. As you can see below, for the past 4-5 years Bitcoin has rarely traded in a range this long. Its price trend has always been either up or down, seldom sideways. This begs the interesting question: Has the cryptocurrency been tamed?

Let’s recap the reasons why Bitcoin is in demand. Its limited quantity (21 million pieces, hard cap) makes it a good hedge against the runaway US debt and, to some extent, inflation. Moreover, Bitcoin is novel, un-physical, and cultish. Many investors with an e-wallet can buy it. Spot iShares Bitcoin ETF (IBIT, factsheet) is now available to Main Street, too.

Most importantly, Bitcoin’s long-term returns, by some miles, are amongst the best in all asset classes. Just not so long ago, a single Bitcoin token traded in single digits. Now? $66,000. As prices went ‘mooning’ , Bitcoin became the fastest asset to reach $1 trillion in market cap ($1.287 trillion now). No wonder many traders are enamoured with it.

What’s the downside to Bitcoin then? Well, high volatility is one; broker implosion is another. If you leveraged up on Bitcoin positions at the wrong time, you can lose money rather quickly.

Coming back to the macro picture, it seems Bitcoin is now digesting the steep rally registered during 2H2023-1H2024, where prices more than doubled. The prospect of falling inflation and interest rates was originally Bitcoin-positive. But these cuts are not coming fast enough. The latest projection is only one cut this year. The overbought rally is being digested with the prospect of higher-than-expected interest rates.

Are AI stocks overtaking Bitcoin?

Another factor to note is that a few other assets are outperforming Bitcoin. Specifically, traders are chasing Nvidia (NVDA) and other hot AI stocks. Since late 2022, for example, NVDA has jumped 12x. The Nasdaq 100 Index is at new highs, as is S&P 500. This is luring momentum money away from Bitcoin.

Should we bet against Bitcoin, then? Not really. This asset has a habit of confounding the market. And since Bitcoin is trading in the middle of the range, it can go $5,000 either way quickly. For now, I’d watch for prices to hit the range boundaries before taking sides.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com